Table Of Contents

What Is After-Tax Income?

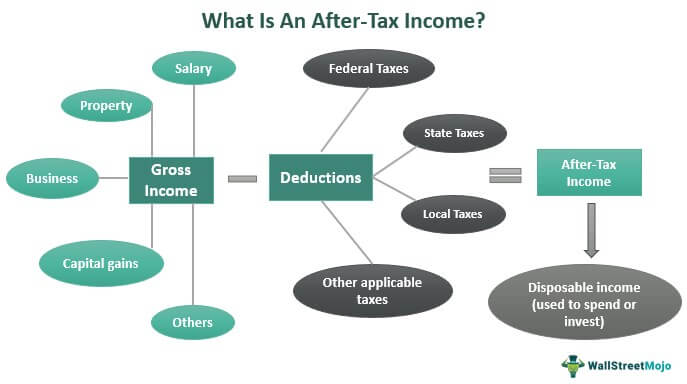

After-tax income refers to the income left after the federal, state, local, and other applicable taxes have been deducted from the gross earnings. This amount is what individuals and entities can use to invest and spend on meeting their monetary requirements.

While the gross income doesn't give a clear picture of the disposable amount, calculating the after-tax income allows individuals to plan their finances accordingly. Income from all sources, including the ones generated from salary, property, business, capital gains, etc., is included in the income after taxes calculation.

Key Takeaways

- After-tax income is the income after the deduction of all the direct taxes levied by the government of respective countries.

- It becomes the income left for the personal disposal of individuals or companies.

- Any income, regular or irregular, forms part of the gross income from which the deductions are to be made.

- Calculating the income after taxes help businesses do the financial planning accordingly and also take up further projects based on the resources available.

Revenue vs Income Explained in Video

After-Tax Income Explained

The after-tax income is the disposable income left with the businesses and individuals to be spent and invested in their future requirements. It is the difference between the gross income and the sum of the applicable deductions.

Before figuring out the after-tax earnings, individuals and businesses have to calculate the deductions applicable against the income generated. The individuals file taxes using the IRS Form 1040, which varies from individual to individual. Once the deductions are totaled, the same is subtracted from the gross income to obtain the disposable income, which is the income after taxes.

The income from various sources are considered for calculating the after-tax income. Therefore, earnings from each source gets added together to obtain the gross income with each source of income, along with the deductions, constituting the components of after-tax income.

This income can be the earnings generated from salary or anything received by renting or leasing out residential or commercial space. In addition, a business's profits form the major part of the gross income.

The revenue from capital gains adds to the list of income generated. People receive this income by selling off capital assets. Though the gains are not regular, they form significant part of the income after taxes. In addition, these profits are of high value; hence, they also add to the income of both individuals or entities and the government.

When calculated for corporations, the income after taxes becomes the Net Income After Taxes (NIAT). However, NIAT includes finding the net income after deducting all expenses, including taxes, from gross income.

Formula

The net after-tax income can be calculated using the formula below:

After Tax Income=Gross Income-Applicable Taxes

Here,

Gross Income = Total of all income generated from different sources

Applicable taxes = Sum of all taxes applied, be it federal, state, local, or other taxes

In Canada, the net or monthly after-tax income is calculated using the formula below:

After Tax Income=Gross Income-Applicable Taxes/ Tax Payable

Here,

Tax Payable =

Calculation Example

While the formula for calculating after-tax income is easy, it is tricky to calculate the value of the components of disposable income. The example below shows how it works:

Jonas computes his income as a singer and finds it to be worth $856 million for the FY 2018-19. He has several other incomes from interest on deposits, which adds up to $44 million. The taxpayer has let out one of his apartments in New York City and another in LA, from which he earns a total net taxable income of $109 million. He has also sold one of his apartments in Spain for $550 million (computed) to a Superstar in the Financial Year.

He has made an investment that is eligible for deductions from total taxable Income, adding up to $45 million. As a result, the total tax rate prevailing in his country becomes 15% of the net taxable income.

So, let us calculate the after-tax income for the taxpayer:

Below is the statement depicting Jonas' income figures for the year 2018-19 under various income heads:

| Particulars | Amount ($ millions) |

| Income from Salary | – |

| (+) Income from Profession | 856 |

| (+) Income from House Party | 109 |

| (+) Income from Other Sources | 44 |

| (+) Income from Capital Gains | 550 |

| Gross Total Income | 1,559 |

| (-) Deductions | 45 |

| Net Taxable Income | 1,514 |

| (-) Income Tax (15% of $1,514 million) | 227.10 |

| After-Tax Income | 1,286.90 |

Thus, Jonas's after-tax income for FY 2018-19 is $1,286.90 million, and the tax paid by him for the FY 201-19 is $227.10 million.