Table of Contents

What Is Treasury Management?

Treasury management refers to the function of managing an organization’s regular cash flows and crucial financial decisions. The decisions within a treasury management system could be related to liquidity governance, credit line maintenance, optimal use of funds, and maximizing investment returns. Additionally, the function is also used to eliminate future risks.

The process of managing financial decisions and cash flow ensures that the organization has enough cash to run operations and also makes sure excess cash is not idle. In simpler terms, it makes sure that the company’s funds are neither underutilized nor overutilized. Failure to efficiently manage these responsibilities can lead to a loss in stakeholder confidence, among other things.

Key Takeaways

- Treasury management is the oversight of an organization’s investments, financial risk, and cash flow. It also looks at maximizing return on investments and minimizing financial risks.

- In a constantly evolving world of finance, regulations, and compliances also keep changing with them. Therefore, companies need to be compliant with all these measures to ensure they avoid legal trouble.

- Automation for companies that have operations in multiple countries helps with keeping track of all operations on one screen.

- There are also challenges, such as changes in interest rates, exchange rates, and commodity rates, which could pose significant risks.

How Does Treasury Management Work?

Treasury management is a practice that manages the liquidity, cash flow, and susceptibility to risk of an organization. To successfully carry out treasury management services, these managers constantly have oversight to make sure that risks are minimized, liquidity positions are solid, and overall financial health is always on a path that leads to improvement.

Incorporating an efficient treasury management system requires a delicate balance between the objectives and needs of the organization. Moreover, the team handling things related to treasury needs to have an in-depth knowledge of financial markets, skills to adapt to changing economic conditions, and risk assessment as well.

The management of cash flow and overall finances is a two-step approach in most industries. Keeping tabs on receivables and payables is the first step, and forecasting cash flow and efficiently managing working capital can do the trick. If the organization has a foolproof system that keeps track of invoices and has a good credit control system, it can ensure good cash flow.

With good cashflows, companies can pay suppliers on time. Therefore, suppliers would be happier to negotiate terms and provide even better repayment schedules. Once the payables and receivables are balanced optimally, the organization can move towards forecasting cash flow based on payment schedules and effectively manage its working capital.

Objectives

The fundamental objective of incorporating these systems within an organization revolves around improving the financial health of the organization. However, there are a bunch of other important objectives as well, which are explained below.

- The fundamental objective is to make sure that daily operations are undisturbed due to insufficient funds.

- Markets are known to be volatile. Therefore, many companies install treasury management software to make sure that financial losses are averted by identifying probable risks and incorporating strategies accordingly.

- Debts are often the pillars of support that push an organization upwards. However, the cost at which they are acquired has a significant impact on the overall process. This process makes sure that debt is acquired at a reasonable cost.

- Financial regulations and compliances keep changing from time to time due to changes in global trends. Therefore, it is essential to stay updated and comply with all the regulations and clearances.

- Surplus funds lying ideal is the first step towards mismanagement of funds or simply underutilization. Therefore, managers handling these funds use systems that let them invest in money market funds or binds to make sure these funds are invested with limited risk and stable returns.

Functions

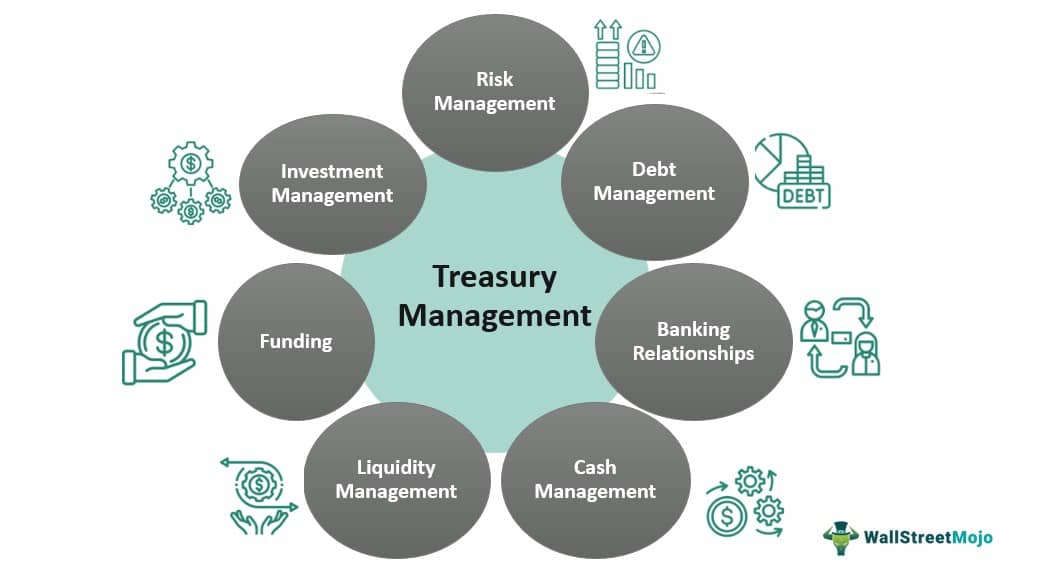

Once the objectives of a treasury management system are clear, it is crucial to understand the functions that are achieved through it as well. The points below cover this vital aspect of the concept.

- Forecasting Cashflow: Based on the payments receivable and payable, companies can calculate and find if they will have cash in surplus or deficit. If there is a surplus of cash, they can plan on employing it towards capital expenditure or invest in short-term securities; however, if there is a deficit in funds, a low-cost debt can be acquired to meet immediate requirements.

- Managing Liquidity: Any business entity has financial obligations throughout the year. Therefore, the system must be able to ensure that prompts regarding efficient cash flow are given to the management always to stay supplied during times of need.

- Limiting Financial Risks: Changing market conditions, geopolitical scenarios, and other such factors. However, to avoid such situations, converting into losses for the company is something that requires sufficient market and business knowledge. These systems are designed to operate well with respect to limiting or, ideally, eliminating these risks.

- Investment Decisions: As mentioned earlier, surplus money lying idle in a company’s account is insufficient utilization of funds. Therefore, systems like these help managers find financial data that helps in making calls regarding investment decisions. These profits shall result in additional profitability for the organization.

Examples

Any concept or phenomenon can be understood in its totality when an aspect of real-life application and practicality is grasped. The examples below shall clarify the intricacies of the concept.

Example #1

Will Jacks Trading Company purchases furniture from China and sells it to corporate offices and restaurants in the United States, Mexico, and Canada. Their sales in the last three quarters have surpassed forecasted sales.

Therefore, in the coming quarter, they are expected to have a surplus of $400,000. Hence, they decided to employ $100,000 towards renovating the office space and invested $200,000 in short-term securities and $100,000 in a long-term bond.

Example #2

Multinational corporations, or MNCs, need help with severe challenges in managing finances in different countries. It leads to problems with reconciliation, especially with manually operating these complex tasks. Moreover, the cost of running business operations has always been on the rise.

Therefore, integrating real-time treasury management software can help with the immediate visibility of cash positions in multiple countries. And thereby, in multiple currencies. As a result, companies can manage their liquidity by transferring funds from one country to another to meet requirements or invest surplus funds. Enigma Technologies has followed these steps in detail to optimize its operations.

How To Improve?

To improve treasury management services within the organization, the company can follow the steps mentioned below.

- In the modern day, digitizing this project not only saves time and effort but also reduces the probability of human errors. Moreover, a significant reduction in cost also helps companies employ the excess cash into better avenues.

- Efficient management of payments receivable and payable can help companies organize their working capital by improving liquidity.

- With all the investments made through surplus funds of the organization must be as diversified as possible. This allows the company to make the most of its gains while also limiting exposure to excessive risks.

- If the company operates in multiple countries, consider factors like exchange rate volatility and other related credit risks to safeguard the company’s financial risk exposure.

- To carry out any financial transaction or implementing risk management strategies would require good relationships with the company’s bank. Therefore, it is essential to choose a bank that has friendly rules that support the transactions and growth of the company.

Importance

The importance of treasury management systems is mentioned below.

- These systems provide CFOs or treasurers with invaluable information regarding the overall cash flow of the organization. If the system is digitized, it can show the cash flow of companies or operations in different geographical locations.

- It gives companies a better vision of their obligations and the amount they are yet to receive from their clients. These factors allow them to forecast their holdings better and employ the funds to effective avenues.

- The world of finance is heavily regulated, and compliance with all regulations is compulsory. Otherwise, strict actions might be taken on non-complying companies. Therefore, these systems help CFOs stay on top of these changes.

- For companies, irrespective of their financial stature, growing with the help of formal and informal sources of debt is quite common. However, the difference this system makes is that it helps stakeholders acquire debt or other forms of loans at rates that do not cut a hole in the company’s pockets.

- Excess cash, commonly referred to as surplus funds, are invested to ensure they continue to be utilized. Treasurer and CFOs oversee these investments through the digital reports of multiple operations across countries.

Challenges

Treasury management services are more flowery and free of challenges than many might think. There are a handful of challenges that CFOs and treasurers must be wary of. They are listed out below.

- Market Volatility: Financial markets are prone to the forces of demand, supply, and other factors. Therefore, changes in interest rates, commodity prices, exchange rates, and other related prices can adversely affect the management of funds within an organization.

- Cybersecurity: In the internet era, more functions than not are digitized. While it saves time, effort, and money, it exposes the data to excessive risks. Cybercrime has been steadily rising and is bound to rise even further. Therefore, companies must take extra precautions to safeguard their data and systems.

- Regulations & Compliances: There are monotonous and extensive regulations that keep changing or keep getting updated. Moreover, there are compliances in areas such as anti-money laundering, risk management, and know-you-customer. These can consume a significant amount of time, which can otherwise be utilized for growth and development.

- Operational Challenges: Operating internationally can pose a variety of challenges with regard to finances. Each country’s financial system is curated differently, with different norms and regulations. Moreover, banking systems, taxation, and currency dynamics differ in every country. To manage, balance, and execute tasks keeping all these in mind can be a significant challenge.

Treasury Management Vs Cash Management

While treasury management systems and cash management might sound like the same function, there are a handful of differences. They are mentioned in the comparative table below.

| Basis | Treasury Management | Cash Management |

|---|---|---|

| Objective | Its main aim is the maximization of investment returns and optimization of capital structure. | The fundamental objective is to efficiently manage cash inflows and outflows on a daily basis. |

| Scope | It caters to broader financial functions and is highly strategic in nature. | Its scope lies in the operational activities of the organization and hence, is tactical in nature. |

| Key Functions | Investment, funding, debt issuance, and risk management. | Cash disbursement, forecasting, and collections. |

| Reporting | Detailed financial analysis and strategic reporting. | Cash flow projections, statement and analysis on a fundamental level. |

| Focus | Financial strategy in broader terms and risk management. | Liquidity and financial operations for a short-term. |