Differences between both the concepts are given as follows:

Table of Contents

EBIAT Meaning

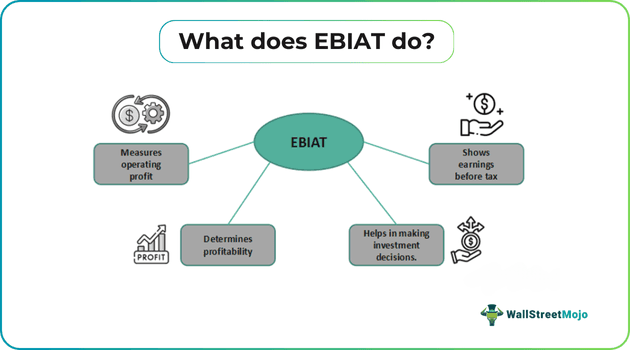

EBIAT, or earnings before interest after taxes, is a financial measure that evaluates the operating and non-operating profit before deducting interest and the cash income tax. It is expressed as the cost of goods sold and administrative and general expenses subtracted from revenue.

It is the amount that is gained after deducting cash taxes from earnings before interest and taxes (EBIT). The value determines a company's profitability by accounting for income taxes while ignoring the impact of interest costs. It draws attention to the company's operational performance.

Key Takeaways

- EBIAT, or earnings before interest after taxes, is a financial measure that evaluates the operating and non-operating profit before deducting interest and the cash income tax.

- It offers a clearer, more reliable indicator of a company's capacity to make profits. It concentrates on earnings from core operations and considers tax liabilities.

- This metric is beneficial when comparing businesses with different tax requirements, financial leverage, and debt structures.

- It is calculated by starting with a company's operating income and then subtracting the taxes paid.

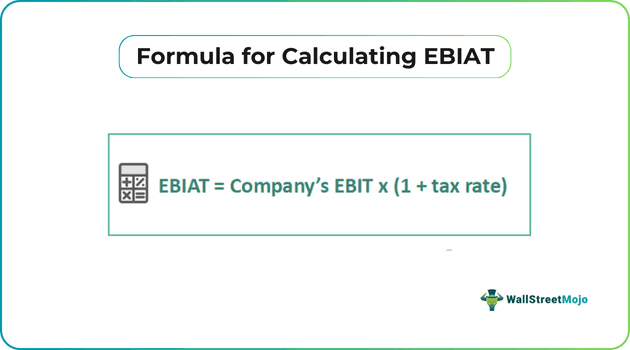

- It excludes interest expenses. The formula for calculating EBIAT: company's EBIT x (1 + tax rate).

EBIAT Explained

EBIAT is a financial metric used to analyze a company's operational performance without considering its tax liabilities capital structure. It enables stakeholders, including investors and analysts, to assess an organization's operational performance without considering its capital structure. This metric provides a clearer, more reliable indicator of a company's profit-making capacity. It focuses on core operational earnings while also factoring in tax liabilities.

This value is regardless of changes in interest payments or debt levels. This facilitates the identification of appealing investment prospects. In addition, it allows for accurate comparisons between companies operating in the same industry. Investors and analysts can better understand the profitability that results from the company's core business operations by studying this concept.

This metric is beneficial when comparing businesses with different tax requirements, financial leverage, and debt structures. This is because it effectively takes such things out of the equation. It allows for a more realistic evaluation of profitability and potential operational efficiency. This is often used in various financial assessments, like valuations, investment decision-making, and industry comparisons. Additionally, it can be used in computations like the EBIAT multiple or Enterprise Value. The value again aids in determining the relative worth of businesses across various industries and scales of size.

Formula

The formula for calculating EBIAT: company's EBIT x (1 + tax rate).

NOTE: EBIT = Business Revenue - Operating Expenses + Non-Operating Income.

In addition to assessing a company's operational performance, investors frequently examine the EBIAT ratio, which is calculated by dividing EBIAT by total sales or other relevant financial measures.

Examples

Let’s consider these examples to understand the concept better:

Example #1

Let's consider ABC Corporation has shown an operating expense of $500,000 and revenue of $1,000,000. It also brings in $100,000 from non-operating sources. The corporation pays 25% in taxes.

Let's first figure out EBIT (Earnings Before Interest and Taxes):

EBIT is the sum of business revenue minus operating costs. Non-operating income is added to the value. This gives:

= $1,000,000 - $500,000 + $100,000

= $600,000

The following formula can be used:

EBIAT is calculated by multiplying EBIT by (tax rate x 1).

= $600,000 x (1 - 0.25)

= $600,000 x 0.75

= $450,000

This amount reflects the company's earnings before interest and after taxes, which shows its operational profitability following the deduction of taxes but before taking interest costs into account.

Example #2

Suppose Dan is an investor who wants to invest in a company. Dan does in-depth financial analysis to evaluate the company's profitability and prospective profits before making investment decisions. Earnings before interest after taxes is one important measure he assesses as the metric ignores the impact of borrowing costs and concentrates on after-tax earnings.

Hence, it is a useful indicator of the operational profitability of a company. He can better understand the company's core profitability and capacity to produce profits from its core business by considering EBIAT.

EBIAT Vs. NOPAT

| Key points | EBIAT | NOPAT |

|---|---|---|

| 1. Concept | It is a financial metric to assess a company's operating performance over a quarter or year. | Net operating profit after tax (NOPAT) is a metric that shows a company's core operations performance. |

| 2. Usage | This metric is used when calculating a company's profitability | NOPAT is a more precise way to assess operating efficiency for leveraged organizations and is widely utilized in economic value-added (EVA) calculations. |

| 3. Exclusions | In this metric, the business's capital structure is not taken into account | Tax savings from a business's existing debt and its one-time losses or charges are not included in NOPAT. |

| 4. Purpose | It shows how much money a business has to pay its creditors in the case of liquidation. | NOPAT helps reveal the FCFF or free cash flow to the firm and economic free cash flow to the firm. |

EBIAT Vs. EBIT Vs. EBITDA

Differences between the three concepts are given as follows:

| Key points | EBIAT | EBIT | EBITDA |

|---|---|---|---|

| Concept | The metric refers to a company's earnings in the absence of any debt-related tax benefits. | EBIT is the profitability metric used to calculate a company's operational profit | Earnings before factors such as interest, taxes, depreciation, amortization, or EBITDA are business valuation indicators used to evaluate the organization's financial health. |

| Calculation | It is computed by first deducting taxes paid from the operational income of the company and by excluding interest charges. | It is computed by subtracting the company's operational costs and cost of goods sold from its total revenue | It is the sum of the company's net earnings, taxes, depreciation, amortization, and interest costs is used to compute it |

| Formula | EBIT×(1−Tax Rate) | Revenue - Cost of goods sold - Operating Expenses | Net earnings + Interest + Taxes + Depreciation + Amortization |