Table Of Contents

Formula

Let us understand the formula that shall act as the basis of our understanding and the formation of the outstanding shares equation through the discussion below.

- The number of stocks outstanding is equal to the number of issued shares minus the number of shares held in the company’s treasury.

- It’s also equal to the float (shares available to the public and excludes any restricted shares, or shares held by company officers or insiders) plus any restricted shares.

For example, if a company issues a total of 1000 shares. 600 shares are issued as floating shares to the general public, 200 are issued as restricted shares to company insiders, and 200 are kept in the company’s treasury. In this case, the company has 800 outstanding shares and 200 treasury shares.

Types

Let us understand the different types of outstanding shares equation through the explanation below.

- Basic Share

- Diluted Share

Basic shares mean the number of outstanding stocks currently outstanding, while the fully diluted number considers things such as warrants, capital notes, and convertible stock. In other words, the fully diluted number of Stocks outstanding tells you how many outstanding stocks there could potentially be.

Warrants are instruments that give the holder a right to purchase more outstanding stock from the company’s treasury. Whenever warrants are activated, stocks outstanding increase while the number of treasury stocks decreases. For example, suppose XYZ issues 100 warrants. If all these warrants are activated, XYZ will have to sell 100 shares from its treasury to the warrant holders.

Why Do They Keep on Changing?

Total outstanding stocks will increase when the company increases its share capital by selling new stock to the public or when it declares a stock split (company divides its existing shares into multiple shares to improve liquidity).

Conversely, outstanding stocks will decrease if a firm completes a share buyback or a reverse stock split (consolidating a corporation’s shares according to a predetermined ratio). Buyback is the repurchase of its shares by the company. As a result, it decreases the number of outstanding stocks in the public and increases the amount of treasury shares.

How Does It Affect Investors?

A higher number of outstanding stocks means a more stable company given greater price stability as it takes many more shares traded to create a significant movement in the stock price. Contrary to this, the stock with a much lower number of outstanding stocks could be more vulnerable to price manipulation, requiring much fewer shares to be traded up or down to move the stock price.

Several outstanding stocks are an essential value for any investors as it is included in the latest market capitalization and earning per share calculation, as shown below:

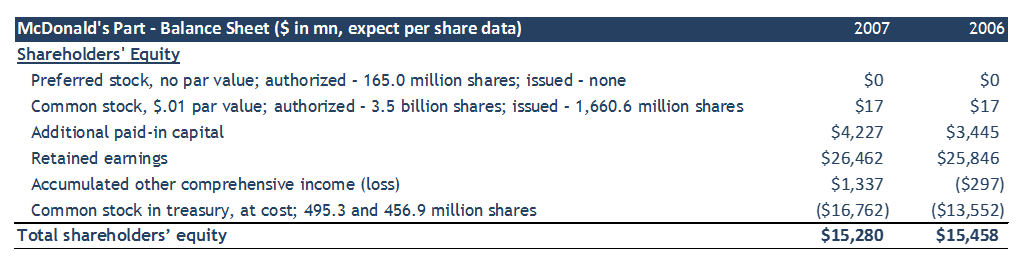

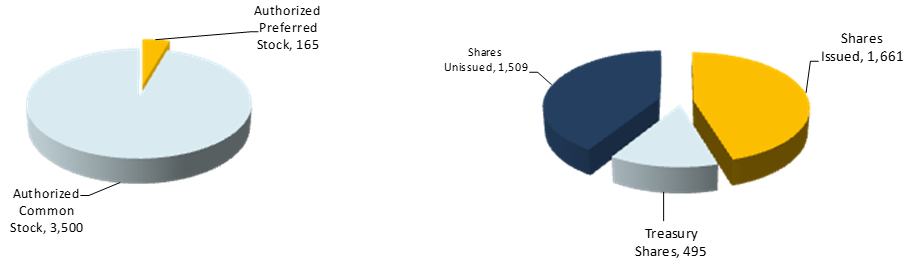

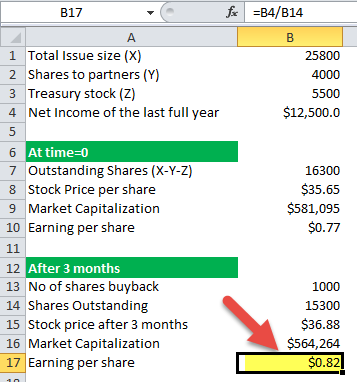

Company A has issued 25,800 shares, offered 2,000 shares to two partners, and retained 5,500 stocks in the treasury.

- Outstanding shares Formula : Shares issued – treasury shares – restricted shares = 25,800 – 5,500 – (2 x 2,000) = 16,300.

- Suppose, stock is currently at $35.65. Therefore, the market capitalization of the firm is 16,300 x $35.65 = $581,095.

- Company A has a net income of $12,500 per the latest financials. Therefore, the firm’s earnings per share is $12,500 / 16,300 = $0.77.

After three months, the company’s management decides on a share buyback of 1,000 shares. The stock price after 3 months is $36.88.

- Therefore, outstanding stock after three months = 16,300 – 1, 000 = 15,300.

- Market cap after three months = 15,300 x $36.88 = $564,264

- EPS after three months = $12,500 / 15,300 = 0.82

- As the number of outstanding stock decreases by 1,000, the company’s EPS increases by 6.54%.

- Also, stock outstanding is an important parameter used in the calculation of Price to book value (P/B ratio), which is an indicator of how much shareholders are paying for a company's net assets.

Where To Find?

Let us understand where investors and analysts can find the data regarding the total outstanding shares of a company through the points below.

- Company Filings (SEC): Investors can access a company's Securities and Exchange Commission (SEC) filings, particularly the quarterly and annual reports (Forms 10-Q and 10-K), to find detailed information on outstanding shares.

- Financial News Websites: Reputable financial news websites often provide up-to-date information on a company's outstanding shares. This information is regularly reported as part of financial news coverage.

- Online Brokerage Platforms: Many online brokerage platforms offer a company's key financial metrics, including outstanding shares, as part of their stock profile.

- Company's Investor Relations Website: Companies typically maintain an investor relations section on their websites, where they publish essential financial data, including the number of outstanding shares.

- Stock Exchanges: Stock exchanges, where the company's shares are listed, often provide relevant information on outstanding shares as part of their reporting and data services.

Recommended Articles

This article has been a guide to what are Outstanding Shares. Here we explain its meaning, types, formula, and where to find them and compare them with issued shares. You may also go through the following recommended articles on basic accounting –