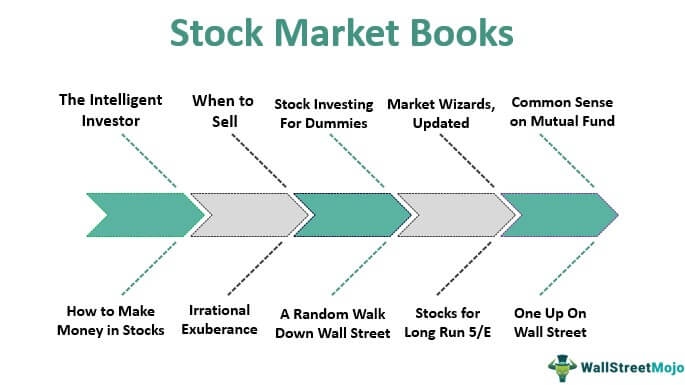

Stock Market Books for Beginners [2025]

Do you look out for the newspaper first thing in the morning to check out the stock market? Does your eye rest on the TV screen to discover the next plausible share jump? Do you worry day and night about the money you have invested in the stock market? Do not keep your heart in your mouth; it is time to go for an intelligent investment to give you a good night's rest. Enhance your knowledge and wisdom about investment and stock markets. Writing an essay about financial planning can also help clarify your understanding of stock market strategies. If you’re overwhelmed with other academic tasks, you can rely on EssayService write an essay for me to handle your essay writing needs. Check out these best stock market books for beginners to become knowledgeable in investing in the stock market.

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Get this book )

- How to Make Money in Stocks (Get this book )

- When to Sell: Inside Strategies for Stock-Market Profits (Get this book )

- Irrational Exuberance (Get this book )

- Stock Investing For Dummies (Get this book )

- A Random Walk Down Wall Street The Time-Tested Strategy for Successful Investing (Get this book )

- Market Wizards, Updated Interviews with Top Traders (Get this book )

- Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies (Get this book )

- Common Sense on Mutual Funds (Get this book )

- One Up On Wall Street: How to Use What You Already Know To Make Money in The Market (Get this book )

#1 - The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel

by Benjamin Graham and Jason Zweig

Who can deny advice from the greatest investor of the twentieth century? And if it is Benjamin Graham, no one can ignore the timeless wisdom he can impart. Benjamin Graham believed in the philosophy of loss minimization and not profit maximization-a theory, which sounds weird, but it is the strategy that true investors should follow. This philosophy works for long-term investors who use their research, analysis, analytical power, and years of discipline and experience to make sound investments. The book puts forward a realistic picture of Wall Street without contortion. Grab this book immediately to attain your financial goals, as this book is the Bible of investment for everyone associated with the stock market.

However, a word of caution for beginners who pick this book, please do your homework on the primary lessons of investing before you graduate from Benjamin Graham. There is a possibility that this book might put you off to sleep if you are a layman with no knowledge.

#2 - How to Make Money in Stocks

by William O'Neil

There is nothing much to be written about this book because its sales and performance speak all about it. A national bestseller, How to Make Money in Stocks, is a seven-step guiding reference for minimizing risk and maximizing gains to build wealth generation for investors. The book involves strategies to find winning stocks before making big price gains. It also provides tips for better investment of money in stocks, mutual funds, and ETFs to maximize profits. But the best deal is that the book helps you decode the twenty-one mistakes that every investor makes.

The book is a magnum opus with comprehensive details about the stock market. Neil's CANSLIM strategy that allowed him to turn into a multi-millionaire is a time-proven strategy demonstrating how the equity (stock) market(s) works – for the passive, minority, outside investor. The 80/20 approach invented by Neil talks about the investor achieving 80% success with 20% effort is based on the idea of proprietary metrics and tools. The book is a classic, and its trading advice is still relevant today. This pocket pinch is a must for investors who want to enjoy a great deal of wealth.

#3 - When to Sell: Inside Strategies for Stock-Market Profits

by Justin Mamis (Author)

The book's name suggests there are great things to learn from it. So, buying it is mandatory if you are looking for the answer: when is the right time to sell your stocks? Justin Mamis spent several years as an "upstairs" Member-Trader for Phelan, Silver, an NYSE specialist firm. Therefore, he is the perfect mentor for investors looking to invest without the working knowledge of the stock exchange. Mamis, in a very layered fashion, discusses the market indicators to understand the correct time for buying and selling and explains the trade secrets of the bonds, options, etc. It is the market segment in which dealers trade financial instruments in various exchanges, for example, the Bombay Stock Exchange (BSE) and the New York Stock Exchange (NYSE)." url="https://www.wallstreetmojo.com/trading-floor/"]trading floor and how the professionals — the "they" many investors refer to grudgingly — benefit from herd psychology.

This book reveals the psychology of the average investor who prefers to lose but is most likely to win in the race. Mamis takes the minutest details into account and meticulously explains how to sell your stocks to earn a bigger profit and when to sell them short of ensuring you prevent yourself from digging a hole in your pocket. Interestingly, he highlights the idea of the stock market as an ideal place to run through various human emotions. From the thrill of earning money to the guilt of losing it all, Mamis truly identifies human weaknesses and weaves them into this informative piece. Moreover, his writing has eased, reflecting his experience and knowledge accumulated. Keep this book handy to use if you are interested in stock picking.

#4 - Irrational Exuberance

3rd edition Revised and Expanded Third Edition

by Robert J. Shiller (Author)

Irrational Exuberance is to remain relevant forever, for it expounds on the idea of stock and bond prices and the cost of housing in the post-subprime boom. The book fundamentally shows how recent asset markets capture and inherently reflect psychologically driven volatility. Written by the Nobel prize-winning Yale economist, the book considers the gamut of human emotions that are at play in the stock market and the lives of the investors after the 2008-2009 financial crisis. The book is a careful study, drawing from the research and historical evidence to conclude that the enormous stock market boom that started around 1982 and picked up incredible speed after 1995 was a speculative bubble, not grounded in sensible economic fundamentals. Shiller points out that the real estate bubble is similar to the stock market bubble and warns that significant (further) rises in these markets could lead, eventually, to even more significant declines. Shiller has proven he is correct, and we know this fact well.

The book is interesting and a great combination of psychology and finance. It provides analysis and concepts learned in traditional finance theory. It allows the student to contemplate bubbles as a myth or reality. Serious economics and finance students with due intelligence can crack this secret code.

#5 - Stock Investing For Dummies

by Paul Mladjenovic (Author)

A newbie is sure to be lost in the ever-changing, fast-paced finance. Therefore, the newcomer must be helped with the basics to form a great base that could be the foundation for the next Warren Buffet. Thus, there is no better book for teaching the basics than "Stock Investing For Dummies." The book begins with basic information on ETFs, a safer way to be more diversified in the stock market, new rules, exchanges, investment vehicles, and much more. Next, the book explores how technological changes bring in new products, services, and ways of doing business and how to protect yourself in such a volatile world of finance eventually. Finally, the book is filled with real-life examples that allow you to grow your stock with a definite investment plan.

The book considers the reader dumb and navigates him through the basic stock math and eventually to the finer points of finding a stockbroker to picking ETFs or mutual funds. The author has meticulously provided the details of published resources and websites to gather enough data and decide about investing in a company.

For beginners, a free tip, invest in this book rather than spending your time in tutorials.

#6 - A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing

by Burton G. Malkiel

A book by a Princeton economist is sure to make heads turn, and if it is the celebrated Burton Malkiel, students cannot resist the inclination to grab a copy of his book. He wrote this book in 1973. It is an established guide for all freshers, novices, or entrepreneurs. Moreover, it is written in a simple and engaging style. This book packs the idea of indexing in the stock market's risk-taking and unpredictable world. It advises lucidly and does a great job of combining the stock market funds' theoretical and practical. Malkiel takes the history of Wall Street and casts a speculative eye, making every bubble very insightful. The author's approach to adhering to the efficient market hypothesis and indexing is correct. He argues every point with statistics and grudgingly acknowledges the outliers in the stock market. Malkiel's approach is mediocre where he does not bombard the readers with complicated terms to take the reader off guard but is lucid and just about technology to help the seasoned and the newbie.

The eleventh edition of the book adds fresh material on exchange-traded funds and investment opportunities in emerging markets; a brand-new chapter on "smart beta" funds, the newest marketing gimmick of the investment management industry; and a new supplement that tackles the increasingly complex world of derivatives. This book is a great source of fundamentals and is recommended for anybody looking for advice on managing his money.

#7 - Market Wizards, Updated: Interviews with Top Traders Paperback

by Jack D. Schwager

Trade secrets are always beneficial. If they are from the market wizards, there should not be anything to stop you from making it big in the stock market. And to achieve that, you need to grab a copy of the national bestseller market wizards. Schwager reveals the basic formula that helped the top traders amass this ton of wealth in a unique format. Interestingly, Schwager does not interfere with the words of wisdom of these top traders and allows the reader to hear them directly as advice that should shape their bright future. The likes of Bruce Kovner, Richard Dennis, Paul Tudor Jones, Michel Steinhardt, Ed Seykota, Marty Schwartz, and Tom Baldwin have been interviewed by Schwager to come out with the story of their sensational trading coups. The themes remain consistent despite the differences in each trader's market area and approach. The book is noteworthy for keeping in your library, not because of the trading patterns revealed or the techniques that are sure to work out but because it tries to instill in the reader the idea that each trader will have to develop their success path, realize their follies and move ahead to achieve success in trading.

#8 - Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies

by Jeremy J. Siegel (Author)

The investment world would turn upside down if it assures investors of safe investments and guaranteed returns. However, when Jeremy Siegel presents this idea in the book, readers are convinced and do not bat an eyelid in surprise. In the long run, stocks present the facts of history to prepare you for a safer investment pattern, i.e., to invest in long-term stocks. In a plaintiff manner, Siegel explains, "The principle of this book is that through time, the after-inflation returns on a well-diversified portfolio of common stocks have exceeded that of fixed-income assets but have done so with less risk. Which stocks you own is secondary to whether you own, especially if you maintain a balanced portfolio.

Today's market is robust, so the investor must maintain patience to maintain a long-term portfolio. However, Siegel categorically contradicts the point and argues that stocks are safer and more productive than other investment types. He explains how to calculate stock returns and examines some of the more technical aspects of analyzing stocks. Siegel is not addressing the general public and provides detailed information on sophisticated investing methods, which works well for a novice rather than a beginner. Siegel's knowledge is, however, handy when anyone of you is looking for a great long term investment plan for the future.

#9 - Common Sense on Mutual Fund

by John C. Bogle (Author)

John C. Bogle needs no formal introduction. As respected in the mutual fund industry, this book is nothing short of timeless commentary; Bogle can dedicate many years to the industry he has given. In a very straightforward manner, the book talks about the ongoing storm and its after-effects on the stock market, offering sound investment advice only after evaluating the fundamentals of the mutual funds and their long-term implications. Bogle also reflects on the structural and regulatory changes in the mutual fund industry.

Bogle is credited with the institution of the first index mutual fund, which became the largest mutual fund globally, and has also founded the only mutual fund owned by its shareholders (Vanguard). Thus, he puts in great effort to present a platform for intelligent investing. Moreover, it analyzes costs, exposes tax inefficiencies, and warns of the mutual fund industry's conflicting interests. In addition, he offers sensible solutions to the fund selection process and reveals what it will take to make it in today's chaotic market. “Common Sense On Mutual Funds” will make you a better investor, helping you gain a footing in the finance industry through good, sound decisions.

#10 - One Up On Wall Street: How to Use What You Already Know To Make Money in The Market

3rd edition Revised and Expanded Third Edition

by Robert J. Shiller (Author)

Irrational Exuberance is to remain relevant forever, for it expounds on the idea of stock and bond prices and the cost of housing in the post-subprime boom. The book fundamentally shows how recent asset markets capture and inherently reflect psychologically driven volatility. Written by the Nobel prize-winning Yale economist, the book considers the gamut of human emotions that are at play in the stock market and the lives of the investors after the 2008-2009 financial crisis. The book is a careful study, drawing from the research and historical evidence to conclude that the enormous stock market boom that started around 1982 and picked up incredible speed after 1995 was a speculative bubble, not grounded in sensible economic fundamentals. Shiller points out that the real estate bubble is similar to the stock market bubble and warns that significant (further) rises in these markets could lead, eventually, to even more significant declines. Shiller has proven he is correct, and we know this fact well.

The book is interesting and a great combination of psychology and finance. It provides analysis and concepts learned in traditional finance theory. It allows the student to contemplate bubbles as a myth or reality. Serious economics and finance students with due intelligence can crack this secret code.

Enjoy reading these stock market books, as I am sure they will greatly enhance your treasure trove of financial knowledge.

Recommended Articles

This article is a guide to the Top 10 Best Stock Market Books. We discuss stock market books for beginners, content, review, and key takeaways. You may also be interested in the following recommended readings: -

- Top 10 Data Analytics Books

- Best Financial Planning Books

- Best Communication Books

- List of Top 10 Finance Books

Amazon Associate Disclosure

WallStreetMojo participates in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.