Table Of Contents

Difference Between Angel Investment and Venture Capital

Angel investments are investments made by informal investors having a high net worth. In the case of Venture capital, investments are taken from the venture capital firms funded by the companies that pool funds from different institutional investors or individuals.

Angel investments are usually the earliest investments made in start-ups by wealthy investors who potentially contribute to the new business through their advice and experience apart from their funds. Angel investors are generally former entrepreneurs who enjoy taking the risk, sometimes even before commercializing the idea of a new business.

Venture Capital investments are early investments usually made in growth companies by organizations that pool the funds from individuals, corporations, pension funds, and foundations. Apart from fund contribution, venture capitalists participate by representing part of the board of directors of the investment firm, recruiting senior management, and advising the top management in their strategic decisions. Venture capitalists take a calculated risk by thoroughly examining the company's revenue growth potential to be invested in and have to be particular about due diligence since they have a fiduciary responsibility towards the investors they represent.

Table of contents

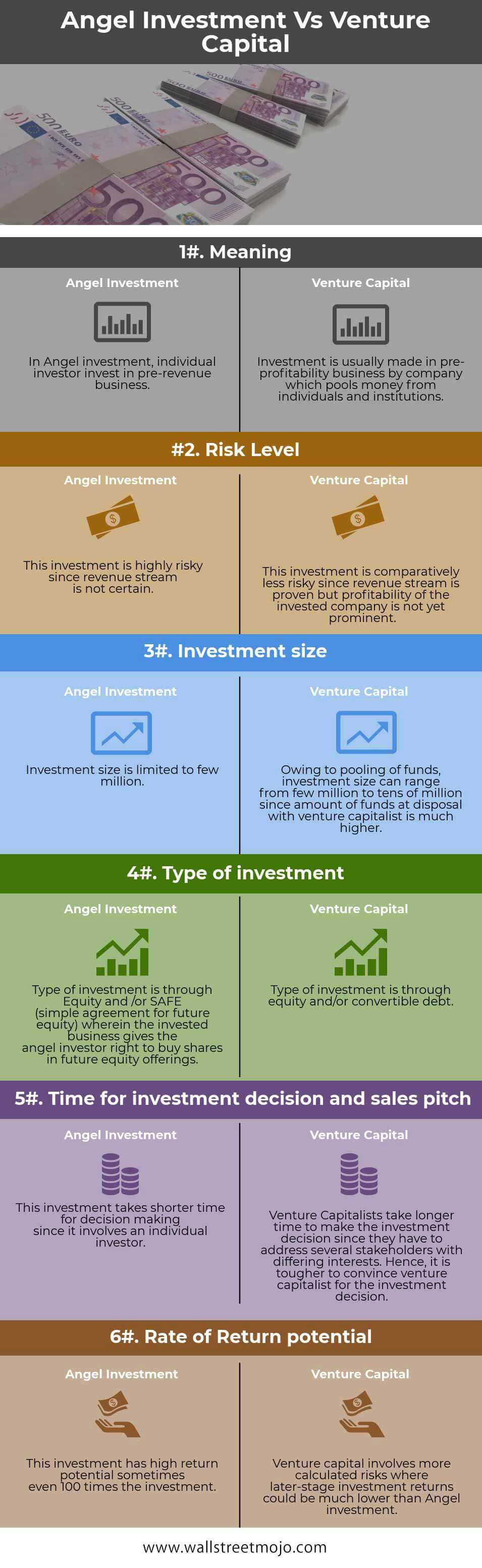

Angel Investment vs. Venture Capital Infographics

Let's see the top differences between angel investment vs. venture capital.

Key Differences

- Angel investment is funded by investors who are usually high net worth individuals (HNIs). Still, Venture Capital investments are funded by companies that pool funds from several individual and institutional investors.

- Angel investors are usually former successful entrepreneurs who like taking a risk and using their experience to judge ideas even before they have been proven or commercialized. Venture Capitalists are usually professional investors who take calculated risks and are more particular about due diligence due to their fiduciary relationship with pooled investors.

- While screening investments, Angel investors focus mostly on qualitative factors like founders' background, the reason for business success, product-market fit, etc. Most start-ups attracting their attention do not have many stable quantitative metrics. Venture Capitalists consider more concrete metrics like revenue growth rate, average revenue per user (ARPU), customer lifetime value, etc. It is more so because of the greater responsibility of venture capitalists to justify the investment decision to their investors.

- Angel investors like to provide mentoring guidance to the start-up owner. However, Venture capitalists hold a seat on the Board of Directors against the funding done. Hence, they are more involved in the strategic decision-making of the invested organization.

Angel Investment vs. Venture Capital Comparative Table

| Criteria | Angel Investment | Venture Capital |

|---|---|---|

| Meaning | In Angel investment, individual investors invest in a pre-revenue business. | Investment is usually made in the pre-profitability business by a company that pools money from individuals and institutions. |

| Risk Level | This investment is highly risky since the revenue stream is not certain. | This investment is comparatively less risky since the revenue stream is proven, but the profitability of the invested company is not yet prominent. |

| Investment size | Investment size is limited to a few million. | Owing to the pooling of funds, investment size can range from a few million to tens of millions since the number of funds at disposal of a venture capitalist is much higher. |

| Type of investment | The type of investment is through Equity and SAFE (simple agreement for future equity), wherein the invested business gives the angel investor the right to buy shares in future equity offerings. | The type of investment is through equity and/or convertible debt. |

| Time for investment decision and sales pitch | This investment takes a shorter time for decision making since it involves an individual investor. | Venture Capitalists take a longer time to make the investment decision since they have to address several stakeholders with differing interests. Hence, it is tougher to convince the venture capitalist for the investment decision. |

| Rate of return potential | This investment has high return potential, sometimes even 100 times the investment. | Venture capital involves more calculated risks where later-stage investment returns could be much lower than Angel investment. |

Conclusion

Both angel investment and venture capital are significant drivers of economic growth since they take a high level of risk to support new organizations. Established companies like Google, PayPal, etc., had started with the help of these types of investments.

So the question arises as to which investor to look for while starting a new business.

- Angel investors can go for limited cash outlay, are easier to convince in sales pitches, and are more interested in a mentoring role, which involves less intrusion into the investing firm. Hence Angel investments are ideal for seed financing where the invested organization hardly has any proven data like revenue stream for convincing the investor.

- In contrast, while venture capitalists can invest more in the business, they demand a place on the board of directors. In case the requirement of funds is high, as, in the case of growing firms, the firm would have to endure making decisions in conformance with a venture capitalist.

Recommended Articles

This article has been a guide for Angel investment vs. Venture Capital. Here we discuss the top differences between them and infographics and a comparison table. You may also have a look at the following articles –