Table Of Contents

What Is Risk Ratio?

Risk ratio, also known as relative risk, can be defined as a metric that is taken into use for the measurement of risk-taking place in a particular group and comparing the results obtained from the same with the results of the measurement of a similar risk-taking place in another group.

These methods are commonly used for drawing valuable comparisons between two groups. The comparisons between the two groups are performed based on the likelihood or probability of an event that can occur in these groups. This is also regarded as a relative risk.

Key Takeaways

- Risk ratio, also known as relative risk, is a statistic used for measuring risk-taking behavior in one group and comparing the findings to the results of measuring identical risk-taking behavior in another group.

- This ratio is a ratio of risk probability in one group to the odds of risk occurrence in another group frequently used to display the results of several organizations. These are called relative risks.

- The experimental group is one of the two groups, while the control group is the other. It is not an inferential statistic since it is a descriptive statistic that does not assess the specific statistic's importance.

Risk Ratio Explained

This can be said to be a ratio of the probabilities of risk in one group compared to the possibilities of an occurrence of risk in another group. It is commonly taken into use to present the outcomes of various groups. These are also termed relative risks.

It is very commonly used for the purpose of statistical measurement especially for clinical research in the medical field. To understand this concept, a clear idea about the statistics related to population is very important. It basically means any study or estimation done within a given set of population. For instance, if we want to find out the effect of a particular drug related to obesity on a set of population, the population statistics will be the average rate of obesity on the population set after taking that drug.

However, in this case, the statistical analysis of the population is done using probability, in which a comparison is made and there is a recording of observation. Here, a comparison is made regarding how much risk one group is bearing in relation to the other. One of the two groups is regarded as an experimental group, whereas the other is the control group. It should not be deemed an inferential statistic since it is a descriptive statistic and does not evaluate a particular statistic's significance.

A relative risk ratio is equal to one means that the outcomes of both groups are identical. On the other hand, a higher or lower rate would indicate the underlying factor responsible for increasing or decreasing the risks in either or both groups.

Formula

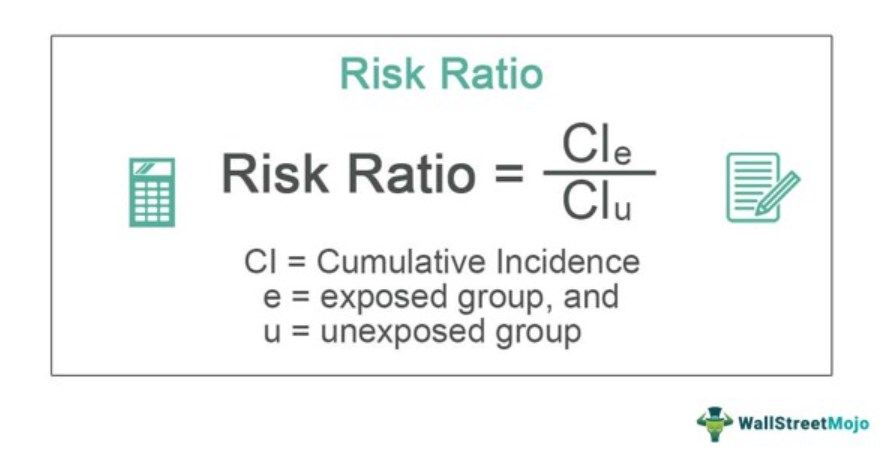

The formula of relative risk ratio is as follows:

Risk Ratio Formula = Incidence in Exposed / Incidence in Unexposed

Or

Risk Ratio = (a / (a + b)) / (c / (c + d)

Or

Risk Ratio = CIe / CIu

Where,

- CI = Cumulative Incidence,

- e = exposed group, and

- u = unexposed group,

Or

Risk Ratio = Risk of Event in A Group / Risk of Event in B Group

Or

(Se / Ne) / (SC / Nc)

Where,

- e = experimental group (A group), and

- c = control group (B group).

We will understand the calculation of the above risk ratio equation in detail.

How To Calculate?

- From the above formula, it is clear that the calculation of financial risk ratio takes the incidence or risk of the event taking place in one group (experimental group) and draws a comparison with the incidence or risk of the event taking place in another group (control group).

- The risk ratio equation is performed by examining two variables. One of the variables shall be used for measuring the incidence of an event (exposed vs. Unexposed), and the second variable shall be used for measuring both groups (Group A vs. Group B).

- It will then require the analyst to divide an exposed event for group A or the experimental group by the incidence of an unexposed event for group B or the control group. This is calculated by taking percentages into use.

- When the values equal 0, it means that not even a single case falling in group A had the incidence taking place, whereas the "x" number of case/s in group B had the incidence taking place. The values equal to 1 mean that the results are neutral. In other words, the probability of an event in one group shall be the same as the possibility of an event taking place in different groups.

Examples

Now, let us understand the calculation of financial risk ratio with some examples.

Example #1

RR, in this case, can be determined by using the formula -

| Particulars | Values | Values |

|---|---|---|

| Had Sports Surgery | Yes | No |

| Any Post-Surgery Infection (A) | 8 | 125 |

| No Post-Surgery Infection (B) | 2 | 79 |

- R.R = CIe / CIu

- = 6.02% / 2.47%

- R.R. = 2.436

Example #2

| Particular | Values | Values |

|---|---|---|

| Had Sports Surgery | Yes | No |

| Cancer (A) | 9 | 3 |

| No Signs of Cancer (B) | 126 | 80 |

RR, in this case, can be determined by using the formula -

- R.R = CIe / CIu

- = 6.67% / 3.61%

- R.R. = 1.844

Interpretation

- Interpreting risk ratio is as important as the calculation of the same. The results of the risk ratio can be equal to zero or one or greater or lower than 1. When the results are more significant than zero, it signifies that none of the incidences in the experimental group or group A had the probability of the event taking place, whereas 'x' no. of incidences in the control group or group B had the likelihood of the event taking place.

- When the results are equal to one, then it is regarded as neutral, or in other words, the incidences in an experimental group are the same as the incidences in a control group.

- When the result is more significant than one, it means that the risk in the exposed group is greater than in the unexposed group. Similarly, when the result is lower than one, it signifies that the risk in the exposed group is lower than in the unexposed group.

Thus, the above steps are simply the process of interpreting risk ratio.

Benefits

Let us look at some benefits of this ratio.

- It is very easy to understand, interpret and use. It basically explains how much or how many time more one group bears a risk compared to another.

- It is a powerful statistical method because it helps in estimating the element of change.

- It detects very quickly if any external intervention or any other variable is affecting the outcome.

Limitation

Now, let us look at the limitations.

- It is not suitable for all types of situation because is just shows the risk in a sample part of a bigger population. Thus, no one can be sure that this outcome is reasonably representing the entire population. This is not a very dependable data.

- Since it is expressed in the form of ratio, it tends to magnify the effect on one group while minimising the effect on another.

Risk Ratio Vs Odds Ratio

Some differences between risk ratio and odds ratio are given below:

- The former provides outcome regarding with regard to the total number of trials, whereas in case of odds ratio, we calculate the number of outcomes of interest with regard to the number of outcomes which are not of our interest.

- While in case of the former, both the outcomes used for the ratio are desired ones, in case of the latter, one outcomeused is desired while the other is not desired.