Table Of Contents

What Is The Acid Test Ratio?

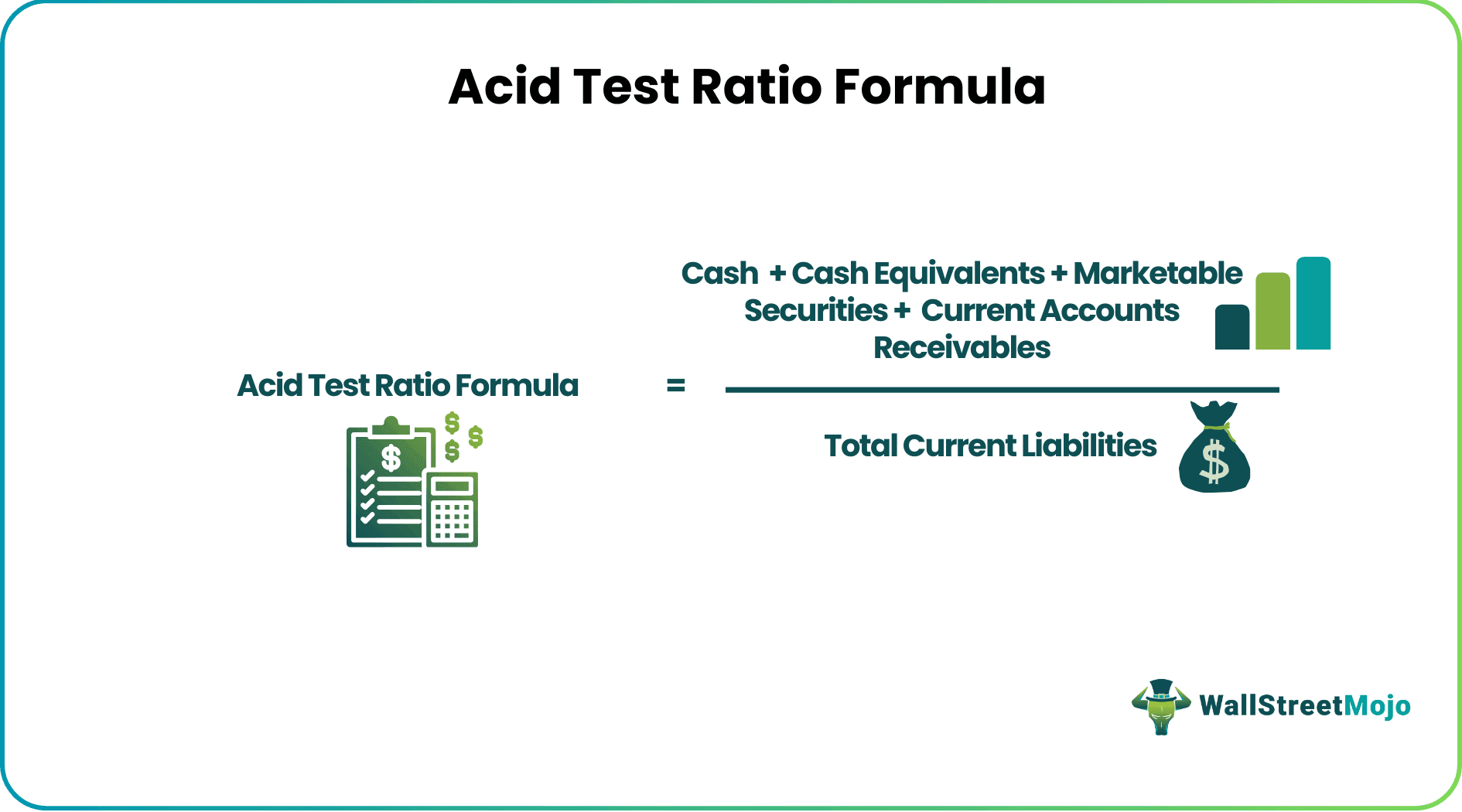

The acid test ratio measures a company's short-term liquidity, indicating its capacity to pay off current commitments using just its most liquid assets. It is calculated by dividing the sum of cash, cash equivalents, marketable securities or short-term investments, and current accounts receivables by the total current liabilities.

Understanding the acid test ratio is very important as it shows the company's potential to quickly convert its assets into cash to satisfy its current liabilities. For example, suppose an entity has an adequate liquid asset to cover its current liabilities. In that case, it does not need to liquidate any of its long-term assets to meet its current obligations. This is paramount since most businesses rely on long-term assets to generate additional revenue.

Key Takeaways

- The acid test ratio measures a company's short-term liquidity, focusing on its ability to meet current obligations using highly liquid assets.

- Calculate the ratio by dividing the sum of cash, cash equivalents, marketable securities, short-term investments, and current accounts receivables by total current liabilities.

- The acid test ratio demonstrates a company's ability to convert assets into cash to fulfill current liabilities quickly.

- An acid test ratio above 1.0 indicates financial stability and sufficient capability to meet short-term obligations. It is a more conservative measure than the current ratio, which includes inventory that takes longer to convert into cash.

Acid Test Ratio Formula

Acid Test Ratio = (Cash + Cash Equivalents + Marketable Securities + Current Accounts Receivables) / Total Current Liabilities

Another more popular formula calculates the acid test ratio first by deducting inventory from the total current assets and dividing the value by the current liabilities. Inventory is excluded in this formula because it is not considered a rapid cash convertible. Mathematically it is represented as: -

Acid Test Ratio Explained in Video

Examples

Below are some examples to understand the concept in a better manner.

Example #1

The following are the current assets and current liabilities of ABC Ltd.: -

- Acid test ratio = ($2,500 + $12,500) / ($12,500 + $1,500 + $500)

- = 1.03

Example #2

The following are the current assets and current liabilities of Apple Inc. for the period ending 29 September 2018: -

Calculate the acid test ratio of Apple Inc. for the period ending 29 September 2018: -

- = ($25,913 + $40,388 + $48,995 + $12,087) / ($55,888 + $20,748 + $40,230)

- = 1.09

Interpretation

- If an entity's acid test ratio exceeds 1.0, it is considered financially secure and sufficiently capable of meeting its short-term liabilities. In addition, this ratio is a more conservative measure than the popularly used current ratio as it excludes inventory, which is considered to take longer to convert into cash.

- As a thumb rule, a low or decreasing trend witnessed in the acid test ratio usually indicates that an entity may have weak top-line growth and struggle to manage working capital due to a lower creditor period or higher receivable period.

- On the other hand, a high or increasing trend in acid test ratio generally means that the entity has strong top-line growth, can quickly convert receivables into cash, and is comfortable in its financial obligation coverage.

Apple's Example

Now let us take the real-life example in Excel of Apple Inc.'s published financial statement for the last four accounting period.

You can easily calculate the ratio in the template provided.

Based on the publicly available financial information of Apple Inc., we can calculate the ratio for the accounting years 2015 to 2018.

The result will be:-

From the above table, it can be seen that the acid test ratio of Apple Inc. has been continuously greater than 1.0 during the period mentioned above, which is a positive sign for any company as it signifies a comfortable liquidity position.

Developing a practical understanding of this ratio is easy via the Financial Planning & Analysis Course. The instructor, who has many years of experience in training learners worldwide, covers financial ratios, including the quick ratio, using examples to help build practical knowledge in addition to a theoretical understanding. The practical approach adopted by the instructor is key to developing the skills required by top finance companies around the world.

Benefits Of The Acid-Test Ratio

The key advantages of a liquid ratio are as follows:

- It assists individuals in evaluating the financial health of a company as it quantifies a company’s liquidity in the short term and the organization’s ability to pay off its current liabilities.

- Computing this accounting ratio is simple.

- One can use this metric to analyze a business over a duration. Alternatively, individuals can use it to carry out a comparison of similar organizations.

Limitations Of The Acid-Test Ratio

Some noteworthy drawbacks of the quick ratio are as follows:

- This ratio alone is inadequate for understanding a company’s liquidity position. One needs to utilize other liquidity ratios, for example, the current ratio, along with the quick ratio, to develop a clear idea of the liquidity position of an organization.

- The ratio does not offer information regarding cash flow levels and timing. These two elements are crucial factors that help determine the ability of an organization to pay off obligations once they are due.

- The acid-test ratio calculation does not factor in inventory or stock of a company, as it typically is not a liquid asset. That said, some organizations have the capability to offload their stock at a fair price. In these cases, the inventory qualifies as a liquid asset.

- This ratio is based on the assumption that a company can readily collect its accounts receivable. That said, it may not be possible in reality.

Acid-Test Ratio vs. Current Ratio

Individuals new to finance often confuse the quick ratio with the current ratio. Let us help people avoid such confusion by explaining how they differ.

| Acid-Test Ratio | Current Ratio |

|---|---|

| The calculation excludes inventory. | Its calculation process requires one to consider the inventory. |

| Analysis with this metric is suitable for companies having significantly highly inventory. | Current ratio analysis is suitable for all kinds of companies. |

| Quick ratio offers a stringent evaluation of an organization’s capacity to fulfill its short-term financial obligations. | It offers a broader view with regard to the short-term liquidity of an organization. |