Table Of Contents

Deal Flow Meaning

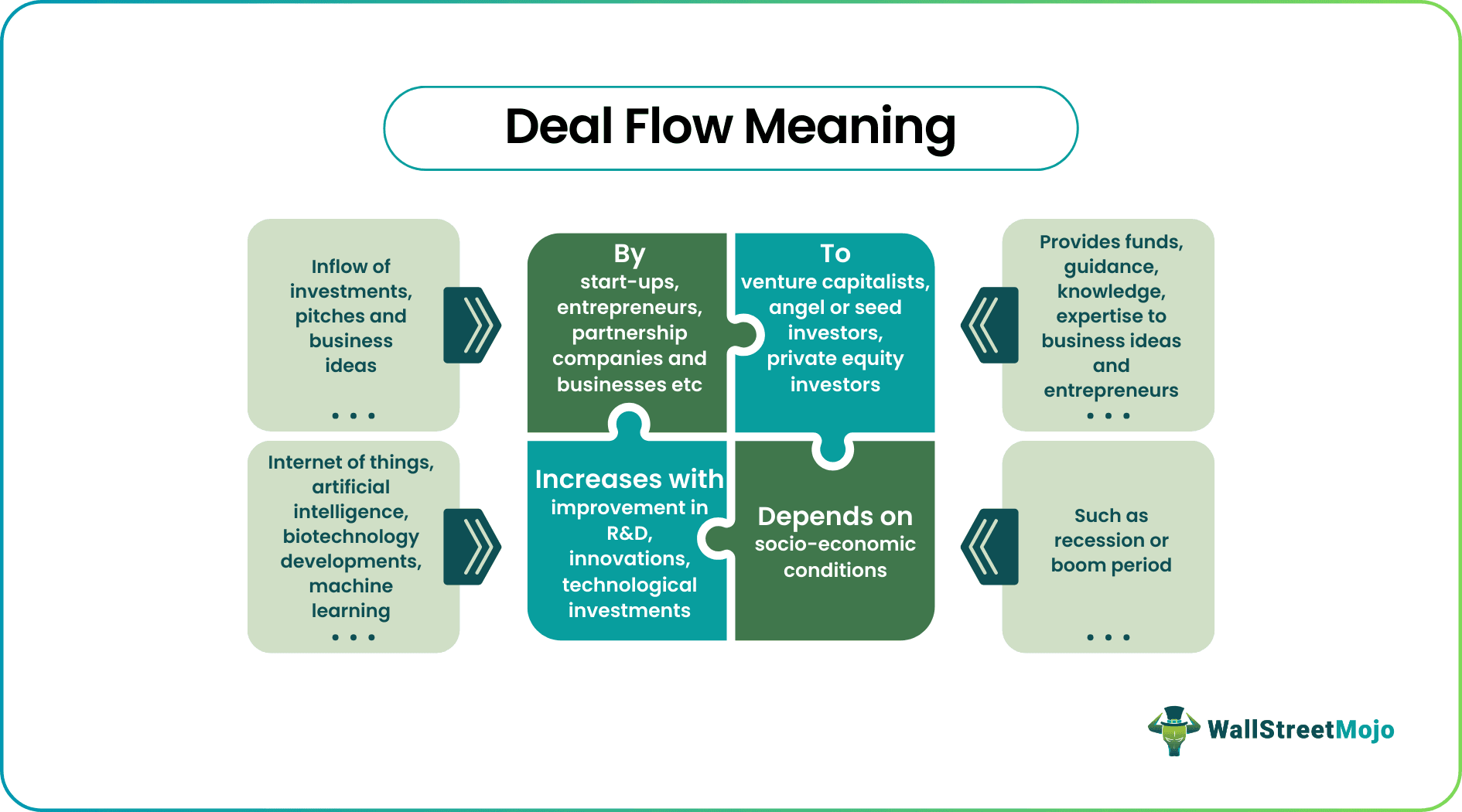

The deal flow definition explains the inflow of investment pitches, business plans, and ideas for investment bankers, venture capitalists, and other corporates to invest in. A deal flow allows investors and businesses to choose the most profitable deals and business proposals, amongst others. Simultaneously, such deals help them earn higher profits.

Deal flow reflects the health of an economy and its research and development capabilities in many ways. As a result, overall good economic conditions or technological advancements will lead to more deals for businesses to invest in. On the contrary, recessionary situations or stagnant growth patterns disincentivizes investors and financial professionals.

Key Takeaways

- Deal flow means the inflow of qualitative and not quantitative deals that include potential and high-yielding investments from an investor's point of view.

- Deal flow management thus requires considerable focus from sourcing to finalizing, wherein the expertise of stakeholders such as investment bankers, venture capitalists, or private equity holders shines bright.

- Various mechanisms, such as networking events, founder meet-ups, or referrals from portfolio companies, assist an investor in optimizing investment opportunities.

- Although the state of the economy or economic cycles greatly influence the inflow of deals and merger and acquisition (M&A) transactions.

Deal Flow Explained

Deal flow explains the flow of investment pitches and business opportunities that demand investments in return for profits for investors. It is not a quantitative measure but rather a qualitative measure of economic conditions. The quality of deals that flow from entrepreneurs and businesses towards investors such as venture capitalists, seed, or angel investors reflects good or bad investments.

Qualitative deals' inflow indicates how successful earlier ventures and investments were for its stakeholder and older investors. Thus, it helps new or potential investors to estimate their future return on investments (ROI).

For instance, a firm of venture capitalists will have a separate team to source and gather deals and another team that chooses the most profitable deals for investment purposes. However, the first step is deal origination or deal sourcing. For this, dealmakers or venture capitalists use their networks and referrals. Subsequently, they network through deal flow events or outsource profitable leads from agencies or online platforms to bid for deals with the highest returns.

Similarly, relationship management and regular communication with brokers and sales professionals help a real estate investor to get insights about projects or proposals and lead to high-quality deal flow. Although, while investing in real estate, an investor should know that it is not a get-quick-rich scheme. The accumulation of wealth and profits from real-estate ventures and holdings take years.

For investment bankers, deal flow management requires the facilitation of corporate takeovers and big-ticket deals amongst businesses and companies for mergers and acquisitions (M&A). Therefore, investment bankers have a comparatively high degree and in-depth knowledge of various business domains and markets to wisely make investment and divestment decisions.

Thus, businesses tend to source, evaluate and close investment deals through private equity to allow firms and companies to maintain their deal flow pipeline.

Deal Flow Process

The deal flow process involves certain phases. Let us find out what they are.

#1 - Sourcing

This stage requires active involvement in identifying potential opportunities. Depending upon how the sourcing of deals takes place, there are two kinds of deals, which are proprietary and intermediated. Typically, a venture capital or private equity firm sources the former type directly. On the other hand, a third party, like a mergers and acquisitions advisor or investment bank, receives an intermediated deal. Generally, experts consider proprietary deals more beneficial as they are not as competitive as intermediated deals. Note that companies may use different marketing methods to source the deals.

#2 - Screening

This phase involves setting certain criteria to begin with preliminary eliminations. It allows organizations to evaluate the potential of companies before starting the due diligence process. The assessment involves carrying out an extensive review of different preliminary materials, including pitch decks. Its purpose is to make sure that the opportunity is in line with the investment thesis of the fund. Investors analyze the market size, competitive landscape, and the experience and profile of the founding team in this phase to spot red flags.

#3 - Preliminary Due Diligence

If a deal moves beyond a preliminary meeting, investors start the preliminary due diligence process. This process involves complex procedures, competitor and market analysis, and multiple meetings.

#4 - Term Sheet, Negotiations, And Deal Drafting

If venture capital firms have sufficient confidence in a portfolio company, they present the investment opportunity to a committee that comprises the firms’ general partners. When such a committee gives approval for a deal, the investor that sourced it starts negotiating with the company by sending a document called the term sheet. The negotiations continue until both parties agree on the main terms of the deal. Following the agreement, the drafting of the contracts takes place.

#5 - Deal Closure And Capital Deployment

Following the completion of the due diligence process and the negotiations, the involved parties put pen to paper once they confirm the fulfillment of the deal closing conditions. Once the deal closure takes place, investors transfer the funds to the company.

After capital deployment, the investor tracks the investment’s performance. Note that transparency and communication are two crucial factors that the company must focus on to ensure the maintenance of a strong relationship with the investors.

Factors Influencing Deal Flow

Some of the key factors impacting deal flow are as follows:

- Brand And Reputation: An investment firm’s reputation and brand can have a significant impact on deal flow. Typically, when investors have a strong or favorable reputation for making successful investments, it can provide early access to opportunities with great return potential. Moreover, it attracts more companies looking to raise funds.

- Relationships: Strong relationships with industry experts, other investors, and entrepreneurs are important for ensuring an optimal deal flow.

- Economic Conditions: During phases of economic growth, investment opportunities and business activities increase. On the other hand, economic downturns can result in a drop in deal flow since organizations adopt a more cautious approach.

- Outreach And Marketing: Proactive outreach and marketing efforts help generate deal flow. This may include attending panel discussions, industry conferences, engaging with investment communities and startups, etc.

If an individual wants to enhance their knowledge of investment banking concepts like deal flow, they can take the Investment Banking Mastery Program (IBMP). This comprehensive bundle includes various courses that have been designed to provide the specialized skills that an aspiring investment banker is looking for to break into the industry.

How To Increase?

A greater inflow of qualitative deals reflects a good increase in the deal flow pipeline. Thus, successfully closing deals in a new field requires investors to gain knowledge about the markets and expect realistic returns. Additionally, they strive to make connections and manage relationships with investment bankers and brokers.

However, a few significant steps can ensure the inflow of qualitative and high-yielding deals for venture capitalists, private equity investors, and investment bankers. These include,

- Sourcing referrals and pitches from other investors,

- A referral from portfolio companies results in higher chances of closing profitable deals. Portfolio companies understand what investors are looking for and watch the markets closely to bag investments.

- Service providers such as accountants, lawyers, brokers, and banking institutions are closely associated with the industry and its insights, providing investors with useful information.

- Pitching and networking events shall significantly increase the chances of meeting industry experts, thriving start-ups, founders, and early-stage ventures. Thereby, an investor can gain a significant amount of knowledge parallels.

- Acting as mentors or judges to pitch events can assist a potential investor in sourcing leads. Thus, having a few deals in the pipeline helps an investor to select ones with extremely high business potential. Additionally, such events help investors to know their niche and area of expertise.

- For deal flow management, investors can build a small internal team for reviewing and market research purposes. Additionally, investment banking firms and venture capitalists can use CRM platforms for better relationship management with leads and for visualization and customization purposes to manage the deal flow pipeline and keep it running.

- Maintaining an online presence is essential, too, with online events and meet-ups blurring geographical boundaries and barriers.

Examples

Let us better understand deal flow by taking a look at these examples:

Example #1

For instance, the onset of the pandemic in 2020 and its spiraling effects on the economy were visible through stock markets plunging and investors turning away from acquisitions. Consequently, an event like the COVID-19 pandemic led investors to focus and shore up their existing investments to increase their returns on investment.

Thus, the developing economic scenario led to the drying up deal flow pipeline as investors stayed away from new investments.

However, as Forbes reported in May 2021, it soon mitigated this industry-wide danger of withering of deal flows. Globally in 2021, a record $1.77 trillion worth of merger and acquisition (M&A) transactions took place in the first four months. According to reports, it was a whopping 124% rise compared to a low-lying pandemic year and 10% higher than any first four months of any other year.

According to analysts, this increased search for yields and returns by investors resulted from extremely low-interest rates and comparatively large capital holding with investors. Additionally, low interest, increased government stimulus, and the excessive liquidity in the hands of investors led to further propping up of the public equity markets. Thus, a surging stock market led to an increase in people's confidence.

Such a cyclical scenario was more profound in the American economy, wherein the initial four months of 2021, M&A transactions worth $1 trillion had already occurred.

Example #2

Suppose ABC is a venture capital firm. After engaging in marketing activities and leveraging its relationship with other investors, the company gains access to different investment opportunities. After the initial screening process that involved evaluating 3 technology companies, ABC picked an option that it deemed to have the highest return potential. Post-selection, it conducted the initial due diligence process and got approval from the investment committee. After getting the approval, ABC sent the term sheet and started negotiating with the company.

Once the key terms were agreed upon, both parties signed the relevant documents and closed the deal. Upon deal closure, ABC transferred the funds to the company’s account and analyzed the performance of the investment on a regular basis.

Importance

One can understand the importance of deal flow by going through the following points:

- Strong deal flow provides a competitive advantage in the market and allows investors to compare different opportunities and choose an investment on the basis of thorough evaluation.

- An optimal deal flow provides an extensive range of investment opportunities across different geographies, industries, and stages. This allows for diversification, which, in turn, minimizes financial risk.

- A steady deal flow can help venture capital and private equity firms increase the chances of sustainable growth.