Table Of Contents

What are Warehouse Bonds?

A warehouse bond is a specific type of surety bond that promises protection for goods stored in a certain facility in cases of losses, as far as they are within the boundaries of the contract. If the goods get damaged, the owner will receive financial compensation from the company responsible for the bond.

The claims can be for many reasons like theft, fire, flood, poor maintenance, poor handling of goods, water damage, inventory loss, building damage, etc. Warehouse bonds have a one-year warranty, after which the bondholder should renew them.

Key Takeaways

- Warehouse bonds offer protection against financial losses to the owner or operator of the warehouse.

- Most states require warehouse owners to acquire these bonds as a safety regulation.

- Warehouse bonds are valid for up to one year, after which the owner should renew them.

- They have limited coverage, and most of the time, they won’t cover losses related to Acts of God.

How does Workhouse Bond Work?

Most storage units offer warehouse bonds to ensure that the items will be legally protected from any eventual harm while kept inside the facility. The bond will protect the warehouse owner from losses such as damaged or stolen goods. In some cases, it can even protect them from lawsuits made by workers who face injuries during the job. However, this service is often sold separately.

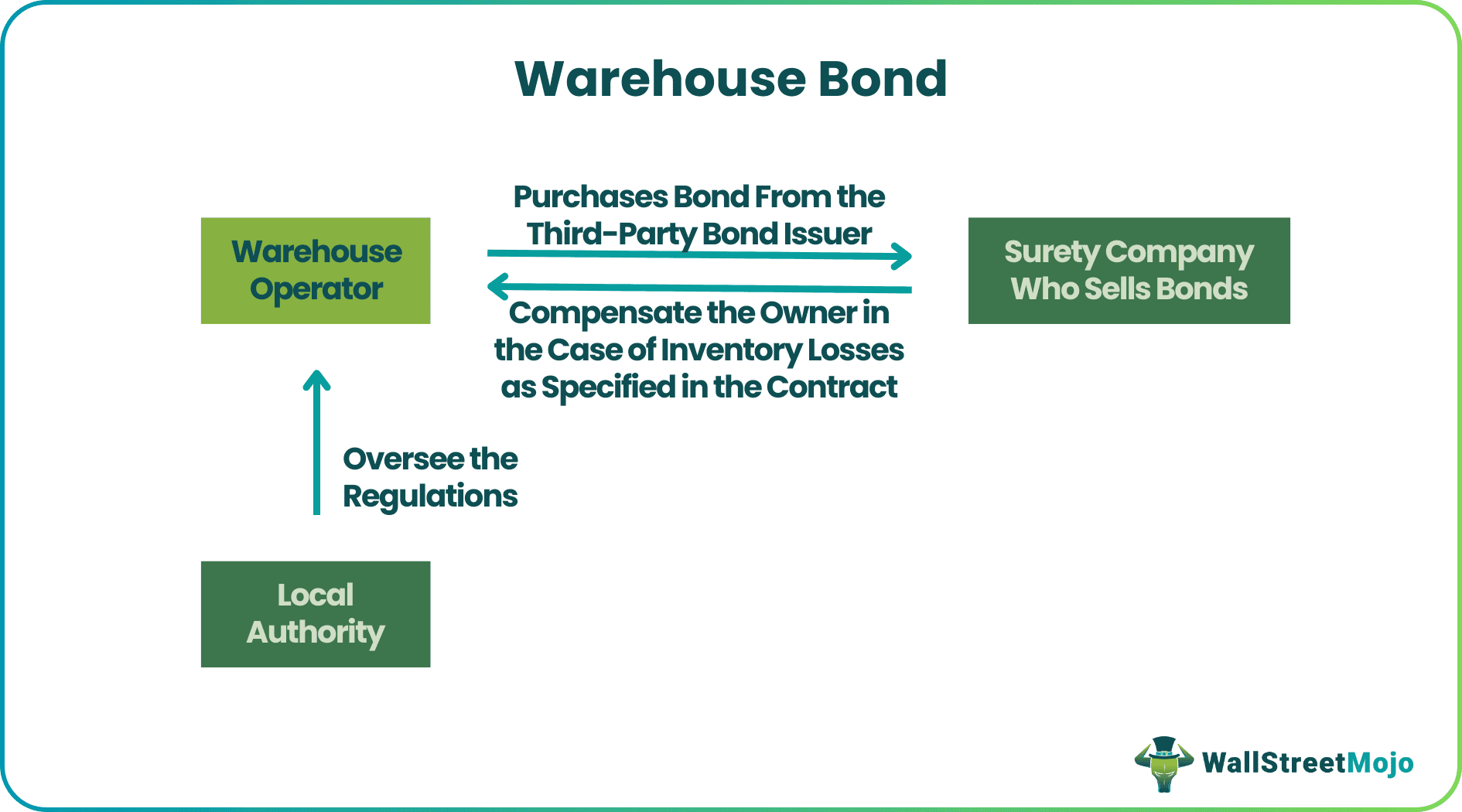

All warehouse owners must acquire a warehouse bond to operate in most jurisdictions. However, the bond requirements for each state may be different. The contract involves the warehouse operator, the local authority, and the bond issuer.

The warehouse owner gets protection, even though they have a few responsibilities. As well as paying the fees, they need to adhere to the state's safety and environmental policies for the bond to be valid. If they do not follow these directions, the contract may be revoked, or they may be sued.

On the other side, the surety bond issuer is responsible for storing the documents related to the process and paying the warehouse owner if something happens. The local authority will oversee if all the parties follow regulations properly, which can be achieved through inspections, and check whether the warehouse owner's documents are valid.

How to Get a Warehouse Bond?

Acquiring a warehouse bond requires a few simple steps. First, the warehouse operator needs to find a company that offers this service. Then, they must complete the application by giving their details and filling out any necessary forms. Sometimes, the regulators may check the warehouse personally before the completion of the process.

Other points to be aware of are the bonds’ credit ratings and costs. If the credit rating of the owner is bad, they may not be able to get insurance via a bond or end up paying a lot more for it. Some companies also ask for background checks before giving warehouse bond licenses.

The three main factors affect the bond’s price:

- The owner’s personal history.

- The size and contents of the warehouse.

- The place where they are based.

After one year, the owner needs to renew the bond to get additional protection, although some plans may renew it automatically.

Warehouse Bond Example

Let’s use an example to contextualize the concepts we’ve learned. First, consider a warehouse owner who operates a warehouse in Massachusetts.

He lives where he needs warehouse bonds to operate his business. So at the beginning of each year, he purchases one year of protection. He pays $10,000 and protects the goods for a year so that he’s compliant with the law.

If there’s a theft and someone steals from the warehouse, the owner can contact the company who provided the service and get reimbursed for what was stolen. If there’s a fire and he loses the contents stored there, the same will happen.

However, if something happens outside of the clauses stated by the service, there’s no reimbursement for the owner. For instance, the service can dictate that Acts of God are not eligible for warehouse bonds. So, if there’s a flood, there’s no payment for lost items.

Things to Note

It’s important to read the agreement before using a warehouse bond because it outlines the limitations of the service. Like most safety bonds, warehouse bonds have limits directly tied to how much the owner pays. Sometimes, one can cover 100% of the warehouse’s goods. Other times, the coverage won’t be so thorough.

Also, the coverage often can’t be higher than the value of the assets the owner is storing in the warehouse. If a warehouse owner needs to pay a lawsuit for losses and the value is too high, they will have to pay from their pocket.

Note that anything considered an “Act of God” will generally not be protected in standard contracts. An Act of God is defined as an accident that results directly from natural disasters and could not have been prevented. Most of the time, floods, hurricanes, and earthquakes fit this definition. However, there’s an important distinction here. If an event could have been prevented, the court does not consider it an Act of God.

So, if there’s a flood announced, and nobody does anything to manage the situation before it happens, the losses do not fit this criterion. But, on the other hand, an unexpected flood that occurred during the night which led to equipment damage, is an Act of God.

To enjoy full protection, one can buy protection from events such as natural fires or floods directly from other organizations.