Table Of Contents

Call Market Definition

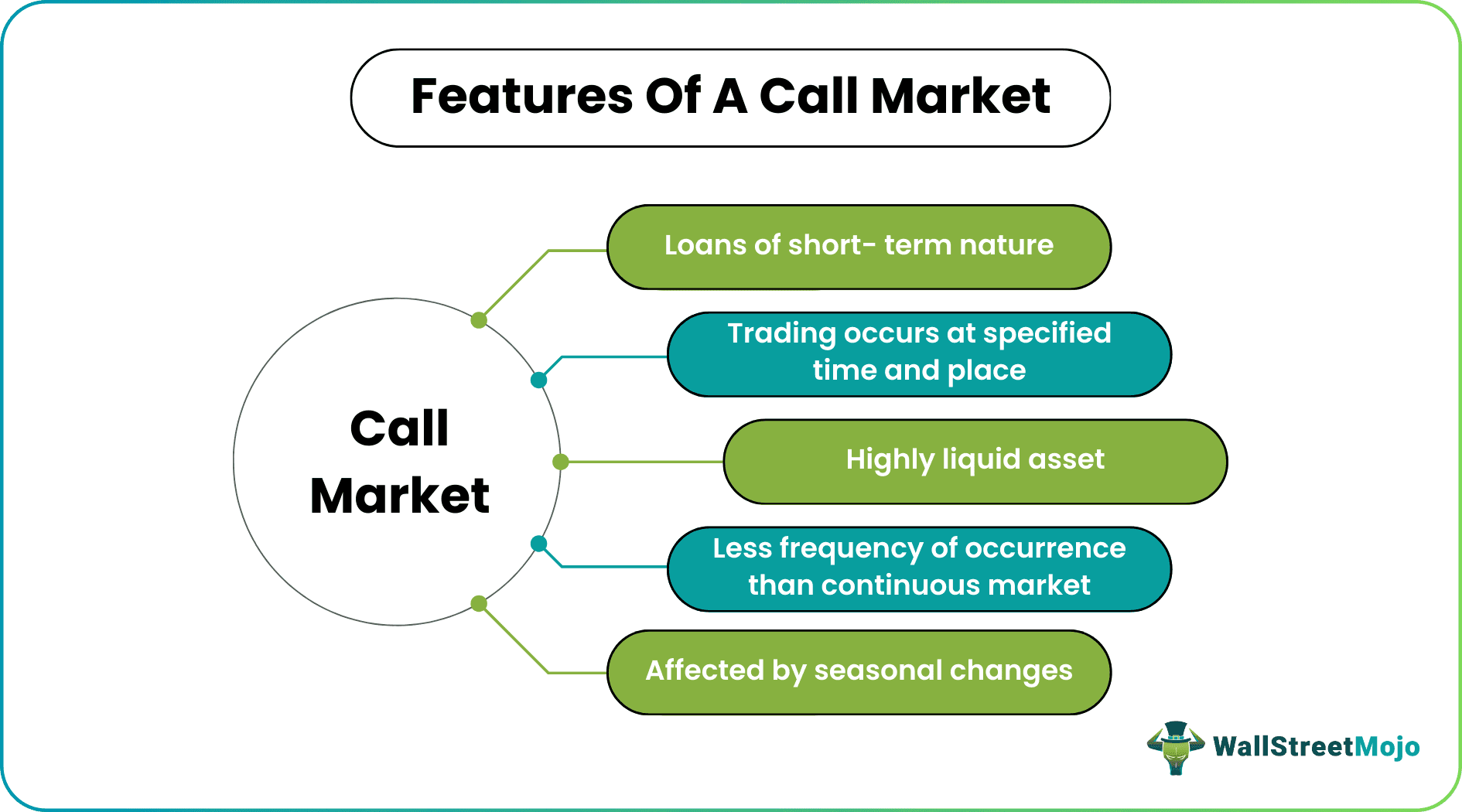

A call market is a marketplace wherein trading occurs at designated time intervals and specified places throughout the business day. It assists in maintaining the underlying security’s supply and demand to conveniently attain a suitable clearing price. The clearing price is decided by the best overall match of the prices.

A Call stock market is used only for illiquid assets or low trading density or volume. Also termed “Call Auction,” it involves matching clustered buy and sell orders accumulated at particular times. This differs from the auction (continuous) market, which deals with constant trading between buyers and sellers.

- A call market is where several trading orders are combined and executed at the best-matched price at specified time intervals within a working day.

- It is perfect for illiquid securities or when the trading volume is too low for an active market.

- The call market boosts liquidity in investments and increases the matching of possible stock market dealings. It is generally employed once or twice on a business day.

- It contrasts with the continuous market in terms of trading frequency, approach, and market orders.

Call Market Explained

Call markets execute trading sessions where all the traders gather at one place and time.

Stock markets categorize diverse trading systems as per several classifications or criteria. But, a call market compiles the purchasers and sellers of an underlying security to trade simultaneously at the same place. In other words, buyers state the maximum rate to purchase the stocks and sellers mention the minimum price to sell the shares.

The auctioneer “calls” for both buy and sell orders on the security to execute their assemblage at selected times during a trading day. Therefore, it is a discontinuous trading approach entailing both limit and market orders.

All orders will be discharged at the stipulated clearing price, i.e., the cost at which most orders are executable. Moreover, limit orders are implemented to purchase at or below the clearing price and sell at or beyond the clearing price. Hence, it offers more investment liquidity and maximizes the execution of possible transactions.

A call market is susceptible to extensive cost unpredictability as the clearing price is discovered after traders register their orders. They are unaware of the expected trading price level or even the possibility of a transaction. From order placement to matching, the price variation prospects are higher in a call market than in a continuous market.

A majority of continuous markets usually begin and conclude their trading session with a call auction. So, it is generally called once or twice within a business day. The rest of the day involves a continuous market session. A call auction incorporates the execution of trades as per the order-driven approach. Therefore, the traders do not have much say in the final price here as opposed to continuous markets where external components play a large role in the market trends.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

What happens in a Call Market

The illiquid market becomes liquid during the trading session and returns to its original state after it dissolves. As per the quantity, the securities may be called all-at-once or rotationally. The rotational operation involves the calling of securities in one cycle.

However, predetermined trading hours in a stock market session call the maximum number of securities in a specified period. It is typically employed to arrange small-sized markets or governments to sell instruments like bonds, bills, and notes.

A call stock market results in a temporary accumulation of trades at prearranged time frames. The compilation of several trade orders reduces the transaction costs for participants and promotes market transparency. It may be oral or written and works well in various markets to identify the opening and closing stock prices.

Example

Let’s say a firm, ABC obtains the following buy & sell orders.

1. Buy 500 shares at $600

2. Buy 200 shares at $550

3. Buy 1000 shares at $615

4. Buy 50 shares at $500

1. Sell 50 shares at $600

2. Sell 1000 shares at $615

3. Sell 200 shares at $590

4. Sell 500 shares at $700

The orders are assembled together and executed at the best matching price. The price that clears most of the transactions is $615. Accordingly, the clearing price is $615 per share for all grouped orders at that moment.

Call Market vs. Continuous Market

The main difference between a call and a continuous market lies in price determination. The recurring order amount is the price in a call market, while market forces establish the price in a continuous market. However, both trading systems require the presence of buyers & sellers for trade execution.

Most current markets are classified as continuous markets, while a handful of markets like Deutsche Bourse are labeled as call auctions.

Here are the key differences between a call market and a continuous market:

| Particulars | Call Market | Continuous Market | |

|---|---|---|---|

| Definition | A marketplace where trading occurs at chosen times | A marketplace where trading occurs continuously | |

| Trading approach | Non-continuous | Continuous | |

| Time & place of trading | Specified time & place | Random & at any place | |

| Examples | Deutsche Bourse | Stock exchanges | |

| Euronext Paris Bourse | Derivatives exchanges Forex market | ||

| Benefits | Enhanced liquidity | Flexible trading | |

| Optimized execution of prospective transactions | |||

| Frequency | Primarily once or twice | Throughout the trading session | |

| Market orders | More price uncertainty | Less price uncertainty | |

| Price limits | Sellers | Not less than the clearing price | No price limits |

| Buyers | Not more than the clearing price | ||

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A call market matches and executes the grouped trade orders at specified times during an entire trading day. But a continuous market matches and completes the grouped trade order throughout a trading day. They differ in terms of trading approach, frequency, and market orders.

A call option is an agreement between the buyer and seller to buy a specific stock within the defined period at a predetermined price. The buyer is authorized but not obligated to exercise the call and buy stocks.

It augments the investment liquidity and optimizes the implementation of such possible proceedings. This assists in the quick and efficient matching of buy & sell orders at a reasonable clearing price.

Yes, it comes with the risk of price unpredictability. The traders record their orders before the clearing price is decided. Hence, they bet on the stocks, unaware of how much the rate would increase or decrease.