Table of Contents

What Is A Leg?

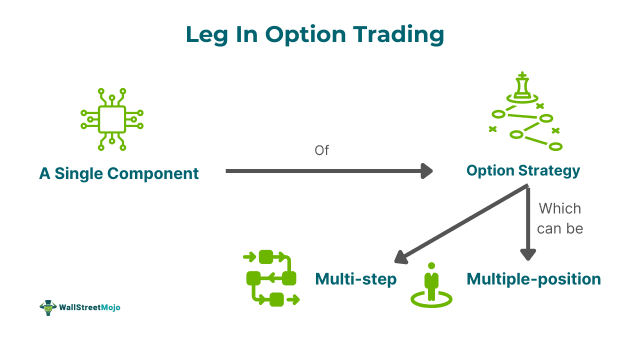

A leg is a separate part of a multi-trade execution. A leg itself is an individual in a long or short position constituting a combination of trade order execution most commonly used in derivatives trading. It is a single component of either options or futures contract strategy. Sometimes, it can be a combination of both.

When a trader initiates a multi-leg trading strategy, it is referred to as legging-in, and likewise, exiting from such a trade position is called legging-out. Investors and traders often enter a multi-leg trade position for several reasons, such as to take advantage of arbitrage, hedge a position, or profit from the tightening of price fluctuations. Each position is a leg in a derivatives contract but can be performed with securities as well.

Key Takeaways

- A leg is a trade position that acts as an individual component of a multi-leg derivatives trading strategy. This is observed in both options and future contracts.

- To enter into a multi-trade strategy is called legging-in, which means to form a combination of two or more trade positions. On the contrary, legging out refers to exiting or winding up one leg or trading out of the combination.

- There are mainly three types of legging options strategies: two-leg, three-leg, and four-leg strategies, also referred to as long straddle, collar, and iron condor techniques.

- Multi-leg trading is crucial and complex. Hence, typically, it is performed by advanced and experienced traders with skills to read and interpret market fluctuations with high-risk tolerance.

Leg In Options Trading Explained

A leg represents one single part of a multi-step or multiple-position trade strategy. It is a common technique in options markets and even in general trading scenarios where a trader takes up multiple positions with the underlying derivative contracts; it can be either a leg in options or futures contracts or can be a combination of both. Here, each position showcases a carefully placed buy or sell order to eventually help the trader in multiple ways. Together, a multi-trade strategy is a complex form of trading technique that allows a trader to protect their investments, interests, hedge position, take advantage of the arbitrage, or register profit by executing the right leg at the right time.

When a trader enters into a multi-leg options order, they parallelly buy and sell options with more than one strike price, expiry date, and other factors, typically converting the trade scenario to a situation where two or more options get completed simultaneously. The most crucial factor for legs to work is timing; in a multi-trade strategy, it is quintessential to exercise the options at a specific time lest any risks are linked to price variations.

When entering a multi-leg trade, it refers to legging, which involves establishing a spread, a combination, or any other multi-leg position. Conversely, to leg out means to close out one leg at a time of any existing derivative position. Legging eliminates the possibility of future risk of profit or loss from the legged-out position. But again, the trader remains exposed to other legs present in the multi-trade strategy.

Legging Options

#1 - Two-Leg Strategy: Long Straddle

When a multi-trade options strategy consists of only two legs, it is called a two-leg or a long straddle technique. It typically involves a long call and a long put position. Such multi-trade positions reap profit for traders irrespective of the rise or fall of the underlying security’s price. In fact, long straddles are mostly common among traders who are confident about the price variation but are not confident about the price direction.

#2 - Three-Leg Strategy: Collar

Similar to a two-leg strategy, a three-leg technique is also referred to as a collar strategy in options trading. It is called a three-leg method because it consists of a long position in the underlying security along with a long put and a short call. In this technique, the bet is placed on the underlying price to rise but, at the same time, is hedged by the long put position. It is also called a protective put because it minimizes the potential degree of loss. This method is common among investors who like to think bullishly about prices but remain rational with price increases being limited.

#3 - Four-Leg Strategy: Iron Condor

This strategy is opted for by investors who are risk-averse and conservative when it comes to taking risks. This is a limited-risk technique with the sole objective of registering profit by placing a bet on the minimum movement of the underlying security’s price. The strategy is developed on four legs. A trader buys a put, sells a put, by a call, and sells a call, ensuring that expiration dates are close to one another.

Examples

Below are two examples of this type of trading; the first is hypothetical, but the second is from world news:

Example #1

For a hypothetical example, suppose Jonathan, who is an options trader, places a buy option and a put option with a strike price of $45 separately. Jonathan makes sure that both the derivatives have the same expiration date. Since this is a two-leg strategy, it can also be referred to as a long straddle. For the sake of example, suppose that the trade costs are a combined bid-ask spread of $0.09 along with a commission of $9 with $0.54 per contract. It amounts to a total of $10.17.

With this two-leg strategy, Jonathan will follow the market and try to seek the right or potentially profitable entry and exit point. He may also try to profit from the arbitrage, which is the difference between the prices of derivatives. This whole multi-leg setup allows Jonathan to protect his capital in case the market flips in an uncertain or unpredictable direction.

Example #2

The second example is a press release from April 2024. Trading Technologies International announced the introduction of TT Splicer, a new TT Premium Order type that offers the industry’s first functionality for synthetic multi-leg spread trading. The managing director of the company expressed how Splicer combines ease with best-in-class execution algorithms to smartly reduce slippage and optimize trade execution when trading with synthetic multi-leg spreads.

Potential Splicer applications include many features. They coordinate execution across collocated servers and track all files in real-time. Trading Technologies is a SaaS technology platform provider to the global capital markets industry. The firm has its global headquarters in Chicago.