Table Of Contents

Difference Between ACCA and CIMA

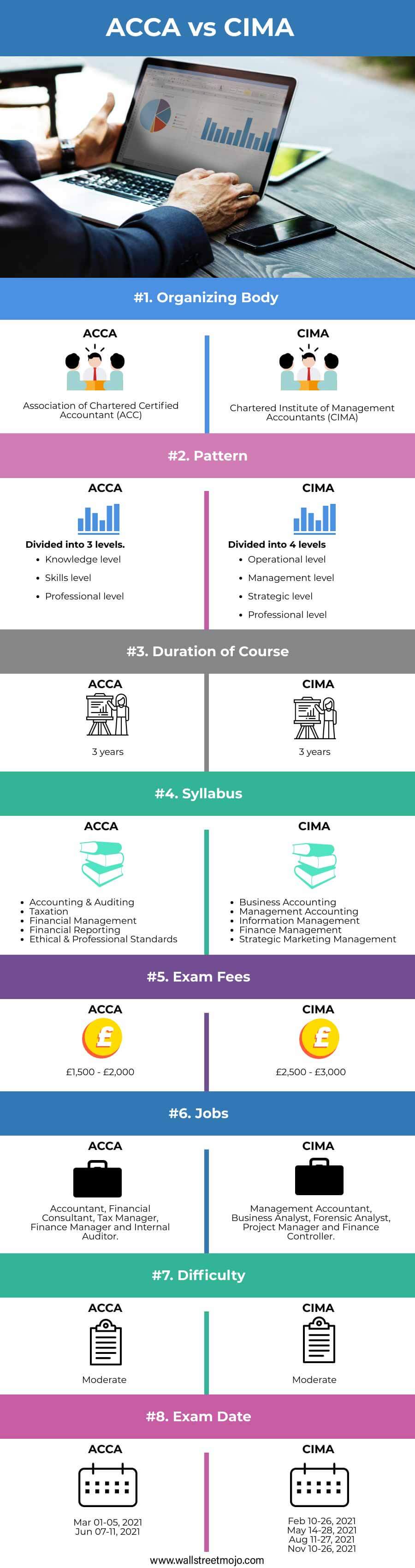

ACCA certification (Association of Certified Chartered Accountant) equips students with skills in accounts handling, management accounting, taxation, auditing, etc., while CIMA certification (Chartered Institute of Management Accountants) provides adequate training and degree concerning management accountancy and various other related subjects.

Both ACCA and CIMA are reputed certifications in accounting and finance. However, CIMA is little more than just accounting as it also helps in honing decision-making skills because it is a mix of accounting and business management. Hence, both certification programs cater to specific job profiles, and the candidates need to decide based on their career aspirations.

Table of contents

ACCA vs CIMA Infographics

Let's see the top differences between ACCA and CIMA.

Comparative Table - ACCA vs CIMA

| Section | ACCA | CIMA |

| Organizing body | Association of Chartered Certified Accountant (ACCA) | Chartered Institute of Management Accountants (CIMA) |

| Pattern | Divided into three levels

|

Divided into four levels

|

| Duration of course | Three years | Three years |

| Syllabus |

|

|

| Exam Fees | £1,500 – £2,000 | £2,500 – £3,000 |

| Jobs |

|

|

| Difficulty | Moderate | Moderate |

| Exam Dates |

|

|

ACCA vs CIMA - Which is Better?

It is a very common question, and sadly there is no easy answer. There is no doubt that both certifications help secure some of the most sought-after jobs in the finance and accounting domain. ACCA emphasizes advanced taxation principles and external auditing and prepares candidates to work independently or in finance-specific private firms. On the other hand, CIMA helps candidates prepare for the business side of accounting with a flair of management expertise.

Skills Obtained

After becoming a certified ACCA, a candidate gains a deeper understanding of the technical side of financial accounting. On the other hand, a CIMA passed out candidate develops excellent strategic and business management skills.

Duration

Both courses require a similar amount of time for completion. For ACCA, candidates need to clear 14 professional exams and three years of supervised accountancy experience. If the candidates can manage their work and studies simultaneously, they can complete the ACCA qualifications in three years. On the other hand, CIMA candidates must complete 16 papers and three years of relevant work experience to complete the CIMA qualification successfully. So, even in CIMA, candidates can complete the course in 3 years if they balance their work and studies well.

Eligibility or Experience Required

A candidate needs to pass high school to be eligible for the ACCA examination. In contrast, the CIMA exams need a candidate to graduate in any discipline from a recognized university. In addition, both ACCA and CIMA qualifications require the candidate to have three years of relevant work experience. Finally, it is to be noted that candidates are eligible for exemption from papers based on their educational background .

Syllabus

Besides core subject areas of accounting, auditing, and taxation, the ACCA course covers business studies, financial reporting, financial management, law, and ethical & professional standards. On the other hand, the CIMA qualification focuses on developing business skills. Its subjects are business accounting, management accounting, information management, finance management, strategic marketing management, etc. The ACCA syllabus has 13 exams, while the CIMA has 16 exams.

Career Opportunity and Salary

An ACCA qualified professional usually starts in the job profiles of Accountant, Financial Consultant, Tax Manager, Finance Manager, and Internal Auditor. On the other hand, a CIMA qualified professional is best fitted in Management Accountant, Business Analyst, Forensic Analyst, Project Manager, and Finance Controller.

The ACCA trainees start with an average salary of £19,300 p.a., while the ACCA finalists and ACCA part-qualified can earn up to £30,700 p.a. and £25,800 p.a. respectively. On the other hand, CIMA qualified professionals get an average salary of £62,000, increasing to £129,000 at senior levels.

Fees and Passing Rates

CIMA is slightly more expensive than ACCA in terms of the examination cost. The cost of ACCA qualification comes around £1,500 – £2,000, while that of CIMA qualification is in the range of £2,500 – £3,000.

Given the historical passing rates, it is fair to say that both courses are moderately difficult. The below table captures the outcome of ACCA exams conducted during March 2020, wherein we can see that the Professional level is the most difficult while the Knowledge level is the simplest one .

| ACCA Qualification | Mar - 20 |

|---|---|

| Applied Knowledge | |

| Accountant in Business | 82% |

| Financial Accounting | 73% |

| Management Accounting | 65% |

| Applied Skills | |

| Corporate and Business Law | 83% |

| Taxation | 46% |

| Financial Reporting | 44% |

| Performance Management | 35% |

| Financial Management | 44% |

| Audit and Assurance | 36% |

| Strategic Professional - Essentials | |

| Strategic Business Leader | 47% |

| Strategic Business Reporting | 51% |

| Strategic Professional - Options | |

| Advanced Audit and Assurance | 33% |

| Advanced Financial Management | 33% |

| Advanced Performance Management | 32% |

| Advanced Taxation | 44% |

The below table captures the outcome of CIMA exams conducted during May 2020. Except for the Professional level, all other levels are of equal difficulty in terms of passing rates .

| CIMA Qualification | May - 20 |

|---|---|

| Operational | 57% |

| Management | 67% |

| Professional | 27% |

| Strategic | 69% |

Exam Availability

The ACCA exams are conducted in March, June, September, and December, while the CIMA exams are conducted in February, May, August, and November. The exam dates of the upcoming ACCA exams are Mar 07-11, 2022 and Jun 06-10, 2022, while the CIMA exams are Feb 09-25, 2022, May 11-27, 2022, Aug 10-26, 2022, and Nov 09-25, 2022.

How to Enroll?

If a candidate is interested in pursuing ACCA, they should visit the official website of ACCA Global for process guidance. On the other hand, if a candidate wants to pursue CIMA, they should register at the official website of CIMA Global.

Recommended Articles

It has been a guide to ACCA vs. CIMA. Here we discuss the difference between ACCA and CIMA, infographics, and why to pursue them. We also discuss their exam requirements. You may also have a look at the following articles –