Table Of Contents

Proration Meaning

Proration is a specific corporate action taken in a merger or acquisition, share buyback or stock split, etc. The company offers the shareholders the option to select between cash and equity payout. Based on what the shareholders select, the available stocks are proportionately distributed among them if either cash or equity stocks are not available in sufficient quantity to satisfy the shareholder demand.

The company ensures that everyone gets a fair share of the deal through the cash and shares proportional division. In addition to a merger or acquisition scenario, a proration calculator is used to determine the salary of an employee based on the number of hours worked, and even calculate the rent for a tent who has occupied the property for a part of the month.

Proration Explained

Proration is the process of calculating, dividing, and paying an amount in proportion to the hours worked, period of occupancy at a property, etc. A proration amount is calculated for salaries, wages, fundings and so on. Therefore, a prorated salary would be provided based on the number of hours or days worked in place of a regular or pre-determined salary.

Now, let us take a hypothetical situation to explain the concept of proration in a corporate setup. Let us assume that XYZ Inc. is in the process of acquiring ABC Inc., and the takeover offer is $400 million in cash and $600 million in equity stock.

- If everybody opts for a cash payout, then the maximum cash payout for each shareholder will be 40%.

- If 20% opts for an equity payout, then 20% of the shareholders will be offered 100% equity stock. The remaining 80% who opt for cash payout will get 50% in cash and 50% in equity stock.

Formula

Let us understand the formula used for proration calculation below:

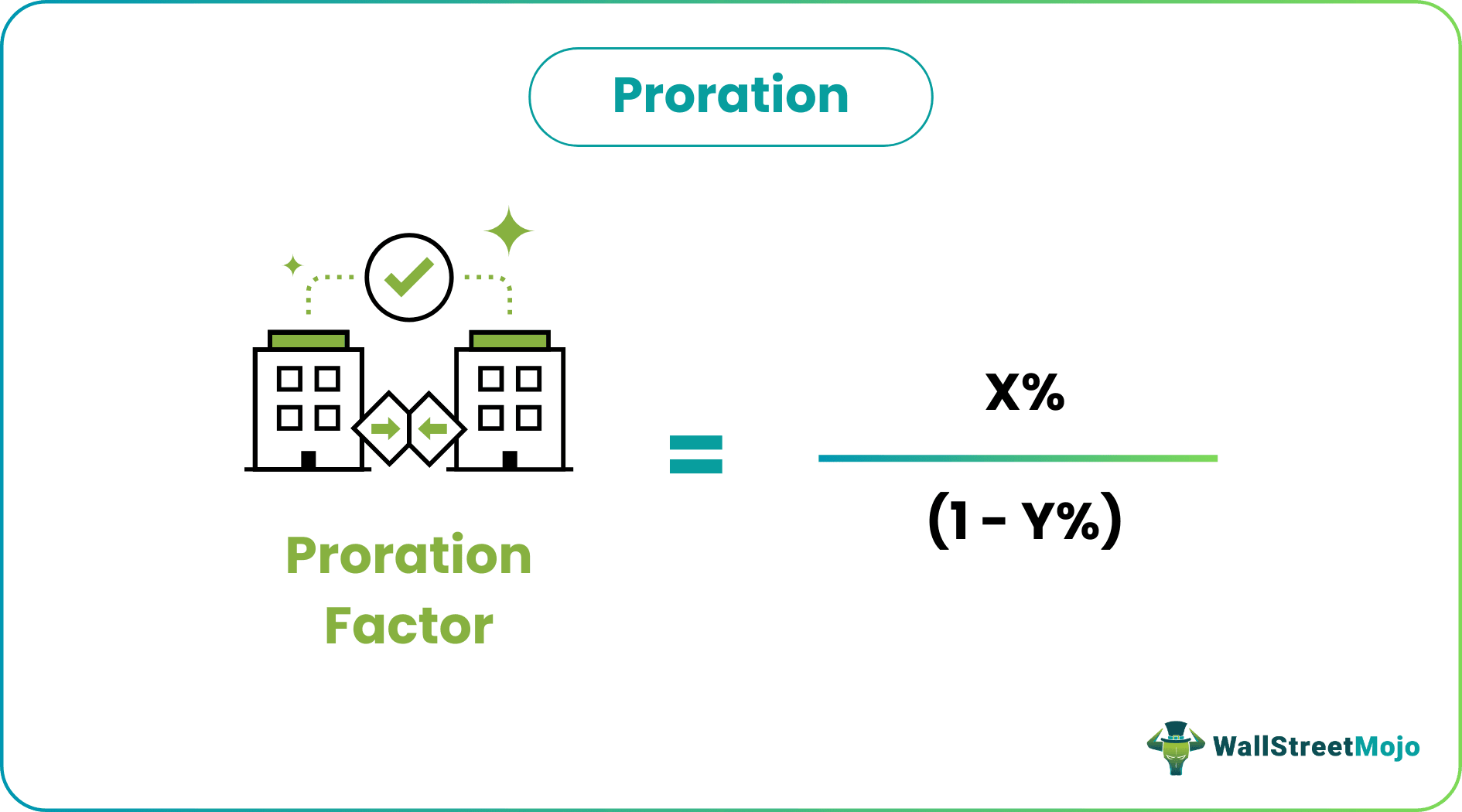

Proration Factor = X%/ (1-Y%)

How to Calculate?

The proration amount represents the proportion of shares accepted by the acquirer for the shareholders intending to participate in the offer. The proration factor can go up to 1, which indicates that the tender offer is neither oversubscribed nor undersubscribed, and all the tender requests have been accepted in full.

The calculation of the proration factor can be broken down into several steps, and they have been briefly discussed below:

Step #1: Firstly, determine what portion of the company’s outstanding shares would be part of the new corporate action, say share buyback in this case. Let us assume that the company decided to buy back X% of its outstanding shares.

Step #2: Determine the proportion of the existing shareholders who intend to opt out of the current corporate exercise as they are not currently interested in selling their equity stock. Let the proportion of shareholders who don’t wish be represented by Y%.

Step #3: Calculate the proportion of the existing shareholders who wish to participate in the share buyback, represented by (1 – Y%).

Step #4: If (1 – Y%) is less than equal to X%, then there is no need for proration as all the interested shareholders will participate. However, if (1 – Y%) is greater than X%, the proration factor will play.

Step #5: Finally, the X% has to be proportionately distributed among the (1 – Y)% shareholders, and this is how the proration factor is calculated, as shown below

Proration factor = X% / (1 – Y%)

Examples

Let us understand the significance of a proration calculation with the help of a couple of examples as discussed below.

Example #1

In January 2020, Winmark Corporation announced the results of its share buyback offer. The company initially offered to purchase 300,000 shares from its existing shareholders at a purchase price of $163.00 per share, which in turn is an aggregate cost of ~$48.9 million (excluding fees and expenses related to tender offer). The depositary confirmed that 361,940 shares were tendered by the shareholders resulting in oversubscription.

The company accepted all the payment requests and distributed the payment for 300,000 shares among the interested shareholders on a pro-rata basis. Based on the number of shares tendered and the proportion of the share accepted for payment, the proration factor for the tender offer can be calculated as 82.9% (= 300,000 / 361,940 * 100%).

Example #2

In August 2013, Halliburton accepted for purchase of 68,041,236 shares of its outstanding common stock at a purchase price of $48.50 per share, which aggregated to approximately $3.3 billion (excluding fees and expenses related to the tender offer). In addition, the company initially offered to purchase 300,000 shares from its existing shareholders at a purchase price of $163.00 per share, which in turn is an aggregate cost of ~$48.9 million (excluding fees and expenses related to tender offer).

While some of the lots were accepted in full, and others were automatically withdrawn. Nevertheless, the depository confirmed oversubscription, and hence the shares were accepted on a pro-rata basis. Based on the number of shares tendered and the proportion of the share accepted for payment, the proportion factor for the tender offer was approximately 69.5%.

Is Proration Necessary?

The proration amount ensures that all the company shareholders are treated equally (not favoring some investors over others). In contrast, the company can stick to its initial plan. Although the shareholders might not get what they initially selected in this process, it ensures that all the shareholders get the same reward.

The proration technique is also useful in various other situations, such as bankruptcy, liquidation, stock splits, special dividends, spinoffs etc. The shareholders approve these corporate actions and are usually listed on a company’s proxy statement or filed before the firm's annual meeting.