Table of Contents

What Is Regulation B?

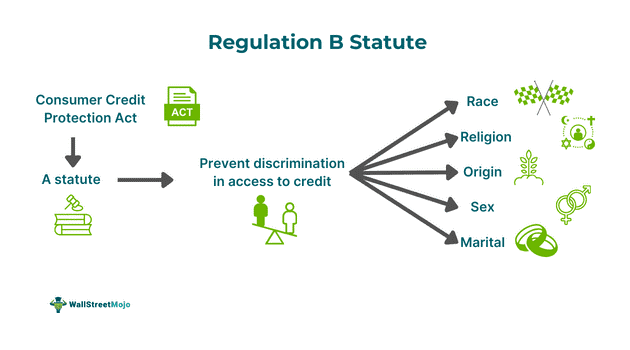

Regulation B is a legal provision that protects applicants from credit transaction discrimination. The Bureau of Consumer Financial Protection issues it under the Equal Credit Opportunity Act (or the ECOA). This is formulated under Title VII of the Consumer Credit Protection Act.

The provision was introduced to promote credit availability to all worthy applicants. It prohibits creditors from discriminating against applicants based on factors such as race, religion, sex, or marital status, among other things. The act advocates equal treatment of similarly situated credit applicants based on credit qualifications. This is a pillar among the U.S.'s fair lending laws.

Key Takeaways

- Regulation B is a critical regulation that deals with the provision of credit in the U.S.

- The law prohibits discrimination based on race, religion, age, marital status, and sex to provide equal access to applicants who are required to credit.

- The regulation covers credit transactions and lender activities. Its key requirements include providing copies of appraisals, prohibiting discriminatory practices, and prohibiting the collection of unwanted information.

- The purpose of regulation B is to promote financial inclusion, discourage discrimination, improve economic growth, etc. It prohibits the discouragement of oral, in-person, or written methods that stop applicants from seeking credit.

Regulation B Explained

Regulation B is a provision of U.S. law that deals with making credit available to all worthy customers for credit without discrimination. The statute defines discrimination as unlawful for creditors to discriminate against applicants based on a few criteria.

Firstly, discrimination on race, religion, color, marital status or sex or age, national origin, etc. With regard to age, the applicant shall be eligible to enter into contracts. Secondly, discrimination based on income derived by the applicant on the basis of public assistance programs. Thirdly, it also prevents discrimination among people who exercise a right in good faith as per the Consumer Credit Protection Act.

ECOA regulation B basically has two fundamental prohibitions against lending practices that are discriminatory:

- Creditors shall not discriminate against applicants on a prohibited basis during any credit transaction aspects.

- Creditors shall not make oral or written statements via advertisement or any other means to applicants that are discouraging in nature. It means the action shall be discouraging on a prohibited basis that persuades the person from pursuing an application.

The statute also covers creditor activities, including those done in the past, during the credit extension, and after the extension. It applies to all persons who regularly participate in the decision regarding credit, including setting its terms.

Requirements

There are a variety of requirements necessitated by regulation B banking and some of them are given as follows:

- The statute requires the law not to mandate creditors ask for signatures of the applicant's spouse or the other person if not a joint applicant if they are creditworthy.

- The creditor is required to obtain the signature of another owner on necessary instruments if it is reasonably necessitated by law. This is required in case the applicant requests unsecured credit based on property.

- Creditors shall provide disclosures, electronic signatures, consumer consent, exceptions, and redelivery through electronic communication. Any other disclosures are to be informed in writing.

- Regulation B banking requires banks to provide copies of appraisal reports used in connection with credit applications secured by dwelling lien. The reports shall be provided routinely or upon written request to the applicant. The bank shall inform the applicant in writing regarding the right to receive copies of the report.

- It requires creditors to provide applicants the copies of all appraisals and written valuations in relation to the application free of cost.

What Transactions Does Reg B Cover?

The ECOA regulation B covers all transactions that satisfy the following conditions:

- If the application is for credit.

- If the application is for credit, it secured by a dwelling's first lien.

- If the appraisal or written valuations are prepared in association with the credit applications.

What Does It Prohibit?

The regulation B lending, among other things, prohibits the following:

- As previously mentioned, it basically prohibits discrimination against applicants and oral or written statements that discourage applicants from seeking credit.

- Based on the prohibition of oral or written communication, it shall also not encourage certain types of borrowers and discourage others.

- Similarly, on the same ground, it shall not use pre-screening methods that can likely discourage credit applicants.

- It prohibits the use of rate quotes, scripts, and other means that instruct loan offices or brokers to discourage minority applicants.

- It prohibits the use of written or in-person telephonic and oral inquiries to discourage applicants.

- The law requires the prohibition of information. Banks shall retain information that they do not use while evaluating applications. This information should have been obtained in accordance with state and federal rules.

- The lending officers shall not request prohibited information before or while taking applications that are not related to the process.

Importance

Given below are some of the points that highlight the importance and purpose of regulation B:

- It helps prevent discrimination against women, minority groups, and people who require the system's support and ensures equality in this regard.

- This helps them get access to credit and improve their standards of living.

- It promotes financial inclusion.

- This helps fuel investment opportunities, innovative ideas, and other activities that can contribute positively to the economic growth of the community and country.

- Since the regulation requires creditors to provide the reason for the denial of credit, this helps the applicant work on the reasons and try better for the next application.

- It protects consumers of credit.