Table Of Contents

What Is Expression Of Interest (EOI)?

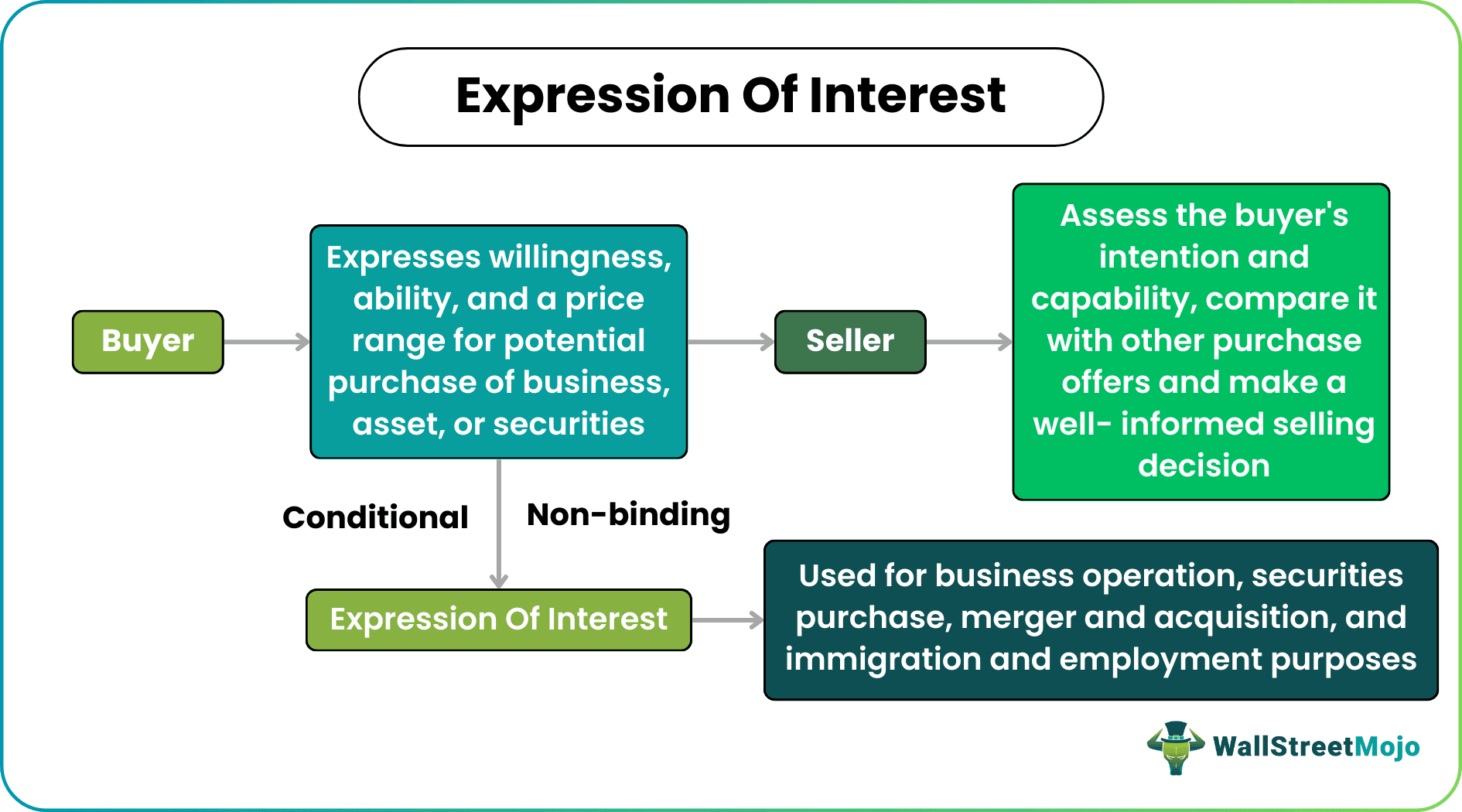

An Expression of Interest (EOI) is a formal document prepared by a buyer for a seller, demonstrating the former’s willingness, ability, and a price range for purchasing the latter’s business, asset, or security. It is usually a one- to a few-page conditional, non-binding contract with details ranging from the potential purchase price to the valuation and settlement period.

Also known as an indication of interest, EOI helps sellers assess the buyer’s intention and capability, compare it with other purchase offers and make a well-informed selling decision. The concept finds relevance in merger and acquisition (M&A) deals, buying securities, making employment approaches, publishing job advertisements, showing immigration interests, etc.

Table of contents

- What Is Expression Of Interest (EOI)?

- An Expression of Interest meaning describes a formal document that demonstrates the buyer's willingness, ability, and price range for purchasing the seller's business, asset, or security.

- The details included by the buyer in an EOI must provide crucial facts and create a transparent settlement procedure under distinct segments for the deal to be successful.

- It assists sellers in evaluating the buyer's intent and capacity, comparing it to comparable buying offers, and making an informed selling decision.

- Depending on the application, the EOI process works in a particular way, such as business operation, securities purchase, merger and acquisition, and immigration and employment purposes.

Understanding Expression Of Interest

An Expression of Interest letter is a document offered by one party to another to ensure the latter understand the former's level of interest in buying a business or financial product or collaborating to achieve a common goal. It is a formal offer that the buyer makes to ensure if the seller accepts the same. The purchase contract is prepared accordingly and fulfilled mutually.

It is worth noting that EOI is not legally binding for the parties involved. Instead, it is an attempt from the buyer to show their level of seriousness for purchase or collaboration. The seller has full liberty to accept or reject the proposal based on the EOI presented by a buyer. While some buyers prefer preparing EOIs before signing a deal, others refrain from doing so. In short, preparing an EOI is not mandatory.

Through EOI, a buyer makes an offer to the seller, specifying all transaction-related details for the deal to take place. It usually includes information regarding the target company's valuation and general terms and conditions. It allows the seller to compare different purchase offers and make their selling decisions. An EOI can also be considered a way of determining the seller’s expectations regarding price and other aspects.

The EOI enables the seller to evaluate the buyer's intention and ability to complete the transaction in the projected schedule. Thus, the buyer must provide critical facts and create a transparent settlement procedure for a successful deal.

Application of Expression Of Interest

As the name implies, EOI is an expression that indicates the serious interest of a buyer in the available deal. The process of EOI works differently, depending on the area of its application, such as:

- Business – It outlines the prerequisites for potential buyers to declare their interest and ability in supplying the seller's goods and services.

- Mergers and Acquisitions – Potential buyers must register their interest in purchasing the security, along with the price range, transaction deadline, and source of funds.

- Securities – Buyers interested in purchasing securities must submit an EOI before the initial public offering (IPO) or registration and regulatory agency’s approval of equities.

- Employment – An Expression of Interest for a job is prepared by the candidate to display their suitability for the position offered by the esteemed organization. The document is strictly professional, showcasing a job seeker's interest, capability, and achievements concerning a particular job profile.

Besides, entities that want their assignments or projects sponsored by multilateral development banks frequently complete an EOI.

What Is Included In EOI?

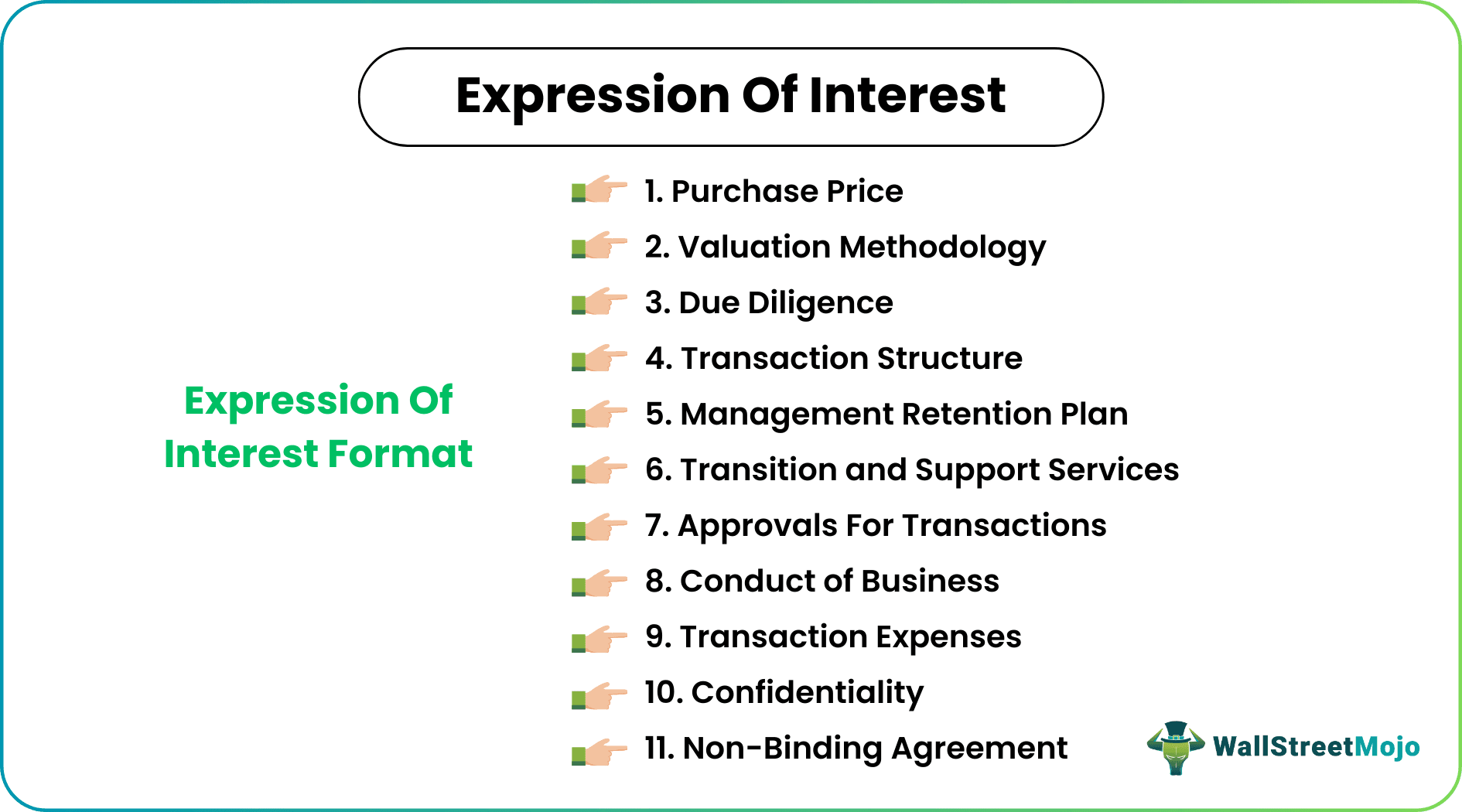

An EOI begins with praising the organization for its tremendous portfolio. Within the EOI, the seller gets to know about the buyer's vision. The seller also studies proposals from interested buyers and shortlist ones that meet their expectations. The details outlined in an EOI are provided under different segments:

#1 - Purchase Price

This segment mentions the total payment or purchase price (cash or debt-free) and the valuation that the buyer is willing to pay after the deal. The details the seller finds here are bonuses, funding sources, and availability, employee stock ownership plans (ESOPs), etc. Even after presenting an EOI, the buyer can modify payment terms and may or may not execute the deal based on the seller’s pricing expectations as it is in no way legally binding for any parties.

#2 - Valuation Methodology

Different interested buyers do valuations differently. Hence, an EOI should explicitly mention the methodology used by the buyer to perform the valuation. This part helps the seller to check valuations made by buyers and mentions:

- The past financial records in the confidential information memorandum must be complete and accurate.

- The seller's company projections must be realistic and correct.

- All contracts, including employee, vendor, facility, and customer agreements, should be handed to the buyer without charge.

- Working capital should be sufficient to run the firm as usual on the closing date.

- The seller should finance all of the retirement benefits at the time of closing.

#3 - Due Diligence

An EOI must specify the buyer's wish to undertake due diligence on the seller and its business. It entails learning about and understanding several aspects of the business, such as sales and marketing, human resources, legal aspects, customer contracts, machinery, technology, facility management, etc.

#4 - Transaction Structure

This section mentions the buyer's interest in a complete or partial buyout. Though buyers choose to buy the entire business in most cases, a few may like to buy a particular division. It also contains details regarding the buyer's source of financing (cash or loan) to complete the purchase.

#5 - Management Retention Plan

This section states if the buyer wants to keep the current management structure or completely reorganize everything.

#6 - Transition and Support Services

A buyer may request that the seller provide some support services or alter existing ones in this section to transition and manage the business efficiently. The buyer would incur no additional costs in this instance.

#7 - Approvals For Transactions

Here, the buyer makes the seller aware of the approval process they intend to use. The EOI would require the board of directors to sign the accompanying papers for the deal to be confirmed.

#8 - Conduct of Business

This part would include the buyer’s plans and terms to continue operating the business in its normal state. If the seller decides to modify the way they do business, they must inform the buyer.

#9 - Transaction Expenses

This segment specifies that each party is responsible for any transaction-related expenses, such as negotiation, due diligence, writing legal agreements, leveraged transactions, professional support, and so on.

#10 - Confidentiality

This section ensures that terms and clauses are not divulged to any other party without the buyer's written authorization. Also, the buyer requests that the seller not expose their name or purchasing considerations to anybody without their permission.

#11 - Non-Binding Agreement

This part states that EOI is a non-binding agreement that only expresses the buyer’s serious interest in the purchase through a formal offer.

The EOI concludes with the buyer thanking the seller for their time and attention and providing them with their contact information.

Example

Let us consider an Expression of Interest example for a better understanding of how it works:

Robert, the owner of pharmaceutical company A, came upon a request for an EOI from company B, a diagnostic center chain. He decided to prepare the same for the transaction using the format mentioned above, demonstrating his serious interest in working with the seller. Robert created the contract, covering all facets of the transaction, from pricing to business practices. It contained all 11 segments to give a detailed proposal to the seller.

He framed the EOI, beginning it with:

"We are pleased to present the non-binding Expression of Interest from Company A …."

Frequently Asked Questions (FAQs)

An Expression of Interest (EOI) is a non-binding formal offer made by one party to another to ensure that the latter is aware of the former's level of interest in purchasing a commercial or financial product or collaborating to achieve a common goal. The seller has complete discretion over accepting or rejecting a proposal based on a buyer's EOI. Even after presenting an EOI, the buyer can change the payment terms and may or may not complete the agreement.

An EOI begins by applauding the organization's impressive track record, followed by other crucial information under different segments:

#1 - Purchase Price

#2 - Valuation Methodology

#3 - Due Diligence

#4 - Transaction Structure

#5 - Management Retention Plan

#6 - Transition and Support Services

#7 - Approvals For Transactions

#8 - Conduct of Business

#9 - Confidentiality

#10 - Transaction Expenses

#11 - Non-Binding Agreement

The EOI is useful in merger and acquisition (M&A) agreements, job applications, job postings, immigration concerns, business operation, securities purchase, etc.

Recommended Articles

This has been a guide to the expression of interest and its meaning. Here we discuss what is included in EOI along with the application and example. You may also learn more about financing from the following articles -