Table Of Contents

Wealth Management Meaning

Wealth management refers to a process where an individual or entity channels its investments to meet various financial goals and procure wealth. It is a process that starts with identifying and setting financial goals or retirement funds and starts contributing through different financial instruments like mutual funds, equities, assets, etc.

It is a part of financial literacy and helps young and middle-class individuals to achieve their long-term financial goals and attain financial freedom to retire or plan for their old age. Such management plans are tailor-made and customized as per the different incomes and goals of the clients.

Table of contents

- Wealth management for an entity refers to identifying the present financial situation, setting goals, and participating in an appropriate plan to grow wealth with time.

- It includes receiving advisory and managing different financial instruments as part of a financial plan.

- Different financial firms provide chargeable consultancy regarding how individuals can start their financial journey and start following a retirement plan.

- While wealth management refers to an entity's overall financial scenario, asset management deals with assets alone

- Private banking can be more accessible and specific while wealth management is a more generic service.

Wealth Management Explained

Wealth management is the supervision of financial products coupled with wise investments and smart strategies to tend to any person's long-term financial objectives. Unfortunately, a gradual part of the population believes they can never become rich because they do not have resources or multiple income streams. Still, the fact is that there are plans strategically made for people with different sets of income and scenarios to be implemented and followed to achieve financial goals like education plans, retirement plans, real estate plans and mutual funds, SIPs, and even cryptocurrency investments. Many individuals are now looking into the Best Crypto exchanges in the UK as part of their strategy to grow wealth, given the growing interest in digital currencies.

There are different types of agencies that help people achieve their financial goals, referred to as wealth management companies. On an individual level, they are called wealth managers or wealth manager consultants who study the present financial situation of their clients and understand their needs. Then, they set out a strategic plan for the clients and incorporate it through investing in bonds, funds, properties, stocks, and other financial assets. They can also be called financial advisors and may refer to other designations or working titles.

Wealth management is not limited to a simple piece of investment advice. But a whole blueprint is created specifically for people with different financial goals catering to their present and future needs, such as the needs of the family. Wealth managers usually work with big or small firms and represent their clients at different levels in the financial markets. Any individual or entity who has a financial goal or wants to achieve financial independence in the long run practices wealth management.

Examples

Take a look at these examples for a better idea:

Example #1

Simon has just graduated from college and joined a good company as an engineer. He is sincere about his savings and wants to create long-term wealth. So he studies the market and decides to connect with a wealth management consultant for the right wealth solutions.

The wealth manager studies Simon's income and advises him on a systematic investment plan. First, he advises Simon to start investing in a mutual fund with a steady and consistent growth history of 18%. This way, Simon starts investing and slowly adds to his long-term wealth objectives.

Example #2

Monika has a simple job but aspires to become wealthy by the time she retires; instead of investing in equities and bonds, she starts reading about wealth creation plans, and as she does not have much money to pay wealth management companies, she starts investing in real estate, she takes a loan and buys a small apartment and then gives it out on rent and starts paying its loan payments through the rent. Slowly, she pays off her debt over the years and now has a small apartment to herself.

She does the same process again, simultaneously working on her simple job, and within the next few years, she successfully has invested in real estate. In addition, she now can afford to hire a financial consultant to help her with her good financial plan.

Wealth Management vs Asset Management

- Wealth management comprises the overall financial scenario, including the benefits of the investments for the families. But asset management refers to accumulating and maintaining all the assets an individual or entity has. It may refer to real estate properties, tangible or intangible assets, collectible arts, and other investments.

- Wealth management includes tax and retirement planning, education planning, insurance, and estate planning. In contrast, asset management is the maintenance and procurement of all types of assets a person or an entity possesses.

- Investment advisors or advisory firms formulate it, and brokers and asset managers generally deal with assets.

- It grows slowly with systematic input and a long-term view of wealth creation. On the other hand, asset management ensures that each asset remains valuable, in control, and ripe with benefits when sold as intangible properties.

- Wealth management firms charge fees for their services and consultancies. On the contrary, brokers charge commissions based on the value of assets.

Wealth Management vs Private Banking

- Wealth management deals with the common person's investment strategy for long-term wealth creation, whereas private banking is the financial service that rich clients exclusively avail.

- There are parts where wealth management firms provide private banking services. But the reverse does not happen often.

- Wealth management is for people trying to secure their future financially, while private banking is for already rich people with a sizable income.

- Private banking allows clients to have a more direct approach and is more accessible, while the other is a general investment service.

- With wiser investments, private banking includes riskier financial management and greater benefits for long-term financial security.

Frequently Asked Questions (FAQs)

The common types of wealth management are Structured Investment Products, also known as SIPs, Traditional Investment Products (Mutual Funds, Equity, Banking Accounts), Real estate/retirement planning, and Personal wealth planning.

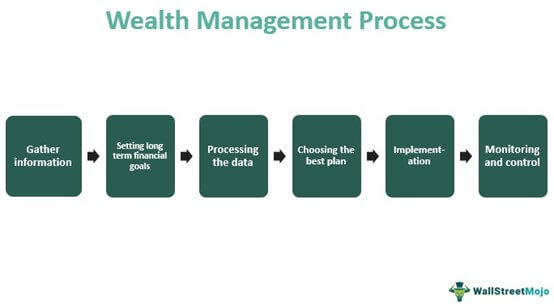

The process of wealth management involves the following steps:

1. Gather information

2. Setting financial goals

3. Processing the data based on financial objectives

4. Choose the best plan

5. Implementation

6. Plan Monitoring

A systematic investment plan is the most common form of wealth management. It is considered a good investment strategy for people who like to invest in long-term goals for a fixed time, putting off a small amount every month in their investment portfolio. It is a mixture of many asset forms, derivatives, and financial tools.

Recommended Articles

This has been a Guide to Wealth Management and its Meaning. We discuss its examples and its differences from asset management and private banking.. You can learn more about accounting from the articles below –