Table Of Contents

What Is Revenue Based Financing?

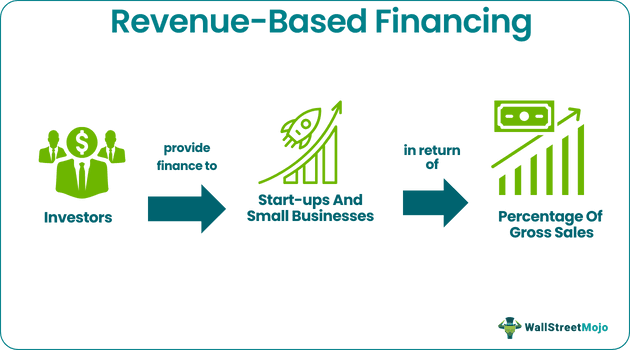

A revenue-based financing model, also known as royalty-based financing, involves investors receiving a share of the company's gross revenue in exchange for capital. The prime aim of this financing is to fund the growth of new businesses like start-ups and small firms and, simultaneously, give better investment returns to the investors.

It allows enterprises to raise equity without losing equity. Also, companies do not have to keep any collateral or guarantee. As a result, businesses can make flexible payments to investors. However, royalty-based financing is not available to companies making pre-revenues.

Key Takeaways

- Revenue-based financing is a capital funding model where investors get paid as a percentage of the company's gross sales.

- The royalty-based financing providers look at various eligibility criteria like historical background, product and services, growth potential, and similar things.

- These capitalists get 1.5x to 3x return on their investment for 2-5 years.

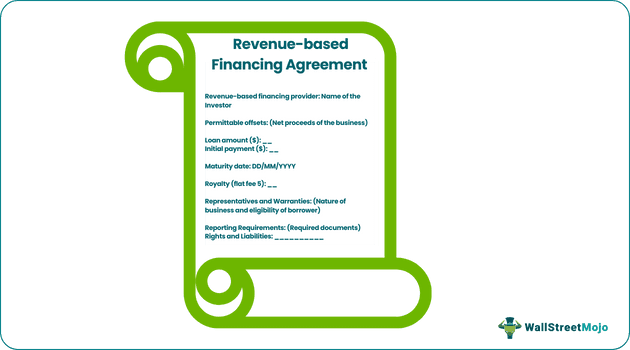

- Companies need to sign a revenue-based financing agreement with the finance provider. It includes details like loan amount, flat fees, maturity date, repayment terms, and similar things.

How Does Revenue-Based Financing Work?

Revenue-based financing model is a give-and-take policy for capital in return for a share in gross revenues. It is a kind of loan plus promissory note where repayment is from the net proceeds of the business. In addition, it acts like a flexible fund arrangement for startups between the funding rounds.

Royalties-based financing dates back to the 1980s, basically in the oil, gas, and mineral industries. The capitalists invested funds in these companies and earned back from the successful operations. Later, in the late 1980s, venture capitalist Arthur Fox proposed his new financing model to businesses in New England. Likewise, in 1992, Fox opened a small royalty-based financing fund company that slowly started yielding a return of over 50%. Furthermore, various biotech companies, start-ups, and small businesses use this model.

Revenue-based financing might look similar to other debt financing methods, but it differs. Companies must first sign up with a royalty-based financing provider through their business financial accounts. It enables providers to browse the company's history and decide its eligibility. Then, based on historical background, growth estimates, use of funds, and product review, the finance provider decides on funding. Next, the company's estimated revenue must meet the criteria to qualify for an advance. Then, the finance providers supply various offers that suit the business. At last, they sign a royalty-based financing agreement with each other.

Per the offer, the finance provider charges a flat fee and its share of gross monthly sales. Once the company generates sales, they need to make monthly payments as a percentage of net proceeds.

Revenue-Based Financing Agreement

Every business planning for royalty has to sign a revenue-based financing agreement with the finance provider. This agreement will include the loan amount, repayment terms, default remedies, and maturity date. Also, it mentions the remedies in case of default payments. Thus, firms must sign the agreement as it will state the top-line revenues and flat fees. Top-line revenues are based on gross sales, while flat fees represent investors' stake in those sales.

Finance providers provide one-third of the company's annual recurring revenue as a loan. Else, it can be four to seven times their monthly proceeds. The flat fee charged by the capitalist is between 4% to 12% depending on the revenue investment activities.

Revenue vs Income Explained in Video

Revenue-Based Financing And Revenue Bonds

Royalty-based financing and revenue bonds share a similar cash flow structure. The category of municipal bonds includes revenue bonds. Municipal projects prefer revenue bonds over general obligation bonds. An example includes a toll road. Standard revenue sources secure these bonds as they finance income-producing projects.

Examples

Let us look at the revenue-based financing examples to comprehend the concept better:

Example #1

Suppose Racheal owns a business that provides ecological beauty solutions to clients. In the past two years, her business scaled annual revenue of $27,000. In the initial years, she received funding from venture capitalists in the first two rounds. However, her business needed more funds for expansion. So, she reached out to Ben for royalty-based financing. This revenue-based finance provider reviewed the business eligibility and approved the loan upon certain terms.

According to the agreement, Ben will provide one-third ($9000) of the loan with a 6.5% flat fee. Also, providers will make the advance payment to the business. This fee (interest) will be a percentage of monthly sales. On maturity, the interest payment stops, and the business has to pay the loan principal amount to the finance provider. But if the business fails to do so, the royalty-based financing provider can take suitable action against them.

Example #2

According to Allied Market Research, a market research company, the revenue-based financing market size will reach $42,349.44 million by 2027. While in 2019, the revenue-based financing market size was $901.41 million. Per region-wise, Asia Pacific would showcase a Compound Annual Growth Rate (CAGR) of 65% during 2020-2027. And this trend continues to increase.

Pros And Cons

Revenue-based financing provides various benefits to companies. Companies can easily access capital as they do not have to keep collateral. Also, they can make flexible repayments without diluting equity. Besides that, even the investors get a good rate of return, i.e.,1.25x times their investment.

It includes certain cons too. For example, not all companies can access this financing. For example, pre-revenue companies cannot sign for it as prior revenue is a vital criterion for eligibility. Also, companies will get only limited checks compared to venture capital.

| Pros | Cons |

|---|---|

| No Collateral | Not suitable for pre-revenue companies |

| Easy access to capital | Limited funding size |

| Flexible repayment | Required timely repayments |

| Relatively cheaper than equity | |

| More control over business | |

| Higher rate of return | |

| No equity dilution |