Table of Contents

What Is Fair Value Hierarchy?

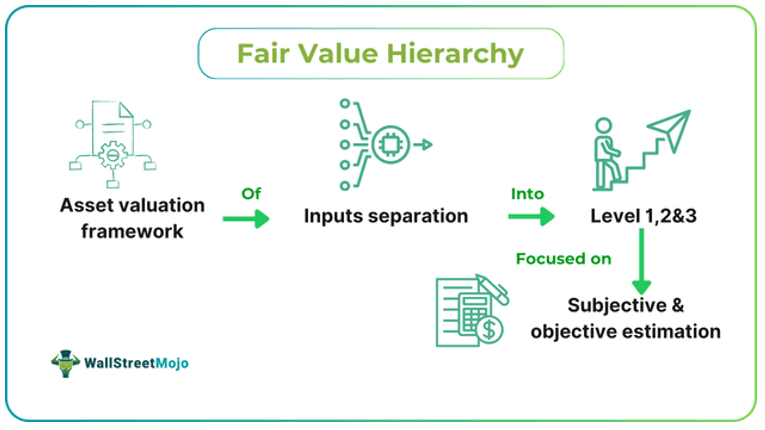

Fair Value Hierarchy is a framework that segregates inputs utilized in valuation methods into three levels to prioritize market data, enhancing comparability and consistency. Each level mirrors the degree of estimation and subjectivity involved, with Level 1 being the most objective and Level 3 being the most subjective, ascertaining financial reporting transparency.

The Financial Accounting Standards Board (FASB) established it under the fair value hierarchy ASC 820. Investors and stakeholders use it to evaluate the dependency of fair value measurements in financial statements. It is also applied in real estate valuations, derivative accounting and investment securities for accurate liability and asset valuation.

Key Takeaways

- Fair value hierarchy segregates inputs for valuation methods into three levels centered on objective and subjective estimation. This hierarchy enhances comparability and consistency and ensures financial reporting transparency.

- The categorization helps prioritize objectivity, enhance transparency, provide a structured framework, assess risk reliability, guide regulators, reduce financial misstatements, and support informed decision-making.

- It faces challenges, like increased regulatory scrutiny due to unobservable inputs, market risks, subjective valuations leading to biases, investor confidence issues, inconsistencies in reporting, and uncertain asset classification amongst levels.

Fair Value Hierarchy Explained

The Fair Value Hierarchy definition states that it is a framework for separating inputs utilized in fair value metrics into three levels. It works by prioritizing inputs according to their dependency on which level offers the most reliable data obtained from active markets, whereas level 3 relies on subjective assumptions and estimates.

- Level 1 – denoting observable market prices

- Level 2 – depicting observable inputs, and

- Level 3 – showing unobservable inputs

Level 1

It represents unadjusted quoted pricing about active markets for equitable liabilities or assets. It offers the most dependent proof of fair value because it reflects actual market transactions related to measurement data. Hence, it ensures accuracy and transparency in valuations.

Level 2

It includes observable inputs separate from quotes, like similar asset prices of active markets, or market data-based derived inputs, like credit spreads and interest rates. Although they provide vital information concerning valuations, they are less reliable.

Level 3

These, being subjective and unobservable, rely on internal assumptions and estimates regarding a liability or asset's value. Such inputs are commonly based on management's judgment. As a result, they introduce noticeable risk and variability into fair value measurements.

This categorization offers consistency and upgraded transparency in financial reporting. It permits investors to evaluate the quality of fair value metrics, leading to wise and informed decision-making. Businesses can utilize it in reporting financial instruments, ascertaining adherence to regulations regarding fair value hierarchy disclosure requirements, and enhancing comparability across entities.

In the financial world, it significantly impacts risk assessments, regulatory compliance and investment valuations. Hence, it shapes how liabilities and assets are recorded and reported on financial reports.

Examples

Let us use a few examples to understand the topic.

Example #1

An online research article published in March 2022 in the RBI bulletin discusses the hierarchy of fair value in financial reports of NBFCs within Ind AS 113. It underscores the 3-level:

- Level 1: It relates to quoted prices.

- Level 2: It has observable inputs such as credit spreads.

- Level 3: It comprises unobservable inputs like assumptions concerning unquoted equity shares.

The study conducted by RBI analyses 10 prominent NBFCs with assets equal to 1.6 trillion rupees. The report revealed the significant dependency on the discounted cash flow technique pertaining to level 3 valuation. In a few cases, level 3 valuation consists of up to 98% of total assets. Therefore, the research article highlights standardized disclosure requirements to increase transparency and decrease subjectivity in valuation.

Example #2

Let us assume an imaginary company, Mytech of Old York City. Mytech has a cutting-edge solar panel technology valued at $1 million per the latest market transactions. It categorizes the price as level 1 input. The firm also has a patent for a new capacity installation solution valued at $1,000,000 utilizing contrastable market data from likewise patents. It comes under level 2 input as determined by the company.

Moreover, Mytech has a private investment in a startup centered on a renewable grid valued at $300,000 as per estimates of the management and projection. It falls under level 3 input as decided by the company. Hence, one can find that the company has categorized its assets in financial reports as below:

Level 1 - Solar Technology

Level 2 - Patent

Level 3 – Startup Investment

Importance

It has numerous importance, including the following:

- It categorizes inputs utilized in valuation into three levels, prioritizing objectivity and enhancing openness in financial reporting.

- It provides a structured framework for disclosing and measuring fair value, ensuring comparability and consistency throughout financial statements.

- Its differentiation of levels into unobservable inputs, quoted prices and observable inputs aids in assessing the reliability of risk levels and valuations.

- It guides regulators and auditors in assessing valuation techniques thereby upgrading disclosures trust and decreasing subjectivity.

- It helps minimize dependence on sophisticated estimation models by prioritizing quote prices off the market level. Thus, it reduces the threat of financial misstatements.

- It provides deeper insights into market activity and asset liquidity, supporting stakeholders and investors in informed decision-making.

Challenges

Following this fair value hierarchy model involves a lot of challenges. Some of these are as follows:

- It has a thin line between assets of levels 1 and 2, complicating valuation because assets alternate amongst these levels owing to their dependence on unobservable and observable inputs.

- The market risks and assessment of illiquidity related to financial instruments are challenging because of inadequate disclosure of assets of level.

- Huge dependency on subjective valuation, such as Discounted Cash Flow (DCF) for assets of level includes biases and risks when actual market conditions do not align with assumptions.

- Investors may lose confidence in solvency assessment and liquidity due to overlapping hierarchies concerning asset classification.

- Some firms may lack consistency in presenting liabilities/assets, resulting in challenges of inter-firm contrasts and benchmarks.

- Regulatory scrutiny and robust justification may become mandatory because unobservable inputs in valuation could yield divergent outcomes.