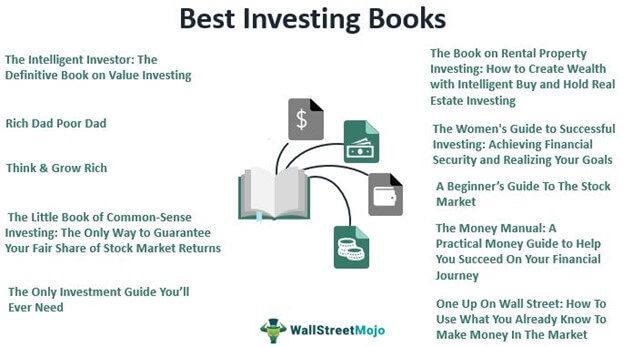

Top 10 Best Investing Books [Updated 2023]

Investment is more than just saving; it is about making money grow over time. Investing is a financial discipline that needs to be better taught in school, but it is something that everyone should be aware of. Before making the appropriate investment, people should understand terms, jargon, strategies, and implementations, among other things. The best approach is reading some of the best investing books and gaining insights.

Here are the top 10 investing books for anyone looking to improve their financial planning skills:

- The Intelligent Investor: The Definitive Book on Value Investing ( Get this book )

- Rich Dad Poor Dad ( Get this book )

- Think & Grow Rich ( Get this book )

- The Little Book of Common Sense Investing ( Get this book )

- The Only Investment Guide You’ll Ever Need ( Get this book )

- The Book on Rental Property Investing ( Get this book )

- The Women's Guide to Successful Investing ( Get this book )

- A Beginner’s Guide To The Stock Market ( Get this book )

- The Money Manual ( Get this book )

- One Up On Wall Street ( Get this book )

Let us elaborately look at each book and try to comprehend what they offer –

#1 - The Intelligent Investor

The Definitive Book on Value Investing

By Benjamin Graham

First came in 1949, this is one of the best value investing books. Author Benjamin Graham is considered the father of value investing.

Book Review

The book works as a gospel for investors. Many podcasters, authors, and investors speak about how well the book deals with and comprehends every aspect of investing and financial literacy. It is a practical book with calculations and graphs to help readers understand the long-term effects of financing. The book also highlights making a profit in the stock market without taking more significant risks. As a result, this book can be of substantial value for someone starting to invest.

Key Takeaways

- The book is as applicable as it was in 1949 when it was first published, making it an absolute classic.

- It processes the real-life performance of companies, stocks, and funds along with marginal safety and room for human error.

- The book plays a crucial role in investment education.

#2 - Rich Dad Poor Dad

By Robert Kiyosaki and Sharon Lechter

Robert Kiyosaki, in this book, talks about how in his childhood he had two fathers, one poor dad and one rich dad, and highlights the swift mentality and behavior science of wealthy people.

Book Review

The poor dad is Robert Kiyosaki’s father, and the rich dad is his friend’s father, who he took as his rich dad. Kiyosaki elaborates on the difference between a poor man’s thinking and a rich man’s mindset. In addition, the book talks about real estate investment strategies the budget, and the firm difference between assets and liabilities. The book was initially released in 1997 and is part of a trilogy further written by the author.

Key Takeaways

- The book is famous for its real-life example and for pointing out the difference between how a poor man works and a rich man operates.

- It has many examples of investing in different assets and earning long-term passive income.

- It has many examples of investing in different assets and earning long-term passive income.

- With the help of pictures and graphs, the book shows the real budgetary problems of a poor man and how rich people use their assets and liabilities.

- The book states the differences between being rich and being wealthy.

#3 - Think & Grow Rich

By Napoleon Hill

The book is written by Napoleon Hill, an American author widely known to write about success and moments of new thoughts. The book talks about building a better career and the scope of money and financial stability. However, the book also discusses human psychology and the power of thought.

Book Review

The book was first published in 1937 and is a self-help classic. The book’s central idea revolves around how to succeed and attract positivity and brilliance through manifesting thoughts and energy. The author discusses never quitting, seeking help, different approaches, and improving skills. It encourages people to start believing in them.

Key Takeaways

- The book highlights five critical areas of desire – career, leading, money, failure, and other people’s desires.

- It reflects the repetition of conscious ideas and the discipline one should follow.

- In terms of investing, the book explores how to grow rich through money and with a mindset.

- The author also compiled stories from great personalities like Henry Ford, Thomas Edison, etc.

#4 - The Little Book of Common Sense Investing

The Only Way to Guarantee Your Fair Share of Stock Market Returns

By John C. Bogle

The book was initially published in March 2007 and contained simple and basic investing methods for long-term wealth creation. The book motivates people to understand the power of growing steadily and providing enough time for money to grow. John C. Bogle, the author, is also credited with creating the first index fund.

Book Review

The book tells the story of the Gotrocks Family and how it made a small mistake and had to pay money in taxes, capital gains, advisory fees, and charges. In addition, the author explains why it is essential to know how index funds can help people grow their wealth in the long run. The book also covers the topic of mutual funds vs. index funds.

Key Takeaways

- The author condemns investing in mutual funds and encourages people to only look for more investment opportunities in index funds.

- He states that emotions and expenses are the two great investment enemies.

- The author supports long-term investing and does not fickle when the market declines.

#5 - The Only Investment Guide You’ll Ever Need

By Andrew Tobias

The name suggests it all, the book was published in 1978. Author Andrew Tobias says there is no reliable method to become richer quicker. But, at the same time, he believed that steadily one could make suitable investments and mature its profit later.

Book Review

The book talks about investment and is written to give the whole financial literacy to its readers. It discusses savings, tax shelters, retirement funds, emergency funds, the pros and cons of financial advertising, and where to invest first. The book covers all areas of financial management and gives a new perspective on learning how to invest.

Key Takeaways

- The book stresses that an individual’s expenditures must not exceed their income.

- The author always says that people cannot register maximum returns from the stock market but only average returns through time.

- He encourages one should only invest the money they do not need in the next five years to grow with time.

#6 - The Book on Rental Property Investing

How to Create Wealth with Intelligent Buy and Hold Real Estate Investing

By Brandon Turner

Brandon Turner has one of the most fantastic real estate investing books. There are times when people want to invest in real estate properties, and this book will help any reader who wants to support and explore the real estate industry.

Book Review

The book is new compared to other investing books. It was initially published in 2015 and discussed using rent as leverage to earn passive income and how real estate investments can grow over time. Brandon Turner defines real estate property as a reliable source of income and suggests ways to create massive wealth from it. The author speaks about multiple forms of profit earning alongside the downside of rental property and other factors like timing, market conditions, etc.

Key Takeaways

- The book deals with the pros and cons of buying property using leverage.

- It suggests using rent to settle debts and create a long-term passive income.

- The book suggests that individuals investing in real estate and rental properties must keep a soundtrack of their cash inflows, or they might face difficult situations.

#7 - The Women's Guide to Successful Investing

Achieving Financial Security and Realizing Your Goals

By Nancy Tengler

Though the title suggests it is not mandatory, strictly speaking for women only, anyone can learn from this book. For example, author Nancy Tengler points out that almost half of any nation’s wealth is managed by women only. Thus, women need to grow their money through different wealth accumulation strategies.

Book Review

The book came in 2014 and talked explicitly about women’s rules in their investing strategies. It is one of the best investing books for beginners. The book has a separate chapter where the author talks about how investing can get women their groove back. In addition, the book comprises notes for women to remember while making financial decisions and investment websites.

Key Takeaways

- The book has new perspectives on women investing and savings.

- It encourages women to look for new prospects and techniques to save money and become independent.

- The book has a role model investment formula for women to follow.

#8 - A Beginner’s Guide To The Stock Market

By Mathew R. Kratter

The book was released in 2019, so it is very fresh, and for people who have never traded or seen the face of any stock market, this book will help them make the first move. Author Mathew R. Kratter has written many books on financial literacy and money management, and this book remains at the top of them all.

Book Review

This book is a blessing for people who want to start early. It begins with the initial introduction to the stock market and investment and keeps it simple so that a fourteen-year-old kid can also relate to the book equally. When we talk about the stock market, there are many aspects that we still need to learn or understand. This book helps the reader remove all their doubts.

Key Takeaways

- The book came out in 2019, so it is not old compared to other investing books.

- It has a simple approach and language.

- The author keeps it subtle when giving information, and any age group can relate to it.

- The book contains A to Z knowledge of the stock market with easily comprehended information.

#9 - The Money Manual

A Practical Money Guide to Help You Succeed On Your Financial Journey

By Tonya B. Rapley

The book was released in 2018 by author Tonya B. Rapley. Another woman author with great ideas advises people on getting rich, maintaining wealth, and using money to make more money.

Book Review

The author says people do not need a degree, certificate, or job to get rich. All they need is well-designed information to follow. In this book, she discusses making it out of mediocrity and becoming self-independent. Rapley is a celebrated millennial money expert and consultant. She has appeared in New York Daily News, Forbes, Vogue, and other famous platforms.

Key Takeaways

- The book serves the purpose of a practical guide to a financial journey.

- It helps readers understand the importance of knowledge and making money without any particular skill.

- It is a good book for people who want continuous learning.

#10 - One Up On Wall Street

How To Use What You Already Know To Make Money In The Market

By Peter Lynch and Joh Rothchild

The book is considered one of the best investing books for beginners. Author Peter Lynch postulates many simple investing approaches to generate profits for new investors.

Book Review

The book came in the year 1989. The authors classified the stocks into six major categories in this book: slow growers, stalwarts, fast growers, cyclical stocks, turnarounds, and asset plays. They firmly believed that individual investors could beat the experts. The author also wrote about the 10 signs of finding an excellent multi-bagger stock. One of the book's critical factors is using people's knowledge to make sound investment decisions.

Key Takeaways

- The author believed that an individual investor could perform better than an expert.

- It sheds knowledge about the types of stocks and how to find a multi-bagger inventory.

- The book ranks among the best investing books of all time.

- Though he wrote the book in 1989, the concept and ideologies are still perfectly relevant.