Table of Contents

Fast Market Definition

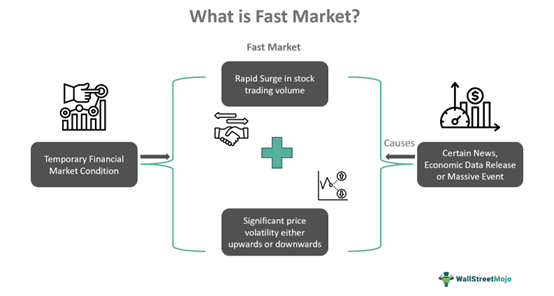

Fast market refers to a temporary financial market situation where the market witnesses a significant price fluctuation and unusual trading volume over a short span as a result of certain events, whether positive or negative. Such a market scenario increases the potential risk for traders and hedgers.

According to the fast market rule prevalent in the UK, the market makers have to switch off their black boxes (I.e., their computerized trading system) to ensure an orderly market amidst this period of rapid volatility and excessive trading. Indeed, during this phase, the market makers need to provide accurate stock prices without following the London Stock Exchange's screen prices.

Key Takeaways

- A fast market is a temporary situation whereby a particular news, event, or economic release significantly alleviates trading activities and increases price fluctuations abnormally, either in an uptrend or downtrend.

- It is a condition declared by the London Stock Exchange (LSE) and regulated through the fast market rule. Market makers are ordered to switch off their trading systems or black boxes to control the volatility of the security price.

- Although such market conditions foster various opportunities to book exceptional gains, they also increase the risk exposure for traders and investors.

How Does A Fast Market Work?

A fast market is a phase whereby the financial market faces sudden acceleration in trading activities and abnormal price movements (either upwards or downwards) in no time due to a specific positive or negative event, a change in market sentiments, and any financial information release. It is a high-risk market scenario for traders and hedgers since it may result in crashing stock prices and chaos in the market. When a particular security experiences unusual price fluctuation and floods trading, it becomes difficult to record its last sale price. Now, the brokers fail to fulfill all the orders, thus accidentally making trades at unanticipated prices, eventually deriving poor returns. Although such events are less commonly seen, except in exceptional cases, they usually impact novice traders and investors.

In this period, the fast market rule was applicable when the market makers refrained from viewing on-screen stock prices on the London Stock Exchange.

(LSE), Instead, the company needs to provide close asset prices without tracking the LSE screen prices. Usually, stock trading is confined to a quoted price band, i.e., the maximum price payable by a buyer and the minimum price acceptable by the seller. However, during fast market events, traders go beyond this quoted price limit to buy and sell stocks.

Some of the key considerations while trading in fast market conditions are as follows:

- The financial market experiences heavy trading due to certain news, information, or market sentiment.

- The stock price movements during this phase are significant, leading to a greater degree of risk or uncertainty along with more profit-making opportunities.

- At the near end of this scenario, the traders may struggle with the buying or selling of stocks due to decreased liquidity.

- Eventually, the stock prices would soon stabilize due to regulatory actions like temporary trading halts or circuit breakers.

- Moreover, traders and investors often employ strategies like limiting loss or stopping loss to mitigate risk.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

The fast market is a temporary condition; however, the participants must be careful when trading during this phase. Let us consider some examples to understand the opportunities and risks of such a market:

Example #1

Suppose ABC Ltd. It is a promising company for investors. The company announced its stock split decision on April 01, 2024, after the market closed. It has resulted in high demand for the company's shares since they have become affordable to medium investors. Also, the high demand caused a significant price rise in the market for the particular stock, and the sellers actively participated to make exceptional gains. Thus, the XYZ stock exchange declared a fast market condition and regulated the stock price volatility through the fast market rule.

Example #2

On July 07, 2005, despite the occurrence of four terrorist attacks in London, the London Stock Exchange remained operational. It witnessed a remarkable surge in trading activity, recording 344,601 British equity trades, surpassing the previous record of 310,843. The trading volume also soared, with over four billion shares exchanged, significantly higher than the usual daily volume of two to three billion. Although after initially dropping by 4 percent, the FTSE 100 index closed down by 1.4 percent at 5,158.30.

The fast market rules were implemented at 11 a.m. to curb volatility, with market makers adjusting their strategies accordingly. It marked the first application of such rules in almost two decades since the 1987 market crash. The exchange's resilience was attributed in part to CEO Clara Furse's leadership and the relocation of its headquarters in 2004 to a site less vulnerable to attacks. Since its deregulation in 1986, the exchange has relied on telephone and computer-based trading, mitigating the impact of disruptions at its headquarters.

Benefits

Fast market events are considered alarming for traders and hedgers; an intelligent investor can reap superior profits. Let us now have a look at its various advantages:

- lActive and Huge Trading: Such market conditions often foster hyperactive trading in considerable volume, making the financial markets more competitive for market makers, traders, and investors.

- lOffers Liquidity: The trading of assets in huge volume also results in financial market liquidity to establish a smooth flow of trade between many buyers and sellers in the market.

- lReal-Time Pricing Data: Since fast market events witness rapid real-time price movements, traders and investors can make better decisions on stock trading based on such information.

- Provides arbitrage and Hedging Opportunities: As the financial market experiences enormous trading and considerable price movements, both upwards and downwards, there are often more profit-making opportunities for the arbitrageurs and hedgers.

Risks

Fast markets, although they bring in exceptional gain opportunities for stock traders and investors, it is equally risky due to the following reasons:

- Inaccurate Prices: The stock prices don't reflect the real-time changes or the last sale price, thus leading to a difference between the quoted price and the execution price.

- lAlternative Strategy Risk: Sometimes, the stop loss orders are ineffectively or prematurely executed, profounding the risk level.

- Order Execution Delays: Mostly, during this condition, the brokers are unable to immediately enact the trading orders, resulting in lower returns or losses.

- Volatility Risk: As the stock market fluctuates rapidly, the securities price quotes may serve on a first come basis, thus depriving others of making gains or sometimes ending up in losses.

- Excessive Load on Information System: The orders for cancellation or change in stock purchase or sale result in increased load over the information system, further slowing down the process.

- lMay Not Process Cancel/Change Orders Quickly: Due to heavy trading traffic, the system may take time to fulfill the orders of stock cancellation and changes.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.