Table Of Contents

What Is A Box Spread?

Box spread is a type of strategy used in arbitrage where there is a combination of two spreads and four trades, i.e., buying bull call spread in a combination of a corresponding bear put spread. Both the spreads have the same strike price and also the same date of expiry.

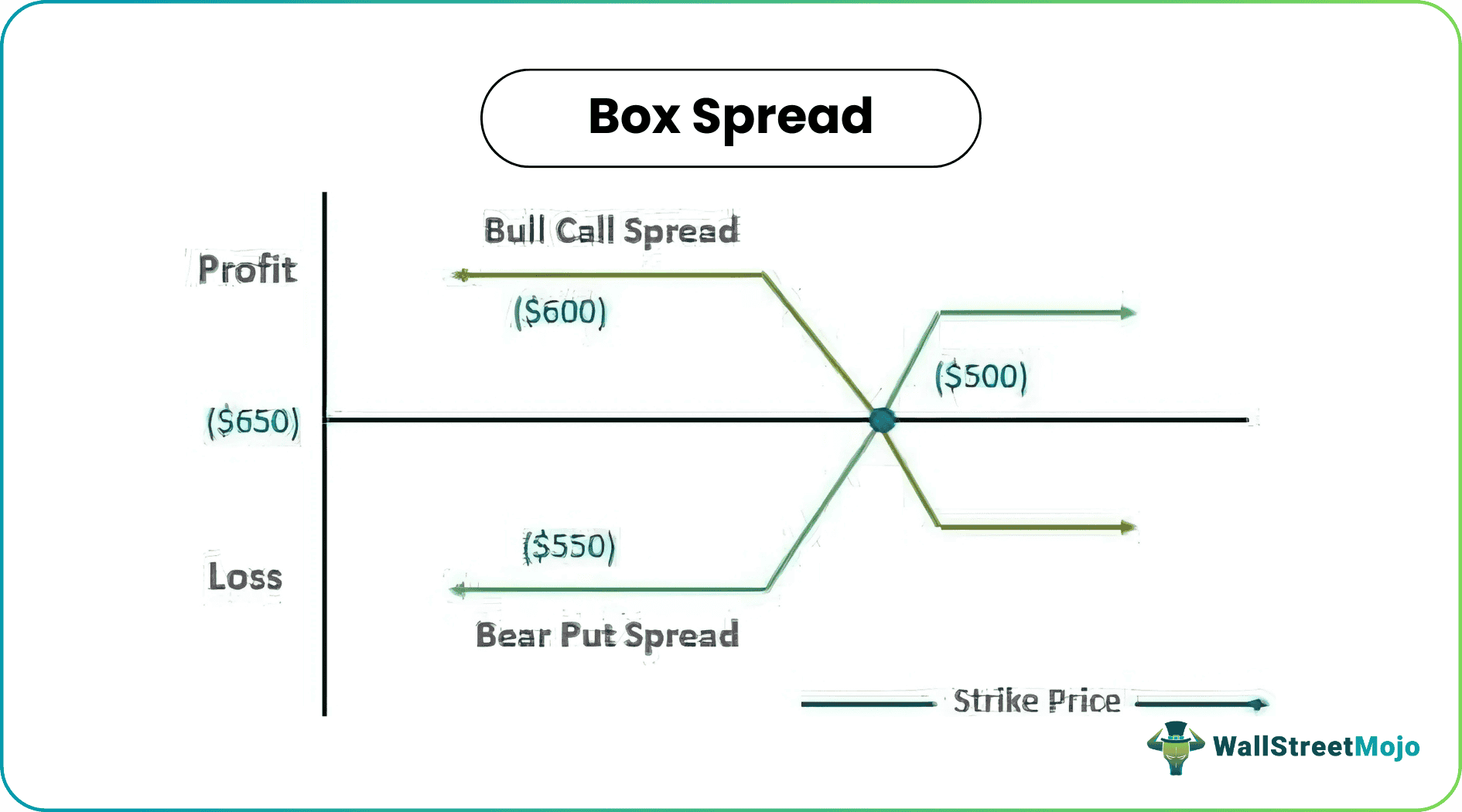

These box spread options are used by market makers and also the electronic communication networks, or ECNs. However, it is not a recommended strategy for a retail investor as it involves commission incentives. When plotted against a graph, this spread strategy forms a box as indicated by the box spread graph/image above. The best thing about this means of trading is that it offers a guaranteed position to traders.

Key Takeaways

- A Box Spread is an options trading strategy combining four options contracts with the same expiration date but different strike prices.

- The Box Spread involves buying a bull call spread and a bear put space simultaneously.

- The strategy aims to lock in a riskless profit by exploiting differences in the premiums between the four options.

- The gain is realized when the net compensation received from selling the bull call spread is higher than the net premium paid for the bear put spread.

- sophisticated options traders or market makers typically use Box Spreads to take advantage of pricing inefficiencies.

Box Spread Explained

Box spread, also called the long box strategy, is an arbitrage technique where traders take four using a combination of two corresponding spreads, i.e., bull call spread and bear put spread. The profit/loss here is calculated as a net of a single trade only. The total cost of the box remains constant irrespective of the deviation of prices of underlying securities. The expiration is here calculated by the difference in prices of the strike of the options considered in the trade. There are primarily two types of strategy, which are known as long box strategy and short box strategy.

It is an arbitrage technique where four trades are involved in a combination of two spreads, i.e., bull call spread and bear put spread. The profit/loss here is calculated as a net of a single trade only. The total cost of the box remains constant irrespective of the deviation of prices of underlying securities.

When they opt for a call spread, they buy a lower strike price for profits, while when they choose to go for a put spread, they buy at a higher strike price. It is known as a box spread for a reason. Let us find out the same.

In the process, the traders involve in two corresponding bull call and bear put spreads. For example, if a trader purchases a 30-50 call spread. In this scenario. The trader buys 30 call spread and sells 50 put spread when the price is down. On the other hand, they purchase 30-50 put spread, they buy 50 put spread and sell 30 put spread for a price down again. These corresponding trades when plotted against a graph, it forms a box. Hence, called box spread.

This is generally used when the spreads are a lot below their prices when compared to their value on expiry. The prime aim of this trade is to derive a limited risk-free profit. The buying and selling continue by the arbitrager as long as the price of the box is reasonably below the combined expiry value of the box. Thus in this way, a riskless profit can be booked.

The expiration value of the box is defined as the difference between a strike price and a lower strike price. The risk-free profit can be calculated as the difference between the expiration value of the box and the net premium paid. The short box strategy is applicable when the components of the spread are under-priced. When the box itself is overpriced, we can attain profit by selling the box, and this type of strategy is termed as a short box strategy.

Example

Let us consider the following instances to understand the concept better and also check how the box spread calculator might work when they have the figures with them:

Let us assume a stock that is currently trading at a price of $50 for December. The available option contracts for this stock are made available at a premium price as below:

Given:

Buy Jan 55 Call: $8

Sell Jan 60 Call: $2

Sell Jan 55 Put: $2.50

Buy Jan 60 Put: $8

Lot Size (Shares): 100

Solution:

First, we will calculate Bull Call Spread

- = Buy Jan 55 call - Sell Jan 60 call

- = (8*100) - (2*100)

- = $600

Now taking the Buy Bear Put Spread,

- = Buy Jan 60 put - Sell Jan 55 put

- = (8*100) - (2.5*100)

- =$550

Total Spread Cost

- Buy Bull Call Spread + Buy Bear Put Spread

- = $600 + $550

- = $1150

Expiration Value

- = (60-55) *100

- = $500

Since the value is greater than the expiration value, we can use the small box strategy to attain the profit.

In case if the box spread is less than the expiration value, then we can calculate the profit by using a long box strategy.

Profit

= 1150 - 500

= $650

The net profit is calculated by excluding the brokerage and taxes from the profit obtained.

When To Use?

Box spread is a useful arbitrage strategy provided the trader is willing to take a minimum risk and also make a minimum profit. Here the experience level required pulling such strategies and gaining benefit out of it is also a matter of concern. Generally, experienced traders will be applying such strategies and make a profit out of it. The timing required to utilize such a strategy is the key to making money out of it.

Considering the example above, we can see how the box plot strategy changes depending on the expiration value and the box spread value. When the expiration value is higher than the box spread value, we use a long box strategy, and similarly, if it is the other way round, we use the short box strategy.

- This strategy is typically used when the spread is under-priced in combination with the expiration amount. It generally combines a bear put and bull call spread. The payoff associated with box spread is minimal, so the use of this strategy also becomes very restricted and should be used only by experienced traders.

- The best occasion to use this strategy is when there exists a difference in prices in the option price or when the put-call balance is affected, which can be a cause of shift of short term demand for options. Here choosing the correct strike price is the key to making money as the benefit of this strategy is generally driven by the difference in the strike price.

Advantages

Box spread is a strategy that helps traders involve in trades that are risk-free or have limited risks involved. They are beneficial for them in many ways.

Some of the advantages of these strategies include the following:

- The prime advantage of this spread is that very low risk is associated with it since it is used to earn a minimal profit.

- It is the best strategy when the expiration value is more than the spread value.

Disadvantages

Besides the benefits that this strategy offers, there are limitations too that restrict traders involving in a box spread option. Let us have a look at some of the demerits of these strategies:

- The profit earned is really very low and minimal.

- The strategy is only helpful for experienced investors and not retail investors, where a lot of knowledge is required to take such a call.

- The margin required to apply this strategy requires a huge margin and maintenance of it which small traders will find it tough to maintain.

- The trader has to keep waiting for the expiry by getting the money stuck in the box spread.

- It is very difficult to spot such opportunities in the trade market and take advantage of it.

- Discrepancies of price get net off very fast, and thus taking advantage of such discrepancies is very tough.

Box Spread vs Iron Condor

Box spread and iron condor are two strategies used to identify and engage in a risk-free trade. However, they two differ in various aspects.

Let us check out the difference between box spread and iron condor in detail:

- It is an arbitrage technique where four trades are involved in a combination of two spreads, i.e., bull call spread and bear put spread. The profit/loss here is calculated as a net of a single trade only. The total cost of the box remains constant irrespective of the deviation of prices of underlying securities.

- The expiration is here calculated by the difference in prices of the strike of the options considered in the trade. There are primarily two types of strategy, which are known as long box strategy and short box strategy.

- Iron condor, on the other hand, is a neutral strategy that is also not suitable for beginners. It, too, has four transactions involved. It is a credit spread where upfront credit is received. This is used when we are under the assumption that there will be very little movement of the price of the security.

- Unlike, like box spread here, we have more chances to make maximum profit. To generate maximum return, the underlying security should bear the same pricing and should be within a specified range.