Table Of Contents

Venture Capital Financing Meaning

Venture capital financing is a high-risk, high return investment methodology in which the money is invested in the form of equity in a company that is privately held, i.e., not publicly traded on a stock exchange, and is planned for three broad stages of the company – idea, expansion, and exit stage.

We need to understand two main aspects of this form of investing; in most cases, the company is already selling a product at a smaller scale. The venture capital sees the potential of the same and therefore thinks of scaling it up. Further, the exit from the company is pre-planned and generally takes the form of an initial public offering (IPO) or a buyout.

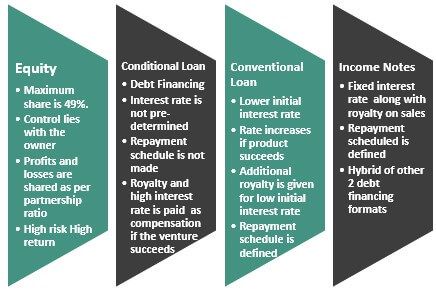

Methods of Venture Capital Financing

Following smart art shows the various investment methods of VC financing:

These methods may vary in terminology or features from one geography to another; however, similar financing frameworks are available globally and cover mostly all formats of financing.

Video Explanation of Venture Capital Financing

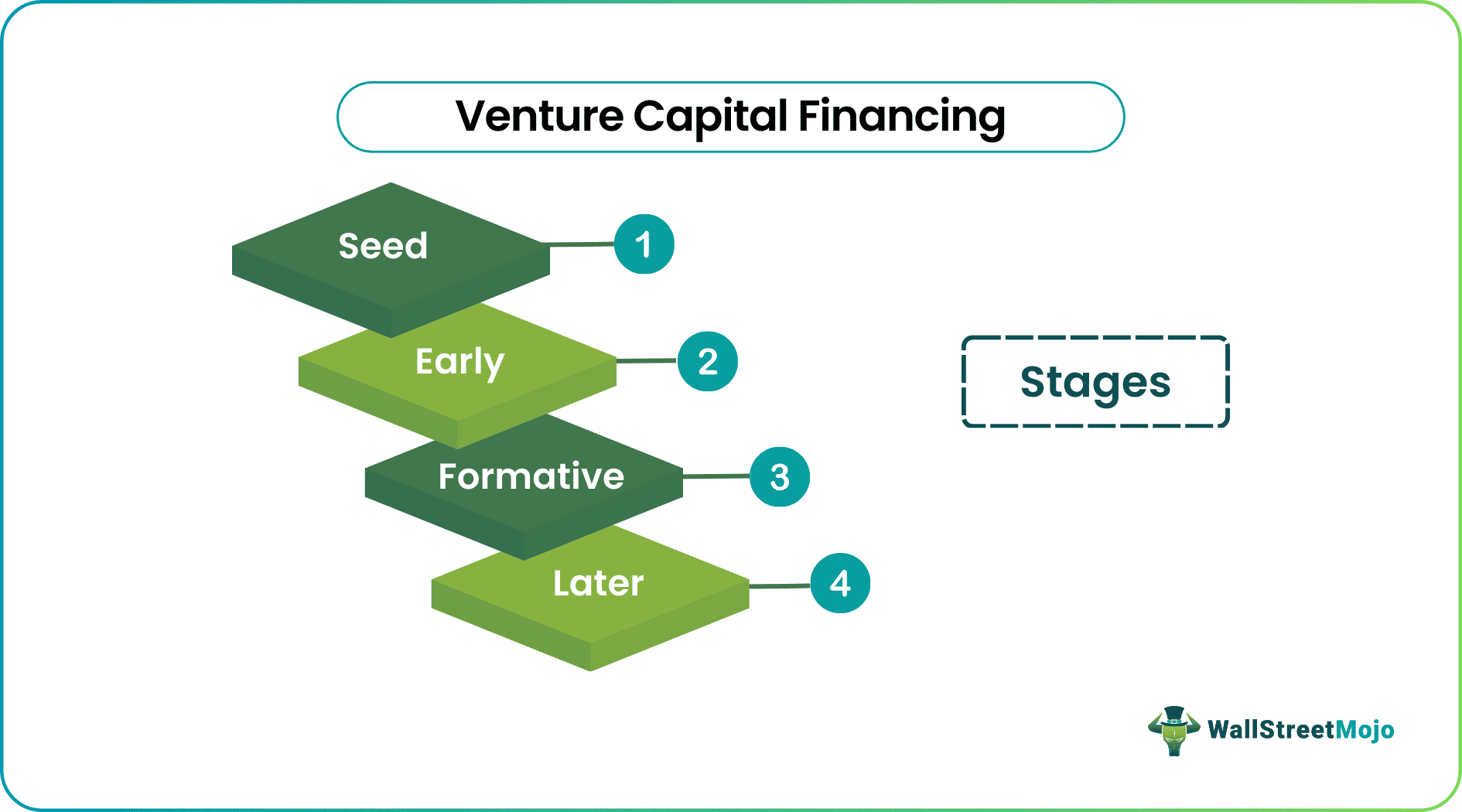

Stages of Venture Capital Financing

Following smart art shows the various stages of VC financing broadly based on Schilit's classification; however, some of the terminologies are adapted based on the evolution of the same and terms of common usage in the present time:

#1 - Seed Stage

At this stage, the funding is required for conducting market research for understanding the product feasibility or for developing the product based on prior market research and prototype developed.

#2 - Early Stage

At this stage, commercial selling has not been initiated, which is why funding is required. This stage has two subparts:

- Start-up: The production has not started; funding is required for starting operations and doing initial marketing.

- First-Stage: Financing is done to begin commercial selling.

#3 - Formative Stage

This is a broader term that engulfs both of the prior two or one of these stages. A very thin line demarcation between all such stages makes determining exactly when one ended and the other began very difficult. Therefore in such products, instead of having several stages, one bigger round of funding is done to encompass all.

#4 - Later Stage

This is after commercial selling has begun and one of the most common stages where the most money is invested. The venture capitalists have higher faith in the product because they can concretely visualize the same. This involves the following sub-stages:

- Second Stage - The profitability has not yet occurred; the commercial sales have begun. However, the company requires initial scaling up because it wants to use the economies of scale and enter the profitability zone.

- Third Stage - Here, the financing is for long-term expansion, such as creating a new plant that caters to a new geographical region; therefore, this involves a huge marketing expense.

- Mezzanine Financing - This is similar to the straw before the last straw, i.e., the interim financing required by the company before its IPO is rolled out, and therefore, the name is given to it.

Example

Valuation of a company is done at two stages, at the time of VC financing. Following are the two stages:

- PRE - This is the valuation before VC Funding is received

- POST - This is the valuation after VC Funding is received

- POST = PRE +Investment

Apart from this, there is a valuation of the risk component that a venture capitalist considers before, which can be calculated in the following manner:

Suppose we are given the following information:

- Required investment: $10 million

- Expected value to be returned: $30 million

- Number of years: 10 years

- Probability of failure per year:

- Cost of Capital - 22%

From this, we can calculate the probability that the project will last for ten years:

- (1-0.3) x (1-0.29) x (1-0.28) x (1-0.24)7

- = 5.24%

Calculation of the NPV of the Project

- =-$10000000 + $4106983

- = -5,893,016.60

Therefore this project has a negative NPV and not worth investing.

Advantages

- High Return - If the venture is successful, there is a chance of a 40 to 50% return, which is higher than most investments. However, this return is not without risks, so it is a trade-off, and only those who have this level of risk tolerance should invest in the same.

- Participation in Innovation - As the times when technology evolves, newer products keep entering the market, and older ones become obsolete; therefore, to keep the returns coming, a venture capitalist should keep investing in the innovations so that he develops a perennial return source.

- Launch-Pad for Entrepreneurship - Small business gets the necessary resources for expansion and higher sales. Therefore VC investment drives entrepreneurship.

Disadvantages

- Lack of Liquidity - As the shares in the company are not traded on the stock exchange, the investment becomes illiquid, and it is a big problem to find an interested buyer because the range of investor search becomes very limited. IPO or buyouts are more probable for successful ventures; however, if the venture is struggling or about to fail, exit becomes problematic.

- Long Term Investment - As the investment can take place at a very early stage, and the returns may come at a very later date, therefore the gestation period till the time the company becomes attractive is quite longer than an average investment horizon. Only patient investors can take such an investment, however, the returns compensate for a greater period of illiquidity.

- Market Value Determination is very Difficult -If the product is highly innovative, there might be very low chances of competitors. Also, there is a lower chance of gauging how the target audience will receive the product. Investment is made before such clarity can be gained; therefore, assessing the company's value is difficult because, at times, very promising ideas fail. So determining the amount of investment becomes a little more difficult.

- Limited Information - As the companies have not existed for a long time, there is very little information regarding their financial position; further, as the product itself is new, the profitability numbers are also not present for too long a time, therefore finding a track record of the company and the product is very difficult.

- Lack of Information on Competition - These companies work in silos. There is very little publicly available information about the company until it has reached the second or third stage of funding, when the product is commercially selling. Marketing is done at a larger scale. So it is very difficult to know how many companies are working on similar ideas, and therefore determining a reasonable market share is also difficult. All these add to the cloudiness of investment.