Table of Contents

What Are Agency Mortgage-Backed Securities (MBS)?

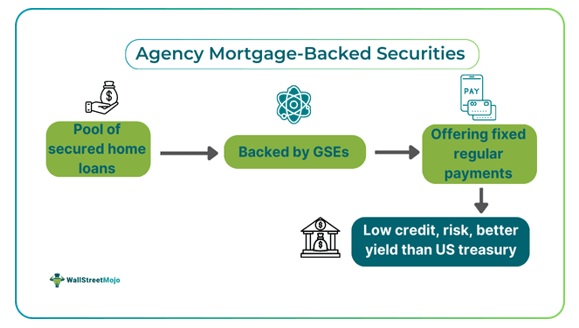

Agency mortgage-backed securities are pools of home loans sold in open markets to investors and companies. These loans are securitized residential mortgage loans because they are issued by government agencies like Fannie Mae, Freddie Mac, and Ginnie Mae. Such debt securities are essential for investors with fixed-income portfolios.

Since these MBS are backed by the US government, they guarantee fixed income to their investors as they are paid monthly every time borrowers make their principal and interest payments. It represents the US Federal Reserve's $1.25 trillion program during the 2008 financial crisis, which was closed after that. The program was restarted in 2020, during the COVID.

Key Takeaways

- Agency mortgage-backed securities are pools of residential mortgage loans issued by Fannie Mae, Freddie Mac, and Ginnie Mae.

- Agency MBS offers regular interest payments to its investors with low risk and return but also helps create fixed-income portfolios.

- In contrast, non-agency MBS, issued by private companies and entities, carries a higher default risk as government guarantees do not back it.

- Agency MBS is the second-largest segment of the US bond market, contributing 27% to the Bloomberg US bond index; its only rival is the US Treasury market.

Agency Mortgage-Backed Securities Explained

Agency mortgage-backed securities are an extensive pool of secured home loans issued by government-sponsored enterprises like Fannie Mae, Ginnie Mae, and Freddie Mac. Agency MBS represents a bundle of securitized residential mortgage loans that are sold to investors as a fixed-income investment that offers them periodic payments with a fixed interest rate. These pools of home loans have a crucial history as the term is commonly used to refer to the US Federal Reserve's $1.25 trillion program to buy agency MBS; the program started in January 2009 and ended in March 2010. During the COVID-19 crisis, the program was restarted in March 2020.

The sole purpose of it was to fight the aftermath of the 2008 financial crisis. Agency MBS are created when home mortgage loans with agency underwriting guidelines are made a pass-through security. The MBS investors then receive the underlying loan principal and interest. Today, agency mortgage-backed securities represent 27% of the Bloomberg US Aggregate Bond Index, making it the US bond market's second largest segment; their only rival is the US Treasury market. When the government purchases agency MBS, it increases its prices, and due to an inverse relationship with interest rates, the mortgage rates decline.

The whole process of agency MBS begins when a bank offers mortgages to homebuyers; now, banks, along with other financial institutions, bundle these mortgage loans based on the same interest rates and maturity. The bundle is sold to a GSE, which structures them into MBS; the GSEs issue them and sell them to investors guaranteed by them. A mortgage servicer collects monthly mortgage payments from borrowers and distributes them to MBS investors. At the same time, they are also tasked with handling escrow accounts and other administrative operations. Investors, on the contrary, purchase MBS lending funds to homebuyers of the bundle and, in return, enjoy periodic payments from the underlying mortgages.

Examples

Here are two examples - the first is a hypothetical example, whereas the second is from real-world news -

Example #1

Suppose Rachel is a new investor. She has no knowledge of the stock market, but she is conservative about her funds and does not want to make a loss. Upon research, she comes across the agency MBS. If Rachel invests in them, she is technically offering a loan to homebuyers in the pool. In exchange, she will receive periodic payments made up of principal and interest payments from the underlying mortgages.

Since agency MBS are backed by government-sponsored agencies, they are secured, and Rachel is guaranteed regular fixed payments. Although the yield is low, there is less risk involved in such investments. This way, Rachel creates a fixed-income portfolio for herself without extensive research. This is a straightforward example, but many elements must be considered.

Example #2

In March 2023, the global issuance of mortgage-backed securities declined to its 23-year low. The main reason for this was the disturbance in the real estate market as higher mortgage rates hit property refinancing and sales. The issuance of agency MBS dropped by 47%, or $42 billion. Agency MBS are known to carry a pool of home loans with real estate debt and carry higher yields than US treasuries.

Many market analysts suggested that a decline of this size could lead to a reduction in credit availability, making it more difficult for homeowners to secure financing, which will eventually lead to a slowdown in the entire property sector growth. Many market participants believe that this fall in agency MBS issuance is because of the low demand from banks as they ditched MBS after the failure of Signature Bank and Silicon Valley Bank. Both banks held large amounts of MBS, and the decrease in bond prices made investors withdraw deposits.

Advantages

The advantages of agency MBS are:

- Agency MBS are issued and owned by government agencies; hence, they guarantee fixed regular payments to their investors.

- They are considered risk-free because the US government backs them.

- Agency MBS comes with a large set for security selection, hence better investable opportunities.

- This pool of secured home residential loans offers a yield benefit over the United States treasury with similar credit quality and duration, creating excess return opportunities.

- Agency MBS is the best option for investors who want to play safe and are planning to create a fixed-income portfolio.

- They have a history of providing a high risk-adjusted return profile compared to other similar high-quality fixed-income sectors.

- Agency MBS are less correlated with equities than corporate bonds, offering potential diversification advantages.

Agency Mortgage-Backed Securities Vs. Non-Agency Mortgage-Backed Securities

The key distinguishing factors between agency MBS and non-agency MBS are:

- Private entities and corporations create government agencies to issue agency MBS, but non-agency MBS.

- Agency MBS have a low or negligible degree of default risk. In comparison, non-agency MBS have a high default risk.

- Agency MBS have low yield and return because of low-risk factors, but non-agency MBS have higher yield potential as they lack government backing.