Table Of Contents

What Are Structured Notes?

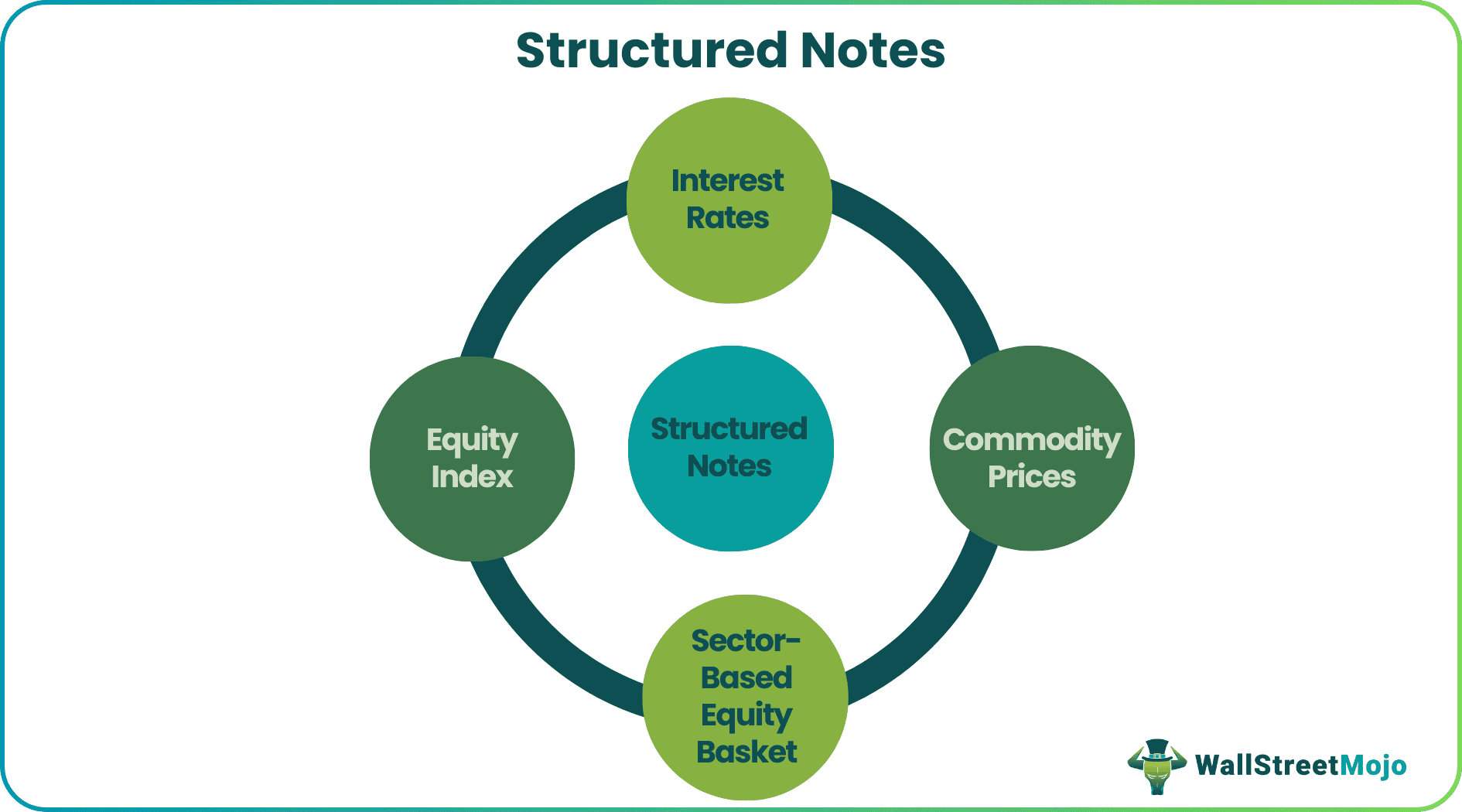

A structured note can be considered as one type of debt security wherein the return is linked to the performance of one or more underlying assets (interest rate, commodity prices) or index such as equity index, sector-based equity basket, etc. They are sold by banks, corporate borrowers, and financial institutions.

Structured notes investments allow more flexibility than most investment options and provide a wider range of potential payoffs which might be difficult to find in another asset class. However, it remains a complicated asset class with significant downsides such as default risks, market risks, and low liquidity. Therefore, this form of investment has not been very popular with the masses.

Key Takeaways

- A structured note is a type of financial product whose return is linked to the performance of one or more underlying assets (such as interest rates or commodity prices) or indexes (including equity indices and sector-based stock baskets).

- It allows investors to be exposed to derivative instruments that offer amplified returns.

- There is an inherent exposure to heightened credit risk in the event of an issuer default. Consequently, conducting thorough due diligence is essential, ensuring a comprehensive understanding of these factors before making any investment decisions.

Structured Notes Explained

Structured notes are debt obligations with a combination of derivatives in the process. The derivatives aspect brings in the changes in the value of the underlying asset.

Structured notes pricing, a well-structured financial product, tends to give investors the benefit similar to 'killing two birds with a single stone as they tend to get exposure to different products using a single product. They will now gain access to markets restricted to only a few well-sophisticated investors, and the common investor would not be able to gain such access.

Moreover, such products offer a great amount of customization and flexibility as the investor can choose to get into a derivative product that he is well aware of after studying the risk-return characteristics, thereby making the right choice after considering his goals and objectives.

Although such structured notes do give the investor the benefit of having to gain through leveraged returns through exposure to derivative products, there are possibilities that the underlying may perform badly, and the investor may experience a significant loss in this regard.

There is, of course, the exposure to significant credit risk if the issuer defaults. Hence it becomes of utmost importance that one carries out thorough due diligence and ensures one has a proper understanding of such products before venturing out to invest in them.

Types

There are different types of structured notes investments depending on the underlying asset, risk appetite, and other related factors. Let us understand the types to fully understand the concept.

- Equity-Linked Note: A single share of a company or an index can determine the rate of return of the contract.

- Interest Rate-Linked Note: The rate of return might be linked to the interest rate of a party relevant to the contract.

- Commodity-Linked Note: Commodity stocks or an index such as food processing or energy or automobiles might be linked to the returns.

- Credit-Linked Note: A change in the credit, both positive or negative such as the changes in risk level, loan default, or even the shift in the value of the collateral can be linked.

- Market-Linked Note: The performance of bonds, a basket of shares, or derivatives might be linked to the rate of returns.

- Currency-Linked Notes: The pairing of two currencies and the movement in each of their market value might be linked to the rate of return.

Examples

Let us understand the concept of structured note pricing with the help of a few examples. These examples will give us a practical understanding of the concept and its related factors.

- One Year Bond with a Call Option on Copper

- Three-Year Bond with a Futures Contract on Crude Oil

- Two-Year Bond with a Put Option on An Index

- 3 Month Bond with a Forward on Currencies

- 1 Year Bond with an Interest Rate Swap

Risks

Like any other asset class, structured notes investments are also not free of risks. Let us understand them to fully understand the concept and its implications through the explanation below.

- Market Risk: In comparison to other asset classes that are easy to sell in the secondary market, this investment might be difficult to sell at a desired price as the price of the contract in the secondary market might be subject to interest rates, economic conditions, and other such factors.

- Credit Risk: If the investor is unable to pay the amount upon maturity or a date thereafter, it becomes difficult for the lender as the investors and not have recourse for the underlying asset. Therefore, investors might not get any returns on their investments.

- Volatility Risk: The movements of the market are beyond anyone’s control and a decline in the interest rate or the market performance can have a significant impact on the returns of the investor.

- Liquidity Risk: In comparison to other assets that can be sold easily on the secondary market such as stocks or bonds, this asset class is considerably more difficult to sell at a desirable price as there are multiple underlying factors.

- Foreign Exchange Risk: If the contract is entered into in a foreign country, the movement in either of the currency could significantly affect the returns of either party.

Pros and Cons

Let us understand the pros and cons of structured notes pricing and other related factors through the discussion below.

Pros

- Accessibility: Investment banks create and sell these products that allow access to asset classes available only to certain investors, which may be difficult for the common investor to access. By participating in such products, the investors will gain access to investing in a wide range of asset classes, which otherwise would not have been possible.

- Diversification: It helps investors achieve the motive of diversification by not having to put all eggs in one basket. By gaining access to a wide range of asset classes, an investor tends to gain the benefit of diversification by spreading the risk along with different assets.

- Customization: Structured notes can tend to have customized pay-outs and also exposures. Some notes will tend to have a return with little or even no investment risks, whereas, at the same time, there will be other notes that offer high returns without any principal protection—hence based on the risk appetite and fanciness of the investor, they may choose to get into derivative contracts through such structured notes, that tend to align with any particular market or even economic forecast.

- Flexibility: A note can be created by mixing a bond with a derivative relating to any market in any combination, giving scope for flexibility as per the investor's risk-return profile.

- Tax efficiency: The returns from a structured note are often considered a long-term capital gain. Some countries and jurisdictions have certain rules and provisions which point out that certain capital gains will not be taxable in the hands of the investors. Hence such structured notes tend to benefit from having gained in the form of tax efficiency.

- Leveraged returns: Another benefit an investor in such structured notes seeks is the returns through inherent leverage that allows the derivatives return to be higher than the underlying asset.

Cons

The points highlighted below to elucidate the cons of this asset class.

- Credit Risk: There is no doubt that a structured note is often purchased to be held until the maturity of the bond. However, like any other debt instrument, it bears the possibility that the issuer may forfeit its obligation. Hence there arises a significant amount of credit risk. The issuer may fail to make all payments on its obligation. Hence the investor would certainly be exposed to a great amount of credit risk prevalent in the particular structured note.

- Lack of Sufficient Liquidity: Structured notes do not trade in the secondary market, unlike the equity or any embedded derivative instrument attached. Should an investor have an urgent requirement for liquidity and needs the money, he would have no other option than to sell the security to the original issuer. However, knowing that the contract binds the investor, the original issuer may take advantage of the situation and not offer a good price or money, assuming they are willing to make a good deal.

- Pricing being Inaccurate: More often than not, the structured notes do not tend to be traded in the market post their issuance. The prices of such products often tend to be calculated by a certain matrix, which is usually different from the net asset value. The matrix pricing is based on a comparative approach to the value of such assets; hence, the bias of the original issuer comes into play. Hence, the pricing may sometimes be inaccurate or even biased to a certain extent.

- Possibility of Huge Loss: As leverage tends to magnify returns, it tends to be a double-edged sword. The derivative returns may also go down south and badly lead to significant losses for the investor. Hence scrutiny and due diligence are required on the part of the investor.