Table Of Contents

What Is Auction Market?

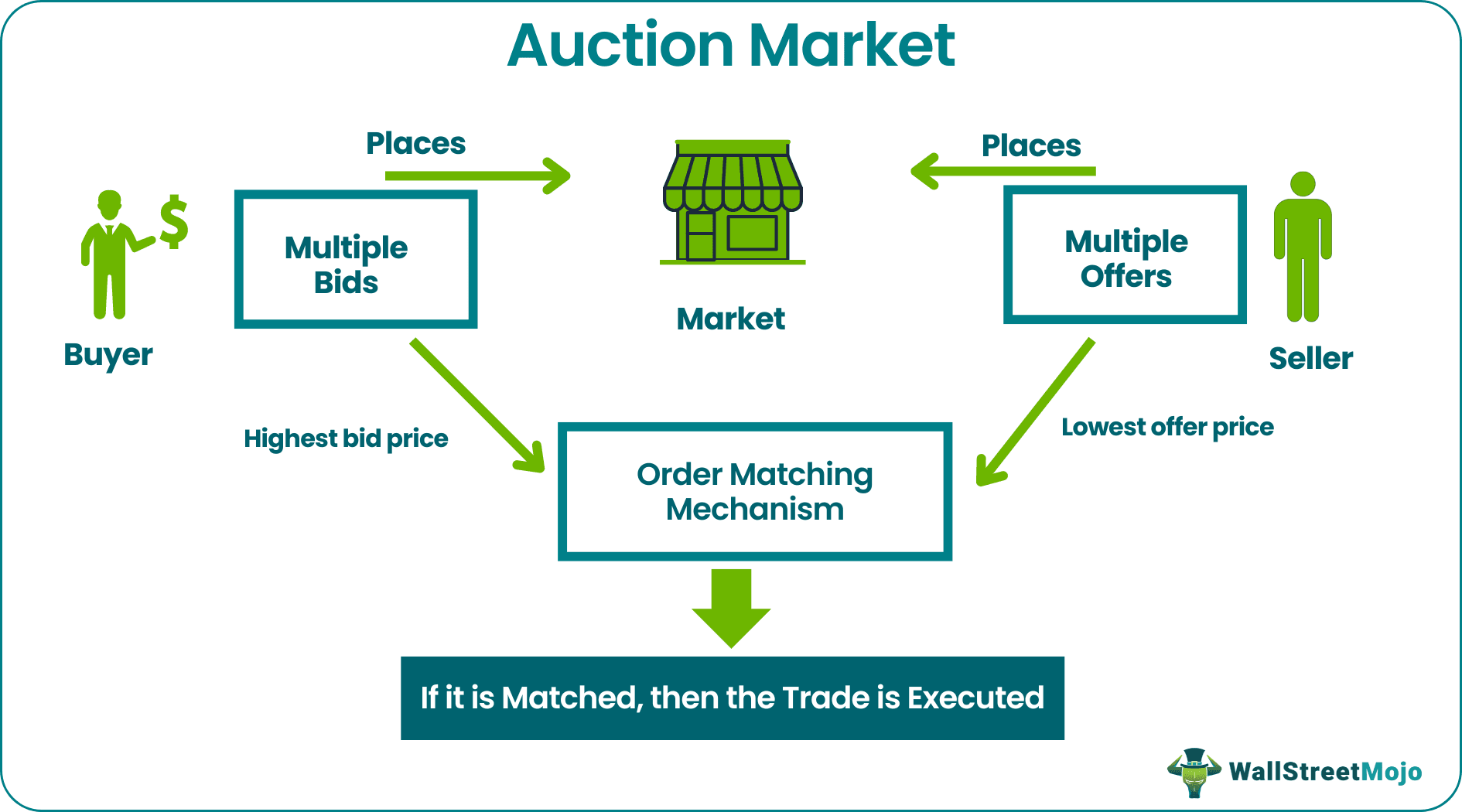

An auction market is a stage for buyers and sellers to trade stocks by making competing bids and offers. It executes at a matching price where the buyer's highest bid matches the seller's lowest offer price. The auction market plays a vital role in facilitating the exchange of goods and assets, providing a transparent and efficient platform for buyers and sellers to transact with confidence.

The auction market place offers transparency and fair pricing through open bidding, which encourages competition among buyers and sellers. It facilitates price discovery and enables efficient trading of a wide range of assets. However, limitations include potential manipulation, lack of liquidity for certain assets, and the possibility of bids not reflecting true market value.

Key Takeaways

- In an auction market, buyers and sellers trade stocks by putting up competing offers and bids. The lowest offer price made by the seller and the highest bid made by the buyer is matched in this transaction.

- Auction markets also have a double auction market that allows buyers and sellers to give a price acceptable from bids, and offers are given a list.

- Chicago Mercantile Exchange (CME) and the New York Stock Exchange still operate in the auction market open outcry system.

- NYSE converted from strictly operating on the auction market to a hybrid market in 2007 that works on both the electronic trading system and the auction market.

Auction Market Explained

The auction market is a platform where buyers and sellers come together to trade goods or assets through an open bidding process. It operates based on the principles of supply and demand, where the bids submitted by potential buyers determine the price of the asset. Auction markets can exist for a wide range of goods, including art, antiques, real estate, financial securities, and commodities.

One of the key features of the auction market is its transparency, as all participants have access to the bidding process and can see the prices offered by other buyers. This transparency encourages competition among bidders and ensures that the asset is sold at its fair market value. Additionally, the auction market provides a level playing field for both buyers and sellers, allowing them to negotiate prices openly and freely.

Auction markets can operate through various formats, including live auctions conducted in physical locations, online auctions facilitated by digital platforms, and sealed-bid auctions where participants submit confidential bids. Each format offers its unique advantages and may cater to different types of assets or preferences of participants.

Furthermore, the auction market theory serves as an efficient channel for price discovery, as the bidding process reflects the collective wisdom and opinions of market participants regarding the value of the asset being traded. This price discovery mechanism is especially valuable in markets where assets are illiquid or lack readily available pricing information.

Process

Let us understand the process that a typical auction market place follows through the discussion below.

- The buyer places multiple bids on the desired financial instrument available in a market.

- The seller places multiple offers in the desired financial instrument market.

- The order matching mechanism focuses on putting up the highest bid price from the buyer and the lowest offer price from the seller.

- If the highest bid price and lowest ask price match. The trade is executed on those securities and decides the current market price on this mechanism.

- The order status remains pending if the bid price and offer do not match.

- An order executed will be processed for settlement as per exchange rules.

- In general, the auction has one seller and multiple buyers. However, in this, there are numerous buyers and sellers.

- Continuous process deciding the current market price through this order matching mechanism.

- Auction markets also have the term known as a double auction market, allowing buyers and sellers to submit a price they feel acceptable from a given list of bids and offers. The trade will proceed to execution when bid and ask prices match.

How To Participate?

For participating in the auction market place, individuals can follow these steps:

- They should comprehend the auction process, rules, and regulations specific to the market or platform where the auction is occurring.

- Registering as a bidder require providing necessary personal information and agreeing to terms and conditions.

- Bidders can enter bids either in person, online, or through proxy, adhering to minimum bid increments and auction deadlines.

- Conducting thorough research on the asset being auctioned, including its condition, value, and potential risks, is essential.

- Ensuring the availability of funds or financing arrangements to cover the cost of successful bids, including any buyer's premium or additional fees, is crucial.

- Attending any preview events or inspections allows bidders to assess the asset firsthand and ask questions to auction staff if needed.

- Establishing a maximum bid amount based on budget and valuation analysis helps prevent overbidding.

- Staying engaged throughout the auction process enables bidders to adjust bidding strategy as needed and respond to competitive bids.

- If successful, following auction procedures for payment, transfer of ownership, and any additional documentation required is necessary.

Examples

Now that we understand the basics and intricacies of the auction market theory, let us apply that theoretical knowledge to practical application through the examples below.

Example #1

Suppose a buyer is interested in buying a share of ABC Ltd. In the market, it trades at $101 per share. He puts bids as follows: $101.05, $101.10, $101.15, $101.20, $101.25, and $101.30. Similarly, sellers willing to sell the same company share in the marketplace offer $101.30, $101.35, $101.40, $101.45, $101.5, and $101.55. In this scenario, the buyer's highest price is ready to pay, and the lowest price the seller is ready to accept is $101.30. Therefore, the trade gets executed at $101.30, and the current share price of ABC Ltd. will be $101.30. All other bids of the buyer and ask if the seller remains pending until bids and ask matches and next trades executed in the market.

Example #2

Chicago Mercantile Exchange (CME) and the New York Stock Exchange are still operating in the auction market open outcry system. An electronic trading method that more or less still operates on the principle of an auction market system but electronically, and every buyer and seller gets access to bid and offer prices in the market on display and make their own decisions. Similarly, reduced cost and improved trade execution speed compared to open human outcry speed, an environment that is now less vulnerable to manipulation. In addition, the availability of the electronic system to any home computer and smartphone free of the cost compared to the open outcry auction market created a popularity for adaptation to electronic trading method.

As time passed with the invention of new technology, all exchanges adapted the method of an electronic trading system. In 2007, even NYSE converted from strictly operating on the auction market to a hybrid market, which operates on both the electronic trading system and the auction market. Some stocks are still traded on the trading floor, which has an extremely high price.

In the auction market, they bound brokers by exchange rules, which act as buyers and sellers representing their clients to make competitive bids and offers to make a trade. Therefore, many investors trading in these markets keeps a continuous eye on the news and moods of the trading pit.

Auction Market Video Explanation

Government Securities Auction

Many governments of various countries hold auctions for their securities in the market, which is open to the public and large financial institutions. Bids are mostly accepted electronically and divided into two groups: competing for bids and non-competing bids. The non-competing buyers are given preference and are guaranteed to receive several securities after the amount as per the minimum and maximum limit of the bid amount. In the case of competitive bids, once the auction is closed, bids are reviewed, and they list competing bids as per bid price. Then, they sell the remaining securities to higher or lower bids.

E.g., The US Treasury holds auctions to finance certain government activities.

Auction Market vs. Dealer Market

Let us understand the distinctions between an auction market place and a dealer’s market through the comparative table below.

| Differences | Auction Market | Dealers Market |

|---|---|---|

| Definition | A market where buyers enter competitive bids, and sellers enter competitive offers. They match the highest buyer's bid and the lowest seller's offer and execute a trade in that financial instrument. | A financial market system in which numerous dealers post prices at which particular instrument security will be bought or sold. |

| Current Price matching | The highest bid price from the buyer and the lowest price offered by the seller when they execute the matched order. | "Dealer"- designated as "market maker" creates liquidity and transparency, showing an electronic display of prices where buyers' bids and sellers' offer' prices are on display. |

| Market Contents | Futures and options markets are auction markets. | OTC securities market and Govt. securities market are the dealers market. |

| Focus on | Order driven markets | Quote-driven markets |

| Example | The buyer of security put bids on the share of the company of ABC ltd. Priced around $250 as $249.2, $249.3, $249.4, $249.5 while seller put offers price on same company share as $249.5, $249.6, $249.7, $249.8. Therefore the highest bid from the buyer and the lowest price offered from the seller, $249.5, is matched, and the order gets executed, and the market's current price comes to $249.5. | The dealer has enough XYZ company available with other market makers at $350/$360 and is willing to sell some quantity into the market. So the dealer can post a quote with a bid-ask of $345/$355, so investors looking to buy this security get a $5 discount from the dealer to compare to other market makers. Like that, a seller will prefer to sell to other market makers since the dealer is bidding $5 less than other market makers. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The auction process is held between 2-2:45 pm daily. It can be experienced only by the exchange member broker and selling short-delivered shares.

A double auction market is where a buyer's price and a seller's asking price match. Then, the trade proceeds at that price. Moreover, It does not involve direct negotiations between individual buyers and sellers during negotiations for OTC trades.

The main goal of the auction market is to bring buyers and sellers together; in the United States, most sizeable firm equity shares are traded in regulated auction markets. The biggest auction market is the New York Stock Exchange (NYSE).

The highest bidder receives the auction-marketed slaughter hogs. In the agents' opinion, the strongest bidders purchase it from terminal commission agents. The producer pays the auctioneer a commission when hogs are sold through an auction market.