Table Of Contents

What Is Management Buyout?

A management buyout (MBO) is a type of acquisition where the company’s management acquires the ownership of the business by increasing their equity stake or by purchasing assets and liabilities to leverage their expertise to grow the company and drive it forward using their resources.

To initiate and accomplish management buyout, individuals and entities require following a series of steps from researching to maintaining confidentiality. It gives corporate managers an opportunity to feel empowered as an owner rather than being an employee.

Table of contents

- A management buyout is a form of possession of assets by a company’s existing management team, a parent company, or an artificial person.

- The methods to achieve MBO are asset purchase and stock purchase.

- The modes of funding of MBO are management contribution, asset finance, bank debt, private equity, and vendor support.

- The setting up MBO process includes research, setting up a transparent discussion, a proper plan for employees retention, business understanding, evaluating business plans, creating a proper financial plan of funding, obtaining proper shareholders consensus, ensuring that all the essential documents are secret until the public announcement, and maintaining all the factors that may impact company’s running and acquisition process.

How Does Management Buyout Work?

A management buyout allows managers in a company to own it by purchasing the majority of equity shares of the firm. It is opted for by individuals and entities to exercise complete control over the company, which they couldn’t do as employees.

Though the process is risky and may or may not work after the company is purchased, the managers are ready to take a change, given the power that they are likely to get exposed to after the buyout. Besides power, there is a significant financial gain too, which the buyers expect to enjoy. Moreover, the buyout can be financed through borrowed capital, which makes it a type of leveraged buyout (LBO).

Process

Furthermore, there is a series of steps that one needs to follow to set up an effective buyout process:

- It is crucial to do initial R&D before going for any buyout options.

- It is essential to have a transparent and open discussion with stakeholders and other parties to disclose the objectives and expectations behind the acquisition.

- Try to determine the agenda for the status of employees post-acquisition while going into a negotiation. So, it can maintain the confidence of the employees in management. It is crucial to retain existing employees.

- Undertake a thorough understanding of the business one considers for MBO.

- Determine its business plans to know how to carry out different activities post-acquisition.

- Do adequate paperwork for undertaking that help present to the fund providers and shareholders.

- Obtain approvals from shareholders and take them in confidence to proceed with the acquisition process.

- The firms must maintain privacy until the parties sign the papers officially and make public announcements; otherwise, there are chances of misuse of these details.

- The businesses must ensure considering all the elements impacting the company's operation and the acquisition process while evaluating the plan.

How To Finance?

There are two ways or methods that help in accomplishing MBO plans –asset purchase and stock purchase.

An asset purchase involves purchasing the company by buying the assets and liabilities of other companies. This method is highly suitable for SMEs and it allows the selection or rejection of assets and liabilities. In addition, it helps in price allocation. In stock purchase acquisition, on the other hand, the buyer directly buys shares of the target company and acquires their interest, ownership, and control in that company.

MBO can be effectively carried out using different financing options, including asset finance asset finance, management contribution, private equity, bank debt, vendor support, etc.

Examples

Example #1

Company XYZ has a promoter who owns 60% of its stock, and the remaining 40% is what it trades publicly.

However, the company plans a management buyout. As per the plan, the management of XYZ Ltd. undertakes arrangements to acquire fair shares from the public to possess a controlling interest of around 51% of the company’s total shares.

For financing the arrangement, therefore, the management may look to a bank, financial capitalist, or VCs to help them fund and set up the acquisition of the target company.

Example #2

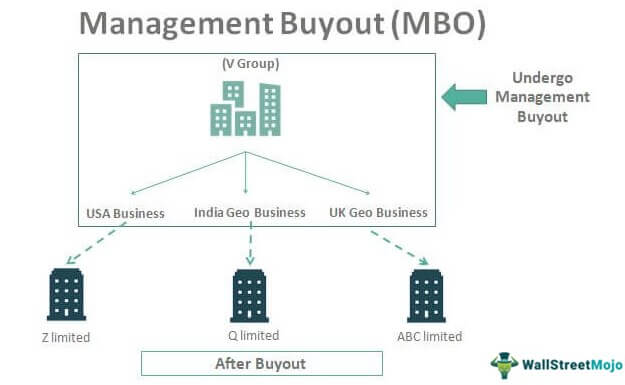

The V Group is rigorous in the buyouts of the peer company for expansion and market penetration. Therefore, the company CEO announces the selling of the USA Geo business as part of a management buyout, later known as Z Ltd.

Another part of the group, India Geo, goes through a management buyout and changes its name to Q Ltd. In addition, the UK Geo group undergoes a similar process and renames itself, ABC Ltd.

Pros & Cons

Advantages

The benefits of management buyouts are so many that managers choose them despite the level of risks associated with them. Let us have a look at some of the advantages:

- Simple and easy to understand: Management buyouts are simple and easy to understand, even for laypeople.

- Maintains confidentiality: One of the important aspects of MBO is that all the details are confidential as no external person is there in the acquisition process.

- High chance of success: The buyout process follows a thorough structure. Hence, the chances of success are very high.

- Adequate for small business persons: These buyouts are suitable for entities with smaller volume operations and fewer complexities.

- Speedier than other options: Normal time for completing management time out is 15 days to a month. That helps in clearing all the formalities sooner.

- Easy to negotiate: MBO does not involve many complexities in negotiation. Therefore, it is straightforward to undertake the negotiation of the same.

Disadvantages

Though the advantages are many, the management buyout disadvantages still exist. So, let us look at its limitations:

- Difficulty in raising funding: As MBOs only involve internal persons, the external world or financial institutions feel stressed while issuing the funding. Hence, it is not easy to raise funding under this option.

- Lack of business ownership success: Existing management will take over the entity in such a buyout. Hence, there are chances that individuals and entities ignore new technology or ideas. As a result, business entrepreneurship can be missing.

- Insider trading risk: The chances are that any management executives may conduct insider trading based on the available critical information as all the parties in MBOs is internal.

- No synergy savings: There are chances that management can be much immature in acquiring the business. Due to this, there can be no synergy savings and reduced stock prices.

Management Buyout vs Management Buy-In

Management buy-in is a term opposite to what MBO implies. While the name itself suggests how different the two terms are from each other, a tabular representation of the differences would give a better view of the comparison.

| Category | Management Buyout | Management Buy-In |

| Involvement | Internal management takes over the company | External sources buy the firm and replace the existing management team |

| Awareness | New owners have a better understanding as they have been involved with the firm for long | The new owners have to do extensive research and learn about the company to explore it. |

| Objective | Power and financial gain | Financial gain |

Frequently Asked Questions (FAQs)

It is executed according to financial and legal procedures. Its process includes:

Market research

Negotiations between buyer and seller

Forecast of financial models

Receiving the financed funding

Transitions

Transferring of ownership

Payback of funds

Company management prefers MBOs for controlling business, growth, and future. In addition, receiving full financial benefits through obtaining the company since they believe they are the experts and their knowledge and experience may help to scale the company’s growth through a management buyout.

A leveraged buyout refers to purchasing a company with a combination of debt and equity, where the business cash flow is the collateral used to safeguard and repay the loan. In contrast, the MBO is a leveraged buyout when the current business/company management team acquires assets from the actual owners.

Recommended Articles

This has been a guide to a what is management buyout. We explain how it works along with the pros, cons, examples, and differences with management buy-in. You can learn more from the following articles: –