Table Of Contents

What Is An English Auction?

English auction refers to the process or method of the sale of a single quantity of a product where the bidding starts with the starting price, which is set by the seller of the product and increases with the continuous bidding from the different buyers until the price is reached at a level above which there is no further bidding. This price will be the selling price of the product under the auction.

Key Takeaways

- English auction means the procedure of a product's single quantity where the bidding starts with the starting price fixed by the product's seller and increases with the continuous bidding from the different buyers. It increases until the price is reached above without further bidding. It is the product's selling price under the auction.

- The variations of the English auction are English clock variations and time interval auctions.

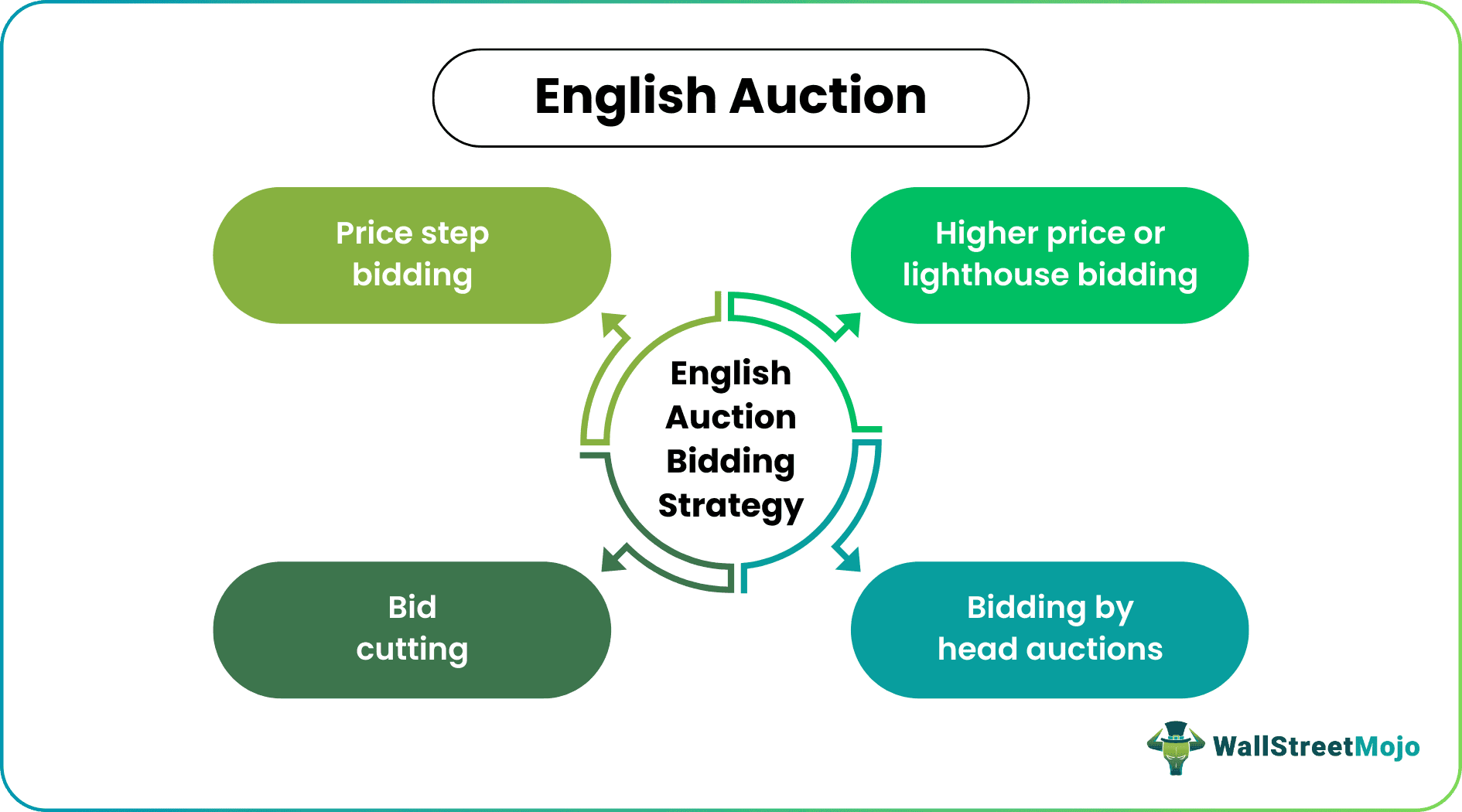

- Price step bidding, a higher price or lighthouse bidding, bid cutting, and bidding by head actions are the strategies of this auction bidding.

Explanation

English auction is the process under which one quantity of a product is listed for sale. Under this method, all the bidders are aware of each other, and the bids are placed openly in front of everyone. The process starts with the declaration of the opening bid or the reserve price, which the product seller sets. After this, the interested bidders start placing their respective bids in an ascending order, i.e., the next bid should be higher than the previous bidder's price. This process continues until there is a bid above which any other buyer is not interested in buying the item. It is the highest bid and the selling price of the product.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features

- English auction is an open and transparent auction with different bidders, and each bidder's value is known to others.

- All the bids should be in ascending order, and the next bidder can place the bid with an amount higher than the previous bid amount.

- The seller of the product sets the reserve price or the opening bid. So, the bid below such price is allowed.

- The auction houses set the mechanism of the bid price increment.

Example of English Auction

Mr. A defaulted on the loan taken from the bank. On his inability to repay the loan, the bank decided to sell off the security attached to the loan, i.e., Mr. A’s house. So, the bank decided to recover the loan by selling the house through the bidding process. Bank arranged the auction and advertised the auction so that many bidders could come and bid. The bank’s initial price was $ 250,000, which was the current market value of the house prevailing at the time of auction.

The bidding process started by the host of the bid program declared the initial set price as $ 250,000 to all the bidders at the auction and asked them to bid further. One of the bidders placed the bid at $ 265,000, and further bid increased to $ 275,000 and then to $ 300,000. After which, no further bid was received. So, the house was sold to the person who bidded for $ 300,000, and with this, the host announced the completion of the auction. It is an example of an English auction.

Variations

- First Variation in an English clock auction where the auction completes in a single day only by arranging the bidding and inviting the bidders to the auction place. In this type of auction, the bid starts with the lower amount and completes at the higher amount, and in the end, the winner is announced, and the host announces the completion of the bid.

- The other type of English auction is time interval auction, which is not completed in a single day, and it takes a few days to complete the auction. The auction may be in physical form or online form. The bidders are given the time frame within which the bid is to be submitted, and then the host will announce the winner, who is the highest bidder. An example is tendered, contract bidding, government bidding, etc.

English Auction Video Explanation

English Auction Bidding Strategy

- Price Step Bidding - In the price step bidding, the bidding starts with the lower amount, and slowly and gradually, it increases without any big gap between the two biddings.

- Higher Price or Lighthouse Bidding - In this type of bidding, the bidding starts with the lower amount, and suddenly the buyer bids for the much higher amount and the small bidders get eliminated.

- Bid Cutting - In bid cutting, the bid starts as normal, and the same gets increased mistakenly by one of the bidders. After that, the bidder wants to correct the bid, so he asks to forbid cutting and bid higher than the previous bid value. Only the bidder can cut the bidding if the host permits him to do so.

- Bidding by Head Actions - If the bidder nods the head, it is considered he is still in bidding, and if he shakes his head, it means he declares by his actions that he can’t bid further.

English Auction vs. Dutch Auction

- English auction is a type of auction where the bid starts from the lower value and reaches the highest value. In contrast, in a Dutch auction, the bidding starts from the highest value and reaches the lower value but not less than the minimum amount set.

- One can bid from minimum to maximum in English bidding, whereas in Dutch bidding, one can bid from maximum to minimum.

- The highest price is not set in an English auction, whereas the Dutch auction is the highest price.

Drawbacks

- Arrangement of bidding involves a high cost.

- It leads to undue gain to the auctioneer if there are aggressive bidders.

- Eliminates the small bidders.

- No maximum price is set. The bidder can bid at any highest price.

- Legal regulations and formalities are more.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Shill bidding in English auction refers to artificially inflating the price of items by having someone known as a shill bidder. Therefore, this technique is considered illegal and unethical in most auction settings.

An advantage to English auctions is that an auction bidder receives information. For example, he can see other bidders discontinue and have the highest bids earlier. Moreover, a bidder may know much about the other valuations, allowing him to revise his valuation.

A bidder's dominant approach is to bid the actual value. Thus, the bidder with the highest valuation gets the product and spends an amount equal to the second-highest bidder's value. Therefore, the English auction is often known as an open second-price auction.