Table Of Contents

What Is A Tax Lien?

A tax lien is a legal claim by the government against the assets or property of a tax defaulter. It safeguards the administration’s stake in all the valuables of non-taxpayers, including financial assets. Moreover, non-taxpayers can prevent a tax lien certificate by quick online registration for full liability payment.

A lien contrasts with a levy as it does not seize the possessions for outstanding dues settlement. Instead, it protects the government's claim on the defaulter’s assets. Meanwhile, non-taxpayers can remove a lien through full payment, withdrawal, subordination, and property release.

Key Takeaways

- Tax lien meaning describes the government’s lawful claim against the financial assets or property of a non-taxpayer.

- Tax lien investing is a great opportunity for knowledgeable investors because of increased stock market fluctuations and reduced interest rates. Also, it ensures high rates of return.

- It may lead to confiscation of current and future assets, disrupted business activities, reduced creditworthiness, and bankruptcy.

- Defaulters can get rid of the lien by complete tax settlement (full or in installments), property release, subordination, or withdrawal.

Tax Lien Explained

Tax lien meaning refers to a situation wherein the taxpayer, deliberately or accidentally, fails to pay the tax debt timely despite repetitive bill reminders by the Internal Revenue Service (IRS). Subsequently, non-payment may lead to stringent actions from lien and levy to complete seizure of the defaulter’s property.

Defaulters must always acknowledge the letters or messages by the IRS. They can also schedule estimated payments through the Electronic Federal Tax Payment System (EFTPS).

The IRS records a public report, Notice of Federal Tax Lien, to establish the preference of their claim against other creditors. Furthermore, it is reported to state or local authorities, like Secretary of State Officers or County Recorder of Deeds.

Tax lien investing has recently gained momentum due to enhanced stock market volatility and historically low-interest rates. As a result, this excellent investment avenue is a boon for professional investors to earn high rates of return.

Steps In Tax Lien Process

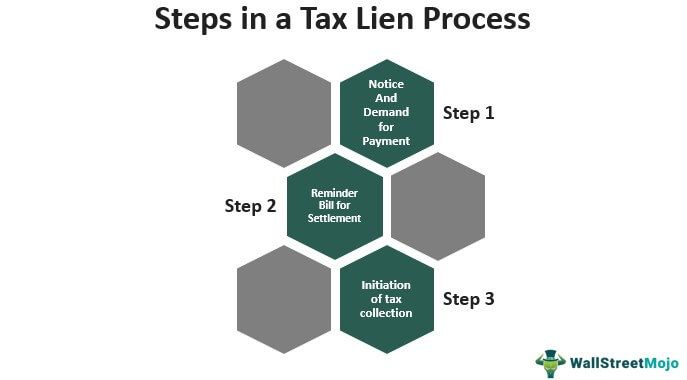

Steps in Tax Lien Process are as follows -

- Notice And Demand for Payment - The taxpayer receives the first bill for outstanding tax payment as per the return, including any penalties and interest.

- Reminder Bill for Settlement - If unacknowledged, the IRS sends at least one more tax bill with updated and increased penalties and interest over time.

- Beginning of Tax Collection Procedures - The IRS puts a lien on the non-taxpayer’s assets, resulting in confiscating their financial assets, bank accounts, and riches. It might also involve a sudden visit from the Revenue Officer at their office or house.

Effect Of Tax Lien

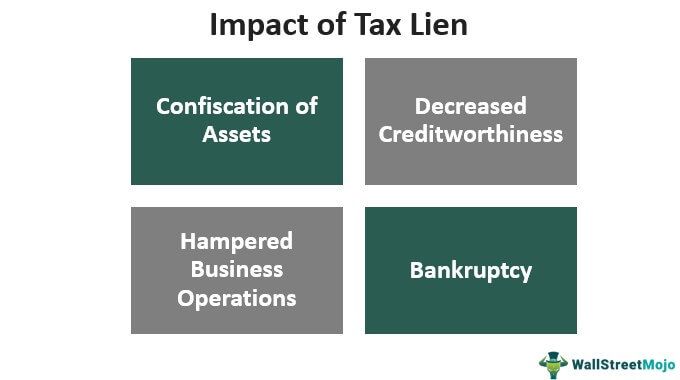

The impact of a tax lien certificate involves:

#1 - Confiscation of Assets

The government is authorized to take over the non-taxpayer’s assets (both current and future possessions throughout the lien period). It contains goods, vehicles, investment securities, and the debtor who is supposed to render the owed amount on the defaulter’s behalf.

#2 - Decreased Creditworthiness

The tax lien certificates negatively affect the creditworthiness of a non-payer. This can lead to a minimized credit potential, therefore compromising the capability for loan application.

#3 - Hampered Business Performance

The lien seizes all business establishments and all privileges to them. Consequently, it restricts regular professional business operations causing terrible market performance.

#4 - Bankruptcy

Though briefly terminated, the federal tax lien notice may persist even after the defaulter has reported bankruptcy.

Example

The billionaire facing the biggest US tax-avoidance case, Robert Brockman, criticized the IRS for confiscating his wife’s bank account. The authority made this move to accrue the outstanding amount worth $1.45 billion.

It happened on the same day when the IRS declined an offer by his family’s Bermuda Trust for lien relaxation. However, the government defends its action against Robert, who pleaded not guilty to avert $2 billion in earnings through the trust. As per the lawyers, the 80-year old billionaire utilizes it to safeguard his taxes collection.

How To Get Rid of A Tax Lien?

Eligible non-taxpayers can remove a lien by:

1. Paying Off The Tax Debits

The perfect method to abolish the tax lien certificate is by compensating the total tax liabilities. The IRS absolves a lien 30 days after the debts are paid. Moreover, the defaulter can payout via,

- Direct Pay for a guest payment

- Credit card, debit card, or digital wallet (like PayPal)

- EFTPS

- Same-day wire

- Check or money order

- Cash, or

- Electronic funds withdrawal

2. Releasing The Property

A release, meaning “discharge”, dismisses particular tax lien properties. Furthermore, non-taxpayers can check their eligibility for the same through various Internal Revenue Code (IRC) provisions.

3. Withdrawal

This withdraws the federal tax lien notice, promising that the IRS is not competing with other creditors for ownership of assets. Nevertheless, the defaulter is still obligated for debt compensation.

Also, the commissioner’s 2011 Fresh Start Initiative has offered two more withdrawal alternatives for qualified non-taxpayers:

- Withdrawal allowance after the lien’s exemption, and

- Withdrawal allowance after joining or changing from a regular installment agreement to a direct debit installment agreement.

4. Subordination

It permits a creditor to stay ahead of the government’s priority spot and easily apply for a new mortgage or loan. Please note that it does not imply lien removal but only shifts the preference from the IRS to the other creditor.