Table Of Contents

Tax Evasion Meaning

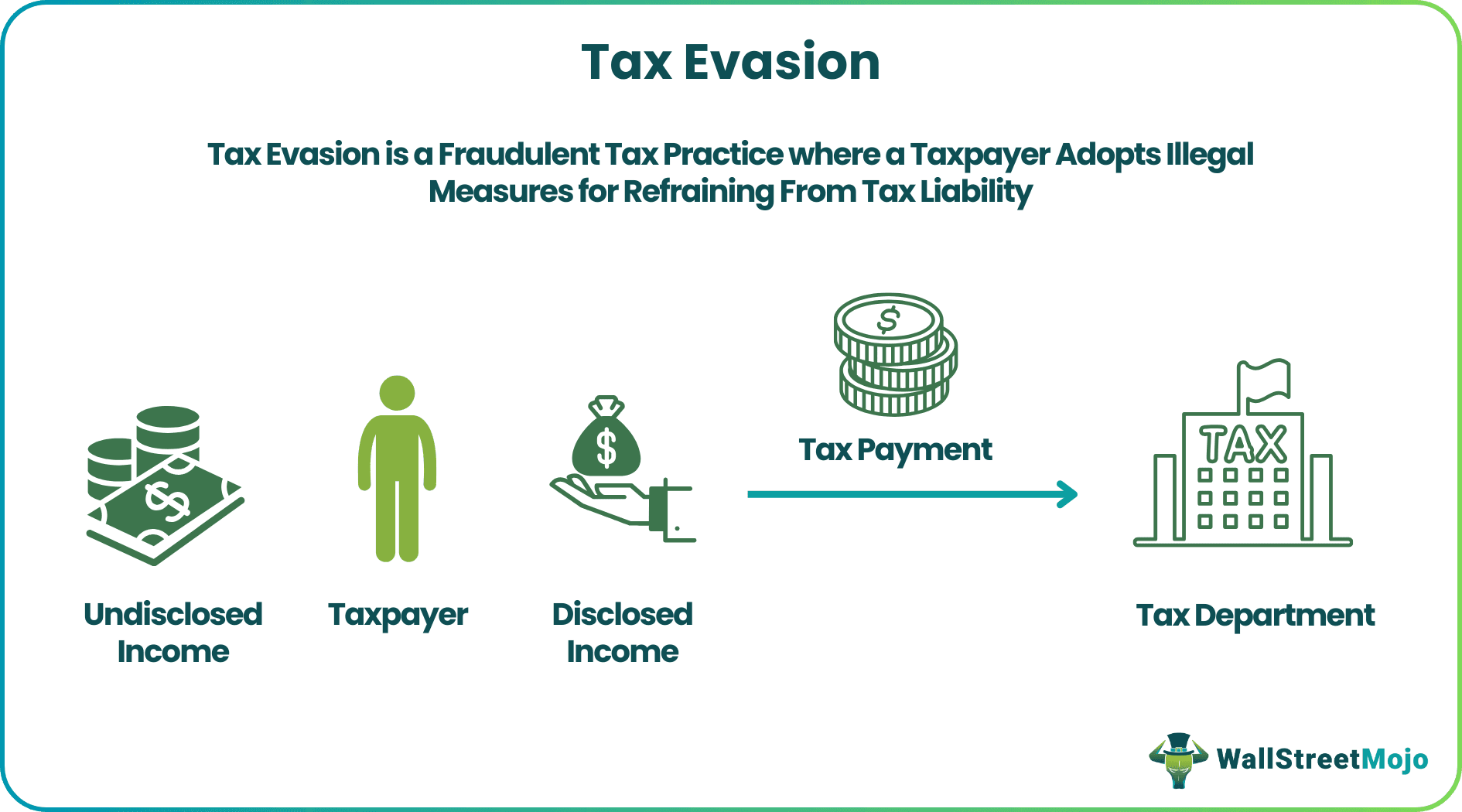

Tax Evasion is the practice of employing illegal means to intentionally escape tax liability. It involves misreporting income by either understating earnings, claiming ineligible deductions, or siphoning off money to secret foreign accounts. It is a criminal offense under the U.S. Internal Revenue Service (IRS) tax code and is punishable.

Thus, willfully evading taxes may result in imprisonment and penalties under federal law. Tax evasion must be distinguished from tax avoidance and tax planning. Though all techniques aim at reducing taxes, the former is illegal, while the latter approaches are legal. Tax planning is considered to be the most desirable approach to minimize taxes.

Key Takeaways

- Tax evasion is a fraudulent tax practice where a taxpayer adopts illegal measures for refraining from tax liability.

- It is recognized as a criminal offense by the IRS, and the defaulter person or business entity has to bear strict consequences like penalty, imprisonment, or both.

- The various method adopted by taxpayers for evasion is submitting false tax returns, claiming incapable deductions and exemptions, transferring income to other accounts, etc.

- It is not the same as tax planning or tax avoidance, whereby taxpayers use legitimate means to save taxes.

Tax Evasion Explained

Taxes are charges levied by a government on the income of its citizens. It is an essential source of revenue for the government. With this money, the government funds infrastructure and other public work projects for the benefit of the general public.

Thus, citizens can enjoy public goods in return for taxes. However, taxpayers may choose to evade taxes in order to save their personal income. In doing so, they continue to enjoy their share of public goods without contributing to it.

However, if many taxpayers start evading taxes, the government's revenue would reduce significantly, resulting in the unavailability of public goods and services. The absence of civic amenities would affect all the citizens of the country and even the economy.

Hence, the tax authorities see evading taxes as a crime. In the eyes of the law, it is a kind of tax fraud whereby a person or corporation acts illegally to avoid tax payments. Thus, the alleged individual or business entity has to bear severe legal consequences for committing such a crime.

Evading taxes cannot be considered as something that happens just by chance. The tax forms being a little complicated may lead to mistakes in filing. Thus, if the taxpayers file the taxes with some errors in the tax return forms, they are not guilty of any charges. However, if the IRS believes that the taxpayer made this mistake deliberately, then such an individual or company has to prove that it happened because of negligence and wasn't intentional.

If underpayment was just an error, then the taxpayer will be asked to pay the deficient amount with a nominal fine or interest on the due amount. If these fines are not paid then, criminal charges may be filed against them. However, if the alleged taxpayer fails to prove the same, the IRS can take serious action against them, including imprisonment and penalties.

Types of Tax Evasion

The IRS has identified the following two ways in which the tax evaders execute their unlawful practices:

#1 - Evasion of Assessment

Tax evaders deliberately attempt to avoid the tax assessment by filing a false return. The fraudulent return hides income and claims inadmissible deductions. As a result, it leads to an incorrect assessment of the tax.

Note that the act must be beyond the extent of just negligence to constitute evasion of assessment. If the person transfers taxable assets in the books to mislead IRS in tax assessment, it is also considered an attempt to evade the assessment.

#2 - Evasion of Payment

If the taxpayer tries to hide the assets after the tax is due and owing, it is an apparent attempt to evade the payment. The various ways of avoiding tax payment include the concealment of the assessable assets or money in a family member's or foreign account so that the IRS couldn't find its clue. However, the inability to pay the due amount doesn't tantamount to evasion.

Tax Evasion Methods

Moving further, let us now discuss the various unlawful practices taken up by the tax evaders to refrain from paying taxes:

- Maintaining incomplete or misleading financial statements

- Reporting income lower than what is earned

- Hiding information while filing the income tax return

- Justifying the false claims for exemption with counterfeit documents or evidence

- Keeping money in foreign accounts or the accounts of family members, friends, or relatives

- Dealing in black money, smuggling goods from other countries, and offering a bribe to tax officials

- Deliberately not paying the tax dues on time even after receiving the warnings and legal notice

Tax Evasion Examples

Hypothetical Example

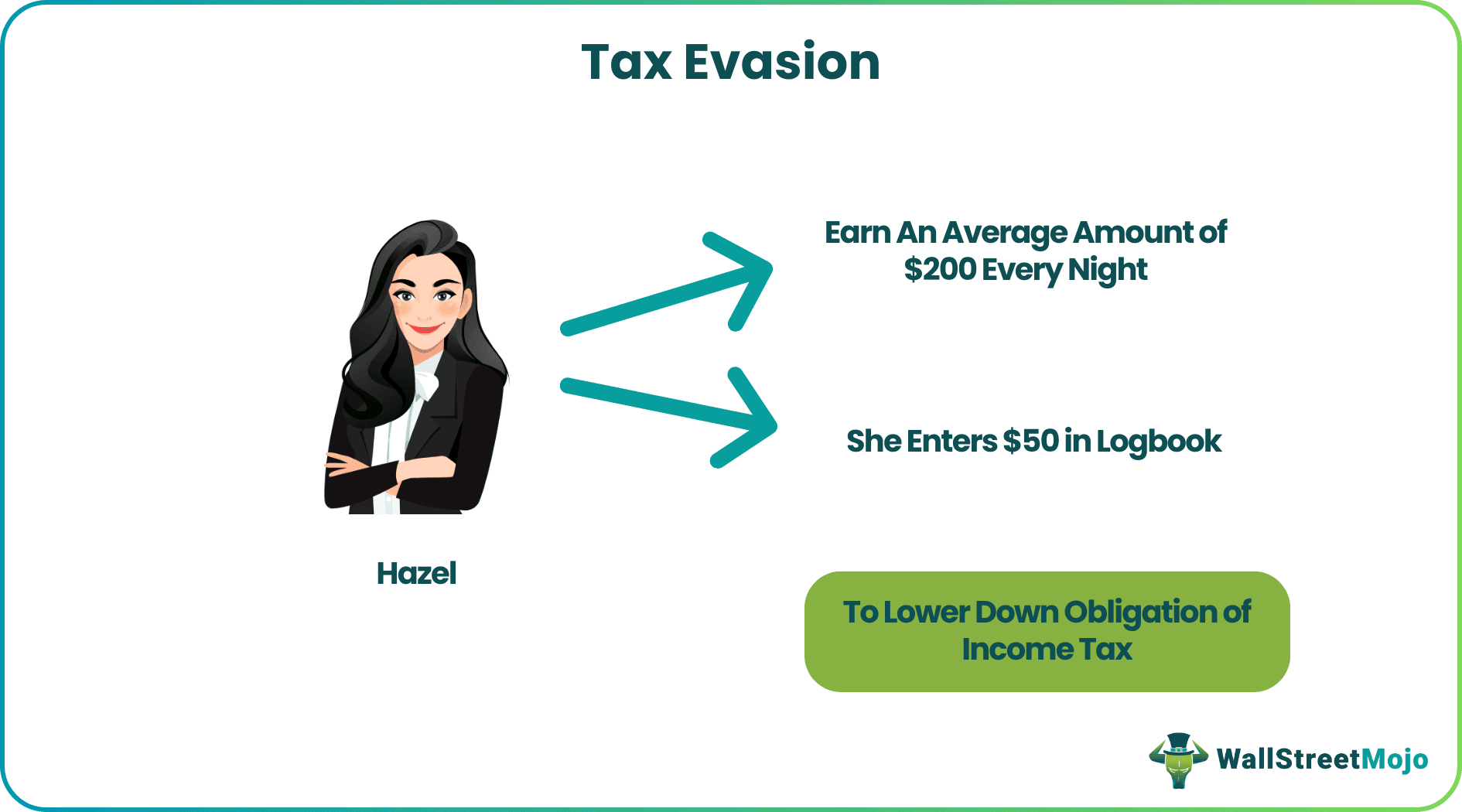

Hazel is the server at a very popular Chophouse. She earns on average an amount of $200 every night through tips. Unfortunately, the employer of Hazel does not keep any track of tips given to the servers as he relies on them to note down the same in the logbook.

Hazel deliberately reports a small amount on her tax return that she mentioned in the employer’s logbook. It averages an amount of $50 every night. It was an attempt to lower down the obligation of income tax expense.

According to the rules, the servers have to report the tips given to them as their income. Hence, tax liability exists. However, here Hazel misstated her income throughout the year, intending to evade tax obligations. As a result, she has committed a felony crime.

Real-Life Example

A recent Bloomberg article reports a high-profile tax evasion case of a Russian Banker, Oleg Tinkov. On October 29, 2021, Tinkov was found guilty of submitting a false tax return, where he had not disclosed his enormous gains from the sale of his bank stocks. Moreover, he denied his naturalized U.S. citizenship (which he received in 1996, he was a Russian then) to trick the U.S. Treasury and the IRS.

All this began in 2013 when Oleg Tinkov formed a Russian bank that had no branches but offered online banking and financial services to its clients. The company was named Tinkoff Credit Services (TCS), and Tinkov held the majority of the company's shares.

On selling a chunk of its shareholding just after the IPO release, he received a sum exceeding $192 million. Three days later, he applied for the renouncement of his U.S. citizenship. He concealed earning a considerable sum from shares and only disclosed the assets worth $2 million in his expatriation statement. Also, he didn't mention his property gains of more than $1.1 billion.

Later, his total tax fraud amounted to around $250 million. For his felony, Oleg was asked to pay approximately $509 million, including due taxes and interest on the same. He was also penalized with $250,000, the maximum limit of evasion fine imposed on an individual. He was even put behind bars for time served and a supervised release of a year.

Tax Evasion vs Tax Avoidance vs Tax Planning

As we know, tax evasion is an illegal and unethical practice of an individual or firm to escape from paying fair taxes to the government. On the contrary, tax planning is a systematic and legal process of using an entity's permissible exemptions, deductions, and other lawful provisions to curtail its tax burden.

Tax avoidance exists somewhere in between the two. It involves using tax laws to benefit the individuals in a way that is not initially intended by law to reduce tax liability. It takes advantage of the ambiguity in tax laws to further an entity's interest.

While evasion is a punishable crime and involves imprisonment and penalties, planning is considered a legally permitted honest mode. On the other hand, tax avoidance, though legal, is generally detested. It is thought of as unethical since it robs the society of the much-needed development funds that should have come as taxes.

Note that the tax authorities are always on a look out to uncover and check tax evasion and avoidance practices, whereas tax planning is a government-endorsed method of reducing the taxpayer's liability. Some of the excellent ways of tax planning include investments in tax-saving municipal bonds, provident funds, Health Savings Accounts, etc.

Penalties for Tax Evasion

The taxpayers who are found guilty of evasion have to face harsh consequences. The IRS imposes the following punishments in the U.S. Internal Revenue Code Section 7201 for the same:

- Penalty: As per the Criminal Fine Enforcement Act 1984's 18 USC Sec 3571, an individual tax evader is fined up to $100,000 (for offenses committed before December 31, 1984) and $250,000 (for offenses committed after December 31, 1984). At the same time, a defaulting firm is penalized with a maximum of $500,000. Other legal penalties accompany these impositions.

- Imprisonment: Similarly, there is a provision for a maximum imprisonment of five years in such a felony to the alleged taxpayer, whether it is an individual or the owner of a firm.

The defaulter may face any one of the consequences or both at the same time.

How to Control Tax Evasion?

The best way to save yourself from the consequences of evading taxes is to avoid doing such unauthorized acts. Given below are some of the measures that can help the tax authorities in identifying and controlling such unethical practices:

- Ease out the tax filing and payment procedure and regulations

- Make strict provisions and laws for audit and collection of taxes

- Ensure that there is no interference of the government and political parties with the tax system

- Encourage the taxpayers through awareness programs and explain to them how tax planning is a better way of decreasing the tax burden

- Strengthen the tax administration system with a team of loyal officers

- Keep a check over bribery and corruption within the department

- Help high net worth taxpayers to legally reduce their tax liability by introducing specific provisions for them.