Table of Contents

Real Estate Settlement Procedures Act (RESPA) Definition

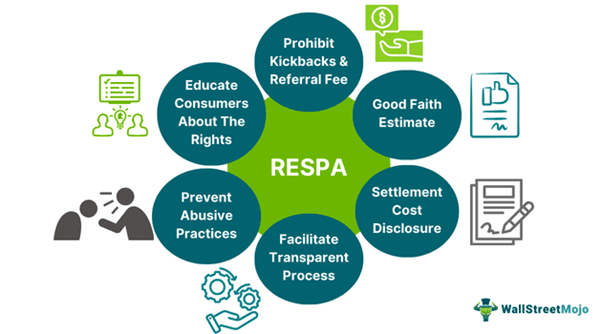

The Real Estate Settlement Procedures Act is a federal law that has been operational since 1974. It regulates real estate settlement processes by asking lenders for specific disclosures to individuals/entities borrowing. These disclosures could include referral fees and kickbacks. The Consumer Financial Protection Bureau (CFPB) oversees RESPA-related matters, mainly relating to transparency in the settlement process.

Since the Real Estate Settlement Procedures Act of 1974 was taken into effect, it has undergone several amendments and changes with the times. However, the core of the act has remained the same—prohibiting the inclusion of settlement fees and kickbacks. RESPA oversees loans secured by linking a mortgage on 1-4 family residential properties.

Key Takeaways

- The Real Estate Settlement Procedures Act (RESPA) is a federal law that provides transparency and prohibits malpractice in the real estate industry.

- RESPA directs lenders, home loan servicers, mortgage brokers, and other such services to disclose details regarding settlement services, consumer protection laws, and other transactions.

- Under the laws of RESPA, loan servicers in the real estate industry must not give or receive kickbacks, settlement fees, or referral fees.

- If a consumer finds out that the loan servicing entity is involved in any such restricted practices, they can file a lawsuit within one year.

Real Estate Settlement Procedures Act Explained

The Real Estate Settlement Procedures Act law was passed by the U.S. Congress in 1974. The primary objective of the act was to inform, protect, and educate homeowners by providing them with assistance when purchasing real estate. The law was put into effect with the intention that extra fees, such as kickbacks or settlement fees, must be prohibited, and the consumers must be aware of such expenditures.

RESPA directs lenders to provide borrowers with timely and pertinent disclosures concerning the costs and nature of the settlement processes. The Real Estate Settlement Procedures Act disclosures include but are not limited to referral fees and dual tracking practices and also limit the usage of escrow accounts.

RESPA was initially enacted because real estate agents, lenders, title insurance companies, construction companies, and other legal entities involved in the buying and selling of real estate engaged in practices that inflated the price of real estate and disturbed price competition in the market. These practices included referral fees, kickbacks, settlement fees, and bait-and-switch tactics.

The requirements, prohibitions, and penalties were initially enforced and supervised by the Department of Housing and Urban Development (HUD). Since its inception in 2011, the responsibility of executing these functions of RESPA has been transferred to the Consumer Financial Protection Bureau (CFPB).

It is also important to note that RESPA does not facilitate loan extensions to government agencies or instrumentalities and does not apply to extensions in cases where the borrower is planning to use the property for commercial, agricultural, or business purposes.

History

The Real Estate Settlement Act history provides a brief account of its purpose, which is explained below.

- RESPA was signed into law by the Congress in December 1974

- It came into effect on June 20, 1975

- The Department of Housing & Urban Development (HUD) initially oversaw the loans secured through a mortgage of 1-4 family residential real estate

- The responsibilities were then transferred to the Consumer Financial Protection Bureau (CFPB), which became operational in 2011

- On October 8, 2015, CFPB curated a compliance bulletin with respect to Marketing Service Agreements (MSAs)

Requirements

The general requirements under the RESPA Act of 1974 are:

- Provide disclosures such as a Special Information Booklet, Good-Faith Estimate of Settlement Costs (GFE), mortgage servicing disclosure, and settlement statement (HUD-1/1A)

- Follow escrow account practices as directed

- Keep GFE and HUD 1/1A in a manner that makes it comparable during closing

- When a borrower applies for loss mitigation options through an application form, lenders should not exercise foreclosure of the loan.

- Service providers such as brokers, agents, and appraisers must not be paid referral fees, kickbacks, or any other extra fees.

What Does It Prohibit?

RESPA prohibits a few practices, such as unearned fees and kickbacks. It also places strict rules pertaining to the use of escrow accounts and also curbs servicers from demanding huge escrow accounts. A few prohibitions are:

- Affiliate Business Arrangements: Brokers in the real estate industry must inform their clients/customers about the relationship before they can refer business opportunities to an affiliate title company.

- Referral Fees: Brokers cannot pay agents or other brokers a sum for referring clients to them through an affiliate mortgage company. RESPA views these fees as a form of kickback, and hence, they are strictly prohibited.

- Marketing & Sponsorship: Marketing activities between brokers and lenders are only prohibited once costs are paid for by parties involved in the proportion of goods or services they shall receive in return. However, if one party pays more than the other, it is not allowed. Moreover, if a party uses a marketing piece to promote its services, it shall fall under the purview of prohibited acts under RESPA regulations.

Examples

Now that the theoretical aspect of the concept is out of the way, it is time to address the practical application aspect of the Real Estate Settlement Protection Act purpose through the examples below.

Example #1

Angelo Mathews, a real estate lender, advertises a home loan at a 6% interest rate. Since this is significantly lower than the market rate of 9%, Mr. Singh decided to approach Mr. Mathews for the loan.

Upon commencing the process, Mr. Singh is delivered an invoice of $6,000 for experiencing the service of the lender’s affiliate title business. The market rate for the same service was approximately $4,000 cheaper. It was said that using their services was compulsory if Mr. Singh wanted to secure a home loan at 6%. Realizing that this is a prohibited practice under RESPA, Mr. Singh appoints a real estate lawyer and sues Mr. Mathews.

Example #2

The Consumer Financial Protection Bureau (CFPB) has been vigilant about brokerages, agents, and others in the real estate industry for any violation of the RESPA rules. In August 2023, the CFPB found a mortgage lender and a real estate brokerage guilty of violating Section 8 (A) of the RESPA Act.

These entities were found guilty of giving and receiving illegal kickbacks for providing mortgage referrals. The lender was awarded penalties of $1.75 million, and the brokerage was awarded penalties of $200,000.

Common RESPA Violations, Penalties, and How to Avoid?

It is essential to mention that if a client believes/knows that the service provider has violated consumer rights under RESPA, they can file a claim within one year of such occurrences. Below are the most common violations and their penalties.

#1 - Demanding Title Insurance (Section 9)

Sellers of a property that a buyer purchases through a federal-related mortgage loan cannot directly or indirectly ask the buyer to get their title insurance from a specific company. The seller cannot list this as one of the conditions/requirements for purchasing the property.

Penalty

If Section 9 of RESPA is violated, buyers can file a lawsuit against the sellers and be compensated up to three times the cost of title insurance.

How To Avoid?

- As a seller, refrain from listing any title company as a part of their conditions

- If sellers want to provide title insurance companies, they must provide options for the clients to choose according to their free will

- Sellers can pay for title insurance from their pocket if the costs relating to it are not added to the “other fees” section

#2 - Inflating Costs (Section 4)

According to Section 4 of RESPA, brokers and mortgage lenders cannot charge clients a higher fee for a third-party service than the original cost. These violations have been specified in HUD-1 & HUD-1A.

Penalty

The Department of Housing and Urban Development (HUD) is responsible for issuing such violations. If an entity is found violating under Section 4, it can be awarded a fine of up to a few hundred thousand dollars.

How To Avoid?

- Brokers and sellers must maintain proper records of client bills and bills for services

- They can reach a mutual consensus with a third-party service provider to charge a set amount to ensure there are no differences in bills

- Ensure not to get involved in giving or receiving kickbacks in cases of bulk discount

#3 - Loan Servicing Complaints (Section 6)

Borrowers can raise concerns with their lenders/servicers in writing if there is any issue in the process. The service provider must respond to the complaint within 20 days of receiving it and solve the problem within 60 days. They can either correct the problem or issue a statement defending their reasons.

Penalty

Borrowers can file a lawsuit for a violation of Section 6 within three years of the event. If the service provider is found guilty, the borrower shall be awarded claims for damages.

How To Avoid?

- Service providers must have a well-established process that ensures that all letters are opened and acknowledged in time.

- All packages and/or letters must be time-stamped and entered or scanned into their CRM software.

- Once the letters of response are mailed, the ticket or issue must be marked resolved to ensure enough proof for future instances of complaints.

Criticism

Despite all the measures, consumers and market experts still need to be happier with a few aspects of the Real Estate Settlement Procedure Act disclosures. A few of the most common ones are:

- Many feel that kickbacks are given and received in different forms, such as captive insurance

- In other cases, lenders charge a higher price and compensate for the lack of a kickback

- Lenders still have more power than the borrower as they can manipulate the choices that are provided to their clients

While both buyers and sellers must disclose all costs, charges, and fees according to HUD-1 and HUD-1a, discrepancies and faults are found regularly