Table of Contents

What Is Regulation V?

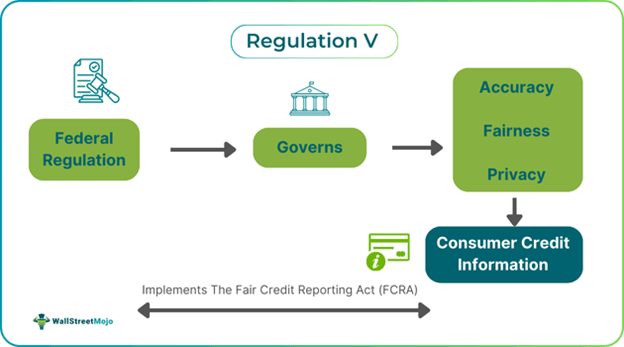

Regulation V is a guideline that governs fair credit reporting. It is established by the Consumer Financial Protection Bureau (CFPB) to promote fairness and accuracy in the collection and use of data by credit reporting agencies. This rule is primarily designed to protect the privacy of U.S. consumers.

This regulatory provision governs the collection and distribution of consumer data, applying to entities that furnish or use consumer credit information. Their primary focus is to ensure reasonable procedures are in place to promote accuracy and fairness in credit reporting, contributing to an efficient financial system.

Key Takeaways

- The Consumer Financial Protection Bureau enforces regulation V to implement the Fair Credit Reporting Act. It aims to ensure fairness and accuracy in reporting consumer credit information.

- Key requirements include accurate data collection, investigation of disputes, and the provision of risk-based pricing notices.

- The regulation helps in making informed financial decisions, prevents identity theft, preserves financial privacy,

- and empowers consumers by reducing the risks of unfair and inaccurate reporting practices.

Regulation V Explained

Regulation V is a set of provisions by the CFPB to ensure transparency, fairness, and accuracy in collecting and distributing consumer credit information. It focuses on credit-related data used to determine a consumer's eligibility for credit, insurance, employment, and other services. This data is generally reported to credit reporting agencies like Equifax, Experian, and TransUnion.

The Regulation V provisions apply to any person or entity involved in furnishing or using consumer credit data, including individuals, corporations, partnerships, associations, trusts, cooperatives, and government agencies. Regulation V enforces the Fair Credit Reporting Act (FCRA), which focuses on ensuring the accuracy and fairness of consumer information reporting. It also establishes procedures to ensure confidentiality and prevent improper use of consumer data.

Inaccurate or unfair credit reporting can undermine public confidence in the financial system, making it vulnerable. Regulation V seeks to maintain an efficient financial system by requiring reasonable procedures to protect consumer privacy, ensure relevance, and promote the proper use of credit information. The Consumer Financial Protection Bureau (CFPB) administers the associated provisions. The provisions empower consumers by granting them the right to access their credit reports and dispute inaccuracies. This is crucial in today's digital age, where data protection and privacy are increasingly important.

Requirements

The following are some of the general provisions required by Regulation V:

- All entities are required to collect accurate information. Consumer reporting agencies must ensure the accuracy of the information collected.

- The information collected shall be specific.

- The data must be collected through fair means.

- Consumer reporting agencies must investigate disputes arising from information sharing and correct any errors found.

- Institutions are required to protect data to prevent identity theft.

- The provisions require agencies to restrict the use and sharing of consumer data with affiliated companies.

- The consumer's medical information must be protected.

- Notices must be provided to consumers if the credit offered is less favorable than that requested.

Examples

Let us look at some examples to understand the concept better.

Example #1

Suppose Dan is a consumer, and he recently received calls from unknown numbers offering loans and other financial products. At first, he ignored them, but the calls became increasingly frequent. Upon inquiry, Dan discovers that one of the credit reporting agencies had a data breach, leaking his personal information, including his phone number. Scammers used this information to contact him under the pretense of a financial agency. Since Dan's data was not properly protected, he may seek justice under the Fair Credit Reporting Act (FCRA), as enforced by Regulation V.

Example #2 - A Real-life Circumstance that is Connected to the Topic

The Consumer Financial Protection Bureau (CFPB) has proposed new rules regarding the removal of an exception under Regulation V that allowed creditors to use medical debt information to determine credit eligibility. The proposal introduces a new term, "medical debt information," which refers to debts incurred for medical services. It would prohibit reporting agencies from including consumers' medical debt information in credit reports, except under certain conditions.

Importance

The following points highlight the importance of CFPB Regulation V:

- Consumers' credit information plays a critical role in financial decision-making and impacts credit eligibility determinations.

- Inaccurate information can lead to inappropriate loan approvals or denials, potentially resulting in financial loss.

- The regulations protect the use of consumers' medical information and help prevent identity theft.

- Consumer credit data is used to determine insurance premiums, conduct employment screening, and process rental applications. Consumers get affected if the data is collected and distributed unfairly.

- Regulation V ensures the financial privacy of consumers.

- It empowers consumers by protecting their data and granting them access to it, allowing them to report discrepancies.

- It promotes transparency in the processes of data collection and distribution.

- The process boosts public confidence and encourages consumers to engage more with the financial system by ensuring accuracy and fairness.