Table Of Contents

What Is An Introducing Broker (IB)?

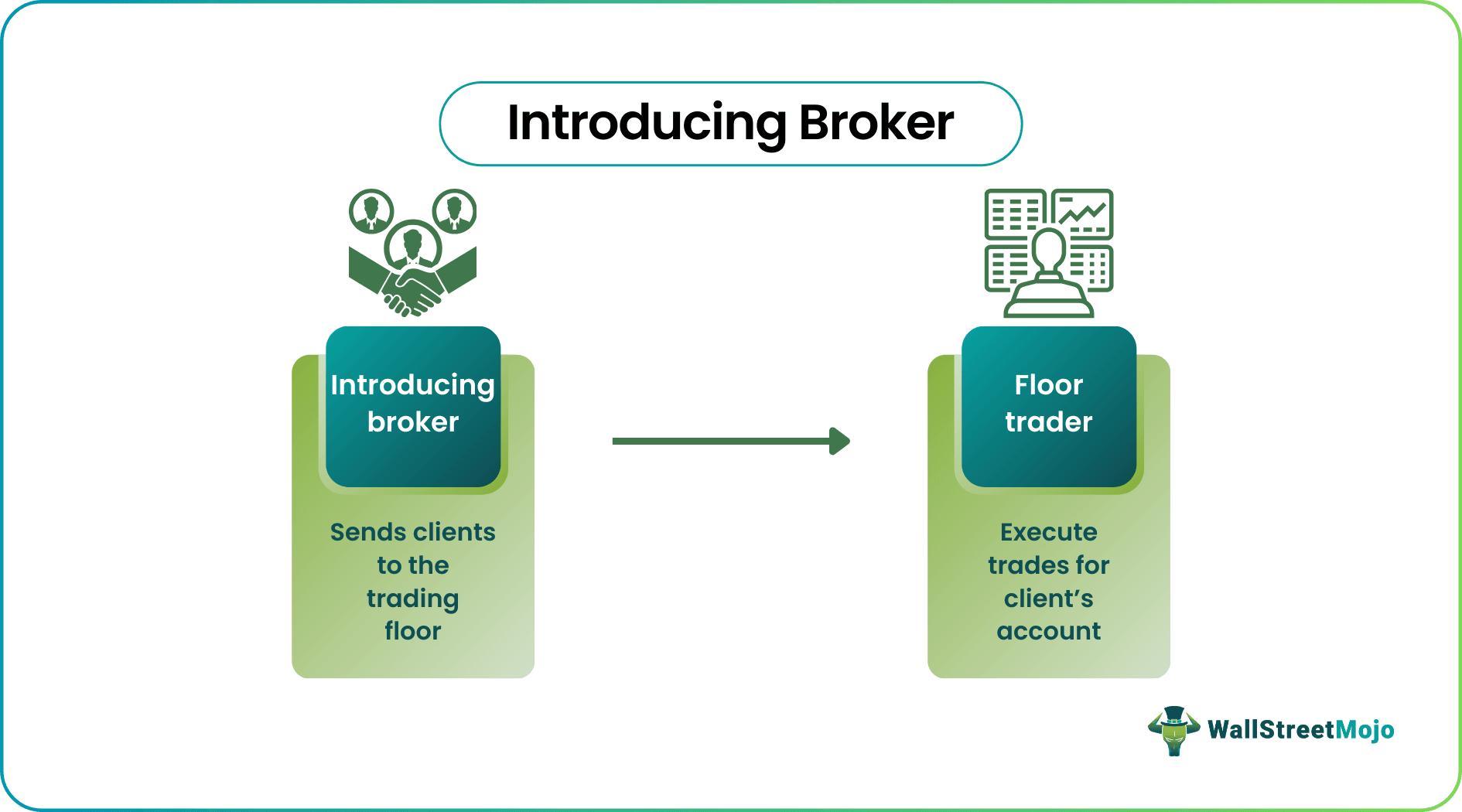

Introducing Broker is a term given to companies or individuals operating majorly in the futures market. An IB advises their clients but does not execute the trades themself. Instead, the IB delegates the trade to someone on the trading floor.

Clients directly pay the FCMs. IBs receive a commission from the FCMs for every trade. IBs play a bigger role in educating new investors. IBs maintain long-term relationships. All IBs require NFA membership. The National Futures Association (NFA) regulates derivatives in the United States.

Table of contents

- What is an introducing broker (IB)?

- Introducing Brokers is a company or an individual that refers clients to the trading floor. IBs do not execute trades themselves; they delegate. The client directly pays the FCM. In return, FCMs pay a commission to IBs.

- A Futures Commission Merchant (FCM) accepts orders to buy or sell futures contracts, options, or forex swaps. Accordingly, Accordingly, FCMs need a separate registration.

- IBs educate, mentor, and guide new investors. In addition, IBs acquaint clients with the current market condition and the critical aspects of financial markets.

Introducing Broker (IB) Explained

An introducing broker (IB) is an individual or an investment company that introduces a client to Forex trading, futures, or options trading. IBs or introducing agents do not receive assets or money from the clients. IBs do not undertake trades themselves; they delegate the client transaction to someone on the trading floor.

IBs are middlemen, a link between the client and the trading floor. In addition, IBs educate, mentor, and guide new investors. Finally, IBs acquaint clients with the current market conditions and the critical aspects of financial markets. As a result, IBs are better connected to clients; they maintain long-term relationships.

An introducing agent introduces the client to a Futures Commission Merchant (FCM). In return, FCMs pay a commission to introducing brokers. This commission is a form of a referral fee. FCMs accept orders to buy or sell futures contracts, options, or forex swaps. IB clients directly pay the FCM. Therefore, FCMs need a separate registration.

All IBs require NFA membership. The National Futures Association (NFA) regulates derivatives in the United States. The NFA started operation in 1982 along with Commodity Futures Trading Commission (CFTC). The CFTC was created in 1974; it checks derivatives fraud in the US.

Some IBs operate as individuals; others operate as a firm. IBs handle the customer-facing side of stock trading. They are localized and focus on customer service. The role of an IB is closely related to an FCM; they work hand-in-hand. Since IBs take care of customer queries, FCMs can focus on the trades without distraction. This way, one FCM can execute more trades and service more clients. Thus, IBs and FCMs together achieve economies of scale.

Alternatively, an IB will need additional financial resources if it tries to work without an FCM. Moreover, they need to register with futures exchanges. In addition, an IB would have to spend a substantial amount on overhead—for accounting, trading, reporting, and trading platforms.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Become?

Now let us discuss how to become an introducing broker. First, there is a separate IB registration process.

But the following professionals do not require IB registration:

- Registered as an AP (should be active).

- Registered as an FCM.

- Operates only on pools and is registered as a CPO.

- Solely manages accounts with power of attorney and does not receive any per trade commission.

- Registered as a CTA

- A non-U.S. resident or firm with only non-US customers who submits all trades to an FCM.

- All IBs must register with the NFA.

The prerequisites for IB registration and NFA membership are as follows:

- First, the firm or individual needs to obtain secure access to NFA's Online Registration System (ORS) by hiring a security manager.

- The broker must fill the Form 7-R online.

- The broker must complete the online NFA membership application.

- The broker must fulfill IB compliance requirements.

- The broker needs to fill out an annual questionnaire online.

- IB applicants must pay an application fee of $200 (non-refundable).

Following are additional registration requirements for associated individuals and principals of IBs:

- The IB associate has to fill out Form 8-R online (separate for each principal).

- They must submit fingerprint cards.

- Each AP must ensure proficiency requirements— sole proprietor, swap, and forex AP.

- Each associate must pay an application fee of $85 (non-refundable). An application fee is not required for registered applicants with the CFTC.

Introducing Broker vs Clearing Broker vs Executing Broker

Now, let us look at introducing broker vs clearing broker vs executing broker comparisons:

- An introducing broker introduces the client to a clearing broker. The clearing broker handles the trade and manages the account. In contrast, an executing broker processes buy orders and sell orders.

- An IB delegates the work to different brokers. In contrast, a clearing broker or executing broker executes the trade themselves.

- IB takes a commission from other brokers. Clearing brokers and executing brokers earn commission from the spread or client earnings.

- IBs earn via rebates. That is not the case with clearing brokers and executing brokers.

- IBs do not receive any fee from the client. In contrast, clearing and executing brokers receive assets or money directly from the clients.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

In 2022, the US introducing agents will earn $125,022 a year. On average, IBs charge $60.11 an hour; that is $2404 a week and $10418 monthly.

Introducing broker earns through commission payments. Independent IBs can work with multiple FCMs. IBs refer clients to different FCMs. In return, FCMs pay a commission to the IB. It is similar to a referral fee. Clients pay directly to the FCM, who executes the trade.

An introducing agent earns a commission for referrals. IBs do not execute trades themselves; they refer the client to someone on the trading floor. The client directly pays the FCM, who runs the business. In return, the FCMs pay IBs a commission.

Recommended Articles

This article has been a guide to what is Introducing Broker. Here, we explain how to become one and compare it with a clearing and execution broker. You can learn more about it from the following articles -