Table Of Contents

Trading Floor Meaning

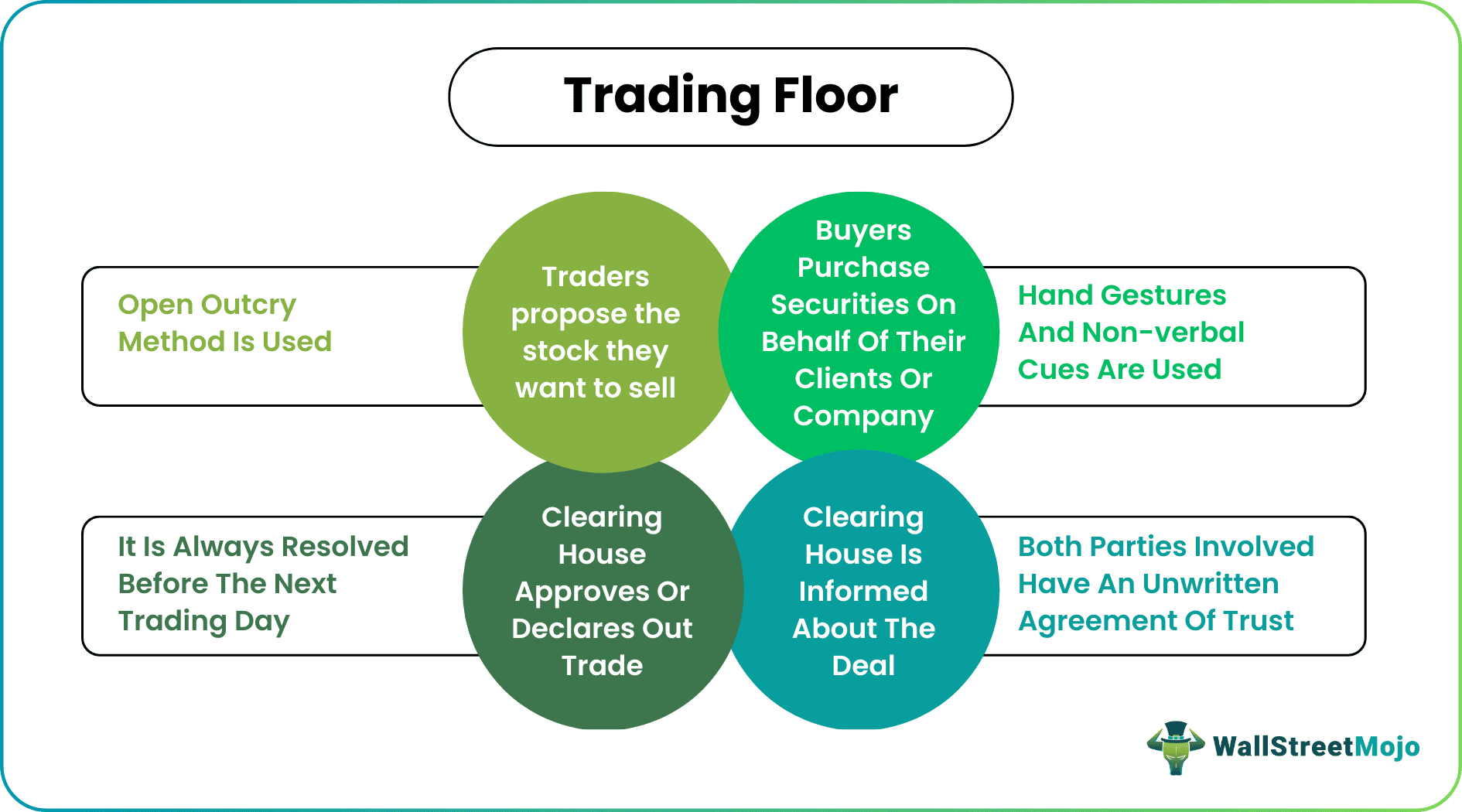

A trading floor is where traders buy and sell fixed-income securities, shares, commodities, foreign exchange, options, etc. It can define as that segment of the market where the trading activities by the dealers in financial instruments like equities, debt, derivatives, bonds, and futures occur. They occur on various exchanges, including the Bombay Stock Exchange (BSE) and New York Stock Exchange (NYSE).

Due to the circular design of the stock market trading floor, it is commonly referred to as “the pit” and professional traders use the open outcry method to buy and sell securities through hand gestures and shouting bids or offers verbally. These practices are the opposite of the modern-day electronic or online forms of trading.

Table of contents

- Trading Floor Meaning?

- A trading floor is where traders buy and sell commodities, fixed-income securities, foreign exchange, shares, options, and other such financial assets. It is the market segment where the dealers conduct trading operations in financial instruments like equities, debt, derivatives, bonds, and futures on various exchanges, including the New York Stock Exchange (NYSE) and Bombay Stock Exchange (BSE).

- The traders follow a specific method on the trading floor called the open outcry method.

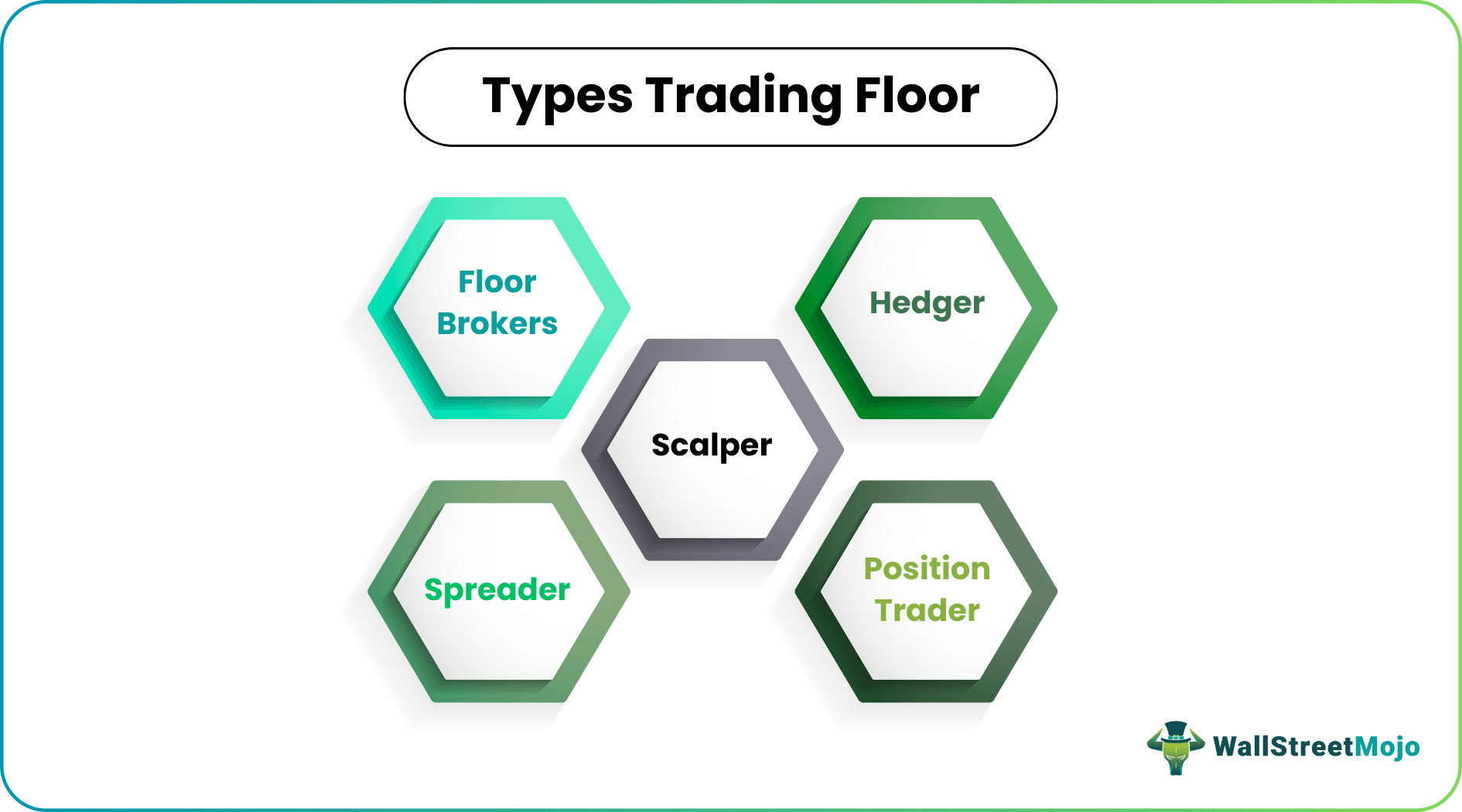

- Floor brokers, scalpers, hedgers, spreaders, and position traders are the types of traders on the trading floor.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How Does Trading Floor Work?

A trading floor is a space where traders buy or sell securities for their clients or their employing organization. The physical floor is usually designed in a circular manner which makes the process of physical trading more efficient. This area is often referred to as ‘the pit.”

One can find these floors in places where trading activities occurred. For example, the New York Stock Exchange or the Chicago Board of Trade holds large floors, where traders buy or sell.

Apart from traders, one can also find these in investment banks, brokerage houses, and firms in the trading business. The traders buy/sell securities on the trading floors, via a virtual trading floor, or through telephone, the internet, and other methods.

There is a particular method that traders follow on the trading floor. It is called the open outcry method.

Under this method, the traders offer hand gestures to attract attention.

This section will discuss how to open outcry works. In three ways, traders communicate for buying/selling securities on the trading floor: -

- The most usual one is screaming and sharing the offers and the bids.

- The second type of gesture is by waving arms to attract proposals and bids.

- Hand signals and gestures.

As one can imagine, a trading floor is where they would see traders screaming and waving their arms. It is a place where trading and related activities happen quickly. Therefore, traders must be on their toes to ensure they do not miss out on lucrative trades.

The trading activity reaches its peaks at the opening and towards the closing time of the exchange. The trading activity is a combination of high and low energy.

As one can imagine, the trading floor is always volatile. So, when a trader sees a runner approaching with a brokering order, even before the order is proposed, they start screaming from the pit to get the attention of the appropriate broker.

The brokers can see the runner from the top of the pit. If the brokers know the runner, they become active and go down the hole to get information and then act accordingly. Other traders standing in the pit may also act quickly to get the attention of that particular broker.

Sometimes when a trader of a particular firm knows or understands that whatever he would sell would be bought by a specific trader of another firm, the former stops shouting and directly gives a sign to the latter that he wants to sell the shares of a particular stock. The former also lets the latter know the number of shares he wants to sell.

Types

There are various types of traders on the stock market trading floor. Let us discuss a few of the most prominent ones: -

- Floor brokers: Floor brokers are the most common traders. They trade on behalf of clients. A floor broker can be an employee of the company or an independent consultant.

- Scalper: A scalper looks for temporary imbalances to buy/sell and make money.

- Hedger: Hedgers are floor traders those represent a commercial firm. One can do hedging by taking a position in one market, the opposite of a role in another market.

- Spreader: Spreaders deal with related commodities and take an opposing position in a market to affect the prices in a connected market.

- Position trader: A position trader holds a position for a more extended period and much longer than a scalper. As a result, the risk increases. And the position trader also needs to ensure that he earns a higher profit.

How Do Traders Trade on a Trading Floor?

There is a particular method that traders follow on the trading floor. It is called the open outcry method.

Under this method, the traders offer hand gestures to attract attention.

This section will discuss how to open outcry works. In three ways, traders communicate for buying/selling securities on the trading floor: -

- The most usual one is screaming from the top of their lungs and sharing the offers and the bids.

- The second type of gesture is by waving arms like crazy to get the attention of the proposals and bids.

- The last kind of demeanor is using hand signals.

As you can imagine, a trading floor is where you would see traders screaming, waving their arms, using their bodies like crazy, etc. It is a place where everything happens pretty fast. And if you miss one bit, you will lose.

The trading activity reaches its peak at the time of starting and the time of ending. The trading activity is a combination of high and low energy.

As you can imagine, the trading floor is always volatile. So, when a trader sees a runner approaching with a brokering order, even before the order is his/hers, he starts screaming from the pit to get the attention of the appropriate broker.

The brokers can see the runner from the top of the pit. If the brokers know the runner, they become active and go down toward the hole to get the fact and then act as per the information. Traders standing in the pit may also act quickly to get the attention of that particular broker.

Sometimes when a trader of a particular firm knows/understands that whatever he would sell would be bought by a specific trader of another firm, the former stops shouting and directly gives a sign to the latter that he wants to sell the shares of a particular stock. The former also lets the latter know how many shares he wants to sell.

Informal Contract on the Trading Floor

On the trading floor, many traders opt for informal contracts. For example, it will be called an informal contract if a trader announces that he wants to sell certain stocks at a particular price and another agrees to buy the shares at that advertised price.

The informal contract is unwritten, but its basis is the integrity of the traders. If a firm trader says that he would buy several shares of a particular stock and veer off course at the end, it will hit the integrity of the whole firm the trader is representing.

Therefore, informal contracts are taken very seriously. Since many informal contracts happen on the trading floor, not maintaining integrity may adversely affect the stock or bond market.

How Does the Clearinghouse Work on the Trading Floor?

When two traders agree upon a particular deal, the clearing member of each trader informs the clearinghouse of the same. Then, the clearinghouse tries to match the agreements from both sides. If the clearinghouse can reach the deal, two traders can claim the acknowledgment. On the other hand, if the clearinghouse cannot match that specific deal, the clearinghouse declares an ‘out trade.’

An ‘out trade’ happens for two basic reasons: -

- Lack of understanding among the traders involved; and

- An error made by traders, operators, or clerks.

The ‘out trade’ is, however, always resolved before starting the trading day, the next day. Of course, determining 'out trade’ is quite expensive, but it has been seen that traders always find a sweet spot and solve the issue.

The fascinating thing about the traders' claims is they do not have a written document that can state the acknowledgment of the deal. Everything happens through trust. Sometimes, many traders only trade with traders they have a long-term relationship to eliminate the risk of breaching trust.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The NYSE exchange is not publicly open, but one may stop by and walk the city's Financial District, which ranks as a top NYC experience. Moreover, one may find nearby iconic sights like the Charging Bull statue and Trinity Church.

One may still see the trading floors in the facilities of the two biggest stock exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). However, most trading has shifted to electronic means or virtual trading floors.

The NASDAQ does not provide a trading floor as it is an electronic exchange. Instead, it is a dealers' market. Therefore, brokers trade stocks through a market maker instead directly from each other.

The trading floor comprises a large room with several circular areas known as pits with broad steps to the edge and a flat center so that traders can see other traders. The traders stand in the pit's center with the outwards facing or the inward-facing on steps.

Recommended Articles

This article is a guide to Trading Floor and its definition. We discuss how a trading floor works, informal contracts, and clearinghouse roles. You may have a look at the following article to learn more about trading: -