Table Of Contents

Key Employee Definition

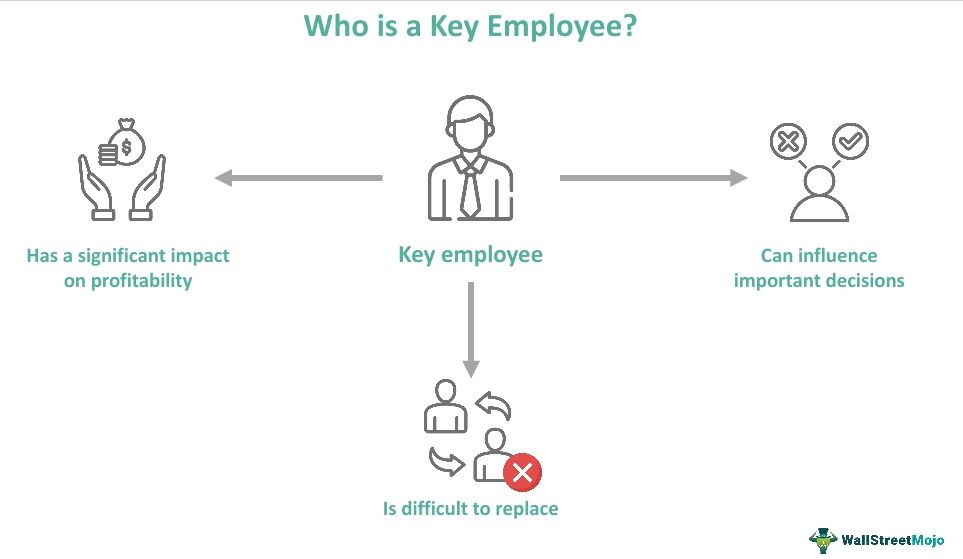

A key employee or key person is a term used to refer to an important employee or executive who is critical to the functioning of a business. Their death, disability, or absence could prove detrimental to the business or organization's progress and profitability.

They play a big part in how a business runs and have a significant degree of control or a position of decision-making within a firm. Employees who consistently go above and beyond the call of duty are "key personnel." High compensation is often given to key personnel through a salary or other benefits.

Key Takeaways

- Key employee or key person is a term used especially to refer to an important employee or executive who is critical to the functioning of the business.

- Their death, disability, or absence could prove detrimental to the business or organization's progress and profitability.

- The functioning of an organization is heavily reliant on key personnel. Therefore, they significantly and directly affect the enterprise's worth.

- The employee's position influences revenue, profitability, growth, and product development and is a crucial business value driver.

- According to the IRS, an officer earning more than $215,000 in 2023 who owns more than 5% of the company is considered a key employee for 401(k).

- It includes a worker who earned over $150,000 during the plan year and owned more than 1% of the company.

Key Employee Explained

A key employee in an organization is someone who has ownership of the company or has influence over decisions made there. The functioning of an organization is heavily reliant on key personnel. They significantly and directly affect the enterprise's worth. The employee's position influences duties and choices that impact revenue, profitability, growth, and product development. And therefore, they are a crucial business value driver.

Finding someone with particular abilities and expertise would be quite challenging. However, these employees have a special skill that makes them more valuable to the business. Key employee strengths include good communication, teamwork, analytical and problem-solving capabilities, leadership, flexibility and adaptability, technical knowledge, and time management skills. If the company lost such an employee, it wouldn't just be awkward or inconvenient; it would harm the company.

Thus they play a significant role in the company's future. In short, these workers envision the future, contribute ideas, and find innovative solutions.

The Internal Revenue Service (IRS) has a different set of definitions for a key employee:

They are:

- Employees in charge of the segment within the company that accounts for 10% or more of its resources, earnings, activities, or costs.

- Those with the power to decide on or manage 10 percent or more of the organization's operational budget, capital expenditures, or employee remuneration.

- If this is the case, they must be recorded as important workers, and their reportable compensation from the company and any affiliated companies during the tax year exceeds $150,000.

According to FMLA (Family and Medical Leave Act), an FMLA key employee is a salaried worker who ranks in the top 10 percent of all business employees who work within 75 miles of the employee's place of employment in terms of pay. For employer-sponsored retirement plans, the IRS defines a key employee as a participant in the plan who is a highly compensated executive or a business owner.

Examples

Check out these examples to get a better idea:

Example #1

Daisy Williams is the head of sales for a clothing company. The sales revenue for the year was $5,00,000, and she single-handedly bought 70% of the revenue, or $3,50,000, into the business. Daisy is also involved in the planning of advertising strategies and the recruitment of new team members. In the past years, she has contributed immensely to the organization's growth and is a key employee.

Example #2

Danny is a product manager and receives a salary of $175,000 from the company he works for. He is a star performer and maintained the same level throughout the years he worked there. Danny accounts for 20% of the revenue made and actively participates in the strategic decisions on planning the development of products and recruiting team members in the department. Therefore, he is a key employee according to IRS standards.

Key Employee Insurance

Some firms rely too heavily on specific executives crucial to the company's operation. Such critical personnel can contribute to large losses if they are absent. Because of this, businesses choose to get a keyman insurance policy that offers protection against losses brought on by the "keyman's" untimely death or disability. Alternative names for this policy include key person coverage and important employee coverage.

Identifying key employees helps determine a 401(k) top-heavy retirement plan. When the value of the plan's assets at the end of the most recent plan year was held by a small number of major owners at more than 60%, the key employee 401k is said to be top-heavy. The employer will have a lot of issues to address if important employees develop a top-heavy plan. Accordingly, they must establish a balance. In addition, employers normally must pay at least a 3% benefit to the lower-paid or non-key employees' accounts who were still working on the last day of the plan year if the top-heavy ratio exceeds 60%.

Key employees for this are those (including retired or deceased employees), at any time during the plan year, were any of the following:

- An officer earning more than $215,000 in 2023 ($200k in 2022; $185k in 2021; $185k in 2020; $180k in 2019);

- An individual owns more than 5% of the company (a "5% owner").

- A worker who earned over $150,000 during the plan year and owned more than 1% of the company.