The Importance of Accurate Financial Reporting in Business Decision-Making

Table of Contents

Introduction

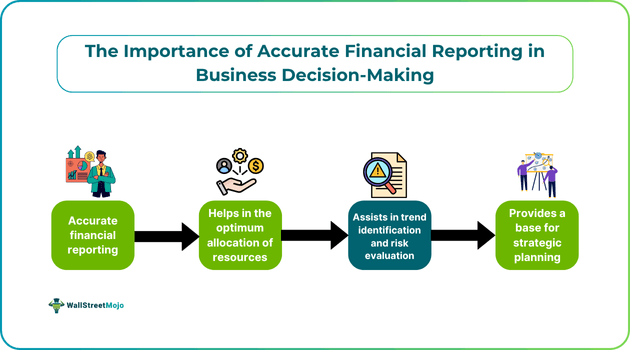

Accurate financial reporting is essential for any business aiming to achieve growth and success. Any organization’s management team requires accurate information to make decisions that can drive the company forward toward its goals. If you are looking to know about the reasons why financial reporting in business is pivotal, you are in the right place.

In this article, we will dive deep into the importance of making accurate financial reports and how inaccuracy with regard to reporting can have a negative impact on an organization. We will also look into the role a chief financial officer, or CFO plays in building a robust and effective reporting culture and explore other things associated with the importance of reliable financial data.

Why Financial Reporting Matters (Beyond Just Taxes)

Let us look at some key reasons why accurate financial reporting is crucial for any business.

#1 - Financial Reports: More Than Just a Tax Season Task

Financial reports created without mistakes provide companies with correct financial data that they can use to compute taxable income accurately. This, in turn, allows organizations to avoid audits conducted by federal tax agencies and penalties. That said, the importance of financial statements’ accuracy is not just restricted to tax filing. It can help in fraud prevention and risk management. This is because focusing on preparing financial records allows companies to spot potential hazards and take measures to minimize them.

Moreover, by following financial reporting best practices, organizations can adhere to regulatory requirements and ensure legal compliance. This, in turn, makes sure that they avoid fines, penalties, reputational damages, or any legal consequences that materialize in case of non-compliance.

Financial reporting is crucial for business decision-making as well.

#2 - Why They Matter for Day-to-Day Decisions

Accurate financial reports provide business owners or managers with trustworthy data, which helps in informed day-to-day business decision-making. Moreover, such reports aid in strategic planning. Organizations can examine the financial information to identify trends and predict future performance. Based on the trends and projections, they can make informed decisions that are in line with their objectives.

Also, note that when businesses have access to reliable financial data, they are able to track operations carefully and identify areas in which they can allocate resources more efficiently. This leads to improved cost control and operational efficiency.

"Good financial reporting isn’t about tracking the past. It’s about giving leaders a clear view of what’s happening right now and what’s possible next," says Lacey Jarvis, COO at AAA State of Play.

How Inaccuracy Can Derail Decisions

Inaccurate financial reporting in business can result in poor decision-making. When incorrect data forms the basis of decisions, companies might end up allocating funds to the wrong areas of the business, leading to a waste of resources and time. Moreover, organizations fail to capitalize on growth opportunities in the market when they make decisions based on incorrect data.

#1 - Wider Consequences Beyond the Company

Besides missed opportunities and inefficient allocation of resources, there are often consequences that are external to an organization. Let us understand these repercussions through the following pointers:

- Limited Financial Assistance: The importance of financial statements is paramount when it comes to raising funds via debt. After all, banks and other lenders analyze the financial data of a company to assess the credit risk. If any inaccuracy in the data is spotted, the lender may not provide funds to the company.

- Non-Compliance with Regulations: Failure to ensure compliance with the relevant regulations can lead to audits, fines, and penalties, which can lead to financial stress.

- Reputational Damage: If stakeholders do not get reliable financial data, they may lose trust in the company. As a result, the chances of building customer loyalty and long-standing relationships decline.

One should note that inaccurate financial reporting can be unintentional. It may happen when an accountant in an organization does not have proper knowledge of all accounting standards. They end up carrying out incorrect practices that lead to inaccuracies, and when the management makes decisions based on the data, they make decisions that affect the business.

“I’ve seen businesses fold not because they weren’t profitable but because they didn’t know they were. Inaccurate books meant they missed key decisions at critical moments,” explains Gary Hemming, Owner and Finance Director at ABC Finance.

Better Budgeting Starts with Better Reporting

Budgeting is crucial for creating effective business plans; it enables the management team to compare the actual results against the targeted outcomes. With respect to budgeting, financial reporting plays a vital role. Let us find out why.

#1 - Why Budgeting Needs Accurate Numbers

Financial reports provide individuals with key insights into a company’s current financial position and in which direction it is heading. Once the management reviews such reports carefully, they can spot improvement areas and make decisions regarding the allocation of resources. If the reports consist of incorrect data, the management will end up preparing unreliable budgets, resulting in uncontrollable expenses and improper resource allocation.

#2 - Avoiding Guesswork and Waste

When preparing budgets, it is vital to steer clear of guesswork and ensure the use of accurate financial information only. If too many assumptions or unrealistic projections are involved, it can lead to the wastage of the available resources. This, in turn, prevents companies from reaching their set financial goals.

“Your budget is only as good as the data that feeds it. A strong reporting framework lets you spot waste and redirect funds where they’ll have the biggest impact,” notes Jesse Morgan, Affiliate Marketing Manager at Event Tickets Center.

Strategic Growth Requires Honest Numbers

When a business plans to expand its operations, formulating an effective strategy is essential, and to create it, having access to accurate information, especially financial data, is a must. Precisely, without accurate financial reporting, organizations cannot clearly define growth targets and ensure the optimum allocation of resources.

Trust Is a Currency, Too

In the business world, trust does not just build long-standing relationships; it plays a significant role in boosting value creation. Indeed, trust results in improved interactions with customers and other key stakeholders and helps build customer loyalty. Moreover, it plays a key role in fostering an efficient work environment and fueling growth.

“Growth is exciting, but it’s also risky. Financial reporting is your safety net. Without it, you’re leaping blindfolded,” says Samuel Charmetant, founder of ArtMajeur.

The Role of Tech in Financial Accuracy

Emerging technologies are proving to be a game-changer for professionals as they can now prepare financial reports with increased precision and speed.

Control, Visibility, and Peace of Mind

Companies are able to utilize platforms offering cloud-based accounting to streamline the structuring and acquisition of bookkeeping information. This improves operational efficiency by reducing the risk of error associated with manual data handling.

In addition, via the deployment of intelligent systems, organizations can now track transactions in real-time. This allows the immediate conversion of raw data into actionable insights. Overall, the automated reporting of financial data provides more accurate financial reports instantly. This increased accuracy offers peace of mind and allows managers to utilize the latest data for strategic decision-making.

“Automation doesn’t replace the finance team—it empowers them. They can spend more time analyzing trends and less time correcting typos,” shares Dan Mogolesko, Owner of JD Buys Homes.

Compliance And Audit Readiness

Accurate financial reporting indicates that a company has complied with the relevant accounting rules and regulations and is ready for audit. Hence, by maintaining accurate reports, a company can make sure that they do not have to pay any penalties. Moreover, when a business is audit-ready, it can avoid costly audit processes as auditors are able to carry do their work without any hassle.

Audit-Ready Means Opportunity-Ready

Audit readiness plays a key role in building investor and shareholder confidence. After all, they depend on accurate financial information for decision-making. When an organization has a history of creating reliable financial reports, shareholders get the confidence to hold their investments. Moreover, the company can attract new investors. One must also keep in mind that audit readiness can enhance a business’s operational efficiency. By spotting and resolving issues, organizations are able to save resources and time. This, in turn, allows them to capitalize on the opportunities that may materialize in this market.

“If you’re always audit-ready, then you’re always investor-ready, partner-ready, and growth-ready. That’s how you stay competitive,” says Edward White, Head of Growth at beehiiv.

Building Trust With Stakeholders

When organizations carry out accurate financial reporting, it is a sign that they are committed to building trust with their stakeholders. Confidence among the stakeholders results in long-term relationships. Moreover, it encourages further investment.

#1 - Trust Starts with Transparent Numbers

A key factor that helps build trust is transparency, especially with regard to financials. When organizations provide a clear picture of their financial health and operations, the possibility of partners, investors, and other key stakeholders trusting the businesses rises. They can have access to all the data required to make informed decisions. Thus, this trust can result in improved investor confidence and enhanced financial backing.

While trust begins with transparent numbers, there are other factors that can build trust. Two examples are open communication and regular updates.

#2 - Building a Culture of Accountability

Building trust for the long term is not possible without accountability. When a business is accountable, stakeholders trust the organization. This is because if organizations are accountable, they stick to commitments diligently. Creating a culture of accountability does not just require setting goals and reviewing the outcomes. Organizations need to take various measures that reinforce ownership across all levels within a company; for example, everyone must acknowledge their mistakes, be transparent about information, etc. If a company manages to establish this culture, it automatically gains the trust of stakeholders.

"Financial reporting isn’t just for boardrooms. When done right, it empowers every team in the business to act like owners," says Justin Azarias, founder and CEO of Property Homebuyers CA.

The CFO’s Role in Reporting Culture

Generally, CFOs have core financial reporting capabilities. They supervise the creation as well as the analysis of financial statements. Moreover, they verify the accuracy of the financial reports and check whether the accountants complied with the regulatory requirements related to financial reporting. CFOs formulate and execute reporting policies if required in case of regulatory or legal changes.

Thus, overall, they are responsible for establishing and maintaining the financial reporting culture within an organization.

“The CFO’s job isn’t just reporting the past. It’s about shaping the future with numbers that people trust,” says Raihan Masroor, Founder and CEO of Your Doctors Online.

Final Thoughts

Now that we are at the end of the article, we hope it is clear that, besides serving as a key to fulfilling regulatory requirements, accurate financial reporting is important for business decision-making and establishing long-term relationships with stakeholders. That said, a lot of businesses struggle to ensure the preparation of proper financial reports because of different reasons, like insufficient resources, lack of time, and absence of accounting expertise. To combat these issues and fulfill the set goals, business owners and managers need to take the necessary measures as soon as possible.