Table Of Contents

What Is A Shelf Registration?

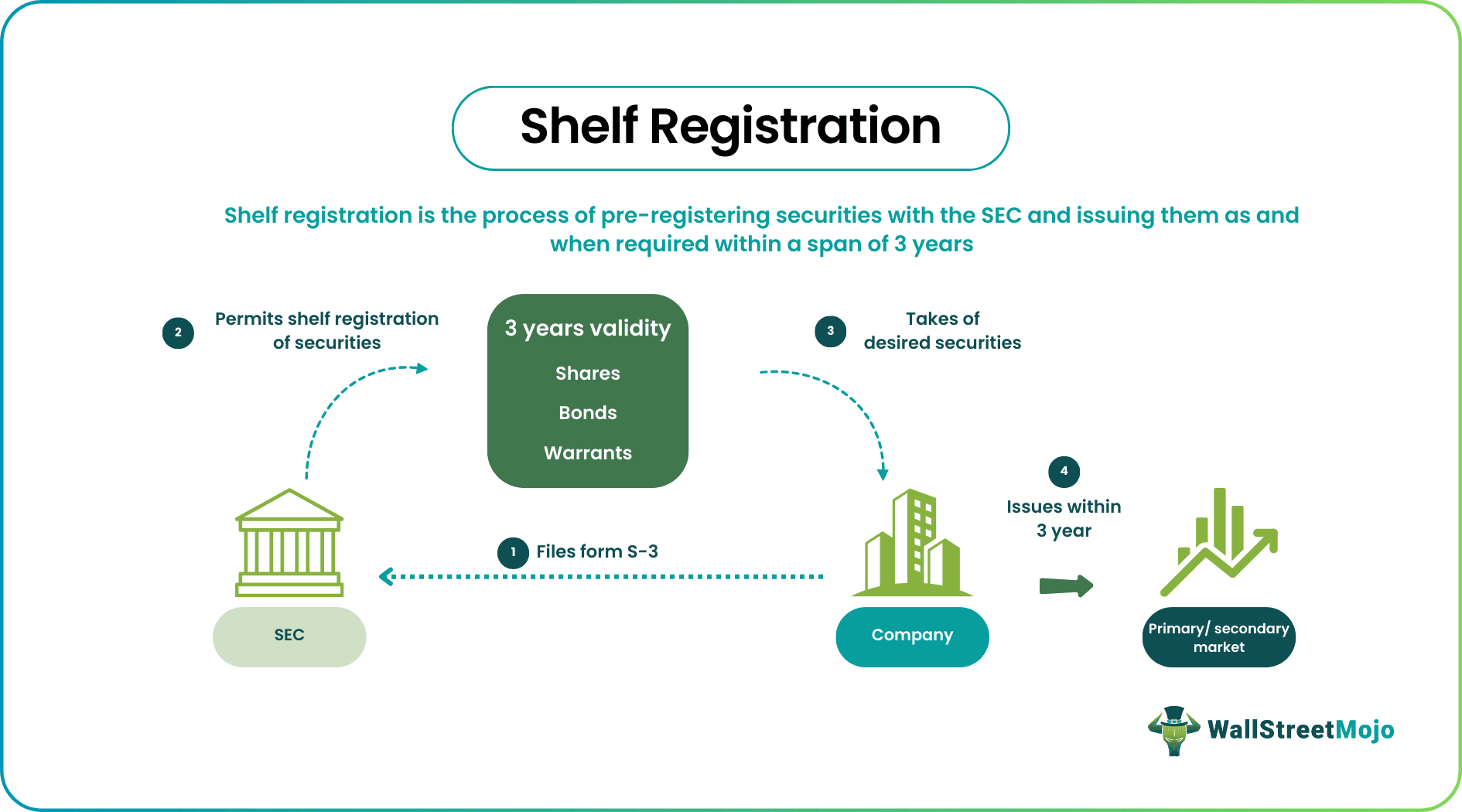

Shelf registration or Shelf offering is the process of pre-registering securities with the U.S. Securities Exchange Commission (SEC) in order to issue them to the public in the future. It gives the security-issuing company liberty to make multiple public offerings using the same registration without filing a separate prospectus each time.

Shelf registration enables the issuing company to raise capital immediately when market conditions are ideal with minimal bureaucratic paperwork. It permits the company to sell new securities (in the primary market) or resell outstanding securities (in the secondary market). Once the registration is complete, it stands valid for three years. During this period, the issuer may offer to sell securities to the public any number of times on a continuous or delayed basis.

Key Takeaways

- Shelf registration allows a security issuing company to make multiple public offerings in the future by registering with the SEC once. However, the offerings must be made within three years.

- It qualifies the issuer to raise the required capital with minimal formalities when favorable market conditions exist.

- Companies aspiring for shelf registration generally have to file Forms S-3 or F-3 with the SEC, along with a base prospectus.

- Shelf offering may be continuous or delayed. In the former, securities are issued immediately after registration, while in the latter, they are deferred.

Shelf Registration Explained

Shelf registration process, also called shelf offering, allows a company to issue multiple securities over a period of three years on filing a one-time registration document with the SEC. Companies usually resort to shelf offering when they don’t want to sell the securities immediately but like to keep the window of opportunity open.

The shelf offering process starts with filling in S-3 or F-3 forms with the base prospectus. Mostly, issuers use S3 forms (a registration statement that comes under the Securities Act of 1933) when filing for shelf registrations. On the other hand, F-3 forms come in handy for foreign companies.

The prospectus of a shelf registration statement usually contains general information such as the kind of securities being registered, investment objectives, distribution plans, the company's performance, and all the risks involved in the offering. It ensure that all crucial facts about the company are disclosed at the time of registration.

The registration statement goes to SEC for a final review. It takes a few weeks for approval. Once the SEC gives its nod, the company becomes eligible to take its securities “off the shelf” at a favorable market time. Technically, this process is called takedown. Once the securities are taken off the shelf, they are released to the public.

The company discloses the specifics related to the offering in the prospectus supplement at the time of sale. However, it can issue securities immediately after the shelf registration comes into effect without waiting for the SEC to review the supplementary prospectus.

Eligibility Requirements

Let us understand the requirements of a shelf registration statement.

#1 - Registrant Eligibility

To be eligible for filing the Form S-3 or F-3, an issuer must:

- Have its securities registered under the Security Exchange Act of 1934 or file reports under Section 15 (d) of the Exchange Act.

- Have filed and updated all its financial statements for the last twelve months before registration.

- Have paid its financial dividends and have not defaulted on its installments on borrowed funds in the last 12 months before registration.

#2 - Primary Offering Eligibility

For primary offerings, the issuer may use Form S-3 if it has a public float of $75 million or more. However, an issuer may file Form S-3 without meeting the $75 million public float requirement if it is issuing non-convertible securities or is a baby shelf issuer.

Requirements for Non-convertible Securities Issuance

Non-convertible securities, unlike convertible securities, do not provide the option of converting securities into shares or equities. To be eligible for offering non-convertible securities in the shelf registration process, an issuer must:

- Have invested at least $1 billion in non-convertible securities 60 days before filling the shelf registration form.

- Stand at a valuation of at least $750 million non-convertible sources (other than common equity) 60 days before filing the shelf registration form.

- Be associated with a well-known seasoned issuer.

Requirements as a baby shelf issuer

Many small issuers do not have the luxury of such a huge market capitalization. Baby shelf issuers are small entities whose market value stands less than the standard $75 million. They need to fulfill certain requirements to take advantage of shelf offerings.

- The issuers should not be on the list of shell companies before a year of filing the registration forms.

- They should have a class of common stocks enlisted on the country’s national stock exchange.

- They should not sell securities worth more than one-third of its public float for a year after its registration.

Types

- Continuous Offering - Through the continuous offering, issuers can offer their stocks immediately after the registration is complete. The offering continues to remain in effect throughout the registration period of three years. During this period, the issuer can sell the securities intermittently. However, note that continuity is restricted only to the offer of securities and not to their sale.

- Delayed Offering - In a delayed offering, the issuing company holds onto its securities instead of offering them immediately after registration. The company can choose to issue its shares in the market anytime within the duration of three years. However, more paperwork is generally required in the delayed offering than continuous offering.

Examples

Let us understand the concept of shelf registration rule with the help of some suitable examples as follows:

Example #1

For example, ABC, a registered company, wants to raise $1,000,000 for funding its new project. It plans to raise capital through the issue of the following securities:

- 5,000 shares

- 2,500 bonds

- 2,500 warrants

Later, it realizes the money obtained by selling these securities would be far more than it requires and plans to sell only 3,000 shares and 2,500 bonds for the time being.

However, ABC senses that it can use the remaining securities in the near future to garner more money. Realizing this, the company files for shelf registration with the SEC under Rule 415, which allows it to sell multiple securities at different points of time.

ABC files a shelf registration statement (Form S-3) with a base prospectus for 3,000 shares and 2,500 bonds. This allows ABC to sell 3,000 shares and 2,500 bonds now and the remaining 4,500 securities whenever it wants to within a time frame of up to three years.

Example #2

In July 2021, Canada’s e-commerce giant Shopify filed $10 billion in a mixed shelf offering with the SEC. The offering was a means to raise funds by issuing debt and equity securities. The company used the proceeds from the offering to reinforce its balance sheet and push forward its growth strategies. By the end of 2021, the company reported a massive 57% increase in the total revenue and an even more impressive growth of 61% in gross profit compared to 2020.

Effect On Stock Price

The shelf registration rule allows the company to register the securities but delay its issue to the public. But it has an effect on the prices of the company stocks in certain ways as given below:

- Market perception – The stock prices may temporarily decline due to the idea of investors that there will be a dilution of stocks in the coming future, because it is planning to raise more capital.

- Market condition – If the securities are issued at a time when the market conditions are healthy and favourable, then a greater number of investors may subscribe to it, thus raising its prices. But during adverse market conditions, the stocks may not be received well, leading to a fall in market price.

- Plan to use proceeds – The investors analyse the use of the capital raised and influence the prices. If the funds are used for development, investment, innovation and growth, the process is taken positively by the market, leading to rise in prices. Otherwise, the stock prices see a downfall.

- Company’s financial condition – The financial health of the company also affects the prices of stocks that are newly issued. If the balance sheet of the company is strong with good growth prospects, then the new issue is taken positively. But a company heavily in debt, invested in risky assets or projects and struggling to earn good revenue may get a negative response regarding the issue of securities.

- Market sentiments – The market sentiments in eneral can also influence the prices. A bullish market may affect it positively because investors are already having a positive outlook about stock investments in general. The opposite may happen in bearish market.

However, it is to be noted that these effects during shelf registration timeline is temporary and there may be other external factors also that have some influence in the newly issued stocks. However, it is necessary for investors to check the company fundamentals and future opportunities before investing.

Advantages

The concept of issuing shares of a company to the investors in this manner has some advantages and disadvantages. Let us look at the advantages first.

- Shelf registration allows its users an opportunity to gain access to capital markets instantly when the market conditions are in their favor.

- It permits the entitled companies to manage their capital efficiently. For example, a shelf registered company with $10,000 shares can choose to sell $4,000 shares now and the other $6,000 two years later if it does not want all the money at once.

- It is a one-step registration process free from multi-layered hassles of documentation, paperwork, and technical legalities.

- It provides control of the supply of shares to the issuing company. This gives the company the power to manipulate its share prices.

- Investors usually trust companies going for shelf offering because all their financial details are open to the public for analysis and interpretation.

Disadvantages

Some disadvantages of the process are detailed below.

- Uncertainity regarding timing – Since the registration takes place beforehand and the issue of stocks take place later, the investors remain in a state of uncertainty regarding the timing of issue, which may make the stock prices volatile.

- Share dilution – Since new shares are issued, it leads to dilution of individual shareholders’ portion of ownership, resulting in a fall in holdings value.

- Assessment of market timing – It is necessary for the company to be able to assess the market conditions at the time of issue to raise the maximum amount of capital in the process. If the market is unfavourable, investors may not subscribe well, and the amount raised will not meet the company expectations.

- Cost – The cost involved in the registration process is high and complex. But since the shares are not issued immediately, the capital remains blocked during the shelf registration timeline. If the offering is not pursued ultimately, then the money is wasted.

- Investor understanding – The investors may interpret the idea of repeaded capital raising as a negative process. They may perceive that the company is not financially sound to meet its capital needs. This is not a good for the business.

- Lack of flexibility – The process limits the company flexibility to adapt to changing market conditions because it may feel the pressure to issue additional shares since it has already registered for it.

- Compliance to regulation – It is necessary for the business going for shelf registration to comply with some rules during the registration period which may burden it with additional administrative complexity.

Thus, it is important to note that inspite of all the disadvantages, the process remains a useful and effective tool method of raising capital as and when required. But it is necessary for both the company and investors to remain well informed about the concept and the current market conditions so that the shares offering is done and at the same time investors can also maintain their trust for the business.