Table Of Contents

What is the Windfall Profit?

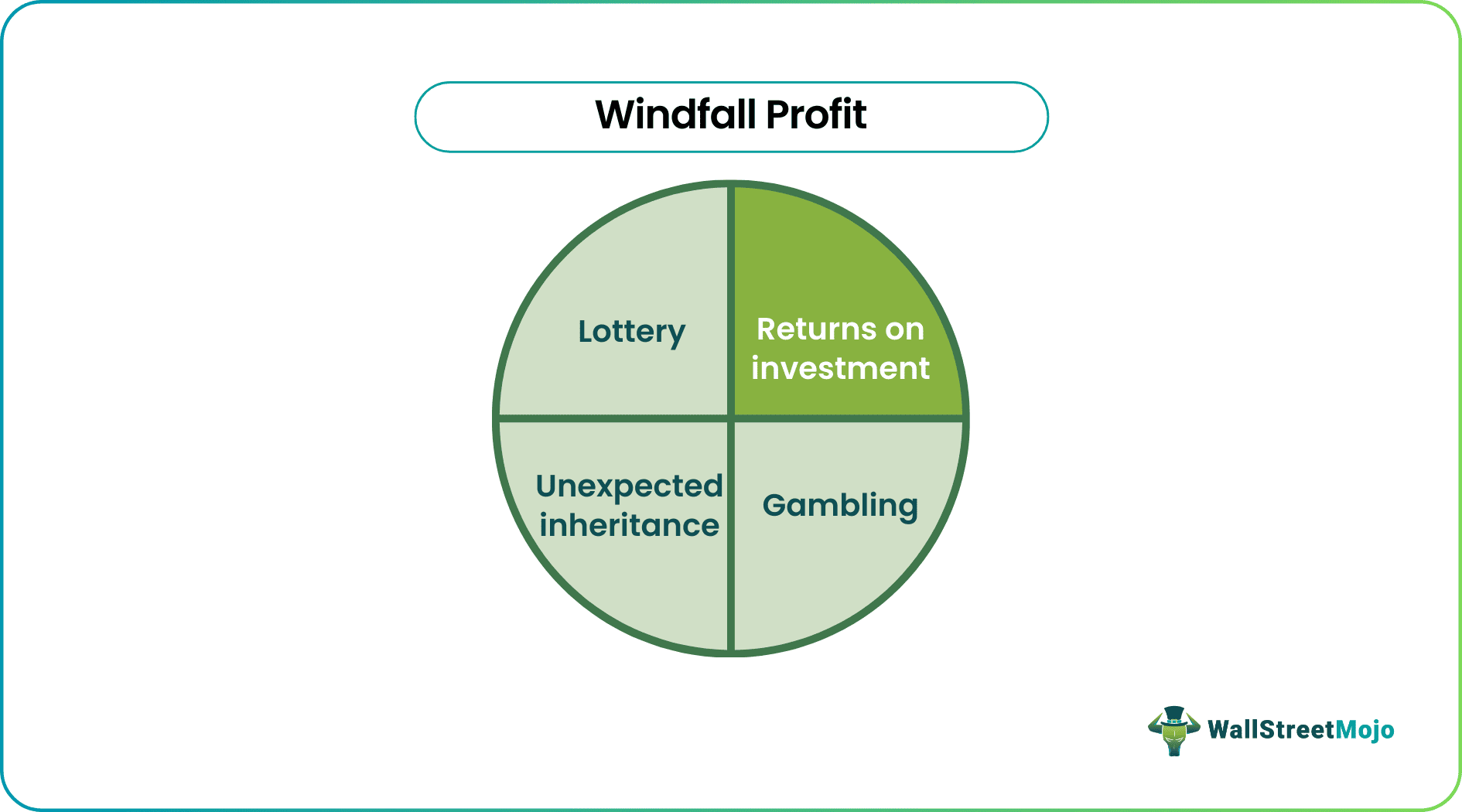

A windfall profit can be a sudden income or profit of abundant nature, which is quite sudden and/or not expected. For instance, it can happen due to the person winning a handsome lottery compensation or inheritance of wealth that one did not expect or demand-supply problems where certain goods/services/commodities are in great demand. Still, there is a limited supply.

Windfall profits cannot be attributed to any particular entrepreneurship traits or business factors. Economists and analysts cannot determine if the profits are fair or otherwise. Therefore, in their opinion, windfall profit tax is a fair concept and must be levied to maintain fairness among citizens.

Table of contents

- What is the Windfall Profit?

- A windfall profit means an unexpected income or profit of abundant nature.

- Individual winning lottery, supply-demand problem, change in prices, and decisions by management are the causes of windfall profit.

- If the operational entity is a company or business firm rather than an individual, the windfall earnings worry the business. On the other hand, windfall earnings are more relevant to a person or people who profit greatly from unanticipated circumstances.

Windfall Profit Explained

Windfall profit is the abnormal or unexpected huge profits individuals, or companies make based on unforeseen scenarios. It can be like when prices of commodities as simple as potatoes go high due to a supply-demand problem. A trader who has previously hoarded quintals of potato in their warehouse can sell the stock at an abnormally high rate and make unexpected gains.

Windfall profit or gain is generally transitory. It mainly occurs when someone has received an unexpected huge bounty from certain scenarios. For example, a person may casually book a lottery ticket with the least hope of winning it by investing a dollar or two still, if he is fortunate and booked, gains the lottery prize. He is allotted millions of dollars as prize money.

It brings about windfall to his earnings, and the gain he makes is called windfall profit. Several countries have also defined fixed laws and taxation policies to tax this unexpected profit. For example, if someone wins a lottery in India, they have to give straightaway close to 35% of the winning amount to the Indian government. Windfall is also relative to the party involved; if a company or individual handles millions and gets another million dollars, that is not considered a windfall. Whereas, if a person or company holds thousands of dollars and manages to get some additional millions, it is considered a windfall.

For a business, a company's management may decide to increase its dividend or give a special one-time dividend, leading to a windfall for the existing shareholders. The administration also utilizes these for future expansions, business growth, and debt reduction.

However, efforts are going on to bring back the policy of taxing such unexpected gains or profits, a common practice earlier. When it comes to a single person or an individual, this profit may be amassing a huge sum of wealth out of some unexpected event, which is generally beyond what they would have expected. On the other hand, when companies earn such profits, they are typically passed over to others or shareholders in the mode of regular dividend or one-time special dividend payout. Some companies sometimes plow back this abnormal profit earned to invest in profitable ventures, use it for further business expansion, or cut down their debt obligation.

Causes

There might be different factors that cause this phenomenon to occur. It is important to know them to understand them to be able to account and pay according to the U.S. windfall profit tax.

#1 - Individual Winning Lottery

A person may casually book a lottery ticket with the least hope of winning it by investing a dollar. Still, if he is fortunate and the ticket he booked gains the lottery prize, he is allotted millions of dollars as the prize money.

#2 - Supply-Demand Problem

A commodity or good may be in high demand, but the supply might be affected due to unforeseen circumstances. In such cases, one who provides the limited supply abnormally increases the price of the goods or services and makes a huge amount of money.

#3 - Change in Prices

Companies that operate in a monopoly market may change the price of their offerings, which might lead to this profit because of the monopolistic market. The customers have no other option other than buying from the same company.

#4 - Decisions by Management

A company's management may decide to increase its dividend or give a special one-time dividend, leading to windfall profits for the existing shareholders.

Examples

Let us understand the concept better with the help of a couple of examples. This shall help us understand different sub-concepts like the windfall profit tax, accounting and implications.

Example #1

On an individual front, an example of windfall profit can be a case where a person casually books a lottery ticket with the least hope of winning it by investing a dollar. Still, if he is fortunate and the ticket he booked gains the lottery prize, he is allotted millions of dollars as the prize money. Another example that one can trade has hoarded huge commodity stocks. For instance, onions. There is a sudden demand-supply gap in onions in the market. In such cases, the trader can make a huge profit by selling his stock in the market at an abnormally high price.

Example #2

On the business front, an example can be a case where the management of the business has decided to give a one-time dividend to its shareholders out of the year of profit plow back. Thus, it brings about a sudden windfall for the company's shareholders. Also, another example can be a case where a company is a monopoly in the market for an essential commodity like oil. If it increases oil prices, customers are bound to buy at higher rates. Thus, this leads to a windfall for the oil company.

Windfall Profits vs. Windfall Gains

Both Windfall gains and profits are often misunderstood for one another. However, the concepts are different and so are their applications in real life. Let us understand the difference through the discussion below.

The windfall profits are more related to business when the entity operating is not an individual but a company or business firm. We term them windfall profits when companies make abnormally high profits from unexpected scenarios. e.g., oil companies in a monopoly market make extraordinary profits while operating at increased oil prices.

Windfall gains, on the other hand, are more related to an individual or person where one makes huge gains out of unexpected events. For example, a person investing a meagre sum in a lottery ticket and winning the first prize amassing a huge wealth or a person inheriting an extraordinary sum of property from their ancestors at a single point in time.

Frequently Asked Questions (FAQs)

A windfall profit tax is a higher tax rate on profits from a sudden windfall gain to a specific company or industry.

Windfall profit in business refers to an unexpected increase in income, which may be due to winning a lottery, unforeseen inheritance, or supply shortage.

As did worldwide prices, energy consumption surged due to the Russia-Ukraine conflict, the pandemic recovery, and supply problems. Gas and electricity rates for consumers in major and minor economies increased significantly due to the rising costs, which also resulted in enormous and recorded profits for energy firms.

A windfall profit investment is a considerable amount that one earns unexpectedly. It may range from small additions to an individual's or prominent wealth.

Recommended Articles

This article is a guide to Windfall Profit and what is it. Here we discuss its examples, causes, and compared it with windfall gains. You may learn more about financing from the following articles: -