Table Of Contents

Index Funds Meaning

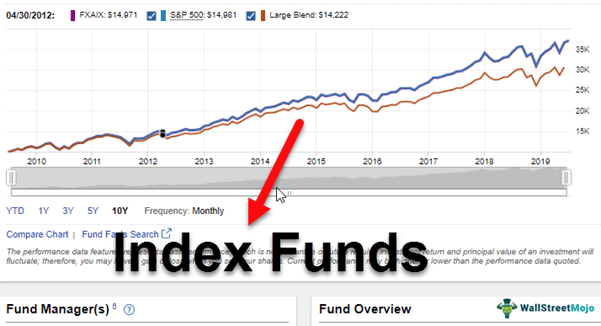

Index Funds are passive funds that pool investments into selected securities. It is a form of mutual fund that replicates a broader market index like the S&P 500. The investment gets diversified into various stocks from different sectors of the economy.

A market index provides a complete purview of the performance of a market segment and thus serves as a benchmark within the stock market. Consequently, a fund that follows the market index is affected by the ups and downs of the whole market rather than a particular firm.

Table of contents

- An index fund is a financial instrument with a portfolio that copies the listing of a market index which is made up of different securities and bonds belonging to multiple segments and industries.

- This investment product clones the risk and returns of the underlying index by providing an average return on the index's securities bundle.

- Such funds are passively managed investment vehicles.

- These funds yield superior returns in 7 years or more and perform even better in efficient markets where most sectors showcase tremendous performance.

Index Funds Explained

Index fund holds the bundle of securities which are also listed under a financial market index. Although these investments do not need to invest in all the index assets, the investment manager chooses some of the listed securities. Since the fund is invested in many stocks and bonds across varied sectors and industries, the investors get exposure to the broad market. For instance, Vanguard Russell 2000 ETF is an index fund that invests in a blend of top small-cap U.S. equities listed under the Russel 2000 index.

One of the unique traits of such a fund is that it is a passively managed asset. The fund manager finds a suitable market index and prepares an investment portfolio comprising securities listed in the index. In contrast to actively managed funds, the role of the fund manager is limited. For active funds, the managers must constantly brainstorm and modify the fund portfolio. Actively managed investments require adding and removing securities to surpass the returns of the benchmark index. But fund managers make mistakes; active management adds risk. Whereas, with passive funds, the investors are sure of generating market-linked returns.

Investors looking out for stable assets that offer regular returns can buy the dividend index funds. Such an investment comprises the selected dividend-paying stocks of the index. Some popular ones include Invesco S&P 500 High Dividend Low Volatility ETF that offers a 4.89% dividend, and iShares Core High Dividend ETF, which yields 4.07% of the dividend.

These funds are very different from regular equities, exchange-traded funds (ETFs), and mutual funds. An Index fund follows the portfolio of its benchmark index, which is a classic combination of securities. With other funds, the individual stocks represent a single company's profit and loss. An exchange-traded fund replicates the stock exchange portfolio. In comparison, mutual funds are actively managed assets that contain various handpicked securities. It is important to highlight that index funds have a disciplined approach. They have a diversified portfolio comprising only recognized securities of the market.

Features

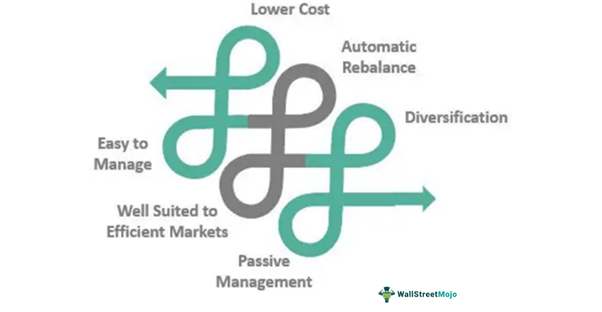

The following characteristics distinguish index funds from other investment products:

- Holds All or Selected Securities of an Index: The fund can track its benchmark index precisely by allocating funds to all the listed assets or by choosing a few from the bunch.

- Lower Cost: The fund is passively managed with few transactions. This leads to a significant decline in the expense ratios of index funds. In contrast, mutual funds are constantly churning out varying portfolios.

- Automatic Rebalance: This type of investment follows and replicates the index of a country. This includes; top winners. This method automatically cleans up the portfolio by removing the underperformers. That too, without any intervention from the fund managers.

- Diversification: There is no security-specific risk associated with these investments since it replicates a broad-market index. It covers various sectors of the economy. Therefore, if one industry or sector faces hardship, it won't affect the fund's performance much.

- Average Return: The portfolio returns for these investments are often the average yield of stocks held by an index. Fidelity ZERO Large Cap Index Fund and Schwab S&P 500 Index Fund are promising products of 2021. Their 2020 total return was 20.05% and 18%, respectively.

- Well Suited to Efficient Markets: It is often noted that as markets become more efficient, these funds can generate a higher margin. Market efficiency refers to stock prices incorporating all the information quickly and efficiently.

- Passive Management: The investment manager merely seeks to buy and hold securities that would represent the index and would go on to match its performance. Since the role of a fund manager is limited, the risk of errors related to inefficient portfolio selection is minimal.

Index Funds Examples

Following are prominent examples of this fund.

#1 - Schwab Total Stock Market Index - SWTSX

The SWTSX is a comprehensive fund that matches the performance of the Dow Jones U.S. Total Stock Market Index. It exactly clones the overall U.S. stock market along with its total returns. It is a blend of various U.S. small-cap, mid-cap, and large-cap equities. While the net expense ratio is 0.03%, there is no minimum investment limit for this fund. The return on equity is recorded at 19.04%.

#2 - Invesco S&P 500 Equal Weight ETF - NYSEARCA: RSP

This fund replicates the S&P 500 Equal Weight Index since it contains the securities of 505 companies. 99.41% of securities listed are US-based firms operating in different sectors like I.T., health care, financials, etc. It has no minimum limit for investment. The fund's management fees and expense ratio is 0.20% each. And the return on equity is 19.92%.

#3 - SPDR S&P Dividend ETF

One of the popular dividend index funds is the SPDR S&P Dividend ETF. This one follows its benchmark index, the S&P High Yield Dividend Aristocrats Index. This underlying index has the various securities of the S&P 1500. It includes stocks of top companies like AT&T, Exxon, Mobil, and Chevron Corporation. This product has a gross expense ratio of 0.35% with a fund distribution yield of 2.59%. The index dividend yield is at 2.85%.

Advantages

Index funds invest in high-potential sectors and comprise a bunch of different securities. The risk is, therefore, diversified. An index has the property of balancing itself. Poorly performing assets get eliminated, and the money is allotted to the stocks at the top of the list.

In the long run, such funds provide profits for at least seven years of holding. They grow with the development of the overall market. Moreover, in efficient markets, such funds yield higher returns. This is the average of all the securities listed under the respective index. Due to the low expense ratio, the investors save on portfolio management fees. Costs are cut as these funds don't require active professional management. They go with the trend of the underlying index.

These assets are easy to manage. They require minimal effort from the fund managers. In comparison, strategizing and handling active funds is hard work. This also reduces the burden on passive fund managers. They are not under constant pressure to generate more indexes.

Disadvantages

Index funds are prone to the risk of market corrections. Since the fund portfolio is directly related to the market movement or economy, it observes a steep downfall during economic recession or depression. Moreover, as these assets are not managed actively by the professionals, its profitability is limited to the underlying index's progress. As a result, this fund often bears the tracking erro. A tracking error is a mismatch between fund returns and the underlying index's returns.

These financial instruments often come with the opportunity cost of not investing in active funds. Also, the investors fail to gain additional returns from growth stocks. Such investment products are not extensively promoted because the brokers and agents get low margins or commissions on selling these funds. These portfolios are rigid and don't incorporate any changes proposed by the fund managers, making it an inflexible product.

Frequently Asked Questions (FAQs)

An index fund is an investment product that reflects and traces the performance of a financial market index by cloning its basket of securities. Sometimes, only a selection of the index securities is chosen by the fund manager.

An index fund follows the footprints of a benchmark index. The policies of index funds restrict the fund managers from modifying or restructuring the investment portfolios. These funds are passively managed products. The risks and returns are identical to the underlying market index.

An index fund is highly diversified. It covers multiple securities such as equities and bonds from companies operating in different sectors, industries, and markets. Although the investors cannot lose all their money in such funds, it is still prone to market risk. The fund is subject to market fluctuations and downfalls.

Recommended Articles

This has been a guide to Index Funds and their Meaning. Here we explain Index fund's features, examples, advantages, and disadvantages. You can learn more about Mutual Funds from the following articles –