Table Of Contents

What is Capital Expenditure?

Capital expenditure examples such as cost of equipment and vehicles refer to the total spending on the purchase of assets by the company in a given period. Examples include spending on the purchase of buildings, office types of equipment, intangible assets, furniture and fixtures, computer equipment, motor vehicles, expenditure on the extension or the addition of assets, etc.

A capital expenditure budget is drafted for most companies to maintain or upgrade existing properties or equipment as technological updating and improvement help companies generate more revenue out of the existing assets. It is important to note that items with a useful life of less than a year are accounted for in the income statement rather than CapEx.

Table of contents

Capital Expenditure Examples Explained

Capital expenditures are spending or payments made toward goods, services, or assets that are capitalized in the company’s balance sheet. These costs are incurred to maintain and upgrade an asset to elongate its useful life.

Capital expenditure is required to expand operations and maintain the company's current operation levels. The amount of capital expenditure that a company makes depends on the nature of the company's business.

Certain businesses are more capital intensive as compared to the others. Thus, capital expenditure accounting is usually driven by a business company's nature.

The most common examples of capital expenditure (CapEx) are as follows: -

- Land

- Building

- Office Furniture

- Computers

- Office Equipment

- Machinery

- Vehicles

- Patents

- Copyrights

- Trademarks

- Licensing and rights

- Softwares

It's important to note that capital expenditure is typically associated with investments that have a long-term impact on a company's operations and future earnings potential. In contrast, operating expenses are related to day-to-day business activities and usually have a more immediate impact on the income statement.

Formula

The formula for capital expenditure accounting is relatively straightforward. Capital expenditure refers to the funds a company or organization invests in acquiring, upgrading, or maintaining long-term assets, such as property, equipment, and infrastructure. The formula for calculating capital expenditure is as follows:

Capital Expenditure (CapEx) = Ending Net Property, Plant, and Equipment (PPE) - Beginning Net Property, Plant, and Equipment (PPE) + Depreciation Expense

Where,

Ending Net PPE: The value of property, plant, and equipment at the end of the period.

Beginning Net PPE: The value of property, plant, and equipment at the beginning of the period.

Depreciation Expense: The portion of the cost of assets that has been allocated as an expense over their useful life. It is subtracted because it represents the reduction in the value of existing assets.

Capital Expenditure Formula Explanation in Video

How To Calculate?

Now that we understand the basics of drafting a capital expenditure budget and its formula, let us now understand how to calculate by applying the formula we discussed earlier through the step-by-step guide below.

- Determine Ending Net PPE: Find the value of property, plant, and equipment at the end of the period. This value should reflect the net book value of these assets after accounting for any accumulated depreciation. Let's say the ending net PPE is $50,000.

- Determine Beginning Net PPE: Find the value of property, plant, and equipment at the beginning of the period. Again, this value should reflect the net book value after accounting for accumulated depreciation. Let's say the beginning net PPE is $40,000.

- Calculate Depreciation Expense: Determine the depreciation expense for the period. This is the amount by which the value of assets has been allocated as an expense over their useful life. Let's say the depreciation expense for the period is $5,000.

Once these values have been found, a direct application of those values into the formula shall give us the CapEx for a specific period. Let us apply the above numbers to clearly understand the concept:

CapEx = Ending Net PPE - Beginning Net PPE + Depreciation Expense

= $50,000 - $40,000 + $5,000

= $15,000

The CapEx is $15,000. This means that during the period, the company invested a net amount of $15,000 in acquiring or upgrading property, plant, and equipment, after accounting for depreciation.

Examples

Let us understand the uses of capital expenditure accounting with the help of a few examples. These examples shall give us a practical overview of the concept and its related factors.

Example #1

The new production unit set up by ABC Ltd. would increase its production capacity by 300 MT.

ABC Ltd. is engaged in cement production. The company had an existing capacity of 500 MT. However, the market demand for cement has grown significantly due to the country's increasing infrastructure and real estate activities. Given the increased market demand, ABC Ltd. decided to set up a new production unit in the same vicinity as the existing unit. As a result, a new unit is expected to increase the production capacity by 300 MT.

This new unit, being set up by the company, is an example of a capital expenditure made by the company. As the unit is being set up to increase the production capacity, the unit's benefits would flow to the entity for more than a year.

The increase in the production capacity of the entity is not a basis for classifying the amount spent on setting up the production unit as capital expenditure. In the above example, even if the production capacity remained constant and the new unit brought efficiency in production or helped reduce the factory's waste, it would still classify as a capital expenditure. So it is since the entity is still utilizing its cost benefits.

Example #2

The entity purchased the vehicle.

An entity engaged in running a manufacturing unit has purchased a vehicle to transport employees from home to office and office to home. Therefore, it falls under the definition of capital expenditure.

The amount spent on purchasing the vehicle shall be capitalized in the entity's books, and depreciation shall be charged on the same, based on the expected useful life of the vehicle and the expected residual value of the vehicle.

Example #3

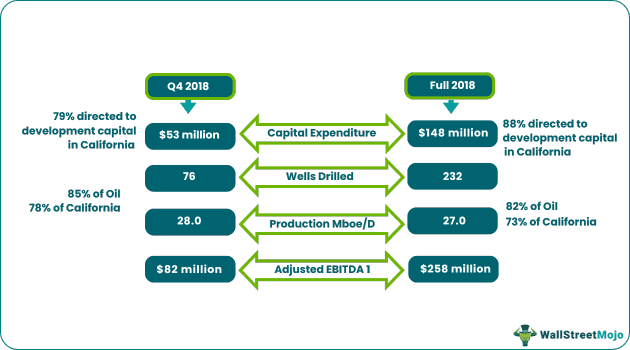

Capital expenditure trend of Berry Petroleum Company, LLC.

Berry Petroleum Company, LLC is one of the oldest companies in the USA. It has been in operation since 1909. Berry expanded its presence in areas outside of California beginning in 2003 as the company observed the opportunities to acquire natural gas and light oil to increase its portfolio.

Since the company is an upstream energy company, which is engaged primarily in the development and production of conventional oil reserves, the below extracts from the annual report of Berry Petroleum Company, LLC provides the company's capital budget.

Source: Berrypetroleum.com

(Reference: Page 7 of Annual report of Berry Petroleum Company LLC for the year ended 31st December 2018)

The following picture provides vital insights into the capital expenditures made by the company, along with their purposes and impacts on the production of the company as well as EBITDA.

Example #4

Capital expenditure trends and nature for GlaxoSmithKline (GSK)

GlaxoSmithKline is a science-led global healthcare company to help people do more, feel better, and live longer. The company does a lot of research, development, and manufacturing in primarily three segments, which are:

- Pharmaceutical medicines

- Vaccines and

- Consumer healthcare products

The company invests significantly in research and development activities and manufacturing facilities.

The capital allocation decided by the company in the year ended 31st December 2018 is as under:

Source: www.gsk.com

The following table provides further insights into the capital allocation framework of the company, along with details of the business that gets the capital on top priority. The extract shows that the company's key priorities for capital are the pharmaceuticals pipeline and vaccines capacity. Its primary driving force is that the demand for pharmaceuticals is ever-increasing globally. Therefore, an increase in capacity is required to serve the increasing needs.

Source: www.gsk.com

Capital Expenditure Vs Revenue Expenditure

Despite these spendings improving the efficiency and profit-making capacity of the business, there are differences in their fundamentals and implications. Let us understand the differences through the comparison below.

Capital Expenditure

- It is the expense incurred by a business to acquire or improve the quality of an asset.

- Companies spend on maintaining the quality of an asset to ensure it performs efficiently during its useful life at full efficiency.

- It is not exhausted during the financial year as it is a long-term expenditure.

- It mostly has a physical form in the form of an asset, except obviously for intangible assets.

- It is a non-recurring expense.

- A capital expenditure accounting is reflected on the balance sheet until benefits are exhausted completely.

- It does not reduce or limit the revenue of the business.

Revenue Expenses

- Revenue expenses refer to the expenditures of the daily operating business, hence, it is incurred on a regular basis.

- It is a short-term expense and its benefits are reaped within the same financial year.

- It has no physical presence as it is spent on daily business activities.

- It occurs repeatedly.

- It is reflected in the income statement or trading profit and loss account.

- These expenditures reduce the business profits.

Recommended Articles

This article has been a guide to Capital Expenditure Examples. Here we explain its formula, and examples, and compared it with revenue expenditures in detail. You can learn more about accounting from the following articles: -