CFA and Investment Banking: Powering Your Career

Table of Contents

What Is Investment Banking?

Investment banking is a section of the world of finance that focuses on facilitating the flow of capital between investors and corporations. It includes a range of financial services, including underwriting securities offerings, providing financial advisory services, facilitating mergers and acquisitions, and trading financial instruments.

One of the fundamental purposes of investment banks is to underwrite securities offerings, such as initial public offerings (IPOs) and bond issuances. In this capacity, investment banks assist companies in structuring and pricing their offerings, marketing them to potential investors, and ultimately facilitating the sale of securities to raise capital. This process involves extensive due diligence, financial analysis, and regulatory compliance to ensure the success of the offering.

Additionally, investment banks offer advisory services to clients on different strategic fronts like mergers and acquisitions (M&A), corporate restructuring, and divestitures. They give their invaluable insights and guidance throughout the transaction process, helping clients figure out challenging negotiations, evaluate potential targets or buyers, and structure deals to maximize value.

Investment banks also engage in proprietary trading activities, where they trade financial instruments such as stocks, bonds, currencies, and derivatives on behalf of the bank's account. These trading activities can generate significant profits for the bank but also have a set of risks. Risks include market volatility and regulatory scrutiny.

Furthermore, investment banks operate in the capital markets, enabling the buying and selling of securities on behalf of institutional investors and providing liquidity to the market. They also offer research services, producing reports and analyses on various companies, industries, and market trends to help investors make informed investment decisions.

Key Takeaways

- A Chartered Financial Analyst (CFA) designation enhances qualifications and credibility in investment banking.

- The CFA program provides in-depth knowledge of finance, valuation, and ethics, which are crucial for investment bankers.

- While highly valued in investment banking, CFAs work in various roles, such as portfolio management, equity research, and risk management.

- The CFA designation is recognized globally, providing CFAs with credibility and recognition in the international finance community.

- Holding a CFA certification can provide a competitive advantage and differentiate candidates in the competitive field of investment banking.

What Do Investment Banks Do?

Investment banks are institutions in the world of finance that provide an extensive range of services to governments, governments, institutional investors, and high-net-worth individuals. Their primary function is to facilitate the flow of capital between investors and businesses.

Investment banks offer various financial services, including underwriting securities offerings, providing financial advisory services, facilitating mergers and acquisitions, and trading financial instruments.

One of the main tasks of investment banks is underwriting securities offerings. Initial public offerings (IPOs) and bond issuances are classic examples. They assist companies in structuring and pricing their offerings, market them to potential investors, and facilitate the sale of securities to raise capital. These institutions carry out due diligence, financial analysis, and regulatory compliance to make entirely sure that the success of the offering is sorted.

Investment banks also operate in the capital markets, enabling the buying and selling of securities on behalf of institutional investors and providing liquidity to the market. They also offer research services, producing reports and analyses on companies, industries, and market trends to help investors take calls regarding their investments.

Investment banks also offer advisory services to clients on strategic fronts such as mergers and acquisitions (M&A), corporate restructuring, and divestitures. They provide expertise and guidance throughout the transaction process, helping clients evaluate potential targets or buyers, negotiate deal terms, and structure transactions to maximize value.

Additionally, investment banks engage in proprietary trading activities, where they trade financial instruments such as stocks, bonds, currencies, and derivatives on behalf of the bank's account.

What Is The CFA Program And Why Is It Important For Investment Banking?

The Chartered Financial Analyst (CFA) Program refers to the professional certification offered by the CFA Institute that is highly regarded in the finance industry. It is curated to provide investment professionals with a solid foundation in investment analysis, portfolio management, and ethical standards.

The program consists of three levels of exams that cover a variety of topics, including ethics, quantitative methods, economics, corporate finance, equity investments, financial reporting and analysis, fixed income, derivatives, alternative investments, and portfolio management. Those are quite a few topics, right?

The CFA Program is a booster for investment banking because it equips individuals with the knowledge and skills necessary for success in the field. Investment banking involves complex financial analysis, valuation techniques, and risk management, all of which are covered extensively in the CFA curriculum.

Holding a CFA charter demonstrates a commitment to excellence and ethical standards in the finance profession, which is highly valued by employers in investment banking firms. Additionally, the CFA designation is recognized globally, providing individuals with credibility and recognition in the international finance community.

How To Become An Investment Banker

- Educational Background: Obtain a bachelor's degree in finance, economics, accounting, or a related field. One can also contemplate pursuing further advanced degrees such as an MBA or a Master of Finance (MFin) for additional specialization and career advancement opportunities.

- Gain Relevant Experience: Try to find internships or entry-level positions in finance-related roles, such as investment banking, corporate finance, or financial analysis. These experiences provide valuable exposure to the industry and help develop crucial skills and knowledge.

- Develop Technical Skills: Polish your financial modeling, valuation, and analytical skills through self-study, practical experience, or by enrolling yourself in an extensive course on investment banking. Familiarize yourself with financial software and tools commonly used in investment banking, such as Excel, Bloomberg, and financial modeling software.

- Build Contacts: Build professional relationships with individuals in the finance industry, including current investment bankers, alums, and industry professionals. Attend orientation or networking events to join relevant associations, and make use of popular platforms such as LinkedIn to widen your professional network and access career opportunities.

- Train Yourself For Interviews: Be prepared to undergo a rigorous interview process, including technical interviews, case studies, and behavioral interviews. Practice answering common interview questions, demonstrate your knowledge of finance and investment banking concepts, and highlight achievements.

CFA To Build A Career In Investment Banking

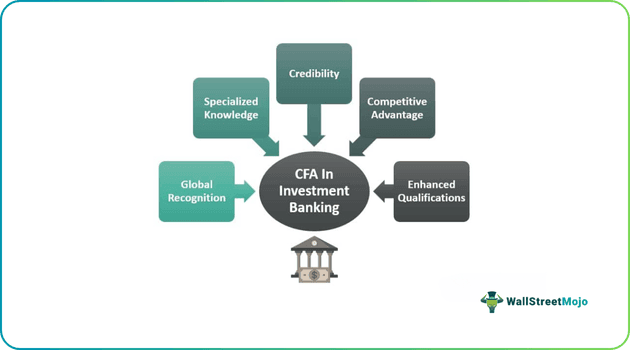

A CFA certification is not an absolute non-negotiable for having an illustrious career in investment banking. However, having a CFA certification can open doors to a broader range of opportunities. It helps candidates on the following fronts:

- Better Qualifications: The Chartered Financial Analyst (CFA) designation is highly regarded in the finance industry and can enhance one's qualifications for a career in investment banking.

- Expertise: The CFA Program covers a wide range of topics relevant to investment banking, including financial analysis, valuation techniques, and portfolio management.

- Global Recognition: Holding a CFA charter demonstrates a commitment to excellence and ethical standards in the finance profession and is recognized globally by employers in investment banking firms.

- Credibility: The CFA designation provides individuals with credibility and recognition in the international finance community. These factors can enhance career prospects and opportunities for advancement in investment banking.

- Competitive Advantage: In the competitive field of investment banking, having a CFA charter can provide a competitive advantage and differentiate candidates from their counterparts. It demonstrates a depth of knowledge and expertise that employers in the industry highly value.

Key Skills And Competencies

Let us understand the critical skills and competencies that a professional must possess to make sure their career graph is always on an upward trend. Let us discuss them briefly through the points below.

- Financial Analysis: Investment bankers must possess strong financial analysis skills to evaluate financial statements, conduct company valuations, and assess investment opportunities accurately.

- Valuation Techniques: Proficiency in various valuation methodologies, such as discounted cash flow analysis, comparable company analysis (CCA), and precedent transactions analysis, is essential for investment bankers to determine the fair value of companies and assets.

- Communication: Effective communication skills are crucial for investment bankers to convey complex financial concepts to clients, colleagues, and stakeholders clearly and concisely.

- Negotiation: Investment bankers engage in negotiations with clients, counterparties, and other stakeholders to structure deals, negotiate terms, and resolve conflicts effectively.

- Attention to Detail: Perfectionism and clarity are critical for investment bankers, who must meticulously analyze data, conduct due diligence duties, and make sure regulatory requirements are complied with.

- Time Management: Investment bankers often work on multiple projects simultaneously, requiring substantial time management skills to prioritize tasks, meet deadlines, and manage workloads effectively.

- Teamwork: Collaboration and teamwork are essential for investment bankers, who often work in teams to execute transactions, coordinate with various departments, and deliver high-quality services to clients.

If you are wondering how you can master all these skills from the comfort of your home/office, click here to get access to one of the BEST COURSES ON INVESTMENT BANKING ON THE INTERNET!!!

Responsibilities And Career Progression

The career progression of a professional in the investment banking segment of the financial world is straightforward. Let us understand the progression and the responsibilities that come with it through the discussion below.

- Analyst: Entry-level investment bankers usually typically start as analysts, responsible for conducting financial analysis, building financial models, preparing client presentations, and supporting senior team members in deal execution.

- Associate: After gaining experience as an analyst, individuals may advance to the role of associate. Associates conduct more enormous responsibilities in deal execution, including managing client relationships, conducting due diligence, and leading transaction processes.

- Vice President (VP): VPs oversee deal teams and perform critical duties in terms of business development, client management, and deal origination. They are responsible for leading transactions, managing client relationships, and mentoring junior team members.

- Director or Managing Director: Directors and managing directors are senior leaders within investment banking firms. They are responsible for driving business strategy, managing key client relationships, and overseeing deal execution. They play a significant role in business development and firm-wide leadership.

Structure, Format, And Tips For Success

It is critical to note that there is no set path or "secret" to success in investment banking. Different people find different combinations that work for them. However, below is a structure, format, and a few tips for success that are commonly found in the industry.

Structure Of Investment Banking

- Hierarchy: Investment banking firms typically have a hierarchical structure, with roles ranging from analysts to managing directors.

- Departments: Investment banks are divided into various departments, including mergers and acquisitions (M&A), corporate finance, capital markets, and sales and trading.

- Deal Teams: Each transaction is typically led by a deal team consisting of professionals from different departments, such as analysts, associates, and managing directors.

Format Of Investment Banking

- Client Meetings: Investment bankers often meet with clients to discuss their financial needs, present proposals, and negotiate terms.

- Financial Analysis: Investment bankers conduct extensive financial analysis, including building financial models, performing valuation analysis, and preparing client presentations.

- Transaction Execution: Investment bankers are involved in all stages of deal execution, from initial due diligence to closing the transaction.

Tips For Success In Investment Banking

- Develop Technical Skills: Keep developing your financial modeling, valuation, and analytical skills to excel in investment banking.

- Networking: Build relationships with colleagues, clients, and industry professionals to expand your network and access career opportunities.

- Stay Updated: Stay up-to-date with respect to market trends, industry developments, and regulatory changes to stay ahead in the competitive landscape of investment banking.

- Attention to Detail: Pay close attention to detail in all aspects of your work, from financial analysis to client communications, to ensure accuracy and professionalism.

- Work Ethic: Demonstrate a strong work ethic, dedication, and commitment to excellence in all your endeavors to succeed in investment banking.

Countries You Can Work As An Investment Banker In After Completing CFA

All of humanity is a closely-knit tribe. This proverb is more valid for the world of finance than any other set of professionals. The financial hotspots are limited as the global finance community likes to remain in the comfort of their clan.

Let us understand the best countries across the world to practice as investment bankers.

- United States: The United States offers numerous opportunities for investment bankers, with financial centers in New York City, Chicago, and San Francisco.

- United Kingdom: London is a central hub for investment banking in Europe, offering a wide range of opportunities for CFA-certified professionals.

- Hong Kong: Being among the leading financial centers in Asia, Hong Kong provides lucrative career prospects for investment bankers with a CFA designation.

- Singapore: Singapore is another prominent financial hub in Asia, attracting investment bankers from around the world.

- Switzerland: Zurich and Geneva are renowned for their banking and financial services industries, offering opportunities for CFA charterholders in investment banking.