Table Of Contents

What is Depreciation Recapture

Depreciation recapture refers to the whole or part of the realized gain from selling depreciable property identified to tax as ordinary income. A taxpayer uses the depreciation deductions to reduce tax liability, whereas if the asset disposal occurs via a profitable sale, the recapture provision gets activated and benefits IRS.

Internal Revenue Code (IRC) sections 1245 and 1250 contain various rules associated with the recaptured depreciation and the types of property subject to it. The provision is common with real estate rental properties and occurs when the property is sold. In addition, taxpayers can use investing tools like the 1031 tax-deferred exchange to minimize the tax burden due to recapture.

Key Takeaways

- Depreciation Recapture refers to the portion of the gain realized from the sale of depreciable property and taxed as ordinary income.

- Internal Revenue Code (IRC) sections 1245 and 1250 contain various rules associated with this recapture procedure. In 2022, the recapture tax rate is capped at 25%.

- Its calculation involves identifying the adjusted cost basis of the asset sold, depreciation deductions or accumulated depreciation, and realized gain.

- If accumulated depreciation and realized gain are compared, the smaller of the two is taken as the recapture amount.

- Taxpayers use the depreciation deduction provision to reduce the tax owed, and the recapture provision helps the government offset losses due to the deduction provision.

Depreciation Recapture Explained

Depreciation recapture is associated with the depreciable property, and selling the depreciable property results in the ordinary income and reduces the capital gain reported for tax purposes. This recapture income under IRC section 1245 or 1250 is also an example of hot assets. The taxpayer is liable to pay tax at the ordinary income tax rate for a specific or whole portion of the capital gain obtained by selling a depreciated capital asset.

It is applied when there is a gain, and there will be no recapture when there is a loss. The maximum value of the recapture tax rate is 25%. Applying the ordinary tax income rate, which is generally greater than the capital gain tax rate, helps the Internal Revenue Service (IRS) compensate for the reduced taxes they receive due to the depreciation deduction allowed. Hence helping the government to offset losses. Furthermore, It is usually applied to the asset held for more than one year, incurring operating or maintenance expenses changing its cost basis.

How to Calculate Depreciation Recapture?

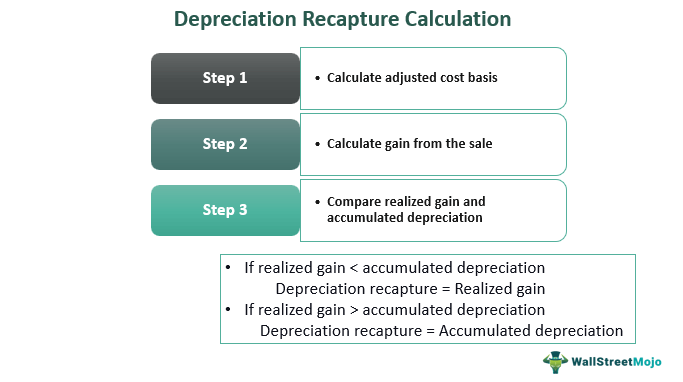

The calculation involves the following steps:

Step 1: Calculate adjusted cost basis

Adjusted cost basis = Purchase price + Improvements – (Accumulated depreciation or depreciation deductions)

Step 2: Calculate gain from the sale

Realized gain = Selling price - Adjusted cost basis

Step 3: Compare realized gain and the accumulated depreciation (depreciation deductions)

If the realized gain < accumulated depreciation

Depreciation recapture = Realized gain

The realized gain is taxed as ordinary income

Tax = Realized gain * Depreciation recapture tax rate

If the realized gain > accumulated depreciation

Depreciation recapture = Accumulated depreciation

The accumulated depreciation is taxed as ordinary income, and the remaining amount in the realized gain is taxed as a capital gain.

Example

Let's look into the following example to understand the calculation better:

Given the purchase price, accumulated depreciation, and selling price.

Case 1:

The purchase price of an asset: $7,000

Accumulated depreciation or depreciation deductions (3 years): $4,200 (1400*3)

Sales price: $5,000

Step 1: Calculate adjusted cost basis

Adjusted cost basis = Purchase price + Improvements – (Accumulated depreciation or depreciation deductions)

=$7,000 + 0 - $4200

=$2,800

Step 2: Calculate gain from the sale

Realized gain = Selling price – Adjusted cost basis

= $5000 - $2,800

=$2,200

Step 3: Compare realized gain and accumulated depreciation

Here the realized gain is less than the accumulated depreciation ($2,200 < $4,200)

Hence, recapture is $2,200

This amount obtained from the realized gain is treated as ordinary income instead of capital gain.

Case 2:

If, in the above case, the selling price is $8,000, steps 2 and 3 will give different answers:

Step 2: Realized gain = Selling price – Adjusted cost basis

= $8,000 - $2,800

=$5,200

Step 3: Compare realized gain and accumulated depreciation

Here the realized gain is greater than the accumulated depreciation ($5,200 > $4,200)

Hence, recapture is $4,200, taxed as ordinary income, and the remaining $1,000 is taxed as a capital gain.