Table Of Contents

What Is A Tax Lien Certificate?

Tax lien certificate is that certificate which is made available to an investor who shows his interest in a property by investing his funds in clearing the outstanding property tax of that property on behalf of the owner of such property. The investor is issued with this certificate on paying the outstanding property tax against which he will earn a specified percentage of interest from the owner of the property when he pays back.

And in case the owner does not pay the amount after a specified period, the owner of the tax lien certificate will have a claim over the property of which he has paid the property tax. A regulatory authority issues this certificate to a person who has the lowest bid in the auction and is ready to accept the low-interest rate on its investments from the owners of the property.

How Does Tax Lien Certificate Work?

Let us understand how a tax lien certificate investment is done.

The municipalities create it on the properties whose property taxes remain unpaid for an extended period. The cities of the respective areas have the right to sell the tax lien of the amount of the property tax outstanding in a tax lien certificate auction.

Investors bid their amount in the auctions, and the winning bid, which is the lowest rate of interest on the outstanding tax amount, would get the tax lien certificate. The investor who wins will pay the outstanding taxes to the municipalities, and in return, they would have the right to receive the taxes paid along with interest they have made payment of from the owners of the property.

The interest rate may vary from Municipalities to municipalities, area to area. The interest rates for these tax liens sold in the tax lien certificate auction are generally as low as 3% to 8%. The property owner has to redeem these certificates within the redemption period of one year to three years, along with the Interest portion outstanding.

How To Buy?

Let us understand how to make tax lien certificate investment. It is not bought from the market. These can be won by placing bids in the auction market when the municipalities place the tax lien certificate for auctions. The investors place their bid for various properties whose property taxes are outstanding, and the investors with the winning bids will be issued these certificates. There is no secondary market from which the investor can purchase these certificates. The only way of buying a tax lien certificate is to win the bids in the auction market for the property you are interested in.

Example

Let us take the example of Jules, the owner of a prime property in Florida. But he is unable to pay the property tax due to fund shortage. So, here comes John, who wishes to invest by buying a tax lien certificate of properties to earn good returns. So, John invests in the certificate of Jules’s property in Florida and agrees to a return of 15% with a maturity period of 3 years. Thus, in the above example, John will pay the property tax and get the certificate redeemed from Jules within three years along with a return of 15%.

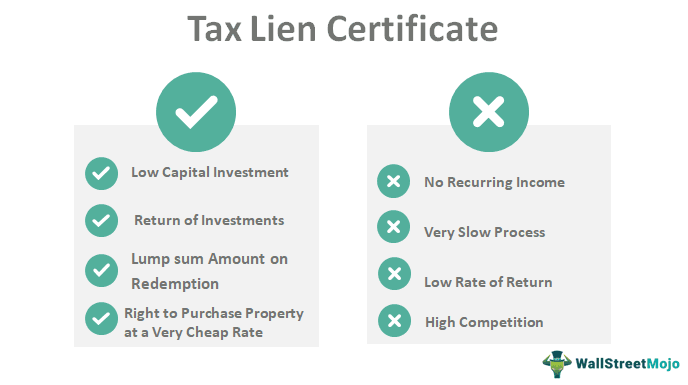

Advantages

#1 - Low Capital Investment

It requires low capital investment as only the amount of outstanding property taxes of the property is to be paid by the investors in order to be eligible for the tax lien certificate. It is made available to the investor on making the payment of property tax on behalf of the owner, which has remained outstanding for an extended period to the area’s municipalities where the property is situated.

#2 - Return of Investments

It comes with a fixed rate of return on the investment made by the investor, which is to be paid by the owner at the time of redemption of the certificate along with the property tax amount paid by the investor to the municipalities on behalf of him.

#3 - Lumpsum Amount on Redemption

The investor will get a lump sum amount on the redemption of this certificate from the owner, along with the interest on his initial invested amount.

#4 - Right to Purchase Property at a Very Cheap Rate

The investor enjoys a right to purchase the property if the owner is unable to redeem these tax lien certificates at the due date of redemption. It will bring a situation of foreclosure where the investor can purchase the property at pennies on a dollar.

#5 - Safe Investments

These are one of the safest investments as these are issued by municipalities and deemed to be redeemed by the owner of the property at maturity. In case not redeemed, the investor will have the right to buy the property at a minimal amount.

Disadvantages

Let us look at the disadvantages or tax lien certificates risk in detail.

#1 - No Recurring Income

Under this, there is no regular return on the investment made by the investor. Whatever would be the return on his investment will be received lump sum at the time of redemption or maturity of the tax lien certificate by the owner.

#2- Very Slow Process

The process of issuing this certificate is very slow. Not just issuing, but even the redemption of these is very slow. Since municipalities issue the certificate, the process is therefore not speedy, and hence neither the issuance nor the redemption of the tax lien certificate is completed on time.

#3 - Low Rate of Return

Even though these certificates provide a return on the investments (ROI), still, these returns are not as high as compared to the other options available in the market to the investors.

#4 - High Competition

There is a very high competition between the investors, as these certificates are issued on the basis of bids, and the bids are placed by many investors, property dealers, and money managers. Therefore the new investors many times do not return with the certificate, whereas the others who are regular in these markets tend to place the winning bids.

Thus, the above are the various tax lien certificates risk that the investor should keep in mind while purchasing the investment.

Tax Lien Certificate Vs Certificates Of Deposit

- Tax lien certificates have the capacity to generate greater

- returns as compared to certificate of deposits.

- The former’s risk is more than the latter.

- The former is suitable for investors whose risk appetite is more than the latter.

- The former requires a lot of research for profitable investment. There is no need of research for the latter.

- Certificates of deposits can be bought from brokers or banks, whereas tax liens do not have that facility.