Table Of Contents

What Is A Asset Management Company (AMC)?

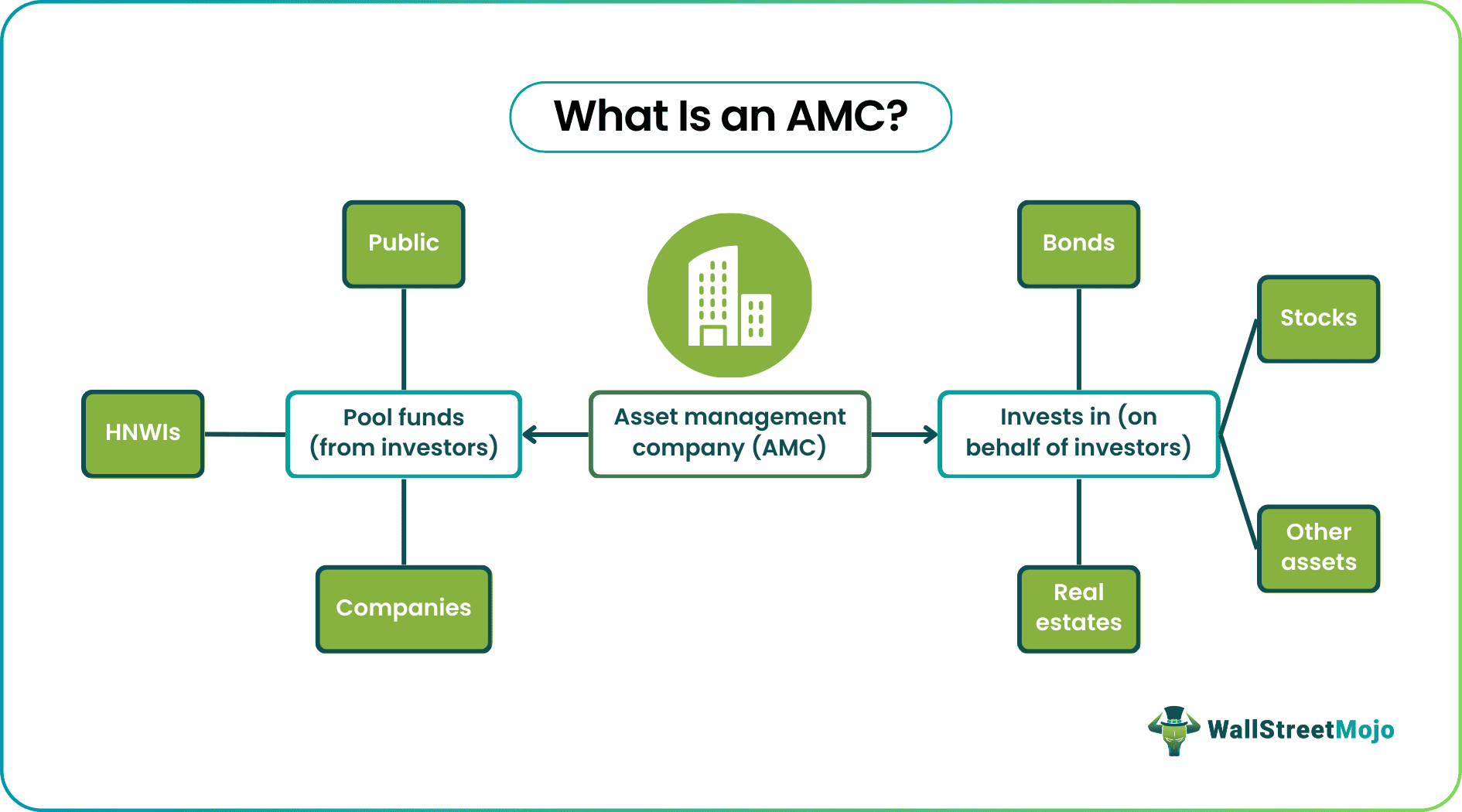

An Asset Management Company (AMC) refers to a fund house, which pools money from various sources and invests the same in purchasing capital on behalf of their investors. These firms make necessary decisions relating to where, when, and how much to invest in assets.

An AMC gathers funds from either individual or institutional investors and utilizes the same to raise client capital. It considers all the risk factors to make smart investment decisions and build a strong investment portfolio. The only aim is to ensure higher returns to investors in exchange for a lenient commission, fee, or charge.

Table of contents

- What Is A Asset Management Company (AMC)?

- An Asset Management Company is a firm that pools funds from different sources and allocates the same to the available assets in the market, likely to yield maximum profits.

- AMCs help manage investor money and spend in assets and securities, thereby maintaining a diversified portfolio on behalf of their clients.

- The money managers carry out the functions properly, namely market analysis, fund allocation for assets, portfolio creation, and performance review.

- AMC is considered a buy-side entity given its need for information that would help it make smart and lucrative investment decisions.

How Does An Asset Management Company Work?

An Asset Management Company determines the best way of asset utilization to reap maximum profits for clients. It manages investor money most effectively. Every AMC runs on a mutual fund theme and is led by a fund manager and team. The company studies the market properly and thoroughly analyzes each dataset to set a financial objective.

When investors trust a fund house, i.e., an AMC, they expect to get the most out of the profit they share with these money managers. They are available in different forms and are classified as hedge funds, mutual funds, private equity funds, index funds, exchange-traded funds, etc. The clients, however, include retail investors, institutional investors, High-net-worth-individuals (HNWIs), private sector, government organizations, etc.

The AMC accumulates the fund from the public and considers varied risks, including market risks, industry risks, political risks, etc. Per the same, it invests in both high-risk and low-risk securities, including debts, stocks, bonds, pension funds, and others. Moreover, their commission is normally a fixed percentage of the client’s total Assets Under Management (AUM). AUM is the total volume of assets the AMCs manage.

The major clients of an AMC include retail investors, private sector entities, institutional investors, public sector entities, especially government organizations, and high-net-worth individuals. The AMCs understand the requirements of the clients and create portfolios accordingly for them.

What is an Asset Management Company (AMC)? Explained in Video

Structure

Whether it is the biggest asset management company or a smaller entity that has just started as an AMC, the entity will have a proper structure to look after the different forms of products it deals with. For every AMC, there are board of directors or trustees or general partners. Besides the ones who aare at the top to oversee and manage the role and functions of an AMC, there are departments that specialize in taking care of some specific functions the company has to perform:

Asset management

This is the section of the AMC that deals with the research work to be conducted related to the assets in question. The professionals working here manage and execute deals for the clients. It is an important division of the AMC, given its role in managing, maintaining, and ensuring sound relationship between the sales team and the clients.

Independent internal oversight division

This team, based on the research and assessments done by the asset management division frame strategies to take care of the risks predicted. The professionals here are responsible for ensuring proper valuation, compliance and control. The internal audits of AMC are conducted by executives working in this section of the firm.

Internal support teams

For smooth working of this organization, there are different team that help every employee and client to be on the same page regarding whatever grievances or queries they have. For example, there is a treasury team and tax team for financial doubts of clients/ customers, human resources for employee and their related issues, billing team to validate invoices for further payment. The tech team, which deals with the technical errors in the system. This team plays an important role, given the market turning into having a completely technological infrastructure.

External service providers

The next division, which may or may not be part of the internal structure of the AMC, but they play a significant role in implementing strategies for clients. The professionals here include brokerage and clearing executives, fund administrator, auditors, etc.

Role

When it comes to asset management company jobs, individuals are seen taking up various roles. Based on the specialized responsibilities handles, the roles of the AMC can be divided into the following categories:

Economists

AN AMC has a dedicates economist who keeps a watch o the market to monitor the trends and patterns and make a detailed analysis based on their economics expertise. They are the ones whose summarized reports are seriously considered for further analysis by the analysts in the firm, who then provide relevant suggestions to clients.

Financial Analyst

They have a separate division that undertakes through research before suggesting to the clients where to invest and when. With their skills and expertise, they help build the strongest portfolio for their clients. They conduct research and find out how the assets are performing in the market and how likely they are to offer maximum profits. They keep their eyes on the market and suggest the best possible time for investment to their clients. They are analysts whose analyses are well-trusted by the individuals and entities who collaborate with them for their services.

Asset Managers

They become their clients’ financial planner. Based on the economists predictions, and analysts analyses, they help manage investments for their clients. This is where the AMC exhibits how serious it is in ensuring to work in the best interest of those trust them with their finances and assets. They are also the risk managers who try to always have a backup for clients so that they do not suffer much from the negative price movements in the market.

Functions

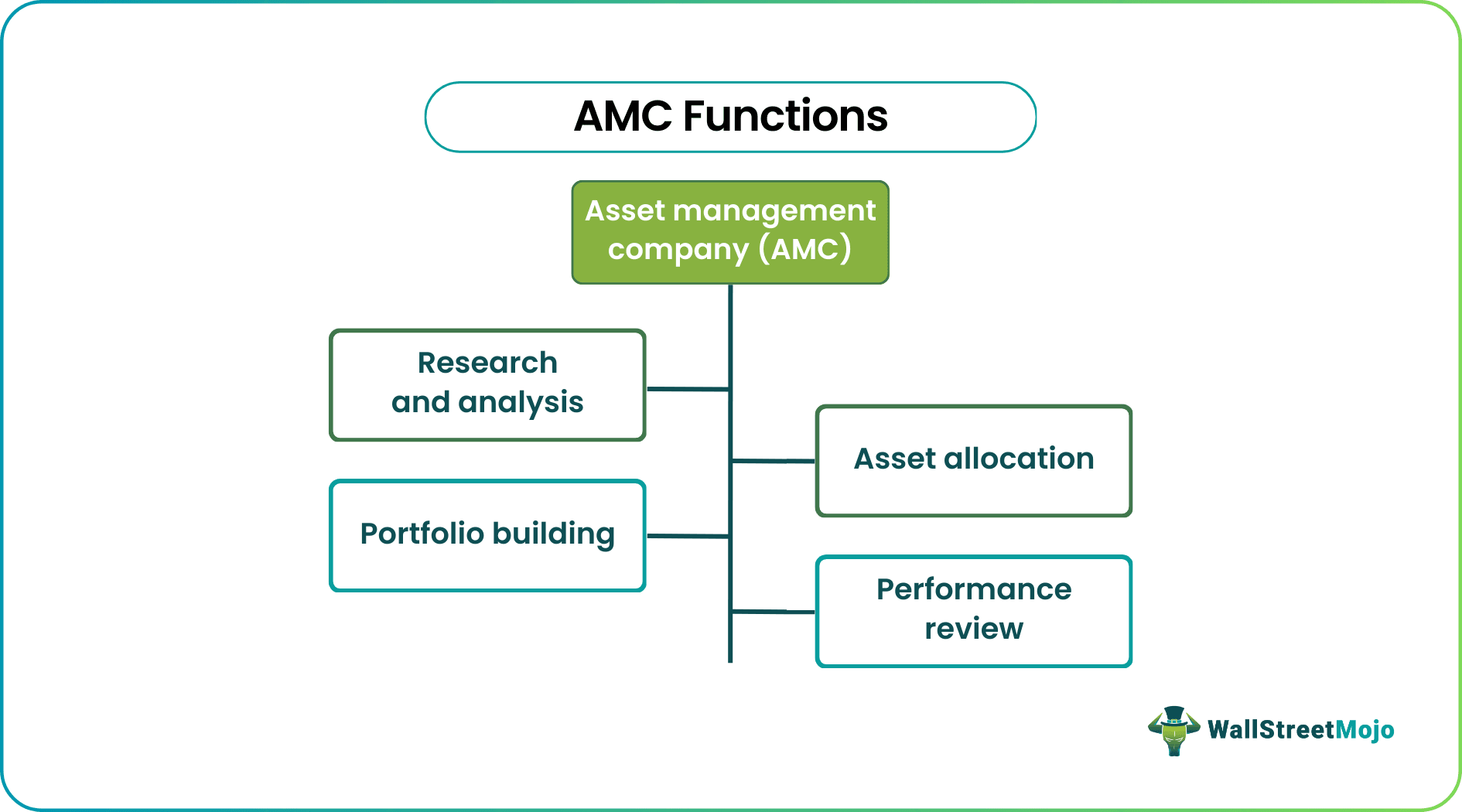

An AMC serves various functions altogether to ensure investor money is managed well. They aim at making the best investments to buy the most fruitful securities and assets. The Asset Management Company functions are divided into the following segments for more effective functioning:

#1 - Research and Analysis

The AMCs conduct thorough research and consider the current market trends to ensure the pooled funds are best utilized. In addition, they study multiple microeconomic and macroeconomic factors to assess the risks involved with each financial deal. Once the money managers understand the financial atmosphere, they shortlist and finally select the most profitable deals to invest in.

#2 - Asset Allocation

Based on their research and calculations, the AMCs list the assets and securities to spend the pooled funds in. Then, they allocate the funds to purchase assets. The profits reaped become the return on the investments. Every investor has a share in those returns based on the proportion of funds offered to the AMCs.

#3 - Portfolio Building

An Asset Management Company dealing in a mutual fund or other assets makes sharp investments for better returns. Once the market research reports are studied and fund allocation is done, the next step is to build a strong, diversified portfolio for their clients. Finally, the fund managers determine all relevant factors and decide which asset or security to buy, sell, or hold.

#4 - Performance Review

When AMCs use the funds gathered from a different source, they automatically become answerable to those fund providers. As a result, money managers must make justifiable decisions. As a result, reviewing their performance from time to time is important. The fund managers or portfolio managers must be ready to justify a buy, sale, or hold positions.

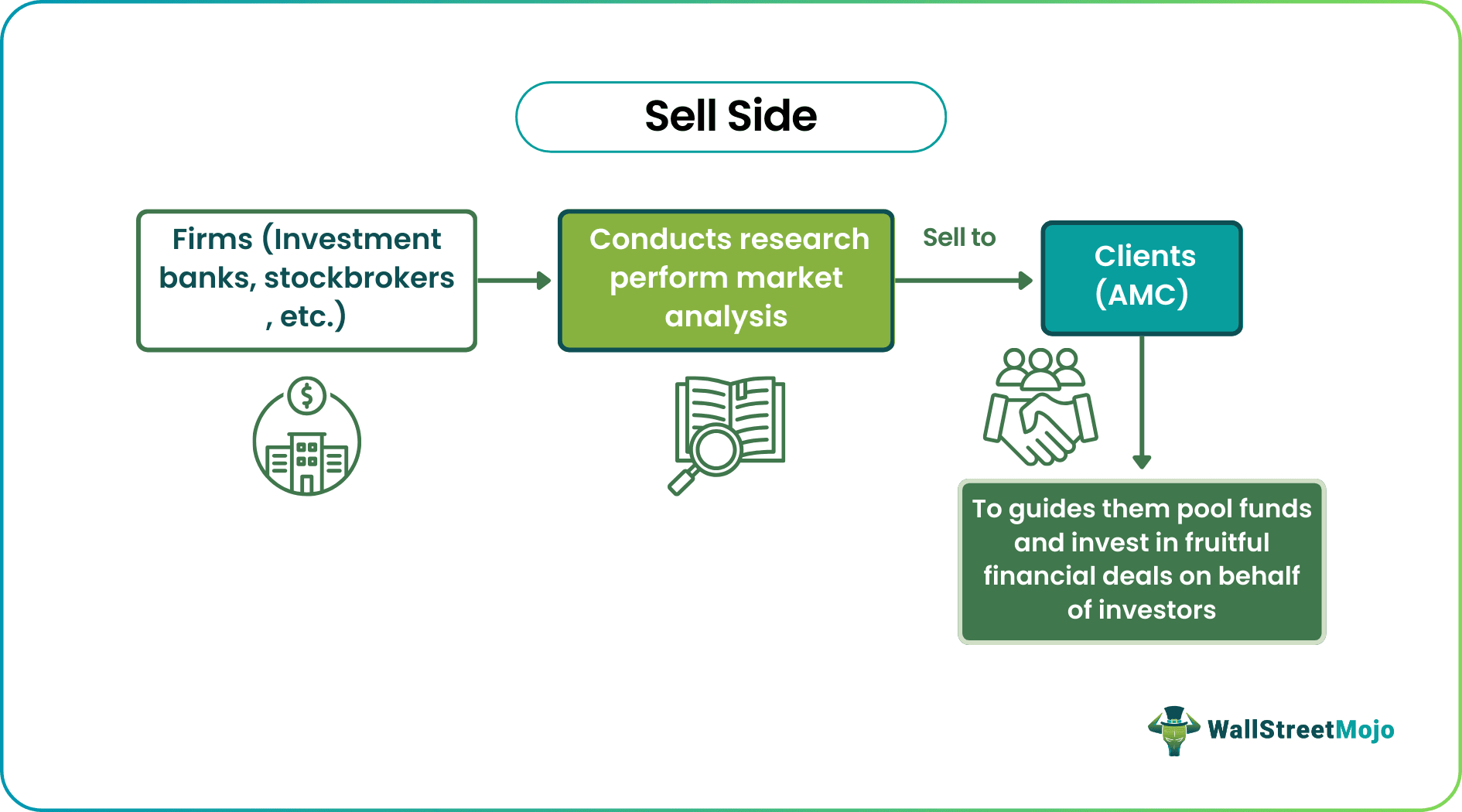

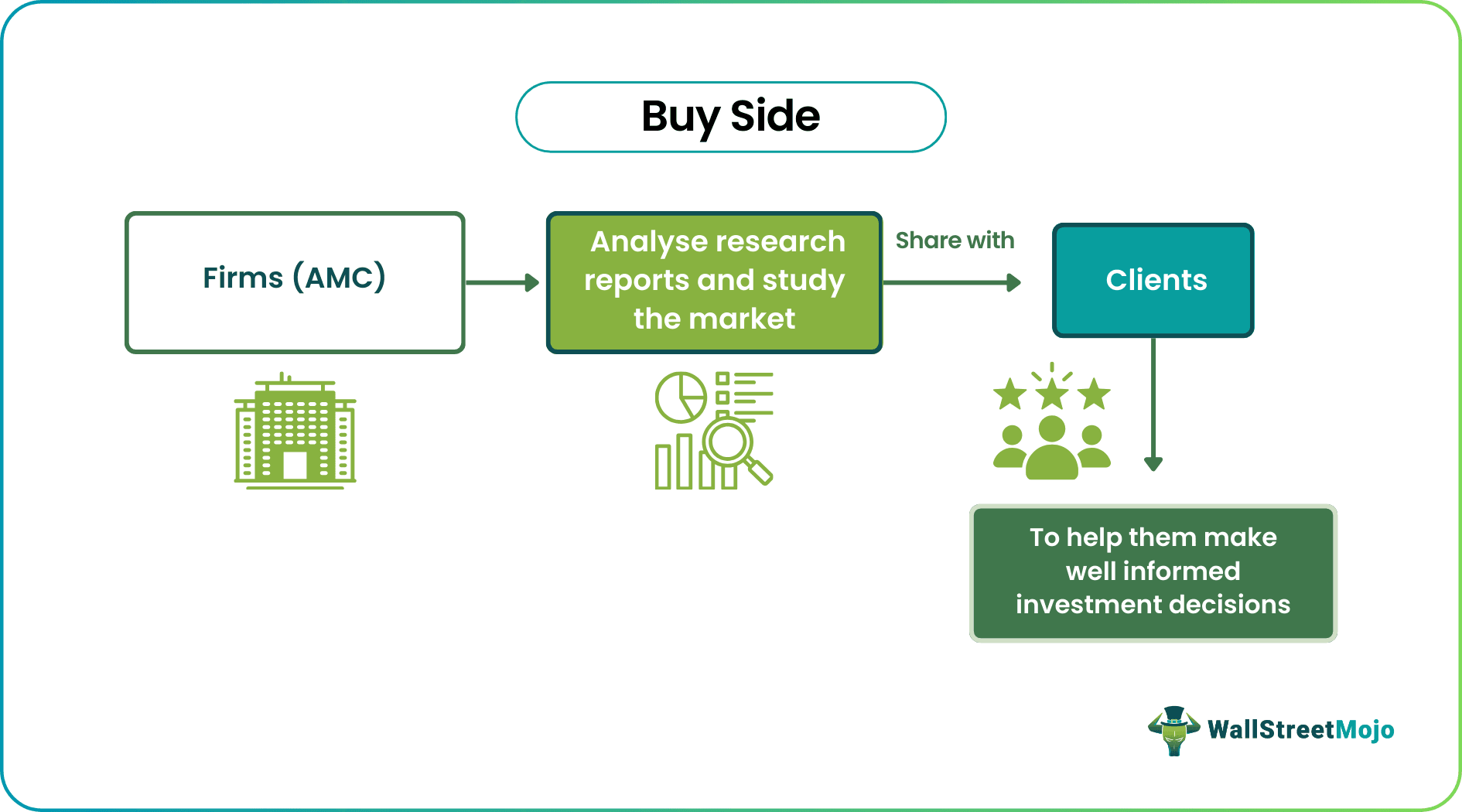

Asset Management Company – Buy Side or Sell Side?

In financial dealing, there are two ends – one is the buy-side, and another is the sell-side. So far as the sell-side is concerned, it is any party that sells anything to another party. This “anything” could be a product, service, security, asset, piece of advice or information, etc. On the other hand, the buy-side is any party that buys the saleable item from the sell-side.

These money managing firms use market research and analysis techniques to understand current market trends. Thus, they end up purchasing relevant data analytics and other relevant pieces of information from investment banks and stockbrokers. As a result, they turn out to be the buy-side. Based on their purchase from the sell side, they make well-informed and smart investment decisions on behalf of their clients.

Examples

Let us consider the following instances to understand the asset management company meaning more clearly:

Example #1

Company A, an AMC, pools funds from the public sector ($5 million), private sector ($5 million), and HNWIs ($10 million). The company studied the market and observed that investing in mutual funds and bonds would be a good idea.

Company A invested in maintaining a diversified portfolio as per the market trend and reaping huge profits. It divided the profit based on the investors' proportion of expenditure to pool funds.

The company kept aside the commission on a mutually agreed-on percentage out of the total profit. It paid the investors their share from the profit, which was more for HNWIs and less for the rest two institutional investors.

Example #2

One of the most renowned AMC players is Vanguard, the renowned Pennsylvania-based investment advisor that manages a global AUM worth $7 trillion. It operates both as a brokerage firm and educational account services provider.

Vanguard is the second-largest exchange-traded fund provider for investors after BlackRock.

Regulations

The asset management firms are regulated by two authorities – Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These two bodies have their set of rules and regulations that guide the financial market and ensure the investors, traders, brokers, AMCs, and all other market players associated with the financial market abide by the standard rules and be ethical in their conduct.

Frequently Asked Questions (FAQs)

An Asset Management Company is an entity that manages investor money in the best possible way and tries to invest the same in deals that are likely to reap maximum profits. Every AMC runs on a mutual fund theme, which a fund manager and team lead. It segregates its role by dividing its functions under different heads – market research and analysis, asset allocation, portfolio building, and performance review.

The advantages and disadvantages of an AMC include:

The top AMCs across the globe are as follows:

● BlackRock

● Vanguard Group

● UBS Group

● Fidelity Investments

● State Street Global Advisors

Recommended Articles

This has been a guide to what is an Asset Management Company (AMC). Here, we explain its structure, examples, role, functions, and regulations. You may learn more about finance from the following articles –