Table of Contents

What Is A Trading Robot?

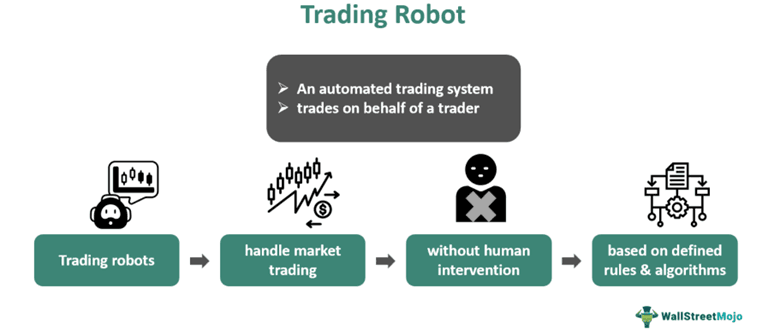

A Trading Robot is an automated trading system that tracks market movements and executes trades based on specified algorithms on behalf of a trader. It is used in equity, forex, and crypto markets as a tool to make trading decisions. It works on predefined rules and strategies for trading in the markets.

It is also called an algorithmic trading system. These auto trading robots use algorithms to place trades. They work without human interference. So, the trades thus placed are not steered by any psychological element. Also, such systems can trade 24/7, facilitating uninterrupted market trading.

Key Takeaways

- A Trading Robot is a program powered by algorithms that traders use to execute trades in financial markets, including cryptocurrency, derivatives, equity, etc.

- Robots can be custom-made by traders for specific trading purposes, where algorithms define every parameter needed to execute trades aiming to make profits while trading.

- Though algorithmic trading was seen as early as the 1970s, the use of artificial intelligence gained popularity much later.

- One of the key advantages of such robots is the elimination of human emotions while trading.

- Some disadvantages include the complexities associated with developing such robots and the potential inability of an algorithm to tackle volatile market conditions, among others.

How Does A Trading Robot Work?

Trading robots refer to computerized programs and software used to place trades in financial markets. Traders can place buy and sell orders to earn profits using these algorithms. However, they need not be physically present to execute trades; the bots will do so on their behalf.

These robots can analyze market trends and predict market movements. These auto trading robots operate in nearly all kinds of financial markets today. For instance, one can find trading robots in stock markets, commodity markets, and options trading, among others. Many traders research the best trading bots to maximize their performance in these diverse markets.

Among the popular types, forex trading robots are used to generate trading signals for currency pairs. Due to the high volatility in forex markets and frequent fluctuations in exchange rates, these bots serve as useful tools, helping traders analyze currency pairs concurrently and identify those that present profitable trading opportunities. These bots are connected to trading platforms with access to real-time data such as price movements, market news, etc. They scan the data for trading opportunities based on the rules they have been fed and place orders accordingly. When the forex trading robot detects trading signals, it executes orders on behalf of traders to make profits.

Algorithmic trading was first seen in the late 1960s and 1970s, with the emergence of the first modern prototypes of automated trading systems. They were semi-automatic systems that focused on tracking long-term market trends. Their primary function was to enable traders to identify certain signals to make trading decisions.

In the early 1970s, a second generation of trading bots emerged that used statistical algorithms to detect trends in financial markets. These algorithms could help traders identify deviations from average prices and highlight oversold or overbought stocks. Gradually, automated trading systems like MetaTrader, Forex Gump, Dash2Trade, and the 1000pip Climber System became popular.

Today, artificial intelligence holds the key to this field. With advanced data analytics, machine learning, and predictive analytics, trading robots will only get better and better. For instance, high-frequency trading leverages the lightning speed and accuracy that trading robots offer traders. So, it would not be incorrect to say that these robots will become even more sophisticated than they are today.

How To Create A Custom Trading Robot For Automated Trading?

Traders can develop robots to help them exploit market opportunities. Development is possible in two ways: creating custom bots or using a professional developer. Creating custom bots requires technical expertise and coding skills, while those who need a complex design can hire professionals for the job. The decision depends on a trader’s trading requirements, expertise, budget, time in hand, and the complexity of their trading strategy.

In this section, let us understand the general steps that enable one to develop a trade bot.

- Outline the trading strategy: The first step is to define the trading strategy based on certain parameters like risk management rules, buying and selling assets, entry and exit points, trading signals, etc. Specific trading goals drive parameter selection.

- Choose a programming language: At this stage, choose a programming language for developing a bot. Traders have options like Python, C++, R, etc.

- Integrate with exchange or Application Programming Interface (API): To access market data in real-time, integration with either a trading platform (exchange) or Application Programming Interface (API) is necessary. This helps capture both real-time and historical data to enable traders to take actions based on trading signals.

- Design trading logic: To ensure that a bot understands a trader’s trading requirements, writing comprehensive code to feed the trading logic is crucial. This includes the parameters a trader needs the bot to consider, such as technical indicators, fundamental analysis, etc.

- Familiarize the bot with risk management: The trading bot should be able to minimize losses and maximize profits. For this, it must understand and execute various risk management techniques, including stop-loss orders, position sizing, etc.

- Backtesting and refining the bot: Conducting test runs using historical data to check how the bot functions is crucial. One must evaluate the performance of the bot based on the defined trading algorithms and make adjustments (if needed). A sandbox environment smoothes out any issues a robot may face later.

- Paper trading: Paper trading helps traders simulate the trading environment and test bots without committing actual money. This enables them to check the effectiveness of their bots.

- Live trading, monitoring, and finetuning: Once a trading bot is ready, traders deploy it for live trading. Continuous monitoring is needed to check if the bot is able to generate returns and earn profits in the market. Based on such observations, adjustments can be made to suit evolving trading needs.

Examples

Let us study some examples of trading robot software to understand the concept further.

Example #1

Suppose Jenny wants to raise capital to buy a house in Texas. She recently began trading in stocks, currencies, and options. However, Jenny is unable to handle all the trades required to make money in these fast-paced markets. Therefore, she decided to use trading robot software to automate her trading endeavors. She approached a developer, Stuart, and had him design a bot that met her market trading requirements.

With a trading bot, she was able to place multiple orders with just one click and accumulated profits of $30,000. Jenny found that activities like identifying market trends, strategizing, and placing stop-loss orders had become simple.

Jenny regularly monitored the bot’s performance to ensure she did not suffer losses at any stage. From time to time, Jenny worked with Stuart to update the parameters and algorithms the bot referred to and continued to make decent profits, enough to buy residential property in Texas.

Example #2

An April 2024 CoinJournal article talks about the success of Bitbot, a Telegram trading bot, which raised over $2.1 million in its presale. Bitbot seems a secure alternative in the market, with superior safety features and higher reliability compared to other products that help traders execute automated trades.

Innovation, along with its potential for long-term appreciation, is believed to drive Bitbot’s growth. The team plans to distribute up to 50% of Bitbot's revenue among token holders to support the token's value and promote community growth.

It has a large following on social media platforms, and the rapidly growing trading bot has captured a significant portion of the market as daily active users steadily increase every day. This telegram bot has a market cap of $1.4 billion, along with $18 billion trading volume in total.

This illustrates the heightened prevalence of trading robots in the market today, where traders choose to rely on bots for trading decisions, particularly in markets that require clear-headed decision-making.

Advantages And Disadvantages

In this section, we will study the advantages and disadvantages of trading robots and understand the aspects traders must remember before making up their minds about employing these automated trading systems in financial markets.

Advantages

- Eliminates human interference: Trading robots eliminate human biases and emotions, improving trading decisions and outcomes through disciplined trading.

- Operational 24/7: These robots allow traders to capitalize upon trading opportunities without needing to actively monitor the markets.

- Saves resources: Automated trading systems save time and effort as they execute trades automatically based on set parameters on behalf of traders.

- Potential for profits: If the algorithm is accurate and reliable, these robots can generate high returns by executing trades in line with trading strategies.

Disadvantages

- Coding issues and complexities: To achieve results, the code traders use must accommodate all their trading requirements without making them vulnerable while trading. This requires programming skills and coding experience, which may not be available to every trader free of cost.

- Limited applicability: Trading bots focus on technical analysis. In the process, they may ignore fundamental analysis. Hence, all relevant market factors may not be considered before trades are executed.

- Logic issues during volatility: In volatile market conditions, trading robots may find it challenging to make logical decisions. This is likely when bots encounter unexpected market conditions.

- Risk management issues: If proper or adequate risk management measures have not been taken, robots can make adverse decisions that may lead to losses. For instance, if stop-loss orders are not clear, they may not be executed in time to stop losses.