Table Of Contents

Clearinghouse Definition

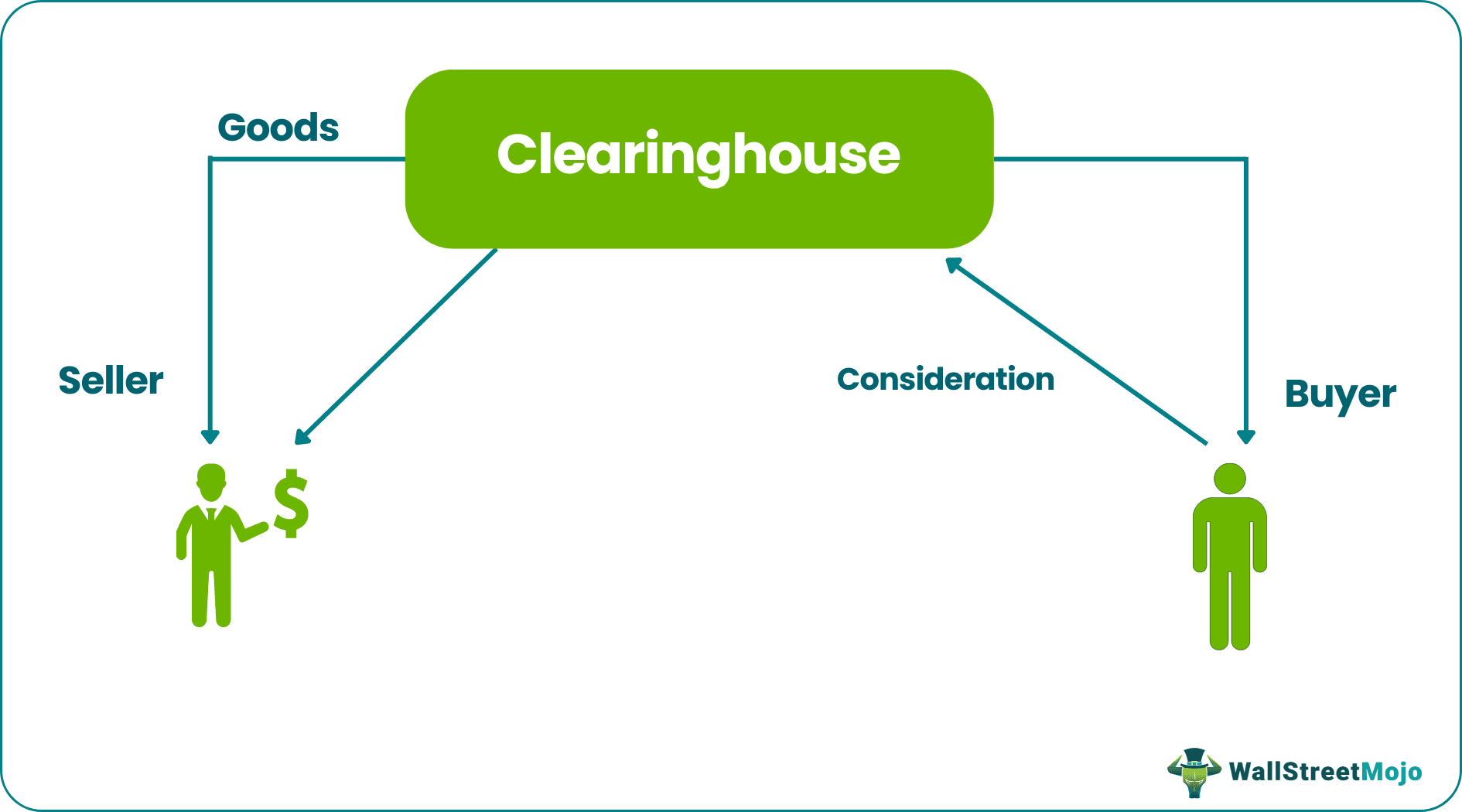

A clearinghouse is a mediator between two firms (which may or may not know each other) engaged in a financial transaction (wherein one party is a buyer and another party is a seller in the said transaction), taking the exact opposite positions for each firm. In addition, it ensures no risk of default in the transaction.

A clearinghouse takes care of the compliance of the contractual clauses. It ensures the two parties involved in a transaction d not disobey the contract and deal with their respective obligations, which is the tradable asset for buyers and the amount in exchange for it for the sellers.

Key Takeaways

- A clearinghouse is an intermediary between two parties involved in a financial transaction, typically a buyer and a seller. It ensures the smooth completion of the transaction by reconciling opposite positions and eliminating default risk.

- Clearinghouses facilitate various transactions, including physical delivery or customized contracts for trading goods and automated exchange-driven contracts for futures, derivatives, and options.

- In the event of a trader violating the maintenance margin, a clearinghouse enforces the requirement for a variable margin, ensuring the financial stability of the transaction.

- Clearinghouses operate under government regulations to maintain control and provide a reliable system on which traders can depend.

How Does Clearinghouse Work?

A clearinghouse is an intermediary that monitors the entire process of selling and purchasing assets to ensure the parties involved do not undergo any hassle in completing the process. In short, a clearinghouse assures of the smooth functioning of this sale and purchase network. Its responsibilities are many, but the motive is only one and that is to ensure the buyer gets the product right, and the seller receives the payment right without facing any difficulty.

As the name suggests, a clearinghouse clears piles once a transaction completes. Let us understand how the transaction flows between two parties. The buyer receives the actual goods from the deemed seller (i.e., the clearinghouse), and the seller receives the consideration for the goods sold to the supposed buyer (i.e., the clearinghouse).

It makes the transaction secure. The question is, Will the clearing do the same for free of cost? The answer is obviously, “No.” The mediator charges a nominal amount from each party to the contract, say 0.001% of the trade involved. Isn't the margin too low? Obviously, yes. But the mediator earns due to huge volumes of business around the globe.

The clearinghouse is involved in regular transactions of trading goods (i.e., manual physical delivery or customized contracts) and futures contracts, derivatives contracts, or options contracts (i.e., automated exchange-driven contracts).

A clearinghouse driven by regulations placed upon by the government. Since they are regulated, traders rely upon the system. Today the stock exchange plays the role of mediation. We can see huge volumes of transactions taking place on the trade. It is possible only through the automated clearing system.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Functions

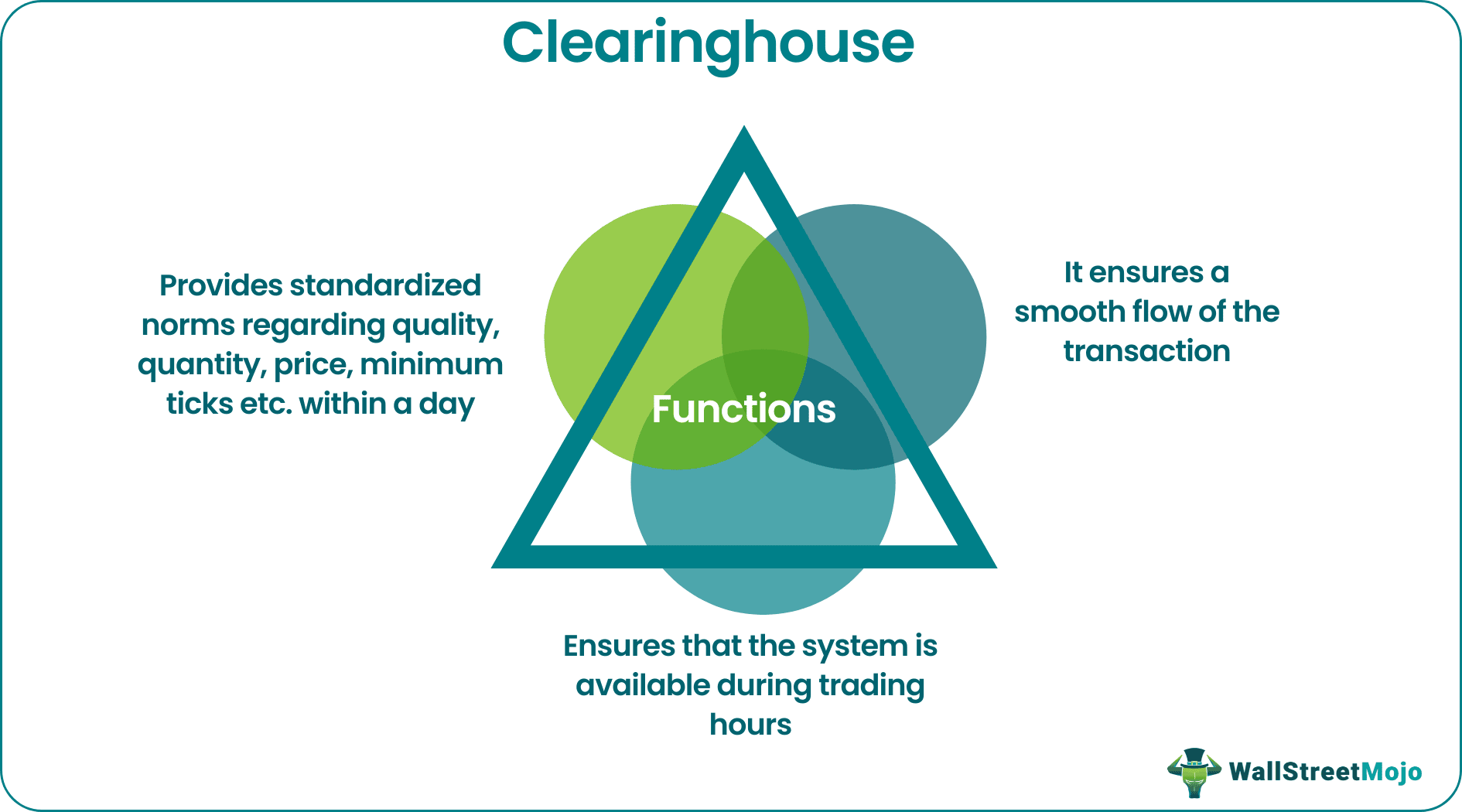

Being the middle entity between the buyer and seller, a clearinghouse has a huge responsibility of maintaining a balance in the procedure of selling assets and confirming its receipt by the other party. When it is there, the buyers and seller hardly have to think of where they are going wrong. The clearinghouse deal wiuth that. Some of its functions of these entities include the following. Let us have a look at them, below:

- The first and foremost thing is to ensure a smooth transaction flow.

- It guarantees the occurrence of the transaction in the manner planned by the said parties.

- This guarantee is given by checking the repaying capacity and credibility of the parties involved. That applies irrespective of whether the parties are natural or artificial persons.

- It ensures that the system is available during trading hours. That makes sure that the market is liquid.

- A clearinghouse also provides standardized norms regarding the quality, quantity, price, minimum ticks, maximum movement of cost within a day, and contract maturity.

Examples

Let us consider the following instances to understand how does a clearinghouse work:

Example 1

Suppose Mr. A promises Mr. B to sell his shares in Johnson Ltd. two weeks from today. In return, Mr. B has paid him a 20% advance today and promises to pay him the balance price for all the shares on that day. Mr. B deals with Mr. C to sell him those shares the same day he receives them.

The risk for Mr B here is the non-delivery of shares from Mr. A. For Mr. C,the risk is of the non-delivery of shares from Mr. B. For Mr. A, the risk is Mr. B's risk of default which might lead to the postponement of payment.

One can avoid such risks if a person between the transactions is responsible for the default. That is the role a clearinghouse plays. So, it facilitates payment transactions or transactions like derivatives or securities. The main purpose is to reduce the risk of honor in trade settlement obligations.

If one observes, the clearinghouse will always take the exact opposite position for each trade side. It acts as a buyer for the person who is selling something. But simultaneously serves as a seller for the person receiving the same. Thus, it has great importance in the financial markets.

Example 2

The stock is trading at $850. You will see several contracts as follows: -

Explanation

Mr. C can buy from Mr. R only 5,000 stocks at $849. The price will move down. Then, you can see Mr. B can buy from Mr. Q at $848 to 10,000 stocks. Mr. Q will remain with 10,000 stocks at $848. Mr. Q can increase his price to $849 and sell to Mr. C stock for 5,000.

The price will not move until one of the parties to the transaction modifies its costs.

So, all these happen in seconds on the stock market. The stock exchange here is the mediator facilitating the trade.

Importance

When there is a clearinghouse to take care of the transactions and whether the process complies with the regulations, buyers and sellers know they do not need to worry about anything. This is what makes these entities such important components in the process.

- Each trader's basic risk is non-honoring the contract and default risk on the buyer's side.

- Clearinghouse eliminates such risks, thereby assuring the financial transaction.

- It is responsible for settlement between the parties, the time limit within which the transaction should get completed, and monitoring the adequacy of margins placed on the accounts of each trader.

- Clearinghouse ensures that the variable margin is called for if a trader breaches the maintenance margin.

Benefits

The presence of ta clearinghouse makes carrying out transactions easily, ensuring compliance of both parties involved with the rules and regulation. Let us have a look at the advantages of this entity in brief, below:

- Ease of transaction.

- It is a secure way of dealing in a financial transaction at a negligible cost.

- Reduction in human-oriented errors.

- Faster processing of transactions.

- There is no need to search eligible counterparty to the transaction.

Disadvantages

There are very few disadvantages to the clearinghouse. The clearinghouse system has emerged due to flaws in the earlier physical settlement system. They made the clearinghouse to advantage the public at large. It can never default due to stringent regulations imposed by the government. We can better call it the limitations rather than the disadvantages.

- Limited settlement hours since the exchange is not available 24x7.

- A specific quantum of orders is required. So, you cannot trade in odd lots at your convenience.

- A slower internet connection may delay placing your orders.

- There is a slight risk of default from the sub-brokers to the clearinghouse.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The types of clearing houses include securities clearinghouses, commodity clearing houses, and derivatives clearing houses. Securities clearing houses facilitate the settlement of securities transactions. In contrast, commodity clearing houses handle transactions in commodity markets, and derivatives clearing houses handle transactions in derivative instruments like futures and options.

A clearing house acts as an intermediary in financial transactions, ensuring the settlement of trades and managing associated risks. In contrast, a depository holds and maintains securities on behalf of investors, providing a centralized location for safekeeping and facilitating the transfer of ownership electronically.

A clearing house serves as an intermediary between buyers and sellers, managing risks and guaranteeing the completion of trades. Clearing members, on the other hand, are financial institutions or brokerage firms that are members of a clearing house. They submit trades to the clearing house on behalf of clients, bear financial obligations related to the trades, and have access to services and benefits provided by the clearing house.