Table Of Contents

What Is An Option Contract?

An option contract is an agreement that gives the option holder the right to buy or sell the underlying asset at a certain date (known as an expiration date or maturity date) at a prespecified price (known as strike price or exercise price).

However, the seller or writer of the option has no choice but is obligated to deliver or buy the underlying asset if the option is exercised. An exchange must specify the terms of the options contracts it trades. It must specify the contract size, expiration time, and strike price, whereas Over counter trades are customized between private parties to meet their specific requirements.

Table of contents

- An option contract offers the opportunity to buy or sell an asset at a predetermined price on a specified future date.

- Once exercised, the seller is obligated to fulfill the transaction by either delivering or purchasing the asset, leaving no alternative.

- The option contract entails an arrangement between two essential parties - the option holder, also recognized as the option buyer, and the option seller, referred to as the option writer. This agreement delineates their respective roles and responsibilities in the options market.

Option Contract Explained

An option contract in derivatives is a type of agreement that takes place between two parties. In this type of contract, the value is dependent on the price of the underlying asset. It has a strike price that is predetermined by the parties to the contract, and there is an expiration date up to which the agreement is valid. They are usually used for hedging or protecting against the risk of loss or for speculation purposes.

There are two types of options: call, which gives the holder the right to buy an underlying asset for a certain price by a certain date. A put option gives the holder the right to sell the underlying asset at a certain date for a certain price.

There are four possible positions in options markets: a long call, a short position in the call, a long position input, and a short position input. Taking a short position in an option is known as writing it.

Thus, an investor gets the facility to invest in a large volume of stock option contract size is large without actually buying or selling it if they go for the active option contract. This fact proves that the exposure for return is much larger than in regular trading. However, it is to be noted that high return also comes with increased risk. If the price of the financial instrument goes against the anticipation of the investor, this can lead to high losses, depending on the type of options contract.

In exchange for the privilege of trading with a big option contract size involving a huge volume securities, the traders or investors who are buying the option needs to pay a premium to the seller.

Features

In this type of contact, the active option contract features are as follows:

- Option Holder or Buyer of the Option: It pays the initial cost to agree. The call option buyer benefits from the price increase but has limited downside risk if the price decreases because, at most, he can lose the option premium. Similarly, the put option buyer benefits from a price decrease but has limited downside risk in the event when the price increases. In short, they limit the investor's downside exposure while keeping the upside potential unlimited.

- Option Seller or Writer of the Option: It receives the premium at the initiation of the option contract to bear the risk. The call writer benefits from the Price decrease but has unlimited upside risk if the price increases. Similarly, the writer benefits if the price increases as he will keep the premium but may lose a considerable amount of price decrease.

- Strike Price – This is the price that is predetermined by the parties to the contract and at this price the option holder can exercise te contact if the price of the underlying asset goes in the anticipated direction.

- Expiration date – This is the date till which the option is valid. The holder of the option can exercise it on or before this date.

Options are currently traded on stock, stock indices, futures contracts, foreign currency, and other assets.

Types

Let us look at the various types of option contract in derivatives available in the market.

Let us look at the various types of options available in the derivatives market.

There are primarily two types of option, call and put.

- Call Option – In this kind of option, the holder has the right to purchase the underlying asset at a particular price, which is pre-specified among the parties. This price is known as the strike price. The holder needs to buy the asset on or before the date of expiry of the option agreement. Investors go for the call option contract if they anticipate that the price of the underlying asset will rise in future. Thus, the option will become valuable because the investor will be able to purchase the asset at the strike price which is lower than the market price of the asset. But if the market price falls below the strike price, the option becomes worthless.

- Put Option – This means that the holder of the option gets the right to sell the underlying asset at the strike price on or before the date of expiry. Such contact helps the investor if they anticipate a fall in the future price of the asset, giving them the opportunity to sell te asset at a higher price.

Options can be further divided into two types as per the date of expiry. They are as follows:

- European option – The holder of such an option can exercise it only on the expiry date. Thus, the flexibility is less here since the agreement cannot be exercised before expiry.

- American option – The hoder can exercise it any time before the expiry. The holder gets a greater strategic opportunity since they can take greater advantage of the price movements.

Examples

Here are some examples that will help us to understand the concept in details.

Example #1 - Call Option

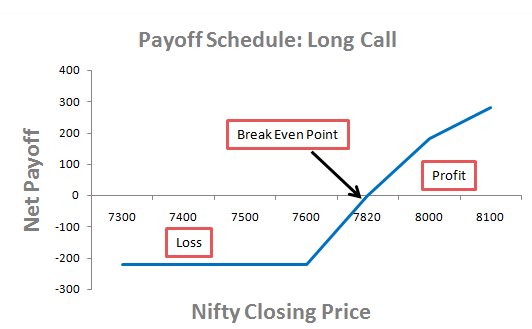

Let's take an example. The call option contract owner is bullish (expects the stock price to rise) on the movement of the underlying assets. It gives the owner the right to buy an underlying asset at a strike price at the expiration date. Consider an investor who buys the call option with a strike of $7820. The current price is $7600, the expiration date is in 4 months, and the price of the option to purchase one share is $50.

- Long Call Payoff Per-Share = net loss is $50.

Example #2 - Put Option

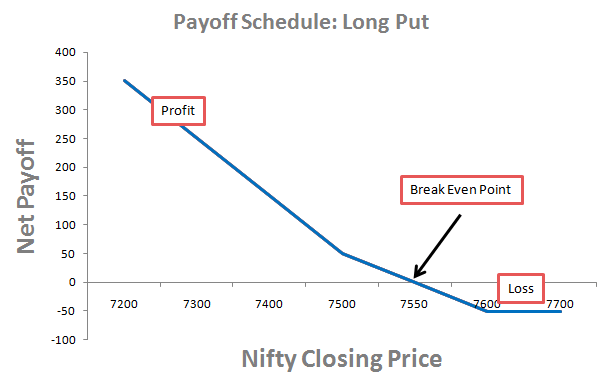

It gives the owner the right to sell an underlying asset at the strike price at the expiration date. Let’s take an example. Consider an investor who buys the put option with a strike of $7550. The current price is $7600, the expiration date is in 3 months, and the price of the option to purchase one share is $50. The put owner is bearish (expects the stock price to fall) on the stock price movement.

- Long Put Payoff Per-Share = [MAX (Strike Price - Stock Price, 0) - Upfront premium Per Share

- Case 1: if the stock price at expiration is $7300, the investor will buy the asset in the market at $7300 and sell it under the terms of put option @7550 to realize a gain of $250. Considering the upfront premium of $50, the net profit is $200.

- Case 2: if the stock price at expiration is $7700, the put option expires worthless, and the investor loses $50, which is the upfront premium.

Uses

The concept has a number of suitable uses in the financial market. Let us identify them and understand them in details.

#1 - Speculation

The investor takes an option position where he believes that the stock price is selling at a lower price but can considerably rise in the future, leading to profit. Or in case he believes the market price of a stock is selling at a higher price but can fall in the future, leading to profit. They are betting on the future direction of the market variable.

#2 - Hedging

The investor already has exposure to the asset but uses an option contract to avoid the risk of an unfavorable movement in the market variable.

Option Contracts Are Exchange Traded Or Over The Counter?

- Exchange-Traded Options have standardized features with respect to expiration dates, contract size, strike price, position limits and exercise limits and are traded in an exchange where there is minimum default risk.

- The Counter Options can be tailored by private parties to meet their particular needs. Since they are privately negotiated, the option writer may default on its obligation. Post-1980 over the counter market is much larger than the exchange-traded market.

Drivers Of The Option Contract Value

- The underlying stock's volatility: Volatility measures how uncertain we are about future price movements. The higher the stock volatility, the greater the value of the option. As volatility increases, the chance of stock appreciating or depreciating increases.

- Time to Maturity: The more time left to expiration, the greater the values of options. The longer maturity option is valuable as compared to a shorter maturity contract.

- The direction of underlying stock: If the stock appreciates, it will positively impact the call option and negatively impact put options. If the stock falls, it will have the opposite effect.

- Risk-free rate: As the interest rate increases, the expected return required by investors tends to increase. In addition, discounting the future stream of cash flows to present value using a higher discount rate decreases the option value. The combined effect increases the value of the call option and decreases the value of the put option.

Advantages

A few advantages of the contract are as follows:

- Provide Insurance: Investors can use Option contracts to protect themselves against adverse price movement while still allowing them to benefit from favorable price movement.

- Lower Capital Requirement: Investors can take exposure to stock price by paying an upfront premium much lower than the actual stock price.

- Risk/Reward Ratio: Some strategies allow the investor to book considerable profit while the loss is limited to the premium paid.

Disadvantages

The following are the disadvantages of the contract.

- Time Decay: When buying an option contract the time value of the options diminishes as maturity approaches.

- Involves Initial Investment: The holder must pay an upfront non-refundable premium which it can lose if the option is not exercised. During volatile markets, the option premium associated with the contract can be quite high.

- Form Leverage: The option contract is a double-edged sword. It magnifies financial consequences that can result in huge losses if the price does not move as expected.

Option Contract Vs Firm Offer

Both the above concept refer to two different types of contracts, whose differences are highlighted below:

- The former is a legally binding agreement between two parties to buy or sell an underlying financial asset, whereas the latter is a promise made by one party to another the buy or sell a product at a fixed price, which is legally binding if the seller accepts it.

- In case of the former, the option holder pays a premium to the option writer but it is not the case for the latter.

- The Former is used in the financial market for hedging or speculation whereas the latter can be used in any type of market.

Frequently Asked Questions (FAQs)

An options contract consists of several key elements: the underlying asset (such as stocks or commodities), the type of option (call or put), the strike price (at which the option can be exercised), the expiration date (when the option contract ends), and the premium (the cost of the option). These elements determine the rights and obligations of the option holder and writer.

Options contracts offer a variety of trading strategies. Some common strategies include:

Covered Call: Selling a call option while holding the underlying asset to generate income.

Protective Put: Buying a put option to hedge against potential losses in an existing position.

Straddle: Simultaneously buying a call and put option with the same strike price and expiration date to profit from significant price movement.

Option contracts provide valuable risk management tools. For instance, buying put options can hedge against potential losses in a portfolio during market downturns. Writing covered calls can generate income but also limit potential gains. Moreover, options enable traders to implement strategies that limit downside risk while allowing for potential upside, helping to create a balanced and controlled risk profile.

Recommended Articles

This has been a guide to what is an Option Contract. We explain it with examples, types, features, differences with firm offer, advantages & disadvantages. You can learn more about excel modeling from the following articles –