Table Of Contents

What is Consignment Accounting?

Consignment accounting is a type of business arrangement in which one person sends goods to another person for sale on his behalf, and the person who sends goods is called the consignor. Another person who receives the goods is called the consignee, where the consignee sells the goods on behalf of the consignor on consideration of a certain percentage on sale.

Sometimes consignment is beneficial for both consignor and consignee as the consignor gets business expansion and the consignee gets commission and incentives without any investment. Hence, consignment can be a good business expansion option. Consignment accounting entries are a type of business arrangement in which the consignor sells goods to the consignee for exchange in return for the commission.

Consignment Accounting Explained

Consignment accounting is a financial practice that arises when a business agrees to sell products on behalf of another entity, known as the consignor. In this arrangement, the consignor retains ownership of the goods until they are sold to a third party by the consignee, who is the selling entity. The consignee essentially acts as an intermediary, promoting and selling the consignor's products without taking ownership of the inventory.

In Consignment, goods are left in the hands of an authorized third party called the consignee for sale on behalf of the consignor. Ownership of goods remains in the hands of the consignor. The agreement made between the consignor and consignee is for a smooth flow of transactions, with a clear understanding of the terms and conditions. Typical products sold through consignment include clothing, shoes, furniture, toys, music & other instruments, etc.

One key aspect of consignment accounting is that the consignee does not initially record the consigned goods as part of its inventory. This differs from typical inventory management, where the selling entity owns goods. Instead, the consignee only recognizes the inventory and associated revenue when the products are sold to an end customer. Until a sale occurs, the consignor still holds these goods on its books.

While a consignment arrangements format can offer benefits such as expanding product reach without bearing immediate inventory costs, there are notable challenges. One drawback is the potential for slower cash flow, as the consignee incurs expenses related to storing and marketing the goods without immediate revenue recognition. Additionally, tracking consigned inventory accurately and managing the consignment sales process can be complex, requiring meticulous record-keeping to ensure transparency and fair financial reporting for both the consignor and consignee.

Features

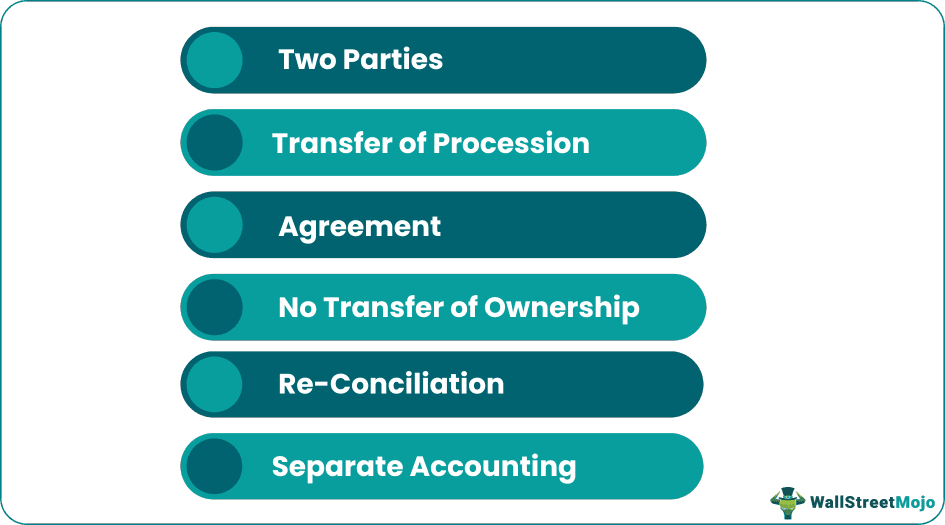

Let us understand the major features of a consignment accounting entry through the detailed explanation below.

- Two Parties: Consignment accounting mainly involves two parties, the consignor and consignee.

- Transfer of Procession: Procession of goods transferred from consignor to consignee.

- Agreement: There is a pre-agreement between the consignor and consignee for the terms and conditions of the consignment.

- No Transfer of Ownership: The ownership of goods remains in the hands of the consignor until the consignee sells them. The only procession of goods is transferred to a consignee.

- Re-Conciliation: At the end of the year or periodic intervals consignor sends a Pro-forma invoice while the consignee sends account sale details, and both reconcile their accounts.

- Separate Accounting: There is independent accounting done of the consignment account in the books of the consignor and consignee. Both prepare consignment accounts and record the journal entries of goods through consignment accounts only.

Examples

Now that we understand the basics and the features of consignment accounting format, let us apply the theoretical knowledge to practical application through the example below.

Example #1

ABC sent goods costing $10,000 to XYZ on 01st Jan 2020 on a consignment basis. He spent $200 on its packaging. As per the term of consignment, XYZ is entitled to a 10% commission. On 3st Jan 2020, XYZ confirmed the receipt of the goods and sent a 50% amount as the advance. On the last day of the month, XYZ sent details of his sales, which showed that 3/4 of the goods were sold for $11,000, and XYZ remitted the balance amount after deducting advance and commission. What will be the journal entries to record the transactions taking place?

Notes

Example #2

SunPower, a leading US-based solar company, is currently facing class action lawsuits over allegations of misleading investors by not disclosing inaccuracies in reported cost of revenue and inventory metrics. The company acknowledged an internal control issue on October 24, revealing a preliminary determination that the value of consignment inventory of microinverter components at specific third-party locations had been overstated by approximately $16-$20 million during the preparation of financial statements.

SunPower has openly admitted to a material weakness in its internal control over financial reporting. Concurrently, negotiations are underway to establish the terms and conditions of a consent and waiver to address the repercussions of the impending restatement under the company's credit agreement with Bank of America.

Law firm Bragar Eagel & Squire released a statement asserting that SunPower is set to restate certain previously issued financial statements for the fiscal year 2022 and the initial two quarters of 2023. These developments underscore the potential legal and financial ramifications for the solar company as it grapples with the fallout from the alleged misreporting of crucial financial metrics.

Terms Used in Consignment Accounts

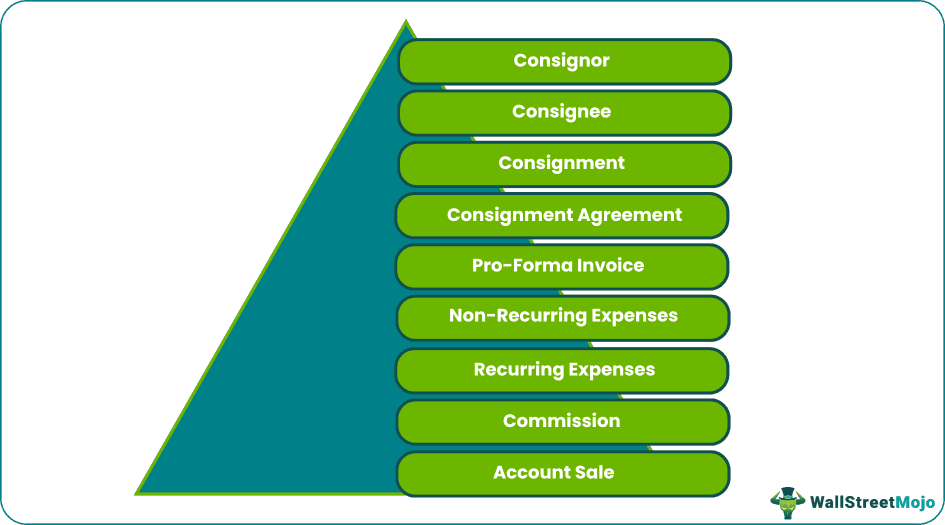

To completely understand consignment accounting entries, it is vital to understand the common terms used in this domain of work. Let us do so through the discussion below.

- Consignor: It is the person that sends goods.

- Consignee: The person who receives the goods is called the consignee.

- Consignment: Consignment is a business arrangement through which the consignor sends goods to the consignee for sale.

- Consignment Agreement: It is a legally written communication between the consignor and consignee, which defines the terms and conditions of the consignment.

- Pro-Forma Invoice: When the consignor sends goods to the consignee, he also forwards statements showing details of goods such as quantity, price, etc., and that statement is called the Pro-forma invoice.

- Non-Recurring Expenses: Expenses that the consignor incurs to dispatch the goods from his place to the consignee's place are called non-recurring expenses. These expenses are added to the cost of goods.

- Recurring Expenses: The consignee incurs these expenses after the goods reach his place. These expenses are maintenance of goods type expenses.

- Commission: Commission is the reward/ consideration for the sale of goods on behalf of the consignor. It is as per the consignment agreement.

- Account Sale: It is the statement forwarded by the consignee to the consignor showing details of goods sold, amounts received, expenses incurred, a commission charged, advance payment and balance due and stock in hand, etc.

How to Prepare?

Now that we are equipped with the intricacies of the consignment accounting format, let us go through the step-by-step process of how to prepare the accounts for the same through the explanation below.

#1 - Debit to Consignment Account:

- Cost of goods sent on consignment

- With expenses paid by the consignor

- Expenses paid by consignee by self or on behalf of the consignor

- Commission on consignment

#2 - Credit to Consignment Account

- Sale proceeds on consignment

- Cost of abnormal loss

- Value of closing stock and proportionate direct expenses

Balance of consignment account transferred to profit and loss account.

Advantages

Let us understand the advantages of inculcating a consignment accounting format in a business through the points below.

- Increase in Business Exposure: Due to consignment sales increase, increasing business exposure. It is a cost-effective method to expand the business.

- Lower Inventory Cost: Less inventory holding costs for the consignor;

- Incentives to Consignee: When the consignee sells on behalf of the consignor, the former receives a commission and other incentives.

- Business Growth: Consignment benefits both consignor and consignee. The consignor gets lower investment inventory-bearing costs, and the consignee, without investment, earn the commission by selling on behalf of the consignor.

Disadvantages

Despite the various advantages mentioned above, there are a few factors from the other end of the spectrum that prove to be a disadvantage. Let us understand them through the points below.

- Lower Profit Margin: Due to consignment accounting entries, the consignor has to pay a commission to the consignee, resulting in a lower profit margin in the hands of the consignor.

- Negligence by Consignee: Consignee’s negligence may create the problem.

- Risk of Goods Damaged: There is a high risk of goods damaged at the consignee’s place or during transport, especially perishable goods.

- High Charges: Sometimes, there are high maintenance charges for goods to be borne by the consignee and high shipping or conveyance charges to be borne by the consignor. It is the consignee's place, and the consignor is far away from each other.