Table Of Contents

Financial Inclusion Meaning

Financial inclusion refers to providing good quality financial products and services everyone can access and afford. Such provision should be irrespective of company size or an individual’s financial condition. It aims at providing an equal economic opportunity for sustainable growth.

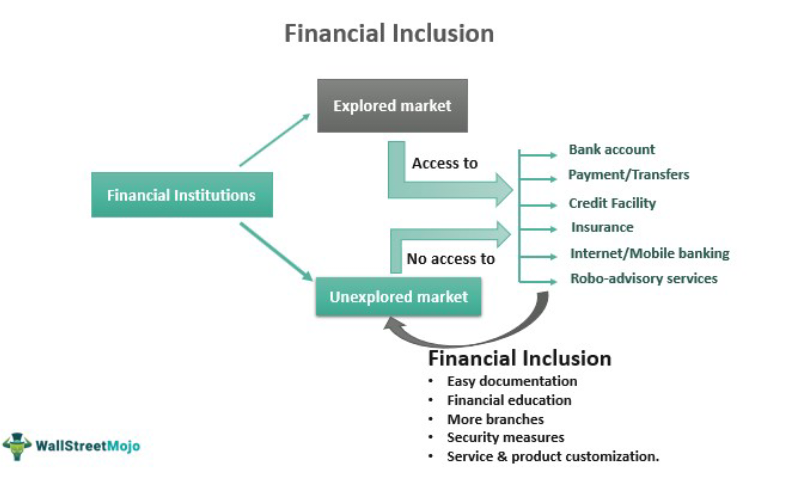

Financial institutions strive to reach the maximum market to make financial services like payments, transfers, credit, insurance, etc., all-inclusive and improve life. The growth of fintech has made a significant contribution by targeting unexplored geographical areas leading to a robust and financially advanced economy capable of absorbing any risks or contingency.

Table of contents

- Financial inclusion aims to provide the best financial products and services at individual and corporate levels.

- Such financial inclusion schemes should not depend on the corporation's size or an individual's net worth.

- The growth of fintech and continuous innovation has made it possible to reach the new market and provide services like transfers, insurance, payments, and credits, making life easy and raising standards.

- Financial inclusion will ensure a sustainable and financially strong economy capable of handling any risk or shock.

Financial Inclusion Explained

Financial inclusion means planning to provide adequate, affordable, and quality financial products or services at all levels of society. A country can only grow if people have unlimited access to financial services.

Financial inclusion in banking, like a bank account to save, pay and transfer money, insurance to cover risks, and a borrowing facility for growth and expansion, is of primary importance. If significant areas of a country remain underbanked, then the financial resources of those areas are wasted.

Financial resource accessibility ensures better monetary plans and the ability to handle emergencies to improve living standards. But, usually, such facilities quickly come to financially affluent societies, leading to a loss of faith and continued low living standards of the non-affluent ones.

However, the advent of digital financial inclusion brought a wave of financial innovation to help individuals and corporates obtain the best services quickly and affordably. They include digital payments and transfers, Robo-advisory services, blockchain, etc., with maximum accuracy and speed.

Objectives

The main objectives of financial inclusions are as follows:

- Provide financial service to all – The process aims to provide accessible and affordable financial services and products.

- Set up financial institutions – Financial inclusion also aims to set up more institutions that would cater to the financial needs of the people.

- Strong economy – As the finance of an economy becomes more robust, the economy grows through growth in trade and commerce.

- Better options – It will provide more investment opportunities.

- Create financial awareness – Financial education is essential for economic growth. Financial inclusion will promote financial education.

- Reach maximum market – Financial inclusion means bringing all under one umbrella. In finance, it will help bring people and corporates from different sources under one roof.

- Globalize digital solutions – Financial inclusion will lead to globalizing any digital methods adopted to promote and grow the financial sector.

- Provide customized solutions – Banks and financial institutions will take more interest in innovation and designing customized solutions to attract clients.

How To Measure?

There are three parameters to measure financial inclusions. They are:

- Financial service usage level

- Financial service access level

- Quality of financial services

However, the data obtained from various government and private institutions help measure financial inclusion in the following ways.

- Size of the adult population having bank accounts – The more bank accounts are seen growing, the more financial service penetration in an economy.

- Size of the adult population having loans – If people and corporates take loans, it means more expansion through industrialization, education, and income growth.

- Size of the adult population having insurance- Insurance policy ensures cover against risk and unforeseen contingencies. It means people are responsible and financially educated. It also means a vast corpus of funds for insurance companies to invest in the market.

- Cashless transactions per capita – Cashless transactions refer to the internet and mobile baking, which signifies the economy is technologically advanced.

- Size of the adult population doing mobile banking – This is similar to cashless transactions used by technologically advanced society.

- Frequency of bank account usage – If bank accounts are frequently used, it can be assumed that clients are actively involved in the financial sector.

- Size and frequency of domestic and international remittances – It refers to the fact that businesses are growing along with the economy.

- Small and Medium Enterprises (SMEs) having bank accounts – SMEs should have bank accounts to mobilize their funds.

- SMEs having outstanding loans – SMEs taking loans to signify they are expanding their business.

- The ability of the population to save – If income growth occurs, people can save more.

- Financial institution branches- A growing economy will expand branches of banks and financial institutions to attract clients for investment.

- The number of operational Point Of Service – Point of Service means clients can visit them to do transactions. Therefore, they should be adequate and easy to use.

- Financial knowledge - Knowledge in finance is essential to ensure people understand how to save and grow their money.

- Financial disclosure requirements – Financial disclosure requirements should not be very stringent. At the same time, they should be transparent and adequate.

- Financial dispute resolution – Dispute resolution should be easy and affordable, so people can quickly settle their problems and complaints. A well-planned financial service sector will have this feature.

How To Achieve?

There are ways to achieve financial inclusion in the economic field in the following ways:

- Making documentation easy – To achieve financial inclusion, the documentation process for opening bank accounts or taking loans should be easy, affordable, and fast.

- Spreading financial education – It is necessary to spread financial awareness so that people understand the importance of saving, investment, and monetary planning.

- Opening branches and points of service in remote areas – There should be offices and departments where people can visit and get their job done or doubts cleared quickly to promote financial inclusion.

- Focusing on aiding women and low-income groups – Women and low-income groups should also participate equally. They are a significant part of any population who should take an interest in financial contribution towards the economy.

- Lower minimum balance for accounts – The minimum balance for maintaining an account should be low to enable low-income groups to use bank accounts for savings.

- Implementing security measures in fintech – Fintech, or using technology in financial services, is multiplying. Therefore, it should be secured and encrypted to avoid the misappropriation of funds by fraudsters.

- Innovation and customization- Banks and financial institutions must try to give customized solutions to clients to suit their needs which will help retain them.

- Financial aid from the government- Low-income groups should get financial assistance from the government so that they will be able to save some part of their income after meeting their basic needs.

Examples

Let us look at some examples to understand the concept:

Example #1

ABC Fintech Group, a global-level financial institution, has been catering to only high net-worth individuals (HNI). As a result, the value and size of the assets the institution is managing are very high. But it wants to increase its customer base. So ABC Fintech Group figures out that diversifying the type of clients is the best way to do that.

Thus, it opens branches in various remote areas of different countries and starts conducting workshops to educate people about the importance of managing finance safely and systematically.

Within the next six months, its customer base doubled, and assets under management increased significantly, which helped the institution to get more deposits and loan them out to borrowers to earn interest. It also attracts many investors who open accounts with them and invests in their financial products and services. This case proves that financial inclusion schemes are essential for the overall development of society.

Example #2

According to a study, most of the world’s population still needs access to banking facilities, resulting in less saving, investment, and borrowing. Undoubtedly, the rise in digital financial inclusion in developing economies has reduced this gap, but there is still a long way to go to improve lives and reduce poverty. Nevertheless, the study points out the positive effect of the rise in the financial inclusion index.

Example #3

A survey by the Federal Reserve Bank of Dallas finds that the central bank’s digital currency will be able to access the financially new market of the US because the digital dollar's fixed cost is half of any bank deposit. It will reduce exclusion by 93%.

Advantages And Disadvantages

The promotion of financial inclusion in banking and various other institutions has some advantages and disadvantages, as follows:

Advantages

- The process will expand the banking system and make it more stable, secure, and smooth.

- The low-income group who did not have access to the banking system will get the facility.

- There will be an increase in the customer base.

- It will promote more savings and investment.

- It will increase the lending power of financial institutions since more funds will be available.

- More businesses will be set up and expanded.

- People will have better access to financial education and planning.

- It will create an economically advanced society and help mobilize financial resources for practical purposes.

Disadvantages

- The institutions may misuse funds through over-lending without proper credit checks of the borrower.

- The borrower may misuse funds by taking a loan for a useful purpose and wasting the money.

- Using fintech for banking may lead to fraud if not adequately secured.

- An easy credit policy may result in a need for customer documentation.

- Overlending financial institutions may ultimately cause an economy to collapse.

Financial Inclusion And Financial Literacy

Financial inclusion and financial literacy are both different concepts. However, both are interlinked. Let us know why it is so.

| Financial Inclusion | Financial Literacy |

|---|---|

| It gives all eligible individuals and corporations easy and affordable access to financial products and services. | Financial literacy in finance is educating oneself about different economic areas. |

| Financial literacy is essential for financial inclusion. | It can be done without inclusion. |

| Financial inclusion in banking helps mobilize finance for valuable purposes. | It helps to understand the purpose and methods of finance mobilization. |

| It provides people with a basket of financial choices. | It educates people to help them make the correct financial choice. |

| People can identify the type of financial products suitable for them. | People can identify loopholes and fraud in the financial system if they have the education. |

Financial Inclusion vs Financial Exclusion

Financial inclusion refers to giving individuals and corporations easy and affordable access to financial products and services, whereas financial exclusion restricts access to financial services and products. The primary differences between them as given below:

| Financial Inclusion | Financial Exclusion |

|---|---|

| Financial inclusion gives access to financial solutions to those who need them. | It excludes people from getting financial solutions. |

| Financial inclusion has a positive impact. | It has a negative impact. |

| An effort to educate people and provide quality financial service leads to inclusion. | Lack of information, documents, high service fees, etc., lead to exclusion. |

| Financial inclusion makes an economy grow. | It limits economic growth. |

| Financial institutions get more access to funds for lending. | It limits the size of funds available for lending by financial institutions. |

Frequently Asked Questions (FAQs)

The financial inclusion index measures how easy or how accessible are financial services and products to the ordinary people of a country and the corporate houses. It helps the economy track how well the banks and financial institutions have extended their services to a country's unbanked and unexplored population.

The six pillars of financial inclusion in the finance field are:

- Access to financial facilities.

- Access to financial education.

- Access to bank accounts.

- Credit availability and guarantee against default.

- Insurance facility.

- Income security in old age.

Blockchain has the potential to accelerate financial inclusion in the finance field at a global level by promoting easy payments and transfer processes. It is the process of organizing transactions in a decentralized manner in a ledger or database, where all such transactions are encrypted. Blockchain can transform banking and make financial services more affordable and secure.

Recommended Articles

This article has been a guide to Financial Inclusion and its meaning. We explain its objectives, examples, advantages, and comparison with financial exclusion. You may also find some useful articles here -