Table Of Contents

Bureaucracy Meaning

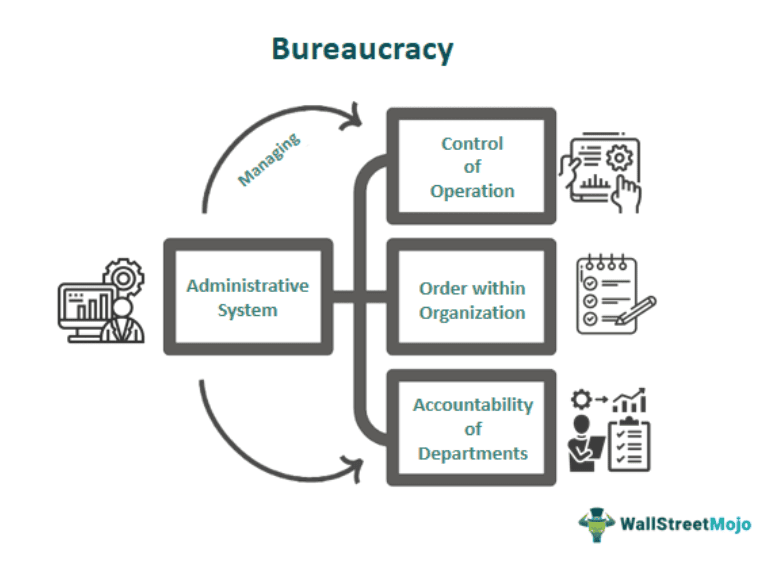

Bureaucracy, in finance, refers to the structured administrative system that manages financial affairs within organizations, institutions, or government bodies. Its primary objectives are maintaining order, control, and accountability in financial operations while achieving specific financial goals.

One of the primary purposes of financial bureaucracy is to regulate and oversee financial markets and institutions to prevent fraud, market manipulation, and excessive risk-taking. Regulatory bodies like the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom play a crucial role in monitoring and enforcing these rules.

Key Takeaways

- Bureaucracy represents a structured and organized administration system within organizations, government agencies, and institutions.

- Bureaucracies typically have a well-defined hierarchy of authority, with different levels of management and decision-making roles.

- Bureaucracies rely on formal rules, regulations, and procedures to govern their operations, ensuring consistency and accountability.

- Bureaucracies aim to enhance efficiency by standardizing processes and promote accountability by establishing clear lines of responsibility.

- Decision-making in bureaucracies is often based on established rules and criteria, reducing the influence of personal biases or favoritism.

Bureaucracy Explained

Bureaucracy in finance refers to the rules, regulations, and administrative procedures governing financial institutions, organizations, and government agencies. The term "bureaucracy" originates from the French word "bureau," which means desk or office, and the Greek word "kratos," meaning power or rule. It gained prominence during the late 18th and early 19th centuries, particularly with the works of French political economist Jean-Jacques Rousseau and German sociologist Max Weber.

Bureaucracy in finance often involves the following key elements:

- Regulation and Compliance: Financial bureaucracies create and enforce rules to ensure financial institutions, markets, and transactions comply with laws and standards. Regulatory bodies like central banks, economic ministries, and securities commissions oversee compliance.

- Risk Management: Bureaucratic structures are essential for evaluating, mitigating, and managing financial risks. This includes credit risk assessments, investment portfolio management, and hedging strategies to protect against adverse market movements.

- Financial Reporting: Bureaucracy ensures the accurate and timely reporting of financial information. It involves the preparation of financial statements, auditing, and adherence to accounting standards to maintain transparency and accountability.

- Resource Allocation: Financial bureaucracy helps allocate resources efficiently by budgeting, cost control, and capital allocation decisions. These processes are essential for organizations to meet their financial goals and objectives.

- Investment Management: In the context of investment and finance, bureaucracy plays a critical role in managing investment portfolios, making investment decisions, and assessing the performance of assets.

Characteristics

Here are the essential characteristics of bureaucracy:

- Hierarchy: Bureaucracies are structured with a clear order of authority. This means there are distinct management and decision-making levels, with lower-level employees reporting to supervisors, who, in turn, report to higher-ranking managers. This hierarchy ensures accountability and a transparent chain of command.

- Specialization: Bureaucracies often emphasize job specialization, where employees have well-defined roles and responsibilities. Specialization allows individuals to develop expertise in specific tasks, increasing efficiency and productivity.

- Formal Rules and Procedures: Bureaucracies govern their operations using legal rules and procedures. These rules provide consistency and predictability in performing tasks and making decisions. They also help ensure fairness and impartiality.

- Impersonality: Bureaucracies strive for impersonality, meaning that decisions are based on established rules and criteria rather than personal biases or favoritism. This fosters fairness and equity within the organization.

- Merit-Based Recruitment: Bureaucracies hire and promote employees based on merit and qualifications rather than nepotism or personal connections. This meritocratic approach ensures that the most qualified individuals fill vital positions.

- Clear Lines of Communication: Effective communication is crucial in bureaucracies. They establish clear communication channels, vertically (up and down the hierarchy) and horizontally (across departments or units), to facilitate information flow and coordination.

- Standardization: Bureaucracies standardize processes and procedures to achieve uniformity and consistency. Standardization helps in replicating successful practices and reducing errors.

- Record Keeping and Documentation: Bureaucracies maintain thorough records and documentation of their activities. This is essential for accountability, compliance, and historical reference.

- Impartiality: Bureaucracies aim to treat all individuals and cases equally, adhering to established rules and regulations. This impartiality reduces the potential for discrimination or favoritism.

Types

Here are some common types of bureaucracy:

- Weberian Bureaucracy: Named after sociologist Max Weber, this is the traditional and most well-known form of bureaucracy. It emphasizes a hierarchical structure with clear lines of authority and a formal set of rules and procedures. Decision-making is often centralized, and positions are filled based on merit.

- Professional Bureaucracy: Professionals with specialized knowledge and expertise play a significant role in decision-making in this type of bureaucracy. Examples include law firms, medical practices, and academic institutions.

- Adhocracy: Adhocracy represents a more flexible and dynamic form of bureaucracy. It is characterized by a decentralized structure that encourages innovation and adaptability. Decision-making can be fluid and based on expertise rather than strict hierarchy or rules.

- Matrix Bureaucracy: Employees have multiple reporting relationships in a matrix bureaucracy, typically with functional managers and project or team leaders. This structure is typical in organizations where employees must balance their contributions to various projects or departments.

- Network Bureaucracy: Network bureaucracies are often found in the public sector and involve collaboration among various agencies, departments, and organizations. They operate as a network of interconnected entities, working together to achieve common goals.

- Virtual Bureaucracy: With technological advancements, virtual bureaucracies have emerged, where teams and employees work remotely or in geographically dispersed locations. Virtual bureaucracies rely heavily on digital tools and communication technologies to maintain coordination and accountability.

- Hybrid Bureaucracy: Many organizations combine elements of different bureaucratic types to create hybrid structures that best suit their needs. For example, a large corporation may incorporate aspects of both Weberian and Adhocratic bureaucracy, allowing for centralized control in some areas while promoting innovation and flexibility in others.

Functions

The critical functions of bureaucracy:

- Rule Implementation: Bureaucracies are responsible for implementing and enforcing rules, laws, and regulations. They ensure that organizations and societies adhere to established norms and standards, promoting stability and predictability.

- Administration: Bureaucracies handle administrative tasks such as record-keeping, document management, and data analysis. This function is crucial for maintaining accurate records, which can be used for decision-making, accountability, and historical reference.

- Decision-Making: Bureaucracies affect decision-making processes, especially in organizations and government agencies. They facilitate the formulation and implementation of policies, strategies, and initiatives.

- Regulation and Oversight: Bureaucratic bodies are often responsible for regulating industries and monitoring compliance with laws and regulations. For example, financial regulatory agencies oversee the banking and securities sectors to protect investors and maintain financial stability.

- Service Delivery: In government settings, bureaucracies provide essential services to citizens, such as healthcare, education, and public safety. They ensure these services are accessible, efficient, and of high quality.

- Conflict Resolution: Bureaucracies can serve as intermediaries in conflict resolution processes. They may facilitate negotiations, mediate disputes, or provide a framework for addressing grievances within organizations or communities.

- Expertise and Advice: Bureaucracies often house experts and specialists who guide and advise decision-makers. These experts offer insights on complex issues, helping organizations make informed choices.

- Public Accountability: In democratic systems, government bureaucracies are accountable to the public. They provide transparency by publishing information, conducting audits, and responding to inquiries from citizens and the media.

Examples

Let us understand it better with the help of examples:

Example #1

Suppose a fictional company called "TechCorp" that operates in a highly competitive tech industry. TechCorp employs a bureaucratic structure to manage its operations effectively. In this imaginary scenario:

- Hierarchy: TechCorp has a precise order, with the CEO at the top, followed by department heads, managers, and individual employees.

- Specialization: Within the company, various departments focus on specific functions, such as research and development, marketing, and customer support. Each department is staffed with experts in their respective fields.

- Formal Rules and Procedures: TechCorp has established standard product development, quality control, and project management procedures. These guidelines ensure consistency and quality in its products.

- Impersonality: Decision-making is based on data and guidelines rather than personal biases. Performance metrics determine promotions and raises.

- Merit-Based Recruitment: TechCorp hires and promotes employees based on their qualifications and job performance, fostering a culture of meritocracy.

Example #2

In an opinion piece published by the Washington Examiner in 2023, the author proposes an intriguing concept known as a "Green-Col" initiative to revitalize the Internal Revenue Service (IRS). The proposal suggests that the IRS, as a bureaucracy, could potentially play a pivotal role in addressing climate change through its existing infrastructure and resources.

The core argument revolves around expanding the IRS's mandate to include climate-related tax issues. This would allow the agency to generate revenue from environmental taxes while contributing to the fight against climate change. The article emphasizes that this transformative initiative could serve as a dual-purpose strategy for the IRS, enhancing its financial outlook while bolstering its image as a proactive government agency.

Furthermore, the piece points out that this "Green-Col" idea might find bipartisan support, given its alignment with fiscal and environmental priorities. The author underscores that the success of such a bureaucratic overhaul would necessitate meticulous planning, adequate resources, and seamless cooperation among various government agencies.

Advantages And Disadvantages

Here's a brief comparison of the advantages and disadvantages of bureaucracy:

| Advantages of Bureaucracy | Disadvantages of Bureaucracy |

|---|---|

| 1. Efficiency: Bureaucracies are often structured to maximize efficiency by streamlining processes and reducing redundancy. | 2. Rigidity: Bureaucratic structures can be inflexible, making adapting to rapidly changing environments or circumstances challenging. |

| 2. Accountability: Bureaucracies establish clear lines of authority and responsibility, making it easier to assign accountability for decisions and actions. | 2. Accountability: Bureaucracies establish clear lines of authority and responsibility, making assigning accountability for decisions and actions easier. |

| 3. Expertise: Bureaucracies can attract and retain experts in various fields, enhancing the quality of decision-making and problem-solving. | 1. Bureaucratic Red Tape: Excessive rules and procedures can lead to bureaucratic red tape, slowing decision-making and responsiveness. |

| 4. Impersonal Decision-Making: Bureaucracies make decisions based on established rules and criteria, reducing the potential for personal biases or favoritism. | 4. Bureaucratic Inefficiency: Inefficiencies can arise from complex processes, excessive paperwork, and a focus on compliance over outcomes. |

| 5. Transparency: Formal rules and procedures promote transparency and accountability, helping to prevent corruption and favoritism. | 5. Communication Challenges: Hierarchical structures can hinder effective communication between different levels of the organization. |

Bureaucracy vs Democracy

Here's a comparison between bureaucracy and democracy:

| Aspect | Bureaucracy | Democracy |

|---|---|---|

| Decision-Making Process | Centralized decision-making authority, often with a hierarchy of officials. | Decentralized decision-making through elected representatives or direct citizen participation. |

| Leadership | Leadership is often appointed based on expertise or seniority. | Leadership is elected by the people, typically through regular elections. |

| Accountability | Accountability is based on adherence to established rules and procedures. | Accountability is through periodic elections and public scrutiny. |

| Citizen Participation | Limited citizen participation in decision-making. Citizens usually have little direct influence. | Extensive citizen participation through voting, advocacy, and civil engagement. |

| Flexibility | Typically less flexible and responsive to rapid changes in public opinion or circumstances. | Can be more responsive to changing public needs and preferences. |

| Transparency | Emphasis on formal rules and procedures, promoting transparency. | Transparency varies but often prioritized to maintain public trust. |